Market Overview

The UAE Carrier Genetic Testing Market is valued at USD ~, reflecting its growing role within preventive healthcare and reproductive medicine. Demand is structurally anchored in national priorities around early disease detection, reduction of inherited disorder burden, and the integration of genomics into routine clinical pathways. The market’s value is supported by sustained investment in diagnostic infrastructure, increasing physician referral rates for preconception and premarital screening, and broader public acceptance of genetic risk profiling as a standard component of family planning and long-term health management.

Within the country, Dubai and Abu Dhabi dominate service adoption due to their concentration of advanced hospitals, fertility centers, and molecular laboratories, as well as higher healthcare spending capacity and strong public health program execution. These cities also act as hubs for medical tourism, which further amplifies testing volumes. On the supply and technology side, the market is shaped by leading global genomics solution providers and sequencing platform innovators whose technologies are licensed or deployed locally, enabling the UAE to operate at international clinical standards without dependence on external testing pathways.

Market Segmentation

By Test Panel Type

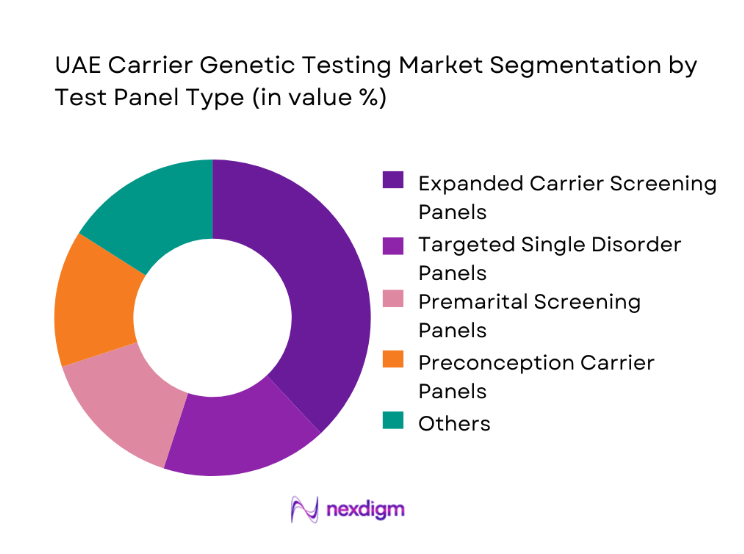

The UAE Carrier Genetic Testing Market is segmented by test panel type into expanded carrier screening panels, targeted single disorder panels, premarital screening panels, preconception carrier panels, ethnicity-specific risk panels, and custom physician-directed panels. Expanded carrier screening panels currently dominate this segmentation due to their ability to evaluate a wide spectrum of inherited conditions in a single test, significantly increasing clinical utility for couples planning families. Healthcare providers increasingly favor these panels because they streamline counseling workflows and reduce the need for multiple sequential tests, improving patient experience and operational efficiency. Their dominance is further strengthened by growing physician confidence in next-generation sequencing platforms that support these panels, along with broader insurance acceptance for comprehensive screening in high-risk populations.

By End-Use Customer Type

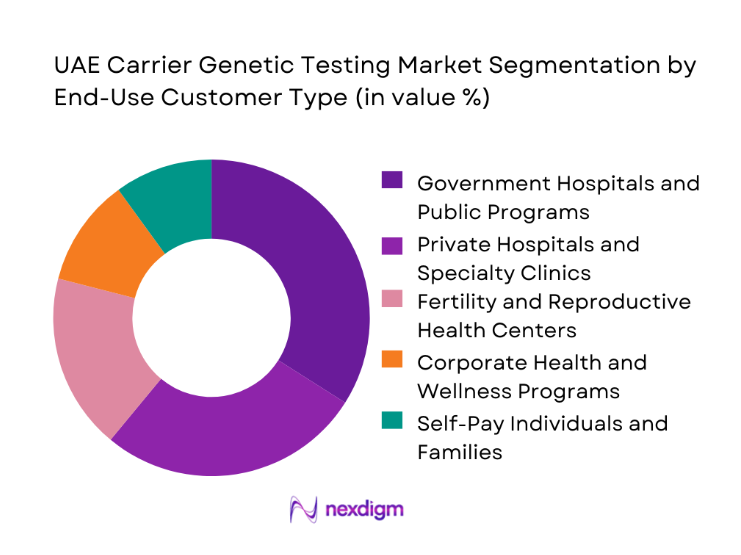

The UAE Carrier Genetic Testing Market is also segmented by end-use customer type into government hospitals and public programs, private hospitals and specialty clinics, fertility and reproductive health centers, corporate health and wellness programs, and self-pay individuals and families. Government hospitals and public programs lead this segmentation as they anchor large-scale preventive screening initiatives tied to national health strategies. Their dominance is driven by policy-backed mandates for premarital and early family planning screening, ensuring steady testing volumes and consistent funding. These institutions also benefit from centralized procurement and integrated care pathways, allowing them to deploy carrier testing across broad population groups more efficiently than fragmented private delivery models.

Competitive Landscape

The UAE Carrier Genetic Testing Market market is dominated by a few major players, including M42 Genomics and global or regional brands like Unilabs Middle East, NMC Genomics, and Mediclinic Middle East Genetics. This consolidation highlights the significant influence of these key companies.

| Company | Estab. Year | HQ Location | Carrier Test Portfolio Depth | Technology Stack | Lab Accreditation | Regional Partnerships | Service Coverage |

| Illumina Inc. | 1998 | USA | ~ | ~ | ~ | ~ | ~ |

| Myriad Genetics | 1991 | USA | ~ | ~ | ~ | ~ | ~ |

| Invitae Corp. | 2010 | USA | ~ | ~ | ~ | ~ | ~ |

| 23andMe Holding Co. | 2006 | USA | ~ | ~ | ~ | ~ | ~ |

| Ancestry.com LLC | 1996 | USA | ~ | ~ | ~ | ~ | ~ |

UAE Carrier Genetic Testing Market Analysis

Growth Drivers

Expansion of National Genomics Initiatives

The acceleration of national genomics programs has positioned carrier genetic testing as a strategic healthcare priority. Government-led efforts to integrate genetic screening into preventive care frameworks are creating structural demand for carrier testing across premarital, preconception, and family planning pathways. This policy-driven momentum translates into increased institutional procurement, standardized clinical protocols, and broader insurance recognition of genetic screening as a necessary healthcare service. The resulting outcome is a stable and scalable demand environment that encourages private investment, laboratory expansion, and technology localization within the country.

Rising Preventive Healthcare Adoption

A broader shift toward preventive medicine is reshaping patient and provider behavior in the UAE healthcare system. As awareness of inherited disease risks grows, families increasingly view carrier screening as a proactive step rather than a reactive intervention. This change in mindset strengthens physician recommendation rates and normalizes genetic testing within routine care. Over time, this cultural and clinical transition is expanding the addressable market, reinforcing carrier testing as a mainstream diagnostic service rather than a niche specialty offering.

Challenges

High Cost of Advanced Genetic Panels

The cost structure of comprehensive carrier screening panels remains a critical barrier to mass adoption. Advanced sequencing technologies, specialized bioinformatics interpretation, and the need for expert genetic counseling collectively elevate per-test expenses. This cost intensity limits accessibility for uninsured and underinsured populations, constraining volume growth despite strong clinical demand. As a result, the market faces a tension between technological advancement and affordability, which shapes pricing strategies and reimbursement negotiations across providers and payers.

Limited Genetic Counseling Workforce

The availability of trained genetic counselors is not yet aligned with the pace of testing adoption. Carrier screening requires careful interpretation and patient guidance to translate complex results into actionable health decisions. Workforce shortages create operational bottlenecks, extend turnaround times for counseling sessions, and reduce the scalability of testing programs. Without sufficient investment in professional training pipelines, this constraint could limit the market’s ability to fully capture the expanding demand for genetic services.

Opportunities

Population-Scale Screening Programs

The expansion of population-wide screening initiatives represents a major growth opportunity for the UAE Carrier Genetic Testing Market. By embedding carrier testing into standardized public health pathways, authorities can significantly increase testing volumes while improving long-term healthcare outcomes. These programs also enable economies of scale for laboratories, reducing per-test costs and improving access across diverse demographic groups.

Public–Private Partnership Models

Collaborations between government healthcare systems and private diagnostic providers create a pathway for rapid market expansion. Through shared infrastructure, co-funded technology deployment, and integrated service delivery models, these partnerships enhance system efficiency and accelerate innovation adoption. This model allows the market to benefit simultaneously from public sector reach and private sector agility.

Future Outlook

The UAE Carrier Genetic Testing Market is positioned for sustained strategic growth as genomics becomes an integral component of national healthcare planning. Continued alignment between public health objectives and private sector capabilities is expected to drive deeper integration of carrier screening into routine care. Advances in automation, digital counseling platforms, and localized high-complexity testing will further strengthen service accessibility, positioning the market as a cornerstone of preventive and personalized medicine in the country.

Major Players

- M42 Genomics

- NMC Genomics

- Mediclinic Middle East Genetics

- Aster Diagnostics

- Unilabs Middle East

- Prime Hospital Genetics

- Medcare Hospitals Genetics

- Abu Dhabi Stem Cells Center Genomics

- Dubai Genetics Center

- Al Jalila Children’s Specialty Hospital Genetics

- G42 Healthcare Precision Medicine

- Star Metropolis Healthcare Genomics

- Centogene MENA

- BGI Middle East

- Genetica MENA

Key Target Audience

- Hospital groups and healthcare providers

- Diagnostic laboratory networks

- Fertility and reproductive health centers

- Corporate health benefit managers

- Investments and venture capitalist firms

- Government and regulatory bodies

- Health insurance providers

- Medical technology and genomics solution vendors

Research Methodology

Step 1: Identification of Key Variables

This phase involved mapping the entire carrier genetic testing ecosystem in the UAE, including laboratories, hospitals, fertility centers, payers, and technology suppliers. Secondary research across industry publications and proprietary databases was used to define core demand and supply variables.

Step 2: Market Analysis and Construction

Historical service adoption patterns and institutional testing volumes were consolidated to establish market structure. Revenue attribution was aligned across care settings to ensure accurate representation of public and private sector contributions.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions were validated through structured interviews with clinical leaders, laboratory directors, and healthcare administrators. These discussions refined insights into pricing models, operational constraints, and growth expectations.

Step 4: Research Synthesis and Final Output

All quantitative and qualitative inputs were synthesized using a triangulation framework, ensuring consistency across datasets and producing a validated, client-ready market narrative.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, terminology and abbreviations, carrier screening taxonomy and test menu mapping, market sizing logic by test volume and panel utilization, revenue attribution across assays sequencing reagents and interpretation services, primary interview program with hospitals fertility clinics labs and payers, data triangulation and validation approach, assumptions limitations and data gaps)

- Definition and Scope

- Market Genesis and Evolution of Carrier Screening in the UAE

- Premarital Screening Context and High Impact Hereditary Conditions

- Care Pathway Mapping Across Premarital Programs Fertility Care and Prenatal Counseling

- Lab Network Structure and Sample Referral Dynamics

- Import Dependence and Send Out Testing versus Local NGS Capacity

- Growth Drivers

Mandatory and programmatic premarital screening expansion

High awareness of inherited disorders and consanguinity risk context

Rising IVF utilization and demand for reproductive genetic screening

Growth of private healthcare and premium diagnostics

Advances in NGS lowering cost per gene and expanding panel adoption - Challenges

Variant interpretation complexity and counseling capacity constraints

Data privacy and cross border genomic data handling concerns

Reimbursement variability and affordability barriers for expanded panels

Turnaround time dependency on send out testing pathways

Quality standardization and accreditation requirements for genetics labs - Opportunities

Localization of NGS carrier screening capacity and bioinformatics

Expansion of digital genetic counseling and care coordination

Partnerships between public programs and private labs for scaling

Panel optimization for UAE population variant prevalence

Integration of carrier screening with prenatal and newborn pathways - Trends

Shift from targeted testing toward expanded carrier screening panels

Rising use of NGS with improved bioinformatics interpretation

Integration of genetics into fertility clinic care protocols

Greater emphasis on informed consent and patient education tools

Growth of longitudinal family risk registries and cascade screening - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Test Volume, 2019–2024

- By Targeted Panels vs Expanded Carrier Screening Split, 2019–2024

- By Public vs Private Provider Revenue Split, 2019–2024

- By Fleet Type (in Value %)

Government hospitals and public health programs

Private hospital networks

Fertility clinics and IVF centers

Independent reference laboratories

Prenatal and women’s health clinics - By Application (in Value %)

Premarital carrier screening

Preconception and family planning screening

IVF and preimplantation genetic testing support

Prenatal carrier screening and counseling

Cascade testing in high risk families - By Technology Architecture (in Value %)

PCR based targeted mutation testing

Microarray based carrier screening panels

NGS based expanded carrier screening

Whole exome sequencing support for complex cases

Send out testing and international reference lab workflows - By Connectivity Type (in Value %)

Standalone lab reporting workflows

LIS integrated genetic testing operations

Digital genetic counseling and teleconsult platforms

EHR integrated ordering and results delivery

Cloud based variant interpretation and knowledgebases - By End-Use Industry (in Value %)

Public health and premarital screening providers

Clinical genetics and counseling services

Fertility and reproductive medicine centers

Hospital laboratories and pathology networks

Insurance and employer wellness programs - By Region (in Value %)

Abu Dhabi

Dubai

Sharjah

Northern Emirates

Al Ain and inland corridors

- Competitive ecosystem structure across local labs international reference labs and hospital networks

- Positioning driven by panel breadth interpretation quality and counseling support

- Partnership models between fertility clinics hospitals and genomic service providers

- Cross Comparison Parameters (panel gene coverage and update frequency, population specific variant inclusion, turnaround time and sample logistics, variant interpretation workflow quality, availability of genetic counseling support, data privacy and compliance posture, reporting clarity and clinical actionability, cost per test and payer coverage fit)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

M42

Pure Health

G42 Healthcare

Al Jalila Genomics Center

Dubai Health Laboratory Services

Abu Dhabi Health Services Company SEHA

BGI Genomics

Illumina

Thermo Fisher Scientific

Centogene

Invitae

Fulgent Genetics

Myriad Genetics

Natera

GeneDx

- Provider decision drivers for panel selection and turnaround time

- Genetic counselor influence and patient education requirements

- Procurement and contracting models in public programs and private networks

- Payer coverage criteria and prior authorization dynamics

- Total cost of ownership across sequencing interpretation and reporting

- By Value, 2025–2030

- By Test Volume, 2025–2030

- By Targeted Panels vs Expanded Carrier Screening Split, 2025–2030

- By Public vs Private Provider Revenue Split, 2025–2030