Market Overview

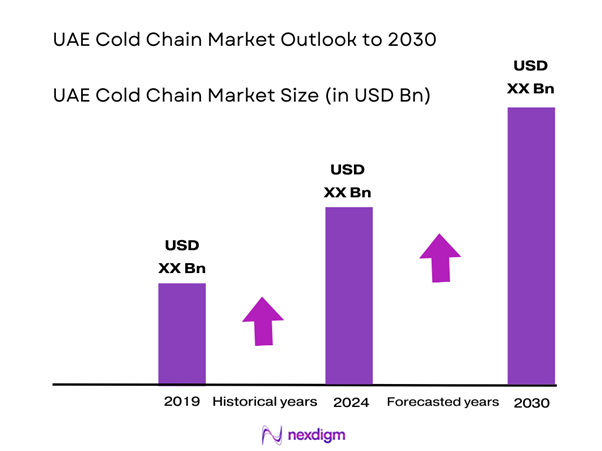

The UAE Cold Chain Market is valued at USD 0.71 Billion in 2025 with an approximated compound annual growth rate (CAGR) of 10.29% from 2025-2030, based on a five-year historical analysis. Key drivers of this market include the increasing demand for temperature-sensitive goods across sectors such as food and pharmaceuticals, as well as continuous investment in cold storage and transportation infrastructure. These developments reflect a heightened focus on food safety standards and efficient supply chain management, pushing the cold chain segment forward.

Major cities like Dubai and Abu Dhabi dominate the UAE cold chain market due to their advanced logistics infrastructure and strategic geographic positioning, which facilitate trade and distribution. Dubai serves as a global logistics hub, benefiting from world-class air and sea ports that enable efficient import and export of perishable goods. The cities are also supported by government initiatives aimed at enhancing supply chain capabilities, thus fostering sector growth.

The UAE government is committed to enhancing cold chain infrastructure through various initiatives under its National Food Security Strategy. Investments in improving logistics and storage facilities have been substantial, with the government planning to invest approximately AED 3 billion in logistics and supply chain infrastructure by end of 2025. This initiative will support the establishment of cold warehouses and temperature-controlled transport networks, critical for preserving perishables.

Market Segmentation

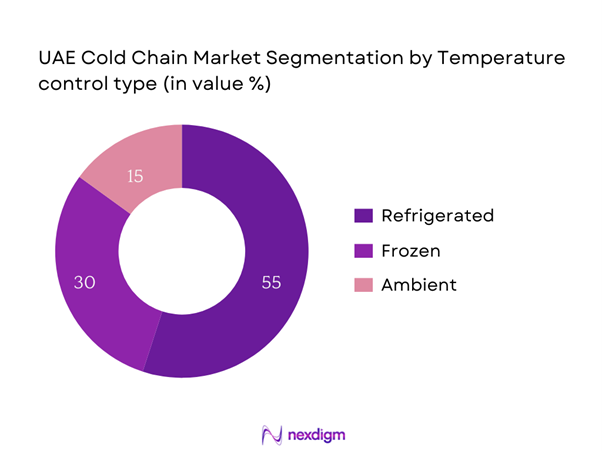

By Temperature Control Type

The UAE Cold Chain Market is segmented by temperature control type into refrigerated, frozen, and ambient storage. Refrigerated storage currently holds the dominant market share, driven by the rising demand for fresh food products and pharmaceuticals that require stable temperature conditions for preservation. The burgeoning food service industry, particularly in urban areas, further amplifies this segment’s growth as restaurants and retailers seek reliable cold storage solutions to maintain the quality and safety of their offerings.

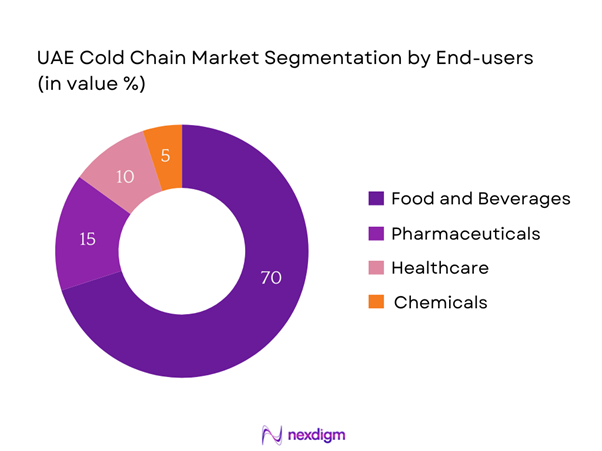

By End-User Sector

The market is segmented by end-user sector into food and beverage, pharmaceuticals, healthcare, and chemicals. Among these, the food and beverage sector commands a significant market share, primarily due to the booming population and robust tourism industry in the UAE. The demand for fresh and processed food items has been on a steady rise, leading retail and wholesale businesses to invest in enhanced cold chain solutions to meet consumer expectations for quality and freshness.

Competitive Landscape

The UAE Cold Chain Market is dominated by a few major players, contributing significantly to its growth. Key companies include GWC, Agility Logistics, and Emirates Logistics, alongside local and international firms seeking to expand their market footprint. This concentration signals the significant influence these leading companies have on market trends and consumer expectations.

| Company | Establishment Year | Headquarters | Temperature Control Solutions | End-User Sectors Served | Annual Revenue (Est.) | Number of Locations |

| GWC | 1997 | Doha, Qatar | – | – | – | – |

| Agility Logistics | 1977 | Kuwait | – | – | – | – |

| Emirates Logistics | 2005 | Dubai | – | – | – | – |

| Al-Futtaim Logistics | 1971 | Dubai | – | – | – | – |

| Al-Watania | 1982 | Abu Dhabi | – | – | – | – |

UAE Cold Chain Market Analysis

Growth Drivers

Increasing Demand for Perishable Goods

The increasing demand for perishable goods in the UAE is driven by the population’s growth, which reached approximately 9.4 million in 2023, according to the World Bank. This growing population is significantly raising the need for fresh food products, especially fruits, vegetables, and dairy items. For example, in 2022, the UAE imported around 90 percent of its food, constituting over USD 12 billion annually in perishable goods. With the population projected to reach 10 million by end of 2025, the trend suggests that perishable goods demand will continuously rise, necessitating a robust cold chain infrastructure to preserve the quality and safety of these products.

Growth in the E-Commerce Sector

The rapid growth of e-commerce in the UAE is a significant driver of the cold chain market. In 2022, the e-commerce sector was valued at approximately AED 21 billion, with online grocery shopping alone expected to contribute over AED 5 billion. This segment’s expansion results from changing consumer behaviors favoring convenience and home delivery, necessitating an efficient cold chain to ensure the safe transit of perishable items. With e-commerce sales projected to grow further, particularly in the food and beverage sector, innovative cold chain solutions will become increasingly essential to meet distribution demands.

Market Challenges

High Initial Investments Required

One of the primary challenges facing the cold chain market in the UAE is the high initial investment required for establishing advanced cold storage facilities and transportation systems. The cost of constructing a state-of-the-art cold storage facility can range between AED 4 million and AED 60 million depending on size and location. Additionally, maintaining these facilities involves significant operational expenditures. Given that cold chain logistics companies require specialized equipment such as temperature-controlled trucks, operators often struggle with financial constraints that impede their ability to scale operations effectively.

Regulatory Compliance Issues

Regulatory compliance is becoming increasingly complex in the UAE, presenting significant challenges for cold chain operators. The Ministry of Climate Change and Environment mandates strict adherence to food safety regulations that impact storage and transport processes. For instance, the UAE has set up around 300 food-related regulations as part of its national food safety program. Non-compliance can lead to stringent penalties, recalls, and reputational damage. Thus, managing compliance effectively while maintaining operational efficiency requires significant resources and continuous monitoring, proving to be a substantial hurdle for many companies operating in the cold chain market.

Opportunities

Adoption of IoT and Automation in Cold Chain

The adoption of IoT technologies in the cold chain is poised to enhance operational efficiency and accuracy in temperature management. As of 2023, about 34% of UAE logistics companies have begun implementing smart technology solutions within their operations, indicating a growing trend. These advancements can significantly improve real-time monitoring of temperature-sensitive products, preventing spoilage and increasing overall supply chain efficiency. With the global market for IoT in logistics expected to surpass AED 30 billion, the UAE is well-positioned to leverage this technology to optimize its cold chain operations and emerge as a regional leader.

Expansion of Online Grocery Platforms

The expansion of online grocery platforms represents a promising opportunity for the cold chain market in the UAE. With consumer demand for online grocery shopping increasing notably, particularly during and after the COVID-19 pandemic, online grocery sales have been witnessing a consistent rise. Based on recent analysis, online grocery sales in the UAE increased by 27% in 2022, reaching approximately AED 5.5 billion. This shift in consumer buying behavior underscores the necessity for efficient cold chain systems to ensure safe and timely delivery of perishable goods

Future Outlook

Over the next five years, the UAE Cold Chain Market is anticipated to exhibit significant growth, fueled by increasing government support, advancements in cold chain technology, and rising consumer demand for high-quality refrigerated goods. The integration of IoT and AI in cold chain logistics is expected to streamline operations and enhance efficiency, vital for meeting the growing expectations of consumers.

Major Players

- GWC

- Agility Logistics

- Emirates Logistics

- Al-Futtaim Logistics

- Al-Watania

- Shafar Group

- Al Marai

- Gulf Agency Company (GAC)

- Abu Dhabi Ports

- Alzahi Group

- Al Jomaih Group

- Kuehne + Nagel

- DB Schenker

- Damco

- Cold Chain Solutions

Key Target Audience

- Retail and Wholesale Distributors

- Food and Beverage Manufacturers

- Pharmaceuticals and Biotech Firms

- Logistics and Supply Chain Companies

- Government and Regulatory Bodies (Food Safety Authority, Ministry of Health)

- Investments and Venture Capitalist Firms

- Grocery and Supermarket Chains

- Cold Storage Facility Operators

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the UAE Cold Chain Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define critical variables that influence market dynamics, including drivers, challenges, and regulatory environments.

Step 2: Market Analysis and Construction

In this phase, historical data pertinent to the UAE Cold Chain Market will be compiled and analyzed. This includes assessing market penetration, the ratio of marketplaces to service providers, and resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates, establishing a robust foundation for understanding market trends.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies within the cold chain landscape. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data obtained.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with key players in the cold chain market to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach and ensures a comprehensive, accurate, and validated analysis of the UAE Cold Chain Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Demand for Perishable Goods

Government Initiatives to Enhance Cold Chain Infrastructure

Growth in the E-Commerce Sector - Market Challenges

High Initial Investments Required

Regulatory Compliance Issues - Opportunities

Adoption of IoT and Automation in Cold Chain

Expansion of Online Grocery Platforms - Trends

Sustainability Practices in Cold Chain Operations

Technological Advancements in Refrigeration - Government Regulation

Compliance Standards for Cold Chain Facilities

Import and Export Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Temperature Control Type (In Value %)

Refrigerated (2°C to 8°C)

– Dairy Products

– Fresh Produce

– Vaccines & Blood Components

Frozen (Below -18°C)

– Frozen Meat & Seafood

– Ice Cream & Ready-to-Eat Meals

– Biopharmaceuticals

Ambient (15°C to 25°C)

– Packaged Snacks

– Confectionery Items

– Temperature-Sensitive Chemicals - By End-User Sector (In Value %)

Food and Beverage

– Perishable Fruits and Vegetables

– Meat and Poultry Products

– Ready-to-Eat Meals and Frozen Desserts

– Beverage Distribution (Juices, Dairy Drinks)

Pharmaceuticals

– Vaccines and Biologics

– Blood Plasma and Insulin

– Temperature-Sensitive APIs (Active Pharmaceutical Ingredients)

Healthcare

– Hospital Supply Chains

– Clinical Trial Material Handling

– Diagnostic Sample Logistics

Chemicals

– Agrochemicals and Fertilizers

– Industrial Chemicals Requiring Stable Conditions

– Specialty and Hazardous Chemicals - By Distribution Channel (In Value %)

Direct

– Manufacturer-Owned Distribution Networks

– In-House Fleet and Cold Warehouses

Third-Party Logistics (3PL)

– Cold Chain as a Service (CCaaS)

– Integrated Transport & Warehousing Solutions

– Contract Logistics Providers

Retail

– Supermarkets & Hypermarkets Fulfillment

– Online Grocery Fulfillment Centers

– Last-Mile Delivery for F&B and Pharma - By Service Type (In Value %)

Storage

– Multi-Temperature Warehousing

– Cold Storage Chambers (Modular/Automated)

– Dedicated Pharma Warehousing

Transportation

– Refrigerated Trucks & Vans

– Reefer Container Shipping

– Air Cargo Solutions for Time-Sensitive Goods

Packaging

– Insulated Boxes & Pallets

– Gel Packs and Phase Change Materials

– Smart Packaging with IoT Sensors - By Region (In Value %)

Central UAE

Northern UAE

Southern UAE

Eastern UAE

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share by Cold Chain Segments, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Organizational Structure, Revenues, Number of Refrigerated Vehicles, Total Cold Storage Capacity, Number and Location of Distribution Points, Technology Utilization, Geographic Coverage, Regulatory Compliance and Certifications, Client Segments Served, Sustainability and Energy-Efficient Operations, Value-Added Services)

- SWOT Analysis of Major Competitors

- Pricing Analysis for Major Competitors

- Detailed Profiles of Major Companies

Al-Futtaim Logistics

Agility Logistics

DB Schenker

Kuehne + Nagel

Gulftainer

Aramex

Emirates Logistics

Alshaya Group

Tamer Group

Al Jomaih Group

DACO Logistics

Taqeef Logistics

ANA Logistics

Transworld Group

Agility Logistics

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory Requirements by Sector

- Needs, Desires, and Pain Points

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030