Market Overview

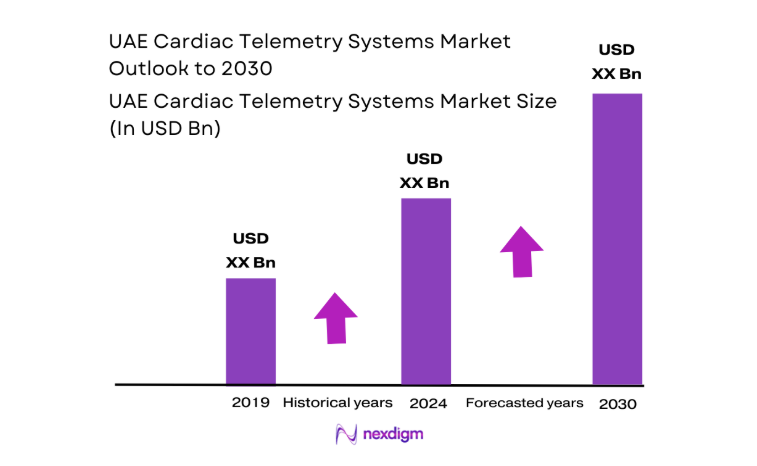

The UAE Cardiac Telemetry Systems market current size stands at around USD ~ million, reflecting a mature clinical monitoring ecosystem supported by advanced acute care infrastructure and growing continuity of care across hospital and home settings. Demand is shaped by high acuity cardiology caseloads, continuous rhythm surveillance needs, and expanding digital care pathways. Investment cycles, procurement cadence, and service enablement continue to anchor system refresh and fleet expansion across tertiary facilities, sustaining stable replacement and upgrade dynamics.

Adoption concentrates in Abu Dhabi and Dubai due to dense tertiary hospitals, cardiac centers of excellence, and integrated digital health platforms. These cities host centralized command centers, specialized electrophysiology services, and established distributor networks that enable rapid deployment and service continuity. Northern Emirates show growing uptake aligned with hospital upgrades and referral pathway strengthening. Policy emphasis on digital health, interoperability mandates, and cybersecurity governance further shape implementation patterns and vendor qualification across care networks.

Market Segmentation

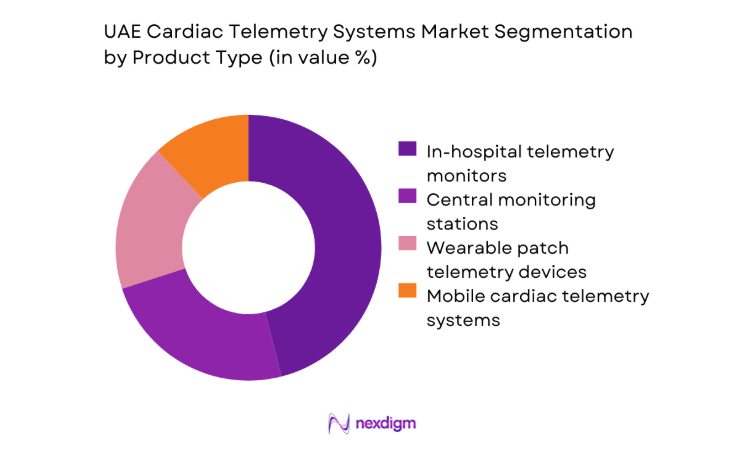

By Product Type

In-hospital telemetry monitors dominate due to entrenched use in step-down units, coronary care, and perioperative wards, where continuous multi-lead monitoring is embedded into care pathways. Central monitoring stations support nurse workflow optimization and alarm management protocols, reinforcing demand for integrated platforms. Wearable patch telemetry adoption is accelerating for post-discharge surveillance and shorter observation cycles, reducing length of stay pressures. Mobile telemetry supports ambulatory workflows in specialty cardiac centers and remote monitoring programs.

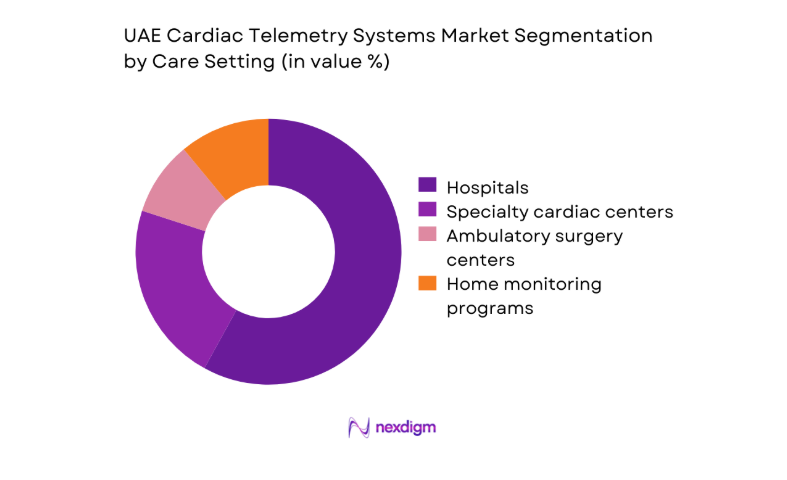

By Care Setting

Hospitals dominate utilization due to intensive monitoring needs in acute cardiology and post-procedural care, supported by telemetry command centers and trained technicians. Specialty cardiac centers contribute significant demand driven by electrophysiology procedures and rhythm diagnostics embedded into care protocols. Ambulatory surgery centers show selective uptake aligned with perioperative monitoring requirements. Home monitoring programs are expanding through payer-aligned pathways and discharge optimization initiatives, emphasizing continuity of care and early detection.

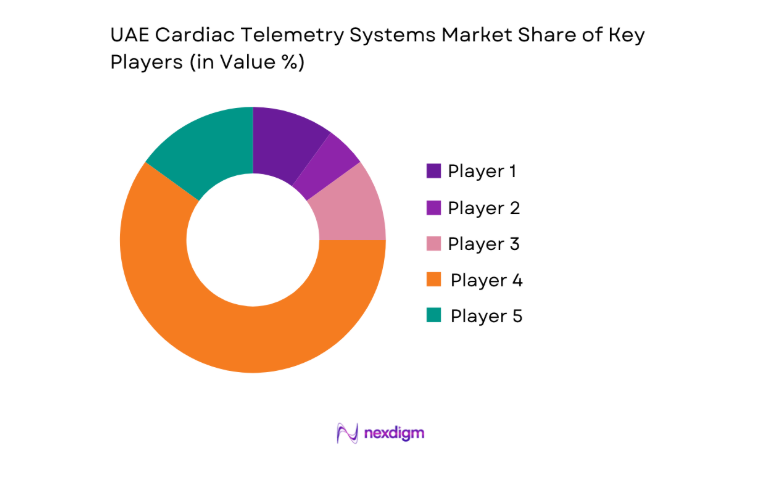

Competitive Landscape

The competitive environment reflects a mix of global technology providers and regional integrators, differentiated by clinical accuracy, interoperability, regulatory readiness, and service coverage. Procurement emphasizes lifecycle service capability, cybersecurity compliance, and integration with hospital systems, with distributor strength influencing deployment speed and post-implementation support.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Philips Healthcare | 1891 | Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

| GE HealthCare | 1892 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Siemens Healthineers | 1847 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Medtronic | 1949 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Abbott Laboratories | 1888 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Cardiac Telemetry Systems Market Analysis

Growth Drivers

Rising cardiovascular disease burden in UAE population

Rising cardiovascular disease burden sustains telemetry demand across acute and post-acute care pathways. In 2023, hospital discharge datasets recorded 182000 cardiovascular admissions nationwide, with arrhythmia-related presentations documented in 26400 cases across tertiary centers. Emergency department throughput averaged 940 patients daily in metropolitan hubs during 2024, increasing continuous monitoring needs in step-down units. Institutional screening programs expanded outpatient Holter referrals to 31600 encounters in 2022 and 34800 in 2024, elevating telemetry utilization. Public health registries reported 11 regional cardiac registries active in 2025, improving referral coordination and continuity of monitoring across care transitions.

Expansion of tertiary care and cardiac centers

Expansion of tertiary care capacity accelerates telemetry deployment across new wards and command centers. In 2022, 7 tertiary hospitals commissioned cardiac step-down units totaling 486 monitored beds, increasing centralized telemetry endpoints. By 2024, two additional cardiac centers operationalized electrophysiology labs with 14 procedure suites, standardizing continuous rhythm surveillance during perioperative care. National bed capacity planning added 1240 acute beds in metropolitan corridors during 2023–2024, necessitating telemetry infrastructure integration. Health information exchange nodes increased from 5 in 2022 to 9 in 2025, supporting cross-facility monitoring workflows and centralized alarm governance across multi-site networks.

Challenges

High upfront cost of telemetry infrastructure

High upfront infrastructure requirements strain capital planning cycles for telemetry deployment. In 2023, public procurement frameworks approved 19 multi-year equipment programs, extending approval timelines beyond 14 months. Capital committee thresholds require dual-stage approvals for projects exceeding ~ million, delaying fleet modernization in high-turnover wards. Facility audits in 2024 identified 312 legacy bedside monitors nearing end-of-life, increasing maintenance downtime and replacement backlog. Commissioning new command centers requires network upgrades across 42 clinical zones per tertiary campus, stretching installation schedules. Budget envelopes prioritize imaging upgrades, compressing telemetry refresh cycles across departments.

Interoperability issues with hospital IT systems

Interoperability gaps impede telemetry integration with hospital information systems and alarm management platforms. In 2022, 6 major hospital groups operated dual electronic records across inpatient and outpatient settings, complicating device data ingestion. Interface engine capacity expanded from 120 to 210 concurrent feeds between 2023 and 2025, yet telemetry streams compete with imaging and laboratory feeds for bandwidth. Cybersecurity compliance audits in 2024 mandated 28 control domains for connected devices, increasing validation steps before go-live. Network segmentation across 9 security zones per campus complicates centralized command center visibility and real-time alert routing.

Opportunities

Home-based telemetry programs for chronic cardiac patients

Home-based telemetry programs present scalable pathways for chronic cardiac management aligned with post-discharge optimization. In 2023, 41800 cardiac discharges were recorded from tertiary hospitals, with 27 readmissions per 1000 discharges within 30 days, underscoring monitoring gaps. Community nursing networks expanded to 62 service clusters in 2024, enabling device onboarding and patient education at home. National telehealth encounters reached 1.9 million visits in 2025, creating digital touchpoints for telemetry data review. Integrated care pilots across 8 referral networks demonstrated reduced emergency presentations when remote rhythm surveillance complemented follow-up clinics.

Integration of AI analytics for early arrhythmia detection

AI analytics integration offers opportunities to enhance early arrhythmia detection and clinician efficiency. In 2022, electrophysiology labs processed 214000 rhythm traces annually, straining manual review capacity. By 2024, clinical informatics teams deployed 17 validated decision-support workflows across cardiac units, accelerating triage and escalation. Alarm fatigue mitigation programs reduced non-actionable alerts by 4200 events per month during 2023 pilots. National digital health roadmaps endorsed algorithm governance frameworks in 2025, standardizing validation and auditability across connected devices. These enablers support scalable analytics adoption within telemetry workflows without expanding clinical headcount.

Future Outlook

The market outlook to 2030 reflects sustained digitization of cardiac care, wider adoption of wearable telemetry, and deeper integration with hospital information systems. Policy emphasis on interoperability and cybersecurity will shape procurement standards. Expansion of home monitoring pathways and analytics-enabled workflows is expected to improve care continuity, while service-led commercial models will support faster deployment across multi-site networks.

Major Players

- Philips Healthcare

- GE HealthCare

- Siemens Healthineers

- Medtronic

- Abbott Laboratories

- iRhythm Technologies

- BioTelemetry

- Preventice Solutions

- Hillrom

- Mindray Medical

- Spacelabs Healthcare

- Schiller AG

- Nihon Kohden

- ZOLL Medical

- Masimo

Key Target Audience

- Public hospital procurement authorities

- Private hospital network administrators

- Cardiology and electrophysiology department heads

- Health system CIO and digital transformation offices

- Home healthcare service providers

- Payers and insurance administrators

- Investments and venture capital firms

- Government and regulatory bodies with agency names including the Ministry of Health and Prevention and Dubai Health Authority

Research Methodology

Step 1: Identification of Key Variables

Clinical use cases, telemetry modalities, care settings, and workflow dependencies were mapped to define scope and variables. Regulatory requirements, interoperability standards, and cybersecurity controls were delineated. Channel structures and service models were identified to capture deployment pathways.

Step 2: Market Analysis and Construction

Demand-side utilization patterns across acute and post-acute care were constructed from institutional datasets and care pathway mapping. Supply-side capability was profiled through distributor coverage, service readiness, and platform integration capacity. Scenario frames aligned with policy and digital health roadmaps.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions on adoption drivers, interoperability constraints, and service models were validated with clinicians, biomedical engineers, and health IT leaders. Operational bottlenecks and deployment timelines were stress-tested against institutional governance processes and compliance requirements.

Step 4: Research Synthesis and Final Output

Findings were synthesized into coherent narratives across segmentation, competitive dynamics, and outlook. Insights were structured to support procurement strategy, service design, and deployment planning, ensuring alignment with regulatory and operational realities.

- Executive Summary

- Research Methodology (Market Definitions and clinical telemetry modalities, UAE hospital procurement databases and tenders, Device utilization and fleet audits in cardiology units)

- Definition and Scope

- Market evolution

- Clinical care pathways and monitoring workflows

- Ecosystem structure

- Supply chain and channel structure

- Growth Drivers

Rising cardiovascular disease burden in UAE population

Expansion of tertiary care and cardiac centers

Government investment in digital health and remote monitoring - Challenges

High upfront cost of telemetry infrastructure

Interoperability issues with hospital IT systems

Data privacy and cybersecurity compliance burdens - Opportunities

Home-based telemetry programs for chronic cardiac patients

Integration of AI analytics for early arrhythmia detection

Expansion of tele-cardiology in remote emirates - Trends

Shift toward wearable patch-based telemetry devices

Cloud-based telemetry platforms with real-time dashboards

AI-assisted clinical decision support in telemetry - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2019–2024

- By Volume, 2019–2024

- By Active Systems, 2019–2024

- By Average Selling Price, 2019–2024

- By Product Type (in Value %)

Mobile cardiac telemetry systems

In-hospital telemetry monitors

Wearable patch telemetry devices

Central telemetry monitoring stations - By Technology (in Value %)

Single-lead telemetry

Multi-lead telemetry

AI-enabled arrhythmia detection

Cloud-connected telemetry platforms - By Care Setting (in Value %)

Hospitals

Specialty cardiac centers

Ambulatory surgery centers

Home monitoring programs - By End User (in Value %)

Public hospitals

Private hospitals

Specialty cardiology clinics

Remote monitoring service providers - By Geography within UAE (in Value %)

Abu Dhabi

Dubai

- Market share of major players

- Cross Comparison Parameters (product portfolio breadth, clinical accuracy and validation, interoperability with HIS/EMR, service and maintenance coverage, pricing and TCO, regulatory approvals in UAE, local distributor presence, training and clinical support)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

Philips Healthcare

GE HealthCare

Siemens Healthineers

Medtronic

Boston Scientific

Abbott Laboratories

iRhythm Technologies

BioTelemetry

Preventice Solutions

Hillrom

Mindray Medical

Spacelabs Healthcare

Schiller AG

Nihon Kohden

ZOLL Medical

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- By Value, 2025–2030

- By Volume, 2025–2030

- By Active Systems, 2025–2030

- By Average Selling Price, 2025–2030