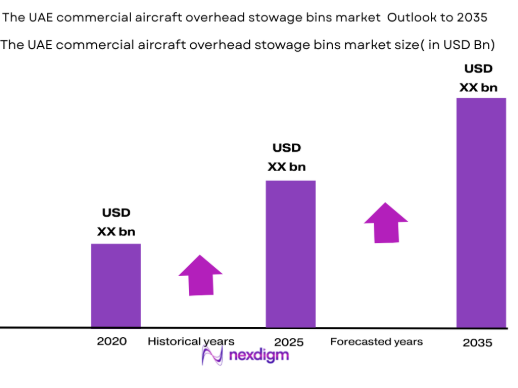

Market Overview

The UAE commercial aircraft overhead stowage bins market is valued at approximately USD ~ million, with growth fueled by increasing air travel and the need for more efficient cabin space utilization. Airlines seek to enhance passenger experience by integrating innovative and space-saving designs, with factors like fleet modernization and technological advancements in materials contributing to this expansion. Additionally, the demand for retrofitting existing aircraft with upgraded stowage solutions drives further growth in the market.

The UAE stands as a key player in the commercial aviation industry due to its strategic geographic position and the strong presence of major airlines like Emirates and Etihad Airways. The country’s continuous investment in airport infrastructure, alongside the rapid expansion of its aviation sector, strengthens its dominance in the region. The growing number of aircraft deliveries, combined with a rising number of travelers and demand for luxury travel, positions the UAE as a leader in the commercial aircraft overhead stowage bins market.

Market Segmentation

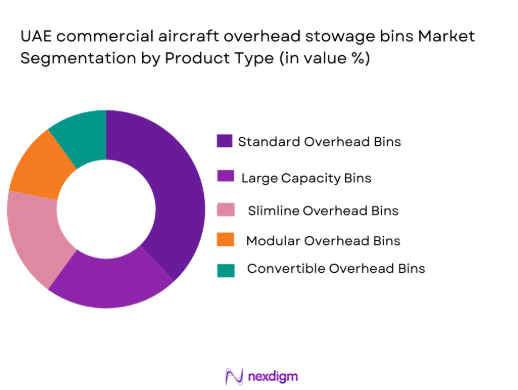

By Product Type

The UAE commercial aircraft overhead stowage bins market is segmented by product type into standard overhead bins, large capacity bins, slimline overhead bins, modular overhead bins, and convertible overhead bins. Recently, standard overhead bins have been dominating the market due to their proven efficiency, cost-effectiveness, and compatibility with a wide range of aircraft. The widespread use of standard bins in both new aircraft and retrofitted older models, driven by operational cost efficiency and ease of implementation, reinforces their market leadership.

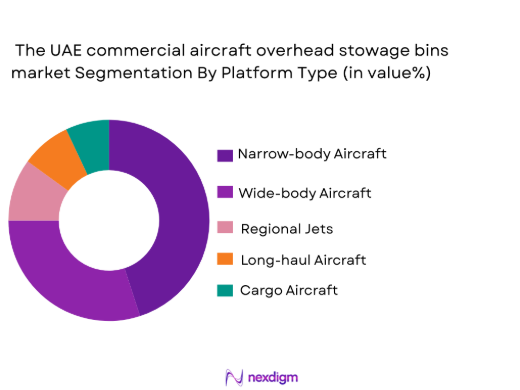

By Platform Type

The market is also segmented by platform type into narrow-body aircraft, wide-body aircraft, regional jets, long-haul aircraft, and cargo aircraft. Narrow-body aircraft dominate the market, driven by their widespread use for short to medium-haul flights, which are common in the UAE’s rapidly expanding aviation market. The preference for narrow-body aircraft by budget airlines, along with their efficient design, contributes to the demand for overhead bins specifically tailored for this platform type.

Competitive Landscape

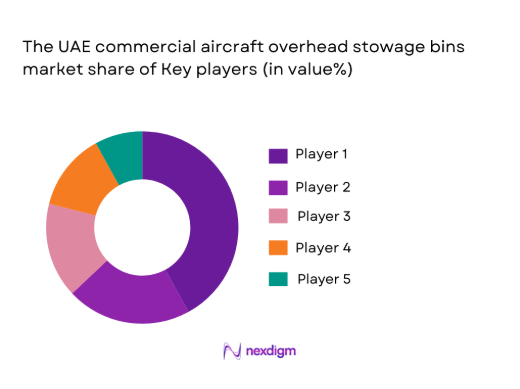

The UAE commercial aircraft overhead stowage bins market is highly competitive, with key players driving innovation and offering a range of solutions to meet the growing demand for efficient and space-optimized storage systems. Major players dominate the market by leveraging their established brand presence, technological capabilities, and strong supplier networks. There has been significant consolidation in the market, with established companies expanding their product portfolios through mergers and acquisitions, strengthening their position in the market.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Market-specific Parameter |

| Zodiac Aerospace | 1896 | Plaisir, France | ~ | ~

|

~

|

~

|

~

|

| B/E Aerospace | 1967 | Wellington, USA | ~

|

~

|

~ | ~

|

~

|

| Diehl Aviation

|

1902 | Germany | ~

|

~

|

~

|

~

|

~

|

| Safran Cabin | 2005 | Paris, France | ~

|

~

|

~

|

~

|

~

|

| Rockwell Collins | 1933 | Cedar Rapids, USA | ~ | ~

|

~

|

~

|

~

|

UAE commercial aircraft overhead stowage bins Market Analysis

Growth Drivers

Increasing Air Travel Demand:

Increasing air travel demand is a primary growth driver for the UAE commercial aircraft overhead stowage bins market. As the number of air passengers continues to grow in the UAE and the broader GCC region, airlines are under pressure to maximize the space available for both passengers and luggage. This growing demand for efficient cabin space has led to the adoption of advanced stowage systems, including larger and more efficient overhead bins. Airlines are increasingly focused on enhancing the passenger experience, and efficient overhead stowage solutions are integral in providing passengers with more space and comfort. The UAE’s status as an aviation hub further drives the demand for modern and space-optimized aircraft cabins. Fleet expansion and the development of new routes are expected to drive continued growth in air travel, further boosting demand for overhead stowage bins that meet the increasing capacity needs of airlines.

Technological Advancements in Materials:

Technological advancements in materials play a pivotal role in driving the growth of the UAE commercial aircraft overhead stowage bins market. The use of lightweight yet durable materials, such as composite materials, carbon fiber, and aluminum alloys, is helping airlines reduce the overall weight of the aircraft, which in turn helps optimize fuel efficiency. These materials are also contributing to the durability and safety of overhead stowage bins, making them more attractive for use in both new aircraft and retrofit projects. With technological innovations making stowage solutions more adaptable and cost-effective, airlines are adopting these new materials to meet both operational and sustainability goals. The ability to integrate smart technologies, such as automated bin opening and closing systems, further enhances the demand for high-tech overhead storage solutions, particularly for airlines looking to enhance the passenger experience and operational efficiency.

Market Challenges

High Retrofit Costs

One of the primary challenges facing the UAE commercial aircraft overhead stowage bins market is the high cost associated with retrofitting older aircraft. The process of replacing or upgrading the existing overhead stowage bins in older aircraft fleets involves significant investment in both parts and labor. For airlines operating older fleets, the financial burden of retrofitting can be a major deterrent, especially in an environment where cost control and profitability are paramount. Additionally, the retrofit process often requires compliance with stringent safety and regulatory standards, adding to the complexity and cost of installation. While newer aircraft are being designed with optimized stowage solutions, the need for retrofitting existing aircraft to meet evolving passenger demands remains a costly challenge that impacts market growth

Supply Chain Disruptions

The UAE commercial aircraft overhead stowage bins market is also facing challenges related to supply chain disruptions. The aviation industry is highly dependent on a global network of suppliers for raw materials, components, and finished products. Recent disruptions in the supply chain, particularly those related to the COVID-19 pandemic and geopolitical tensions, have caused delays and increased costs for manufacturers and airlines alike. The reliance on specialized materials and components further complicates the supply chain, as shortages or delays in raw material availability can result in extended lead times for production and delivery. These disruptions are contributing to higher costs and slower delivery times for new overhead stowage bins, impacting airlines’ ability to meet their operational timelines.

Opportunities

Expansion of Low-Cost Carriers

The rapid expansion of low-cost carriers (LCCs) in the UAE and the wider GCC region presents a significant opportunity for the commercial aircraft overhead stowage bins market. LCCs prioritize cost efficiency, which includes maximizing available space and optimizing storage solutions within their aircraft. As these carriers increase their fleets to cater to growing passenger demand, the need for more efficient and affordable overhead stowage bins will rise. The demand for lightweight, cost-effective stowage solutions that balance passenger comfort with operational efficiency provides opportunities for manufacturers to innovate and offer specialized products that cater to the specific needs of low-cost carriers. With LCCs making up an increasing portion of the regional aviation landscape, this trend offers a promising avenue for growth in the overhead stowage bin market.

Growth in Regional Aviation

The growth of regional aviation in the UAE and the Middle East is another opportunity for the overhead stowage bins market. As regional airlines expand their fleets and offer more routes to cater to business and leisure travelers, the demand for efficient overhead stowage solutions will increase. Regional jets, which are often used for shorter flights, require stowage bins that maximize available space while minimizing weight. As the UAE continues to develop its regional aviation sector, the need for customized stowage solutions for smaller aircraft platforms will drive market demand. Airlines operating in the region are seeking to enhance the travel experience by offering improved cabin space, and overhead stowage bins are a key component in achieving this goal.

Future Outlook

The future outlook of the UAE commercial aircraft overhead stowage bins market remains optimistic, with expected growth driven by continued air travel demand and technological advancements. The market will likely see an increase in demand for lightweight and efficient stowage solutions as airlines strive to improve fuel efficiency and passenger comfort. Additionally, the ongoing expansion of low-cost carriers and regional airlines will create significant opportunities for product innovation and adaptation. As airlines focus on sustainability and operational efficiency, overhead stowage solutions will continue to evolve, incorporating smart technologies and eco-friendly materials. Regulatory support for innovation and a growing emphasis on safety and passenger experience will further drive market growth in the coming year.

Major Players

- Zodiac Aerospace

- B/E Aerospace

- Diehl Aviation

- Safran Cabin

- Rockwell Collins

- Honeywell Aerospace

- Collins Aerospace

- Airbus

- Lufthansa Technik

- Stelia Aerospace

- JAMCO Corporation

- Boeing

- Tata Advanced Systems

- Aviointeriors

- GKN Aerospace

Key Target Audience

- Airlines and aviation operators

- Aircraft manufacturers

- Aircraft retrofit and MRO service providers

- Government and regulatory bodies

- Aviation equipment distributors

- Aviation technology developers

- Airline fleet managers

- Investment and venture capitalist firms

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the key variables that influence the market, including trends, growth drivers, and challenges that affect the commercial aircraft overhead stowage bins sector.

Step 2: Market Analysis and Construction

Market analysis is conducted by reviewing historical data, industry reports, and identifying growth trends in the commercial aircraft overhead stowage bins market.

Step 3: Hypothesis Validation and Expert Consultation

This step involves validating the hypotheses formulated from the initial research by consulting with industry experts, manufacturers, and stakeholders to confirm findings and adjust assumptions.

Step 4: Research Synthesis and Final Output

After gathering all necessary data and insights, the research is synthesized to provide a comprehensive market report, including key forecasts and analyses.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for passenger comfort and convenience

Advancements in lightweight materials enhancing fuel efficiency

Increase in the number of air travelers in the UAE and GCC region

Integration of smart technology for enhanced user experience

Regulatory standards driving improvements in overhead bin design - Market Challenges

High cost of advanced materials and technology

Complexity in retrofitting bins to existing aircraft

Supply chain vulnerabilities impacting availability of parts

Cost and time implications of design and customization

Balancing between capacity optimization and weight limitations - Market Opportunities

Expansion of low-cost carrier fleets driving demand for cost-efficient bins

Emerging markets in the Middle East and Africa creating new growth avenues

Collaboration with MRO service providers for retrofit opportunities - Trends

Shift towards eco-friendly and sustainable materials

Integration of automation and smart technology in stowage bins

Increased focus on maximizing overhead bin capacity in narrow-body aircraft

Growing emphasis on passenger-centric designs

Adoption of modular stowage bin designs - Government Regulations & Defense Policy

Adoption of stricter aviation safety regulations influencing design changes

UAE government’s investment in aviation infrastructure projects

Emerging standards for in-flight technology and passenger safety - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Standard Overhead Bins

Large Capacity Bins

Slimline Overhead Bins

Modular Overhead Bins

Convertible Overhead Bins - By Platform Type (In Value%)

Narrow-body Aircraft

Wide-body Aircraft

Regional Jets

Long-haul Aircraft

Cargo Aircraft - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Retrofitting Fitment

Refurbishment Fitment

Custom Fitment - By End User Segment (In Value%)

Commercial Airlines

Charter Airlines

Cargo Operators

Aircraft Manufacturers

MRO Service Providers - By Procurement Channel (In Value%)

Direct Sales

OEM Sales

Third-party Distributors

Online Sales Platforms

Aftermarket Service Providers - By Material / Technology (In Value %)

Composite Materials

Aluminum Alloys

High-Durability Plastics

Carbon Fiber Reinforced Polymers

Smart bin Technologies

- Market share snapshot of major players

- Cross Comparison Parameters (Technology Focus, Product Innovation, Market Reach, Key Products, Revenue)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Zodiac Aerospace

B/E Aerospace

Diehl Aviation

Safran Cabin

Rockwell Collins

Honeywell Aerospace

Collins Aerospace

Airbus

Lufthansa Technik

Stelia Aerospace

JAMCO Corporation

Boeing

Tata Advanced Systems

Aviointeriors

GKN Aerospace

- Adoption of space-saving solutions by commercial airlines

- Focus on reducing operational costs for low-cost carriers

- Retrofitting demand driven by older aircraft fleets

- Customization opportunities for regional and smaller aircraft

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035