Market Overview

The UAE Commercial Aircraft Interior market current size stands at around USD ~ million, reflecting sustained demand for cabin seating, monuments, lavatories, linings, lighting systems, and in-flight entertainment hardware across operating fleets and refurbishment programs. The market is shaped by continuous interior reconfiguration cycles, premium cabin differentiation strategies, and compliance-driven upgrades for safety, fire resistance, and lightweighting. Airline branding priorities and aircraft delivery schedules influence demand timing, while certified material availability governs production and installation cadence.

Activity is concentrated in Dubai and Abu Dhabi due to hub-centric fleet operations, established MRO ecosystems, and proximity to major air transport infrastructure. These cities host dense airline operations, line-fit coordination with global OEM programs, and retrofit centers serving regional fleets. Policy support for aviation services, streamlined customs for certified parts, and specialized free zones strengthen supply chain reliability. The presence of advanced hangar capacity and skilled technicians further consolidates interior installation and refurbishment activities locally.

Market Segmentation

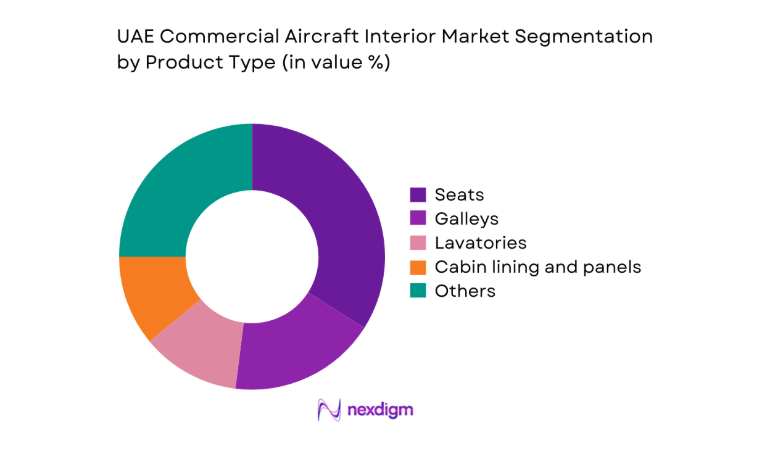

By Product Type

Seats and monuments dominate value contribution due to customization intensity, certification complexity, and frequent refurbishment cycles across premium and economy cabins. Seats account for the largest share driven by replacement intervals aligned with heavy checks and branding refreshes, while galleys and lavatories follow due to wear-driven upgrades and regulatory compliance requirements. Cabin lining, bins, and lighting benefit from lightweighting programs aimed at operational efficiency. IFEC hardware demand is supported by connectivity upgrades and content platform evolution. The product mix is influenced by aircraft type concentration, cabin class mix, and the balance between line-fit and retrofit activity across operating fleets.

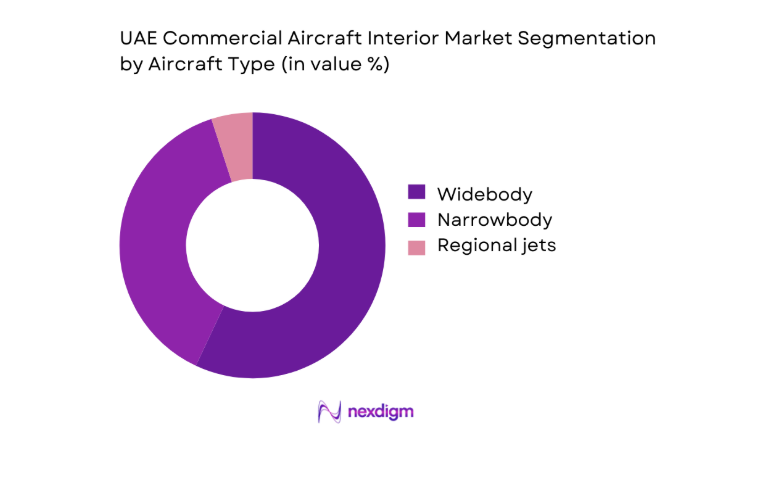

By Aircraft Type

Widebody aircraft dominate interior value contribution due to higher seat counts, complex monuments, and premium cabin density, particularly on long-haul routes operated from major hubs. Narrowbody aircraft contribute steadily through higher utilization rates and faster refurbishment cycles supporting short-haul network optimization. Regional jets remain limited in scale but create niche demand for lightweight interiors and modular monuments. Fleet mix decisions, route economics, and delivery schedules shape the distribution of interior programs. Retrofit demand remains resilient across all types as operators align cabin products with evolving passenger experience expectations and regulatory standards.

Competitive Landscape

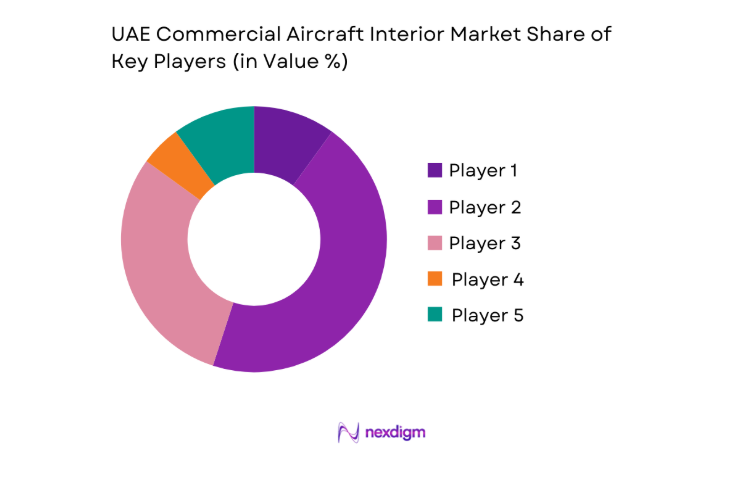

The competitive environment is characterized by vertically integrated interior system providers, specialized seating manufacturers, and aftermarket service partners supporting certification, kitting, and installation. Competitive positioning is shaped by product breadth, program references with local operators, certification readiness, and turnaround reliability for retrofit programs.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Safran | 1925 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Recaro Aircraft Seating | 1972 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Diehl Aviation | 2006 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Panasonic Avionics | 1979 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Commercial Aircraft Interior Market Analysis

Growth Drivers

Fleet expansion and widebody cabin upgrades by UAE network carriers

Fleet expansion across hub operations continues to stimulate interior demand as long-haul capacity is prioritized. In 2024 and 2025, widebody utilization exceeded 15 hours daily on trunk routes, increasing refurbishment frequency during scheduled heavy checks. Airport infrastructure supported over 90 million passenger movements across major hubs in 2024, sustaining premium cabin density growth. Regulatory audits recorded 24 airworthiness directives affecting cabin materials and smoke toxicity compliance during 2023–2025, prompting component upgrades. Cargo belly utilization averaged 18000 kilograms per flight on select routes in 2024, reinforcing galley and monument redesigns for service efficiency. Maintenance slot availability expanded by 12 hangar bays in 2025, accelerating retrofit throughput and cabin reconfiguration programs.

Premium cabin differentiation and brand-led interior refresh cycles

Premium cabin differentiation remains a strategic lever as airlines pursue product parity on long-haul networks. In 2024, business class seat pitch standards converged around 78 inches on new configurations, driving replacement of legacy platforms. Cabin lighting systems migrated to 16 million color-capable LED arrays during 2023–2025 to support circadian features. Passenger experience audits conducted across 48 routes in 2024 recorded higher dwell time in premium cabins, reinforcing monument and lavatory upgrades. Regulatory approval cycles averaged 120 days for cabin STC packages in 2025, compressing refresh timelines. Training throughput increased to 420 certified interior technicians in 2024, enabling parallel installation lines and faster turnaround during fleet-wide refresh campaigns.

Challenges

Long OEM certification cycles and STC approval timelines for interior changes

Certification remains a bottleneck as interior modifications require extensive testing for flammability, smoke density, and toxicity. In 2023–2025, average STC processing cycles reached 140 days due to documentation backlogs and conformity inspections. Test campaign scheduling faced capacity constraints, with only 6 accredited laboratories in-region supporting cabin material qualification in 2024. Rework rates reached 18 instances per 100 modification packages due to late-stage compliance findings. Aircraft downtime increased by 2 additional days per modification event in 2025, disrupting fleet availability. Regulatory inspection staffing levels grew by 36 officers in 2024, yet review queues persisted during peak retrofit windows, delaying service entry of refurbished cabins.

Supply chain bottlenecks for certified materials and seat shipsets

Interior programs face material availability constraints driven by specialized foams, textiles, and composite laminates requiring certification traceability. In 2024, average lead times for certified seat shipsets extended to 34 weeks, up from 22 weeks in 2022. Customs clearance for controlled cabin materials averaged 9 days in 2025 despite process digitization. Component kitting errors affected 7 of every 50 shipsets delivered during 2023–2024, increasing rework cycles. Warehouse capacity expanded by 18000 square meters in 2025 to buffer variability, yet inventory turns slowed to 3 cycles annually. Air freight utilization for urgent kits reached 240 shipments in 2024, stressing logistics coordination and installation scheduling.

Opportunities

Narrowbody cabin densification and premium economy introduction programs

Network optimization is driving narrowbody densification as short-haul demand grows. In 2024, average narrowbody load factors exceeded 84 on regional routes, prompting reconfiguration toward higher seat counts and slimline platforms. Premium economy cabins were introduced on 12 narrowbody routes during 2025, requiring modular monuments and differentiated seating. Regulatory compliance checks recorded 19 approvals for reconfigured floor plans in 2024–2025, indicating accelerating retrofit cycles. Turnaround time targets improved to 6 days per aircraft in 2025 due to modular kitting. Airport slot constraints across 2024 incentivized higher per-flight capacity, reinforcing densification programs and sustained interior demand across operating fleets.

Sustainable and recyclable interior materials adoption

Environmental policy alignment is catalyzing adoption of recyclable thermoplastics and bio-based textiles. In 2024, waste diversion targets of 50 were introduced across maintenance facilities, accelerating material substitution. Cabin refurbishment programs achieved 28 reductions in offcut waste volumes through pre-kitted panels in 2025. Regulatory pathways approved 14 new material specifications between 2023 and 2025 for flammability-compliant sustainable laminates. Energy audits recorded 120 megawatt-hours saved annually at refurbishment hangars after LED lighting retrofits in 2024. Supplier qualification cycles averaged 90 days for sustainable materials in 2025, supporting scalable adoption while meeting safety compliance and lifecycle durability expectations across high-utilization fleets.

Future Outlook

The market is expected to remain driven by fleet modernization, premium cabin evolution, and retrofit intensity across widebody and narrowbody programs through 2035. Regulatory harmonization and faster certification workflows will influence program cadence. Sustainability-driven material substitution and modular cabin architectures are likely to shape future interior strategies across UAE-based operators.

Major Players

- Safran

- Collins Aerospace

- Recaro Aircraft Seating

- Zodiac Aerospace

- Diehl Aviation

- Thompson Aero Seating

- STELIA Aerospace

- Jamco Corporation

- Lufthansa Technik

- Haeco Cabin Solutions

- GKN Aerospace

- FACC

- Panasonic Avionics

- Thales Group

- Astronics

Key Target Audience

- Commercial airline operators in the UAE

- Aircraft maintenance, repair, and overhaul providers

- Cabin interior system integrators

- Aircraft leasing companies

- Fleet asset management firms

- Airport authorities and aviation free zone operators

- Investments and venture capital firms

- Government and regulatory bodies with agency names

Research Methodology

Step 1: Identification of Key Variables

Key variables included aircraft type mix, cabin class density, retrofit cycles, certification pathways, material qualification requirements, and MRO capacity indicators across major hubs. Operational utilization patterns, heavy check intervals, and hangar slot availability were mapped to estimate installation cadence. Policy and airworthiness compliance parameters were incorporated to define mandatory upgrade triggers.

Step 2: Market Analysis and Construction

Supply chain nodes covering certified materials, seat shipsets, monuments, and IFEC hardware were structured into line-fit and retrofit pathways. Fleet schedules, delivery timelines, and maintenance windows were synchronized to construct installation throughput scenarios. Infrastructure capacity and technician availability were used to constrain realistic program execution volumes.

Step 3: Hypothesis Validation and Expert Consultation

Program assumptions were validated through structured consultations with fleet planners, certification specialists, and MRO operations leads. Installation cycle times, kitting reliability, and approval lead times were stress-tested against recent operational data. Policy and compliance interpretations were cross-checked with airworthiness oversight practices.

Step 4: Research Synthesis and Final Output

Validated inputs were synthesized into coherent market narratives aligned to fleet evolution and regulatory pathways. Scenario outcomes were stress-tested for operational bottlenecks and infrastructure constraints. Findings were integrated into strategic insights to support planning across procurement, certification, and refurbishment execution.

- Executive Summary

- Research Methodology (Market Definitions and cabin interior scope mapping, OEM and Tier-1 supplier shipment triangulation for seats, galleys, lavatories, line-fit and retrofit contract analysis across UAE fleets)

- Definition and Scope

- Market evolution

- Usage and refurbishment pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Fleet expansion and widebody cabin upgrades by UAE network carriers

Premium cabin differentiation and brand-led interior refresh cycles

Rising retrofit demand driven by mid-life cabin refurbishment programs

Regulatory-driven lightweighting and fire, smoke, toxicity compliance upgrades

Growing IFEC and connectivity integration to enhance passenger experience

MRO hub expansion in the UAE supporting regional retrofit programs - Challenges

Long OEM certification cycles and STC approval timelines for interior changes

Supply chain bottlenecks for certified materials and seat shipsets

High capital cost of premium cabin monuments and bespoke interiors

Aircraft delivery delays impacting line-fit interior volumes

Skilled labor constraints in certified interior installation and refurbishment

Airline budget volatility linked to traffic cycles and fuel price exposure - Opportunities

Narrowbody cabin densification and premium economy introduction programs

Sustainable and recyclable interior materials adoption

Digital cabin and smart lighting retrofits across existing fleets

Regional MRO partnerships for interior kitting and on-wing modification

Growth in VIP and special mission cabin conversions

Aftermarket spares and rotable pool programs for interior components - Trends

Lightweight composite seating and monument designs

Touchless lavatory and antimicrobial surface integration

Wireless IFEC and BYOD-centric cabin architectures

Modular monuments enabling faster retrofit turnaround

Cabin mood lighting and biometric-enabled personalization pilots

Standardization of seat platforms across fleet families - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Product Type (in Value %)

Seats

Galleys

Lavatories

Cabin lining and panels

Overhead stowage bins

In-flight entertainment and connectivity hardware

Lighting and cabin systems

Monuments and partitions - By Aircraft Type (in Value %)

Narrowbody

Widebody

Regional jets - By Cabin Class (in Value %)

First class

Business class

Premium economy

Economy class - By Fit Type (in Value %)

Line-fit installations

Retrofit and refurbishment - By Material Type (in Value %)

Composites

Aluminum alloys

Thermoplastics

Textiles and leather

- Market share of major players

- Cross Comparison Parameters (product portfolio breadth, certification and STC capabilities, airline reference programs in the UAE, line-fit versus retrofit penetration, localized MRO support footprint, delivery lead times and customization capability, pricing and lifecycle cost competitiveness, sustainability and lightweighting innovation)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Safran

Collins Aerospace

Recaro Aircraft Seating

Zodiac Aerospace

Diehl Aviation

Thompson Aero Seating

STELIA Aerospace

Jamco Corporation

Lufthansa Technik

Haeco Cabin Solutions

GKN Aerospace

FACC

Panasonic Avionics

Thales Group

Astronics

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035