Market Overview

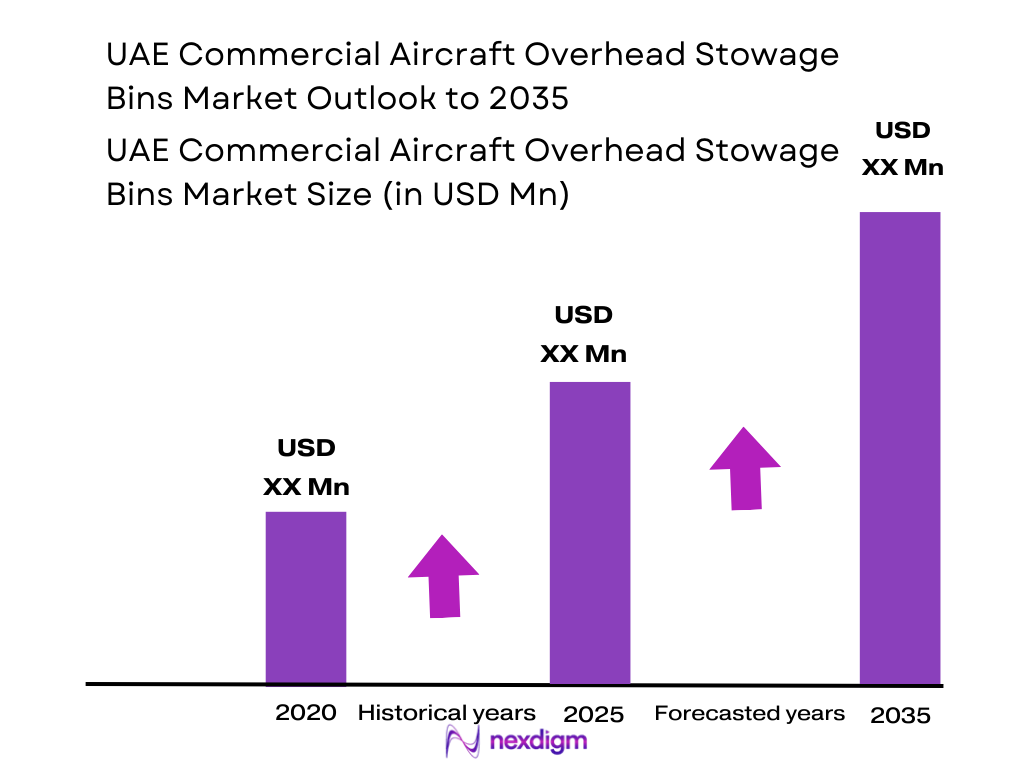

Based on a recent historical assessment, the UAE Commercial Aircraft Overhead Stowage Bins Market recorded a total market size of USD ~ million, supported by sustained aircraft deliveries, active cabin retrofit programs, and continuous interior modernization by regional carriers. Demand is driven by airline focus on higher passenger convenience, optimized cabin storage, and lightweight interior solutions aligned with fuel efficiency objectives. OEM production line installations, combined with strong aftermarket activity, underpin consistent procurement volumes. Regulatory compliance requirements for safety, fire resistance, and durability further sustain replacement cycles and technology upgrades across active commercial fleets.

Based on a recent historical assessment, Dubai and Abu Dhabi dominate the UAE Commercial Aircraft Overhead Stowage Bins Market due to their roles as global aviation hubs hosting major widebody fleets and high passenger throughput airports. These cities benefit from concentrated airline headquarters, MRO facilities, and strong OEM partnerships. The UAE’s strategic geographic position supports long haul connectivity, increasing widebody utilization and cabin reconfiguration demand. Strong government support for aviation infrastructure, coupled with high fleet utilization rates, reinforces sustained investment in advanced cabin interior systems across the country.

Market Segmentation

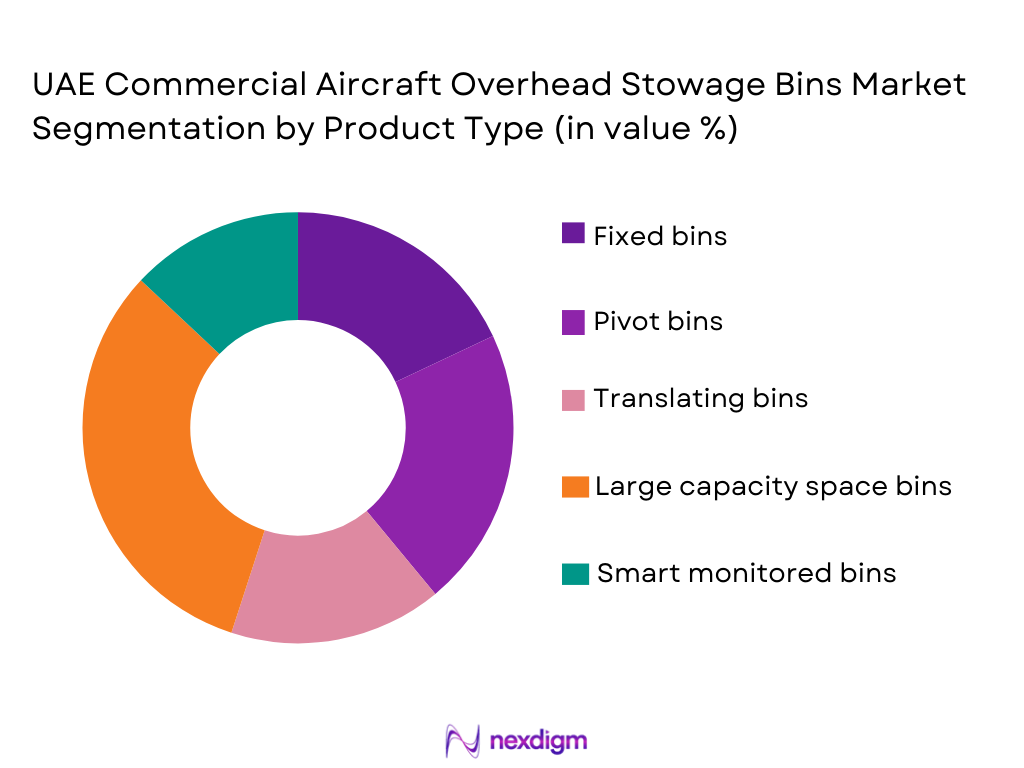

By Product Type

UAE Commercial Aircraft Overhead Stowage Bins Market is segmented by product type into fixed bins, pivot bins, translating bins, large capacity space bins, and smart monitored bins. Recently, large capacity space bins have a dominant market share due to their ability to significantly increase cabin baggage volume without structural redesign. Airlines operating long haul and high density routes prioritize these bins to improve passenger satisfaction and boarding efficiency. Their compatibility with widebody platforms, reduced congestion, and enhanced safety features support adoption. OEM standardization and retrofit feasibility further reinforce their preference across UAE airline fleets.

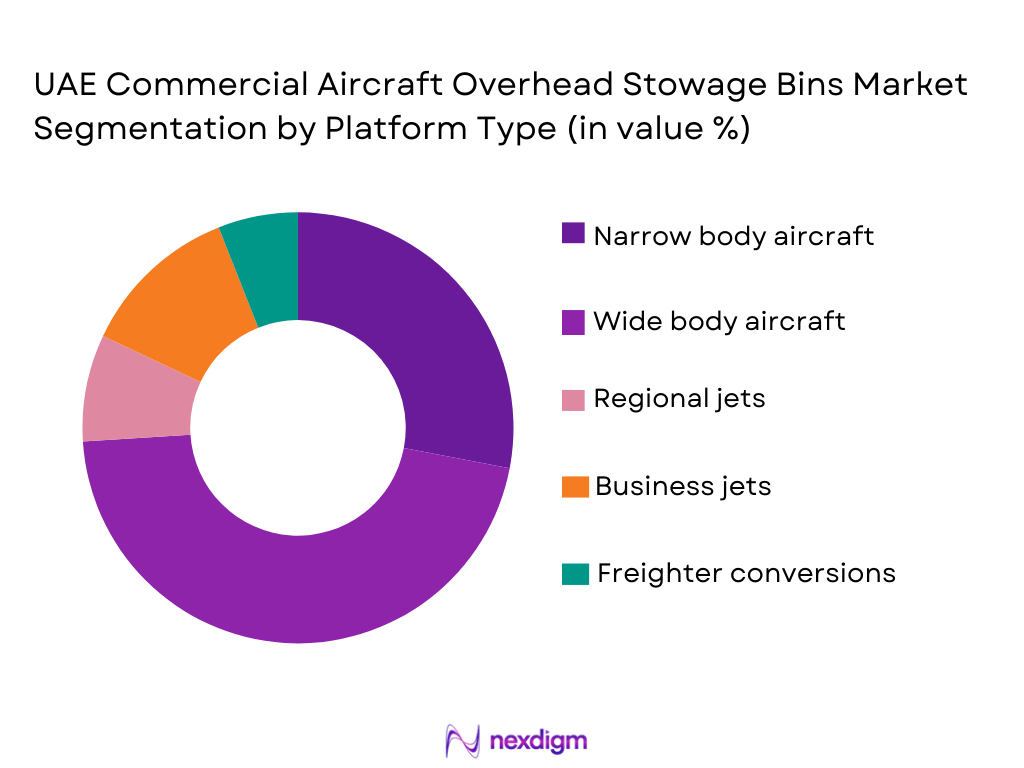

By Platform Type

UAE Commercial Aircraft Overhead Stowage Bins Market is segmented by platform type into narrow body aircraft, wide body aircraft, regional jets, business jets, and freighter conversions. Recently, wide body aircraft have a dominant market share due to the UAE’s strong focus on long haul international connectivity. Flag carriers operate large widebody fleets requiring frequent cabin upgrades and high capacity storage solutions. High passenger loads, premium cabin configurations, and extended utilization cycles increase replacement and retrofit demand. Concentration of widebody maintenance facilities further accelerates procurement and customization activity.

Competitive Landscape

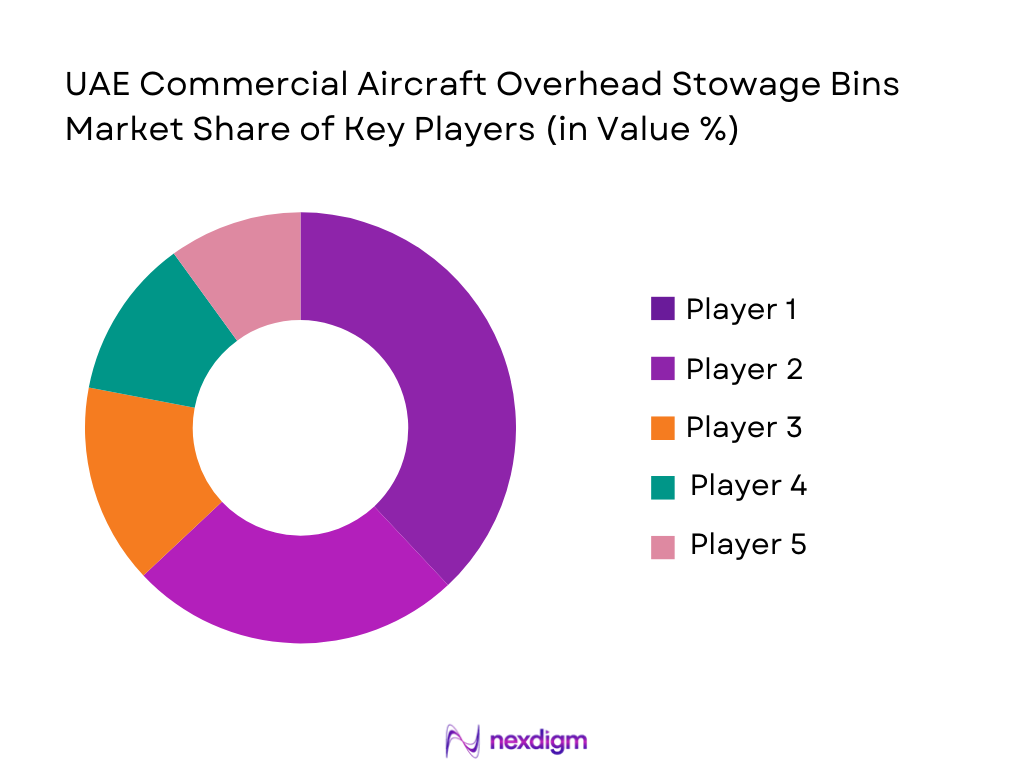

The UAE Commercial Aircraft Overhead Stowage Bins Market features a moderately consolidated competitive landscape dominated by global cabin interior suppliers with established OEM certifications and long term airline contracts. Leading players benefit from strong engineering capabilities, composite material expertise, and integrated aftermarket support. Competition is driven by product weight reduction, installation efficiency, and regulatory compliance. Strategic partnerships with airlines, leasing companies, and MRO providers reinforce market positions, while high certification barriers limit rapid entry by smaller or regional manufacturers globally.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Certification Capability |

| Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ | ~ |

| Safran Cabin | 2005 | France | ~ | ~ | ~ | ~ | ~ |

| Diehl Aviation | 2006 | Germany | ~ | ~ | ~ | ~ | ~ |

| FACC AG | 1989 | Austria | ~ | ~ | ~ | ~ | ~ |

| Jamco Corporation | 1955 | Japan | ~ | ~ | ~ | ~ | ~ |

UAE Commercial Aircraft Overhead Stowage Bins Market Analysis

Growth Drivers

Fleet Modernization and Widebody Aircraft Expansion:

Fleet modernization and widebody aircraft expansion strongly drive the UAE Commercial Aircraft Overhead Stowage Bins Market as national and regional airlines continue investing in next generation aircraft to support long haul connectivity and hub based operations. Widebody fleets require larger, lighter, and more durable stowage systems to manage higher passenger volumes and increased cabin baggage. Airlines prioritize standardized cabin interiors across mixed age fleets, which accelerates replacement of legacy bins with advanced space optimized designs. OEM line fit demand remains stable due to continuous aircraft deliveries, while retrofit demand grows as carriers extend aircraft service life. High utilization rates increase interior wear cycles, making bin replacement a recurring requirement. The financial strength of UAE carriers supports sustained capital expenditure on certified cabin components. Regulatory safety compliance further reinforces adoption of new generation overhead bins.

Cabin Retrofit Programs and Passenger Experience Optimization:

Cabin retrofit programs and passenger experience optimization represent another major growth driver for the UAE Commercial Aircraft Overhead Stowage Bins Market as airlines focus on service differentiation and operational efficiency. Overhead bins directly influence boarding speed, cabin comfort, and perceived space, making them a priority upgrade item during cabin refresh cycles. Airlines adopt larger capacity and ergonomic bin designs to reduce aisle congestion and improve safety. Retrofit projects are often bundled with broader interior upgrades, ensuring consistent demand across the aftermarket. The presence of advanced MRO infrastructure in the UAE enables efficient retrofit execution with minimal aircraft downtime. Leasing companies also drive demand by mandating cabin upgrades to preserve asset value and marketability. These combined factors sustain long-term growth across OEM and aftermarket channels.

Market Challenges

Stringent Certification and Regulatory Compliance Requirements:

Stringent certification and regulatory compliance requirements represent a critical challenge for the UAE Commercial Aircraft Overhead Stowage Bins Market due to the highly regulated nature of aircraft cabin interiors. Overhead stowage bins must comply with rigorous fire, smoke, toxicity, structural load, and crashworthiness standards mandated by international aviation authorities. Any modification in design, material, or configuration requires extensive testing, documentation, and re-certification, significantly extending development timelines. These processes increase costs for manufacturers and slow the introduction of innovative designs. Airlines also face scheduling constraints, as retrofit programs must align with certification approvals to avoid operational disruptions. Smaller or new suppliers encounter high entry barriers, limiting supplier diversity and competition. For operators, certification-driven delays can result in aircraft downtime, directly affecting fleet availability and revenue generation. The complexity of maintaining compliance across different aircraft platforms further compounds these challenges.

Supply Chain Dependency and Cost Pressure Across Global Aerospace Networks:

Supply chain dependency and cost pressure pose another major challenge for the UAE Commercial Aircraft Overhead Stowage Bins Market, as critical components and advanced materials are sourced through global aerospace manufacturing networks. Disruptions in raw material supply, composite manufacturing, or logistics can delay production and delivery schedules. Long lead times complicate airline retrofit planning and inventory management, especially for high utilization fleets. Transportation costs, import duties, and currency fluctuations add to procurement expenses. Limited localized manufacturing capabilities increase reliance on international suppliers, reducing flexibility during demand surges. Airlines and MRO providers must maintain buffer inventories to mitigate risks, increasing working capital requirements. Additionally, cost pressure from airlines seeking operational efficiency limits pricing flexibility for suppliers. Balancing cost competitiveness with quality, certification, and delivery reliability remains a persistent challenge across the value chain.

Opportunities

Adoption of Smart and Lightweight Overhead Stowage Bin Technologies:

Adoption of smart and lightweight overhead stowage bin technologies presents a significant opportunity for the UAE Commercial Aircraft Overhead Stowage Bins Market as airlines increasingly prioritize operational efficiency and data driven cabin management. Smart bins equipped with sensors for load monitoring, latch status, and usage cycles enable predictive maintenance and enhance safety compliance. Lightweight composite materials reduce overall aircraft weight, supporting fuel efficiency objectives and emission reduction targets. Premium carriers operating from the UAE are early adopters of advanced cabin technologies, creating favorable conditions for market penetration. Integration of smart bins with broader aircraft health monitoring systems increases value proposition for airlines. OEM collaboration and line fit adoption accelerate certification pathways. These advancements allow suppliers to differentiate offerings and capture higher value contracts across new deliveries and retrofits.

Expansion of Aftermarket Retrofit and Fleet Life Extension Programs:

Expansion of aftermarket retrofit and fleet life extension programs offers a strong growth opportunity for the UAE Commercial Aircraft Overhead Stowage Bins Market as airlines extend aircraft operational life to optimize capital investments. Aging fleets require frequent interior upgrades to maintain passenger experience standards and regulatory compliance. Overhead stowage bins are among the most replaced cabin components due to wear and evolving capacity requirements. Strong MRO infrastructure within the UAE supports efficient retrofit execution with reduced downtime. Aircraft leasing companies drive additional demand by requiring standardized and upgraded cabin interiors to protect asset value and enhance remarketing potential. Rising secondary market aircraft transitions further increase retrofit activity. These factors collectively create sustained long term demand within the aftermarket segment.

Future Outlook

The UAE Commercial Aircraft Overhead Stowage Bins Market is expected to experience steady growth over the next five years, supported by ongoing fleet expansion, retrofit activity, and technology adoption. Lightweight materials, smart cabin solutions, and modular designs will shape product development. Regulatory compliance will continue to influence procurement decisions. Strong airline investment capacity and infrastructure support will sustain demand across OEM and aftermarket segments.

Major Players

- Collins Aerospace

- Safran Cabin

- Diehl Aviation

- FACC AG

- JamcoCorporation

- Triumph Interiors

- Aviointeriors

- Nordam Group

- AIM Altitude

- LatecoereInteriors

- AernnovaInteriors

- ST Engineering Aerospace

- HaecoCabin Solutions

- Elbit Systems Aerospace

- Zodiac Aerospace

Key Target Audience

- Commercial airlines

- Aircraftleasing companies

- Aircraft OEMs

- MRO service providers

- Cabin interior integrators

- Airport operators

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Key variables including fleet size, aircraft type, retrofit cycles, and procurement patterns were identified. Data sources included aviation authorities, OEM disclosures, and airline reports. Variables were screened for relevance and reliability. Only validated indicators were selected.

Step 2: Market Analysis and Construction

Data was analyzed to construct the market framework. OEM and aftermarket demand was mapped. Supply chain structures were evaluated. Market boundaries were clearly defined.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses were validated through industry expert consultations. Inputs from airline engineers and MRO specialists were incorporated. Assumptions were refined based on feedback. Conflicting data points were reconciled.

Step 4: Research Synthesis and Final Output

Findings were synthesized into a cohesive report. Data consistency checks were performed. Insights were structured by market segments. Final outputs were reviewed for accuracy.

- Executive Summary

- UAE Commercial Aircraft Overhead Stowage Bins Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Fleet expansion of wide body aircraft in UAE hubs

Rising passenger traffic driving cabin capacity upgrades

Airline focus on lightweight interior solutions

Increased cabin retrofit activity for fleet life extension

Regulatory emphasis on safety and fire resistance standards - Market Challenges

High certification and compliance requirements

Customization costs for airline specific cabin layouts

Supply chain dependency on global aerospace suppliers

Downtime constraints during retrofit installations

Cost pressure from airline margin optimization - Market Opportunities

Next generation lightweight bin designs for fuel efficiency

Smart bins with integrated sensors and monitoring

Growth in aftermarket retrofit demand across aging fleets - Trends

Shift toward larger pivot and space bin architectures

Adoption of composite intensive interior components

Integration of passenger convenience features

Standardization of modular cabin interior designs

Increased collaboration between airlines and OEMs - Government Regulations & Defense Policy

Civil aviation safety and cabin interior regulations

Fire, smoke, and toxicity compliance standards

Local aviation authority certification requirements - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Pivot bin systems

Translating bin systems

Fixed overhead bins

Large capacity space bins

Smart monitored bin systems - By Platform Type (In Value%)

Narrow body aircraft

Wide body aircraft

Regional jets

Business jets

Freighter aircraft conversions - By Fitment Type (In Value%)

Line fit installations

Retrofit installations

Cabin refurbishment programs

Fleet upgrade fitments

Lease return modification fitments - By EndUser Segment (In Value%)

Full service airlines

Low cost carriers

Charter and ACMI operators

Business aviation operators

Aircraft leasing companies - By Procurement Channel (In Value%)

Direct OEM procurement

Tier-1 interior integrators

MRO procurement contracts

Leasing company sourcing

Aftermarket suppliers - By Material / Technology (in Value %)

Advanced thermoplastics

Carbon fiber reinforced composites

Aluminum alloy structures

Hybrid composite assemblies

Lightweight fire resistant materials

- Market structure and competitive positioning

- Market share snapshot of major players

CrossComparison Parameters (Product Weight, Load Capacity, Certification Compliance, Material Technology, Customization Capability, Installation Time, Lifecycle Cost, Aftermarket Support, OEM Partnerships, Geographic Presence) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Collins Aerospace

Safran Cabin

Diehl Aviation

FACC AG

Zodiac Aerospace

Latecoere Interiors

Jamco Corporation

Triumph Interiors

Aviointeriors

Nordam Group

AIM Altitude

Aernnova Interiors

ST Engineering Aerospace

Haeco Cabin Solutions

Elbit Systems Aerospace

- Airlines prioritize bin capacity to enhance passenger experience

- Leasing companies demand standardized and easily maintainable bins

- MRO providers focus on fast installation and certification support

- Business aviation users emphasize premium aesthetics and customization

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035