Market Overview

Based on a recent historical assessment, the UAE commercial aircraft upholstery market was valued at USD ~ million, driven primarily by sustained fleet expansion, cabin retrofit programs, and premium interior differentiation strategies adopted by major carriers. Strong widebody utilization, high aircraft utilization rates, and frequent cabin refresh cycles support consistent demand. Upholstery replacement is also influenced by strict cabin safety and flammability regulations, mandating certified materials. Growth is further supported by MRO-driven refurbishment activities, airline branding initiatives, and increased demand for lightweight, durable, and premium-grade cabin interior materials across commercial aviation fleets operating in the country.

Based on a recent historical assessment, Dubai and Abu Dhabi dominate the UAE commercial aircraft upholstery market due to their roles as global aviation hubs hosting large full-service carriers and extensive MRO infrastructure. Dubai benefits from high long-haul traffic density, premium cabin demand, and advanced interior retrofit capabilities. Abu Dhabi supports market leadership through widebody fleet concentration and strong OEM and Tier-1 supplier presence. The UAE’s strategic geographic position, robust aviation regulations, strong leasing activity, and high passenger service expectations collectively reinforce regional dominance without reliance on low-cost operational models.

Market Segmentation

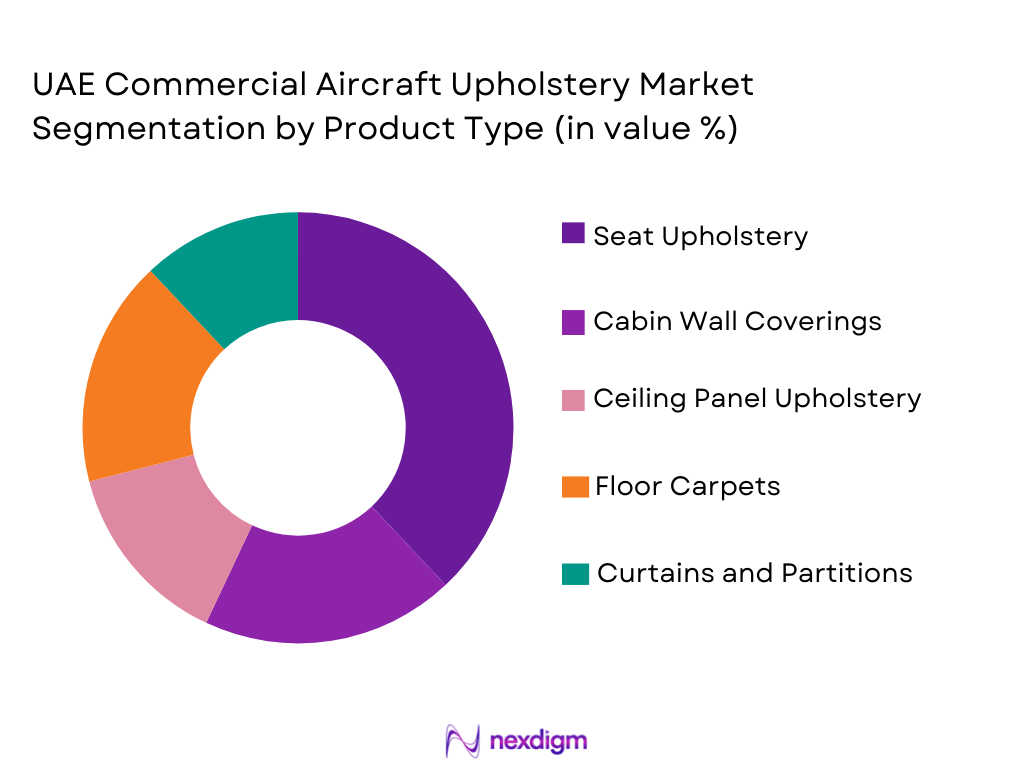

By Product Type

UAE Commercial Aircraft Upholstery Market market is segmented by product type into seat upholstery, cabin wall coverings, ceiling panel upholstery, floor carpets, and curtains and partitions. Recently, seat upholstery has a dominant market share due to constant wear cycles, stringent safety compliance requirements, and frequent replacement driven by passenger comfort expectations. Airlines prioritize seat materials because they directly influence passenger perception, brand differentiation, and cabin class segmentation. Premium economy and business class expansions further accelerate demand. High utilization rates increase replacement frequency, while evolving fire-retardant and lightweight material standards necessitate upgrades. Seat upholstery also attracts higher customization spending, supporting its dominance.

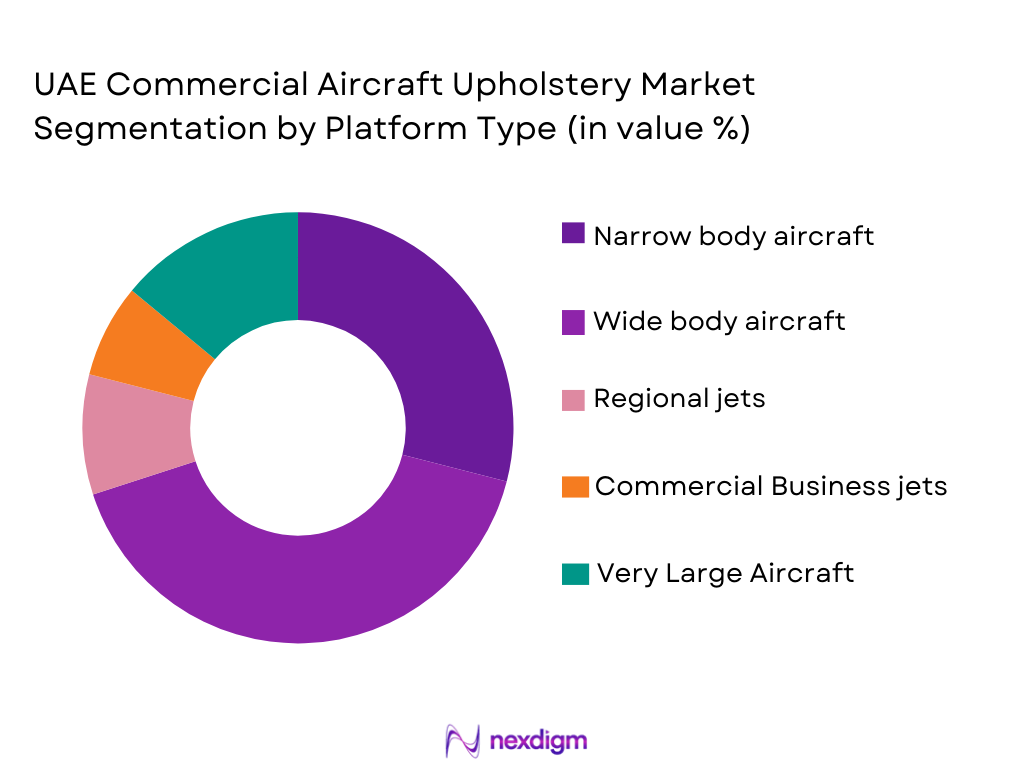

By Platform Type

UAE Commercial Aircraft Upholstery Market market is segmented by platform type into narrow body aircraft, wide body aircraft, regional jets, very large aircraft, and business jets used in commercial operations. Recently, wide body aircraft have a dominant market share due to the UAE’s strong long-haul network, premium cabin density, and international hub operations. Widebody cabins require higher upholstery volumes, premium materials, and frequent refurbishments to maintain brand standards. Flag carriers emphasize cabin consistency across routes, while higher seat counts and complex interiors further concentrate upholstery demand within this platform category.

Competitive Landscape

The UAE Commercial Aircraft Upholstery Market exhibits a moderately consolidated competitive structure dominated by global cabin interior and seating specialists with established airline and MRO relationships. Large Tier-1 suppliers influence material standards, certification compliance, and pricing through long-term supply agreements with full-service carriers. Competition is driven by product quality, certification capability, customization flexibility, and delivery reliability rather than volume alone. Strategic partnerships with regional MRO providers strengthen market access, while high switching costs and stringent safety regulations limit frequent supplier changes and reinforce incumbent advantages.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Upholstery Specialization |

| Safran Seats | 1905 | France | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ | ~ |

| Recaro Aircraft Seating | 1972 | Germany | ~ | ~ | ~ | ~ | ~ |

| Adient Aerospace | 2016 | United States | ~ | ~ | ~ | ~ | ~ |

| Diehl Aviation | 2006 | Germany | ~ | ~ | ~ | ~ | ~ |

UAE Commercial Aircraft Upholstery Market Analysis

Growth Drivers

Premium Cabin Experience Enhancement and Brand Differentiation:

Premium Cabin Experience Enhancement and Brand Differentiation is a major growth driver for the UAE Commercial Aircraft Upholstery Market as airlines increasingly compete on passenger comfort, visual appeal, and cabin consistency rather than ticket pricing alone. Full-service carriers operating from the UAE emphasize business, first, and premium economy cabins to attract high-yield international travelers, making upholstery a critical element of brand identity. Seat coverings, cabin fabrics, and interior finishes directly influence passenger perception of quality and luxury. High utilization of long-haul aircraft accelerates wear, increasing replacement frequency. Airlines also implement periodic cabin refresh programs to maintain a modern appearance without full aircraft replacement. Upholstery upgrades are often bundled with connectivity, lighting, and seating improvements, strengthening demand. Strict safety and flammability requirements further drive certified material replacement. Together, these factors create sustained and recurring demand for high-quality, compliant upholstery solutions across UAE-based fleets.

Fleet Expansion, Aircraft Utilization, and MRO-Driven Refurbishment Activity:

Fleet Expansion, Aircraft Utilization, and MRO-Driven Refurbishment Activity strongly drive the UAE Commercial Aircraft Upholstery Market due to the country’s role as a global aviation hub with high aircraft movement and intensive operational cycles. Airlines continue to expand and optimize fleets to support long-haul connectivity and transit traffic, increasing the installed base requiring upholstery fitment and maintenance. High daily utilization accelerates interior wear, particularly in seating and high-contact cabin surfaces. Rather than retiring aircraft early, operators increasingly extend service life through structured maintenance and refurbishment programs. Upholstery replacement is a core component of these activities, especially during heavy maintenance checks and lease transitions. The UAE’s advanced MRO infrastructure attracts international aircraft for refurbishment, further expanding demand beyond domestic fleets. Leasing activity also supports neutral cabin refurbishment, sustaining stable aftermarket upholstery demand across multiple aircraft types.

Market Challenges

Stringent Certification, Safety, and Compliance Burdens:

Stringent Certification, Safety, and Compliance Burdens represent a critical challenge for the UAE Commercial Aircraft Upholstery Market due to the highly regulated nature of aviation cabin interiors. Upholstery materials must comply with rigorous flammability, heat release, smoke density, and toxicity standards defined by global aviation authorities, including FAA and EASA-aligned regulations enforced locally. Achieving and maintaining certification requires extensive laboratory testing, documentation, and periodic revalidation, significantly increasing development costs and time-to-market. Any modification in material composition, supplier source, or manufacturing process can trigger recertification, discouraging rapid innovation. Airlines demand full traceability and compliance assurance, transferring regulatory risk to suppliers. Smaller or regional manufacturers face high entry barriers due to certification expenses. Additionally, overlapping international regulatory requirements complicate multi-market deployment of the same upholstery solution. These factors collectively slow product innovation cycles, constrain supplier diversity, and increase operational complexity across the market.

Supply Chain Dependency and Cost Volatility of Specialized Materials:

Supply Chain Dependency and Cost Volatility of Specialized Materials pose another major challenge, as the UAE commercial aircraft upholstery ecosystem relies heavily on imported aviation-grade textiles, leathers, foams, and composite materials. Many of these inputs are sourced from a limited number of specialized global suppliers, exposing the market to procurement risks, price fluctuations, and logistical disruptions. Volatility in raw material costs directly impacts supplier margins, while long-term airline contracts often restrict price pass-through mechanisms. Global transportation disruptions, extended lead times, and geopolitical uncertainties further strain inventory planning and delivery schedules. Airlines and MRO providers operate under fixed maintenance windows, leaving little tolerance for material delays. To mitigate risks, suppliers must maintain higher inventory levels, increasing working capital requirements. Currency exchange exposure also affects procurement economics. These supply-side constraints reduce flexibility, pressure profitability, and increase the complexity of sustaining consistent upholstery supply across refurbishment and retrofit programs.

Opportunities

Sustainable and Lightweight Upholstery Material Innovation:

Sustainable and lightweight upholstery material innovation represents a major opportunity for the UAE Commercial Aircraft Upholstery Market as airlines increasingly align cabin investment strategies with environmental responsibility, fuel efficiency, and long-term lifecycle cost optimization. Lightweight upholstery materials directly contribute to aircraft weight reduction, enabling measurable fuel savings across long-haul and high-frequency routes that dominate UAE aviation operations. Airlines operating premium fleets are actively evaluating advanced textiles, synthetic leathers, and composite-based upholstery solutions that combine durability with lower environmental impact. Regulatory encouragement for reduced emissions further strengthens adoption momentum. Sustainability has also become a branding differentiator, influencing passenger perception and airline positioning. Upholstery suppliers investing in recyclable materials, low-toxicity coatings, and bio-based fibers gain preferred supplier status. Long-term supply agreements increasingly include sustainability compliance clauses. This shift allows suppliers to command premium pricing while securing recurring retrofit and replacement contracts.

Expansion of Regional MRO-Led Cabin Refurbishment and Customization Ecosystem:

Expansion of regional MRO-led cabin refurbishment and customization ecosystem creates strong growth opportunities as the UAE consolidates its role as a global aviation services and refurbishment hub. Airlines and leasing companies increasingly favor regional refurbishment to reduce aircraft downtime, logistics complexity, and total refurbishment costs. Upholstery customization demand rises during lease transitions, cabin rebranding programs, and mid-life aircraft upgrades, all of which are strongly represented in the UAE market. Localized upholstery production and installation capabilities shorten turnaround times and enhance responsiveness to airline-specific design requirements. Government-backed industrial development initiatives further encourage localized value addition. Partnerships between global upholstery suppliers and UAE-based MRO providers expand service portfolios and strengthen market penetration. This ecosystem supports demand stability by serving both domestic carriers and international operators routing aircraft through UAE maintenance facilities.

Future Outlook

The UAE commercial aircraft upholstery market is expected to experience steady growth over the next five years, supported by fleet modernization, premium cabin expansion, and sustainability-driven material innovation. Technological advancements in lightweight and fire-resistant textiles will shape supplier competitiveness. Regulatory alignment with global aviation authorities will continue to influence material selection. Strong airline demand, MRO expansion, and regional hub positioning will collectively sustain long-term market momentum.

Major Players

- Safran Seats

- Collins Aerospace

- Recaro Aircraft Seating

- Adient Aerospace

- Diehl Aviation

- JamcoCorporation

- Lufthansa Technik

- ST Engineering Aerospace

- AIM Altitude

- FACC Cabin Interiors

- Zodiac Aerospace

- Thompson Aero Seating

- HaecoCabin Solutions

- Acro Aircraft Seating

- B/E Aerospace

Key Target Audience

- Airlines

- Aircraftleasing companies

- MRO providers

- Cabin interior OEMs

- Raw material and upholstery fabric suppliers

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aviation infrastructure developers

Research Methodology

Step 1: Identification of Key Variables

Key variables include fleet size, refurbishment cycles, material pricing, certification standards, and airline cabin strategies. These variables define market structure and demand behavior. Data sources are screened for reliability. Variables are validated through cross-referencing.

Step 2: Market Analysis and Construction

Market structure is constructed using bottom-up and top-down approaches. Demand is mapped across product and platform segments. Supply-side capabilities are analyzed. Data consistency checks are applied.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are validated through expert interviews and industry consultations. Airline, MRO, and supplier insights are incorporated. Assumptions are refined. Contradictions are resolved.

Step 4: Research Synthesis and Final Output

Findings are synthesized into a coherent framework. Data is normalized for comparability. Insights are structured for clarity. Final outputs undergo internal validation.

- Executive Summary

- UAE Commercial Aircraft Upholstery Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expansion of UAE-based airline fleets

Rising aircraft cabin refurbishment cycles

Premium cabin experience differentiation

Growth in regional and long-haul connectivity

Strict compliance with international cabin safety standards - Market Challenges

High certification and flammability compliance costs

Supply chain dependency on imported raw materials

Volatility in aircraft delivery schedules

Cost pressure from airline operating margins

Complexity of customization and low-volume production - Market Opportunities

Fleet modernization and cabin upgradation programs

Increasing demand for lightweight and sustainable materials

Growth of regional MRO and refurbishment hubs - Trends

Adoption of lightweight cabin materials

Shift toward sustainable and recyclable upholstery

Increased use of antimicrobial and easy-clean fabrics

Digital cabin design and rapid prototyping integration

Rising demand for premium economy cabin upgrades - Government Regulations & Defense Policy

GCAA cabin safety and material certification norms

Alignment with EASA and FAA flammability standards

National sustainability and waste reduction initiatives - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Seat upholstery systems

Cabin wall and side panel coverings

Ceiling and overhead panel upholstery

Floor carpet and liner systems

Curtain and partition upholstery - By Platform Type (In Value%)

Narrow body commercial aircraft

Wide body commercial aircraft

Very large commercial aircraft

Regional jets

Business jets configured for commercial use - By Fitment Type (In Value%)

Line-fit installations

Retrofit installations

Cabin refurbishment programs

Lease return refurbishment

Post-MRO upgrade fitment - By EndUser Segment (In Value%)

Full service airlines

Low cost carriers

Charter and ACMI operators

Aircraft leasing companies

Government and VIP transport operators - By Procurement Channel (In Value%)

Direct OEM supply contracts

Tier-1 cabin integrator procurement

Aftermarket MRO procurement

Leasing company sourcing

Third-party refurbishment vendors - By Material / Technology (in Value %)

Synthetic leather composites

Natural aviation-grade leather

Wool blend and advanced textile fabrics

Fire-resistant polymer laminates

Lightweight composite upholstery materials

- Market structure and competitive positioning

- Market share snapshot of major players

CrossComparison Parameters (Product Portfolio Breadth, Material Technology Capability, Certification Compliance, Customization Flexibility, Lead Time Performance, Cost Competitiveness, Aftermarket Support, Regional Presence, OEM Partnerships) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Safran Seats

Recaro Aircraft Seating

Adient Aerospace

Thompson Aero Seating

Collins Aerospace Interiors

Zodiac Aerospace Interiors

Diehl Aviation

FACC Cabin Interiors

Jamco Corporation

Lufthansa Technik Cabin Solutions

ST Engineering Aerospace Interiors

AIM Altitude

Haeco Cabin Solutions

B/E Aerospace Interiors

Acro Aircraft Seating

- Airlines focus on passenger comfort and brand differentiation

- Leasing companies prioritize durability and lifecycle cost control

- MRO providers emphasize fast turnaround and compliance

- Charter operators demand flexible and customized cabin solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035