Market Overview

Explanation of Market Size and Drivers

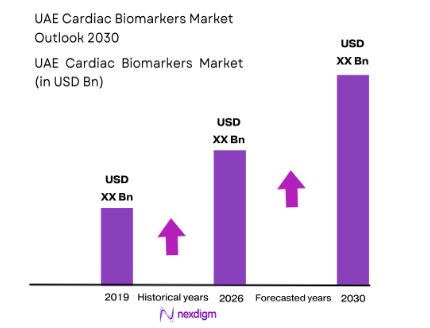

The UAE cardiac biomarkers market is valued at approximately USD ~ million, driven by an increasing prevalence of cardiovascular diseases (CVD) and the rapid adoption of advanced diagnostic technologies. The surge in heart-related health concerns, particularly in urban areas, has accelerated demand for diagnostic testing and cardiac biomarker assays. This market is propelled by healthcare innovations, government healthcare policies, and the expansion of diagnostic services, further boosted by rising healthcare expenditures. The increased awareness of early-stage diagnostics and advancements in high-sensitivity assays like Troponin and BNP have contributed significantly to market growth, particularly in hospitals and diagnostic laboratories across the region. With healthcare digitalization and investments in point-of-care testing devices, the UAE’s cardiac biomarkers market is poised for sustained growth in coming years.

The UAE market is primarily dominated by the capital, Abu Dhabi, and the commercial hub, Dubai, due to their well-established healthcare infrastructure and high demand for specialized medical services. Dubai, with its leading healthcare institutions, including diagnostic centres and hospitals, stands out as a major driver for innovation in biomarker-based diagnostics. Additionally, government-backed health initiatives in these cities foster the implementation of cutting-edge diagnostic solutions in cardiac care. The region’s advanced healthcare system, strong investment in medical research, and presence of international healthcare brands strengthen the market dominance of these cities. Furthermore, cities like Sharjah also show emerging growth in diagnostic testing owing to their expanding medical infrastructure.

Market Segmentation

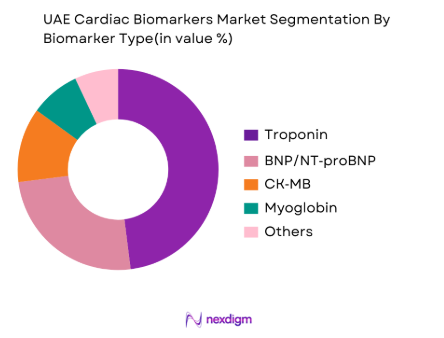

By Biomarker Type

The UAE cardiac biomarkers market is segmented by biomarker types, including Troponin, BNP/NT‑pro BNP, CK‑MB, Myoglobin, and others. Among these, Troponin dominates the market, owing to its proven clinical significance in detecting myocardial infarction and acute coronary syndrome. The sensitivity and specificity of Troponin assays, coupled with their widespread use in emergency and hospital settings, make it a staple in cardiac diagnostics. This biomarker is preferred for its precision in identifying cardiac injury even in the early stages, contributing to its major share in the market. Additionally, the high adoption of high-sensitivity Troponin tests in diagnostic labs and hospitals has further solidified its position as the leading biomarker in the region

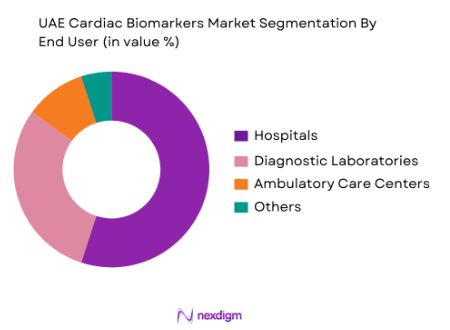

By End User

The end-user segmentation of the UAE cardiac biomarkers market includes hospitals, diagnostic laboratories, ambulatory care centres, and others. Hospitals dominate this segment, driven by the demand for timely and accurate diagnostics for patients with cardiovascular issues. With specialized cardiac care units in major hospitals like Rashid Hospital and the UAE Heart Centre, hospitals are key drivers of biomarker usage. These healthcare institutions invest heavily in advanced diagnostic equipment to offer rapid and reliable results, ensuring that Troponin and BNP tests are routinely employed in emergency departments for acute coronary syndrome detection. The growing demand for real-time diagnostic solutions, particularly in critical care and emergency rooms, has contributed to hospitals’ dominant market share.

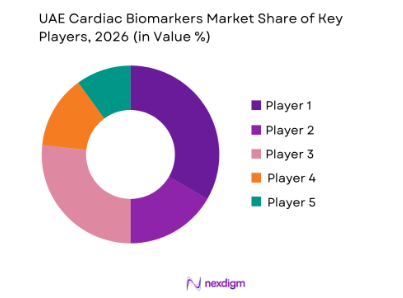

Competitive Landscape

The UAE cardiac biomarkers market is dominated by a select few key players, both global and regional, who provide a variety of biomarker assays. The market is heavily influenced by companies like Abbott Laboratories, Roche Diagnostics, and Siemens Healthiners, among others. These companies hold a significant share of the market, due to their innovative solutions and widespread distribution networks. Additionally, local players in the diagnostic services and point-of-care devices segment contribute to the overall competitive structure. The dominance of international companies is attributed to their long-standing presence, regulatory approvals, and strong healthcare relationships in the region, while local companies are capturing market space by offering cost-effective solutions tailored to regional healthcare needs.

| Company | Establishment Year | Headquarters | Market Focus | Product Portfolio | Distribution Channels | Regulatory Approvals |

| Abbott Laboratories | 1888 | USA | ~ | ~ | ~ | ~ |

| Roche Diagnostics | 1896 | Switzerland | ~ | ~ | ~ | ~ |

| Siemens Healthineers | 1847 | Germany | ~ | ~ | ~ | ~ |

| Thermo Fisher Scientific | 1956 | USA | ~ | ~ | ~ | ~ |

| BioMérieux | 1963 | France | ~ | ~ | ~ | ~ |

UAE cardiac biomarkers market Analysis

Growth Drivers

Rising CVD Prevalence (CVD, ACS, MI)

The UAE has seen a marked rise in cardiovascular diseases (CVD), including acute coronary syndrome (ACS) and myocardial infarction (MI), driven by lifestyle factors such as high rates of obesity, diabetes, and hypertension. In 2024, cardiovascular diseases accounted for over 30% of total deaths in the UAE, with heart disease being the leading cause of mortality. According to the World Health Organization (WHO), the prevalence of hypertension among UAE adults was around 30%, while diabetes affected nearly 16% of the population in 2024. These conditions significantly contribute to the growing demand for cardiac biomarkers and diagnostic services.

Government Healthcare Investments & Screening Initiatives

The UAE government has committed substantial investments in healthcare, particularly to combat chronic diseases, including CVD. The National Health Strategy 2024-2025 highlights a focus on expanding preventive healthcare services, which includes widespread cardiovascular disease screening programs. In 2024, the UAE government allocated AED ~billion for healthcare services, including the enhancement of diagnostics and early detection programs. These efforts aim to reduce CVD-related mortality by promoting regular screenings and early identification of cardiovascular conditions, which drives the adoption of cardiac biomarkers in healthcare settings.

Market Challenges

Regulatory Approval Complexity

Regulatory approval processes for diagnostic devices and assays in the UAE are often complex and time-consuming, impacting the timely entry of new cardiac biomarker products into the market. As of 2024, all medical devices and diagnostic tools must receive approval from the UAE Ministry of Health and Prevention (MOHAP), which requires rigorous clinical validation. The approval process for new cardiac biomarkers can take several months, delaying the adoption of innovative technologies in UAE healthcare settings. These regulatory hurdles can create challenges for market players seeking to introduce advanced diagnostic products.

Cost Pressures on Diagnostics

Despite advancements in cardiac diagnostics, cost pressures remain a significant challenge. The price of diagnostic assays for biomarkers such as Troponin and BNP can be a barrier, particularly in public healthcare settings. In 2024, a typical cardiac biomarker test could cost up to AED 500, which puts financial strain on both healthcare providers and patients, especially in lower-income segments. This is compounded by the increasing demand for advanced diagnostic solutions, leading to higher operational costs for hospitals and diagnostic labs. Such price pressures hinder broader access to diagnostic testing, limiting market penetration.

Opportunities

Digital Integration of Biomarker Platforms

With the rapid evolution of healthcare technology, there is a growing opportunity for digital integration of biomarker platforms in the UAE. Digital health solutions, such as telemedicine and electronic health records (EHR), are becoming increasingly common across the UAE’s healthcare system. In 2024, over 70% of hospitals in Dubai were reported to use digital platforms to manage patient data and diagnostics. Integrating cardiac biomarker testing with these platforms allows for more efficient, real-time analysis and monitoring, particularly in emergency departments and intensive care units. The UAE government’s push towards a fully integrated digital healthcare ecosystem provides significant growth prospects for cardiac biomarkers.

AI & Data Analytics in Cardiac Diagnostics

Artificial intelligence (AI) and data analytics are transforming the field of cardiac diagnostics in the UAE. AI-driven platforms are increasingly being used to analyze complex cardiac data, improving the speed and accuracy of biomarker test interpretation. In 2024, AI-powered cardiac diagnostic tools were implemented in several leading hospitals in Abu Dhabi and Dubai, enabling real-time monitoring of patients’ cardiovascular health. The UAE’s strategic focus on AI development, as part of its national agenda for digital innovation, is expected to provide significant opportunities for integrating AI into cardiac biomarker testing. AI’s ability to enhance predictive analytics in cardiology represents a future growth area for the market.

Future Outlook

The UAE cardiac biomarkers market is set to experience substantial growth over the next several years, supported by continuous advancements in diagnostic technologies, increasing healthcare awareness, and robust government investments in medical infrastructure. The UAE’s proactive healthcare policies and initiatives promoting preventive care, particularly for cardiovascular diseases, are anticipated to further stimulate the demand for cardiac biomarkers. The shift towards point-of-care testing devices and digital health integration will drive market transformation. Additionally, as the regional healthcare landscape evolves, there will be an increased focus on cost-effective, high-sensitivity tests to meet the growing demand for accurate and efficient diagnostics in both urban and rural healthcare facilities. With these trends, the market is expected to continue its upward trajectory with increased adoption of newer biomarker assays and technologies.

Major Players

- Abbott Laboratories

- Roche Diagnostics

- Siemens Healthineers

- Thermo Fisher Scientific

- BioMérieux

- Beckman Coulter

- Randox Laboratories

- Sysmex Corporation

- Ortho Clinical Diagnostics

- Mindray

- Quidel Ortho

- Becton Dickinson

- GE Healthcare

- Diasorin

- Nova Biomedical

Key Target Audience

- Healthcare Providers

- Diagnostic Laboratories

- Biomarker Assay Manufacturers

- Investment and Venture Capitalist Firms

- Government Healthcare Agencies

- Private Healthcare Investors

- Pharmaceutical Companies

- Medical Device Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The research process begins by identifying and defining the key variables that influence the UAE cardiac biomarkers market. This involves building an ecosystem map through extensive desk research using proprietary databases. Critical market factors, such as biomarker types, applications, and end-users, are determined.

Step 2: Market Analysis and Construction

In this phase, historical data is compiled and analysed, covering market penetration, growth rates, and revenue streams. Detailed analysis of market trends and player performance is conducted to ensure the accuracy of market construction and segmentation.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations play a crucial role in hypothesis validation. Industry experts from leading diagnostic centers and cardiac healthcare institutions are interviewed to gain insights into current and future trends, which are used to refine the market data.

Step 4: Research Synthesis and Final Output

The final step involves compiling all collected data, synthesizing the findings from various research phases, and validating the results with industry stakeholders to ensure accuracy and reliability. The output is a comprehensive and validated market report.

- Executive Summary

- Research Framework & Methodology (Market Scope & Coverage, Definitions: Cardiac Biomarker Types & Diagnostic Modalities, Abbreviations & Terminologies, Data Collection & Validation Protocols, Primary vs Secondary Research Balance, UAE Clinical & Epidemiological Inputs, Market Size Modelling & Forecasting Assumptions, Limitations and Analytical Adjustments)

- Market Genesis & Evolution in UAE Healthcare Diagnostics

- Core Biomarker Classes

- Biomarker Innovation Landscape

- UAE Healthcare Infrastructure & Diagnostic Readiness

- Reference Market Benchmarking

- Growth Drivers

Rising CVD Prevalence

Government Healthcare Investments & Screening Initiatives

Adoption of High‑Sensitivity Assays - Market Challenges

Regulatory Approval Complexity

Cost Pressures on Diagnostics

Reimbursement & Payment Barriers - Opportunities

Digital Integration of Biomarker Platforms

AI & Data Analytics in Cardiac Diagnostics

Expansion of POCT in Emergency Care - Key Trends

Shift Toward Rapid, Multiplex Biomarker Panels

Remote Monitoring & Digital Health Connectivity

Localized Clinical Validation Studies

- Current Market Size, 2019-2025

- Market Growth Drivers by Metric, 2019-2025

- Biomarker Revenue Contribution by Type, 2019-2025

- Hospital vs Laboratory vs POCT Revenue Mix, 2019-2025

- Market Price Analysis, 2019-2025

- By Biomarker Type (In Value%)

Troponin I/T

BNP

NT‑pro BNP

CK‑MB

Myoglobin - By Clinical Application (In Value%)

Acute Coronary Syndrome

Myocardial Infarction (MI)

Heart Failure & Cardiac Stress Monitoring

Preventive Cardiac Risk Screening

Post‑Operative Cardiac Monitoring

- Testing Format (In Value%)

High‑Sensitivity Cardiac Assays

Standard Immunoassays

Multiplex Panels

Point‑of‑Care Testing (POCT) Devices

Laboratory‑Based Diagnostics - By End User (In Value%)

Tertiary Hospitals

Diagnostic Laboratories

Ambulatory Clinics & Cardiology Centers

Emergency Medical Facilities

Preventive Health Chains

- By Distribution Pathway (In Value%)

Direct OEM to Hospital

Diagnostic Distributors

e‑Commerce / Online Procurement

Clinical Partnership Agreements

- Market Share & Competitive Structure

- Cross‑Comparison Parameters (Product Portfolio Depth, Clinical Sensitivity & Specificity Benchmarks, Regulatory Approvals Held, Distribution Reach in UAE Diagnostics Network, Hospital & Laboratory Contract Footprint, Innovation Pipeline & R&D Investment, Price Positioning by Product Tier, Data Integration & Digital Health Capabilities

- SWOT Analysis

- Price Matrix

- Porter’s Five Force

- Detailed Profiles

Abbott Laboratories

Hoffmann‑La Roche

Siemens Healthineers

Thermo Fisher Scientific

Danaher / Beckman Coulter

Bio‑Rad Laboratories

BioMérieux SA

QuidelOrtho

Becton Dickinson & Co.

Randox Laboratories

Mindray

Sysmex Corporation

Ortho Clinical Diagnostics

Luminex Corporation

ova Biomedical

- Hospitals

- Diagnostic Laboratories

- Ambulatory Care Centers

- Point-of-Care Testing (POCT) Facilities

- Forecast Methodology & Growth Scenarios, 2026-2030

- Baseline Growth Scenario, 2026-2030

- Rapid Adoption Scenario, 2026-2030

- Disruptive Innovation Scenario, 2026-2030