Market Overview

Based on a recent historical assessment, the UAE Commercial Aircraft Windows and Windshields Market was valued at USD ~ million, supported by continuous fleet utilization, mandatory airworthiness compliance, and certified replacement demand. High exposure to extreme heat, sand abrasion, and ultraviolet radiation accelerates wear of cockpit windshields and cabin windows, sustaining aftermarket spending. OEM line-fit requirements for newly inducted aircraft further contribute to revenues. Strict visibility and safety regulations enforced by civil aviation authorities ensure recurring replacement cycles, while rising MRO activity reinforces stable expenditure patterns across operators.

Based on a recent historical assessment, Dubai and Abu Dhabi dominate the UAE Commercial Aircraft Windows and Windshields Market due to their concentration of airline hubs, large-scale MRO facilities, and aviation free zones. Dubai benefits from high aircraft turnaround volumes driven by its role as a global transit hub, increasing windshield and window replacement frequency. Abu Dhabi is strengthened by integrated aerospace clusters, government-backed aviation programs, and advanced maintenance infrastructure. The UAE’s dominance is reinforced by strong regulatory enforcement and premium long-haul airline operations.

Market Segmentation

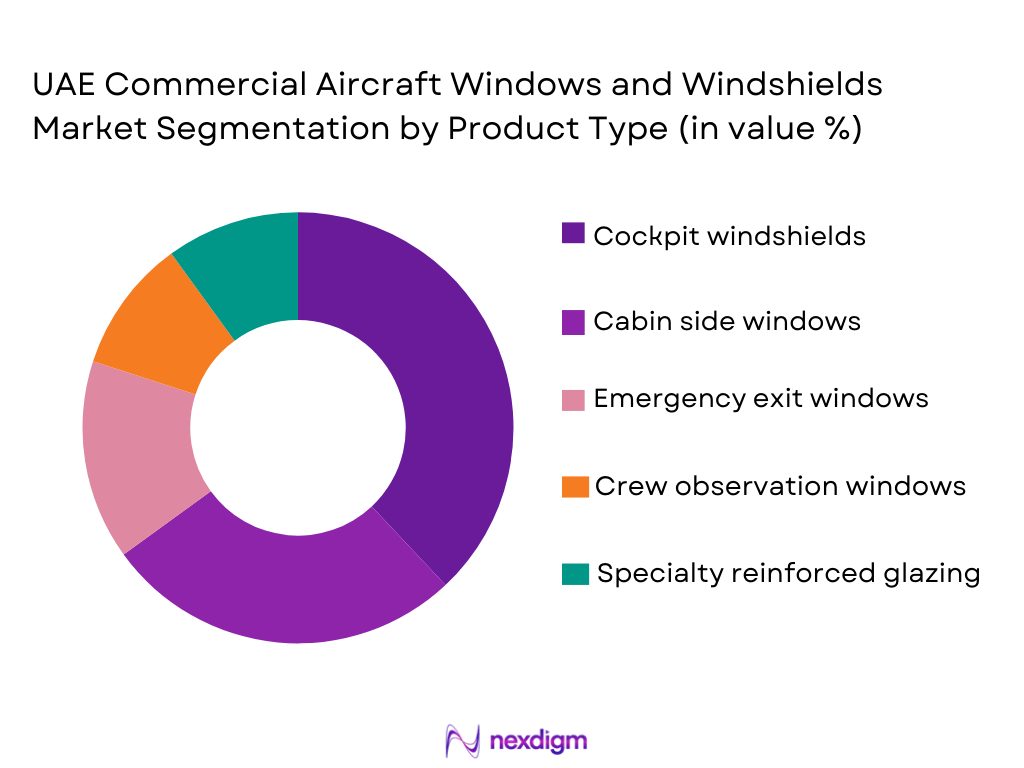

By Product Type

UAE Commercial Aircraft Windows and Windshields Market is segmented by product type into cockpit windshields, cabin side windows, emergency exit windows, crew observation windows, and specialty reinforced glazing. Recently, cockpit windshields have a dominant market share due to their critical safety role, higher replacement frequency, and complex multilayer construction incorporating heating and anti-icing systems. These components face maximum exposure to thermal stress, sand erosion, and impact risks, requiring frequent certified replacement. Regulatory mandates prevent extended usage beyond approved thresholds, ensuring consistent demand. Higher unit pricing and technological complexity position cockpit windshields as the leading revenue contributor.

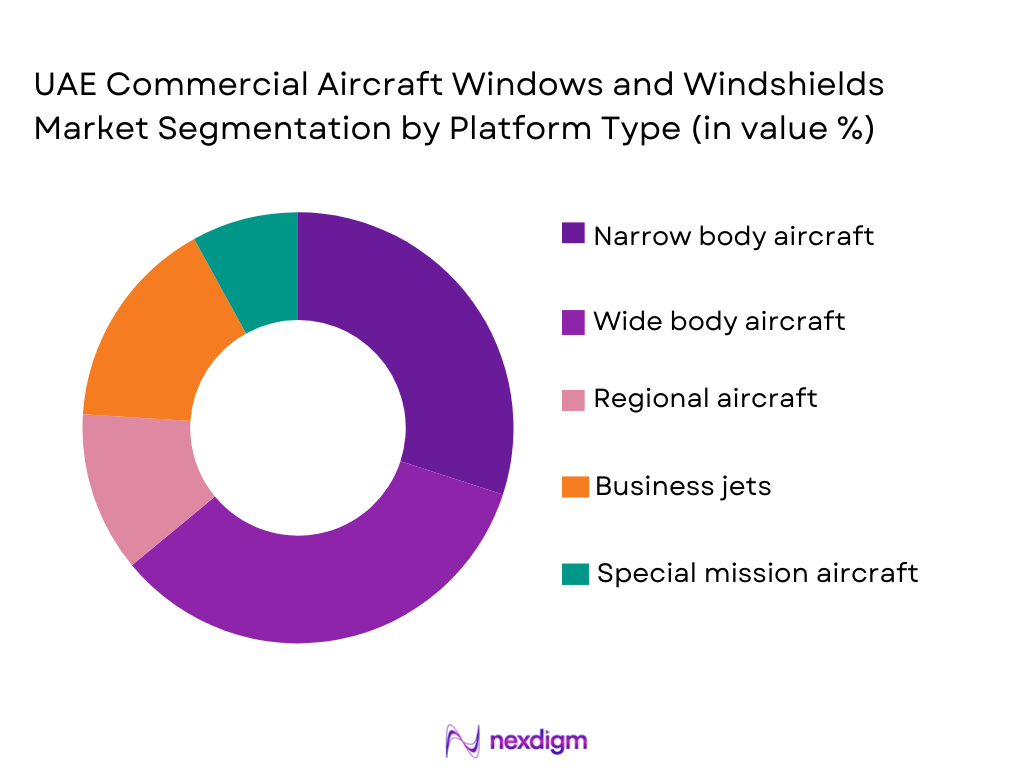

By Platform Type

UAE Commercial Aircraft Windows and Windshields Market is segmented by platform type into wide-body aircraft, narrow-body aircraft, regional jets, business jets, and special mission commercial aircraft. Recently, wide-body aircraft dominate due to their extensive long-haul utilization, higher number of glazing units per aircraft, and premium windshield specifications. Prolonged flight durations and repeated pressurization cycles increase stress on windows and windshields. UAE carriers emphasize premium passenger experience and cockpit performance, encouraging adoption of advanced glazing technologies and higher-value replacement components.

Competitive Landscape

The UAE Commercial Aircraft Windows and Windshields Market is moderately consolidated, with global aerospace glazing manufacturers dominating through OEM supply agreements and certified aftermarket channels. Leading players benefit from strong regulatory approvals, long-term airline contracts, and integration with MRO networks, limiting entry of new competitors.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| PPG Aerospace | 1883 | United States | ~ | ~ | ~ | ~ | ~ |

| Saint-Gobain Aerospace | 1665 | France | ~ | ~ | ~ | ~ | ~ |

| GKN Aerospace Transparencies | 1759 | United Kingdom | ~ | ~ | ~ | ~ | ~ |

| Nordam Group | 1970 | United States | ~ | ~ | ~ | ~ | ~ |

| Gentex Aerospace | 1974 | United States | ~ | ~ | ~ | ~ | ~ |

UAE Commercial Aircraft Windows and Windshields Market Analysis

Growth Drivers

Fleet Utilization Intensity and Environmental Exposure:

Fleet Utilization Intensity and Environmental Exposure drive sustained demand for the UAE Commercial Aircraft Windows and Windshields Market as aircraft operate under extreme climatic conditions that accelerate material fatigue and optical degradation. High ambient temperatures, airborne sand particles, ultraviolet radiation, and repeated pressurization cycles significantly shorten glazing service life. Continuous long-haul and high-frequency short-haul operations increase cumulative stress on cockpit windshields, requiring certified replacements to maintain safety compliance. Airlines prioritize uninterrupted operations, making windshield replacement non-negotiable. Advanced multilayer constructions with heating and anti-icing elements raise component value. Regulatory inspections enforce visibility standards strictly. MRO centers maintain inventory to reduce downtime. This operational intensity ensures stable aftermarket demand independent of fleet expansion.

Regulatory Compliance and Safety-Driven Replacement Cycles:

Regulatory Compliance and Safety-Driven Replacement Cycles strongly influence the UAE Commercial Aircraft Windows and Windshields Market through mandatory adherence to international airworthiness standards. Aviation authorities require certified glazing meeting optical clarity, impact resistance, and thermal performance criteria. Scheduled inspections detect micro-cracks, delamination, or coating degradation. Replacement is mandated even without visible damage. Airlines adopt conservative maintenance strategies to avoid compliance risks. OEM-approved components dominate procurement. Certification updates encourage adoption of newer glazing technologies. This compliance framework stabilizes long-term market demand.

Market Challenges

High Certification Complexity and Cost Burden:

High Certification Complexity and Cost Burden remains a critical challenge for the UAE Commercial Aircraft Windows and Windshields Market due to the stringent technical, safety, and regulatory requirements governing aerospace glazing. Each windshield and window assembly must undergo extensive optical clarity testing, impact resistance validation, thermal performance assessment, and long-duration fatigue evaluation before receiving certification. These processes significantly increase manufacturing and procurement costs, particularly for advanced multilayer and heated windshield systems. Limited numbers of globally approved suppliers reduce competitive pricing pressure, leaving airlines with minimal sourcing flexibility. Installation further requires specialized tooling, trained technicians, and calibrated procedures, often resulting in aircraft grounding during replacement. For operators managing high-utilization fleets, downtime translates into revenue loss beyond component cost. Inventory stocking of certified spares also ties up working capital for airlines and MRO providers. As certification standards evolve, previously approved components may require revalidation, adding further expense. These cost pressures make lifecycle management of glazing systems financially demanding despite their safety-critical nature.

Dependence on Global Supply Chains and Limited Localization:

Dependence on Global Supply Chains and Limited Localization constrains market efficiency and resilience within the UAE Commercial Aircraft Windows and Windshields Market. Most certified windows and windshields are manufactured outside the region, exposing operators to long lead times and logistics complexity. Supply disruptions caused by geopolitical events, transportation delays, or regulatory bottlenecks can directly affect aircraft availability. Certification transfer requirements often prevent rapid substitution between suppliers, increasing vulnerability to shortages. Local manufacturing remains limited due to high capital investment needs, proprietary technology barriers, and strict intellectual property controls held by OEMs. Airlines and MRO providers compensate by maintaining higher inventory levels, increasing storage and obsolescence risks. Changes in aircraft configuration or certification standards can render stocked components unusable. Additionally, currency fluctuations impact procurement costs for imported glazing systems. This structural dependence complicates long-term cost planning and reduces flexibility in maintenance scheduling. Without broader localization or diversified sourcing strategies, supply chain dependence will continue to challenge operational efficiency across the UAE aviation ecosystem.

Opportunities

Expansion of Localized MRO and Certified Aftermarket Ecosystems:

Expansion of Localized MRO and Certified Aftermarket Ecosystems represents a significant opportunity for the UAE Commercial Aircraft Windows and Windshields Market as the country continues to position itself as a regional aviation maintenance hub. Increased investment in hangars, tooling, and certified technical workforce allows glazing inspection, repair, and replacement activities to be conducted domestically rather than relying on overseas facilities. This reduces aircraft downtime and logistics costs for airlines operating dense flight schedules. Strategic collaborations between global OEMs and UAE-based MRO providers enable technology transfer, localized stocking of certified windshields, and faster regulatory approvals. Airlines benefit from predictable maintenance planning and reduced operational disruption. The presence of aviation free zones further encourages aftermarket expansion by simplifying import and re-export of certified glazing components. As regional carriers increasingly route maintenance through UAE facilities, demand for windows and windshields sourced locally is expected to strengthen, creating long-term value across the aftermarket supply chain.

Adoption of Advanced and Smart Aircraft Glazing Technologies:

Adoption of Advanced and Smart Aircraft Glazing Technologies presents another major opportunity for the UAE Commercial Aircraft Windows and Windshields Market as airlines prioritize passenger comfort, operational efficiency, and safety enhancements. Electrochromic windows, UV-filtering materials, and lightweight composite glazing systems are gaining acceptance due to their ability to improve cabin environment while reducing aircraft weight. For cockpit applications, advanced windshields with enhanced optical clarity, improved heating efficiency, and superior impact resistance support pilot performance in extreme operating conditions. Premium long-haul operations common in the UAE accelerate adoption of such technologies as airlines seek differentiation and brand positioning. Regulatory authorities are increasingly certifying next-generation glazing solutions, enabling broader deployment across fleets. Higher unit values associated with advanced materials and embedded technologies support revenue growth even without fleet expansion. As fleet modernization programs continue, smart glazing adoption aligns with broader digitalization and efficiency initiatives within UAE commercial aviation.

Future Outlook

The UAE Commercial Aircraft Windows and Windshields Market is expected to witness steady expansion over the next five years, supported by sustained airline operations and regulatory-driven replacement demand. Advancements in smart glazing and durability technologies will influence procurement. Government-backed aviation infrastructure and localization initiatives will strengthen aftermarket capabilities. Demand will remain resilient due to safety-critical replacement requirements.

Major Players

- PPG Aerospace

- Saint-Gobain Aerospace

- GKN Aerospace Transparencies

- Nordam Group

- Gentex Aerospace

- Lee Aerospace

- Triumph Group

- Meggitt

- Fokker Technologies

- Cobham Aerospace

- AIP Aerospace

- Marshall Aerospace

- Aviation Glass & Technology

- Llamas Plastics

- Aerospace Plastic Components

Key Target Audience

- Commercial airlines

- Aircraftleasing companies

- MRO service providers

- OEM suppliers

- Aviation infrastructure developers

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense and state aviation operators

Research Methodology

Step 1: Identification of Key Variables

Key variables including product scope, certification standards, replacement cycles, and fleet activity were identified through aviation authority publications and OEM documentation. Regulatory frameworks guided variable inclusion. Demand-side and supply-side factors were mapped. Relevance and consistency checks were applied.

Step 2: Market Analysis and Construction

OEM shipment data, airline fleet activity, and MRO replacement patterns were analyzed. Supply and demand data were integrated. Market boundaries were clearly defined. Data triangulation ensured reliability.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through consultations with aviation engineers and procurement specialists. Certification impacts were reviewed. Feedback refined demand drivers and challenges. Adjustments improved accuracy.

Step 4: Research Synthesis and Final Output

Validated inputs were synthesized into structured analysis. Cross-checks ensured consistency. Insights were aligned with operational realities. Final outputs reflect verified market conditions.

- Executive Summary

- UAE Commercial Aircraft Windows and Windshields Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expansion of UAE commercial aviation fleet

Rising aircraft MRO and replacement cycles

Stringent safety and certification requirements

Growth in premium and long-haul aircraft deployments

Adoption of advanced glazing and visibility technologies - Market Challenges

High certification and compliance costs

Dependence on imported glazing technologies

Complex installation and maintenance procedures

Exposure to sand, heat, and extreme climate conditions

Long lead times for certified replacements - Market Opportunities

Fleet modernization and cabin upgrade programs

Growth in regional MRO and aftermarket services

Adoption of smart and electrochromic window systems - Trends

Integration of lightweight and damage-resistant materials

Increased use of electrochromic cabin windows

Focus on improved thermal and UV insulation

Growth of localized MRO support capabilities

Rising emphasis on pilot visibility enhancement systems - Government Regulations & Defense Policy

Civil aviation safety and airworthiness regulations

Import certification and conformity standards

National aviation infrastructure and fleet development initiatives - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Cockpit windshields

Cabin side windows

Emergency exit windows

Observation and crew windows

Special mission reinforced glazing - By Platform Type (In Value%)

Narrow body commercial aircraft

Wide body commercial aircraft

Regional jets

Business jets

Special mission and VIP aircraft - By Fitment Type (In Value%)

Line fit installations

Retrofit and replacement

MRO-based replacements

Life extension upgrades

Damage and impact replacement - By EndUser Segment (In Value%)

Commercial airlines

Aircraft leasing companies

MRO service providers

Government and state aviation

Charter and private operators - By Procurement Channel (In Value%)

OEM direct procurement

Tier-1 system suppliers

Authorized aftermarket distributors

MRO sourcing contracts

Government approved procurement programs - By Material / Technology (in Value %)

Acrylic aircraft glazing

Polycarbonate advanced glazing

Laminated glass composites

Electrochromic smart windows

Heated and anti-icing windshield systems

- Market structure and competitive positioning

- Market share snapshot of major players

CrossComparison Parameters (Product portfolio breadth, Certification coverage, Material technology capability, OEM partnerships, Aftermarket support strength, Regional presence, Pricing competitiveness, Lead time efficiency, Customization capability) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

PPG Aerospace

Saint-Gobain Aerospace

GKN Aerospace Transparencies

Nordam Group

Lee Aerospace

Meggitt Aerospace

Triumph Group

Aviation Glass & Technology

Gentex Aerospace

Fokker Technologies

AIP Aerospace

Marshall Aerospace

Cobham Aerospace

Llamas Plastics

Aerospace Plastic Components

- Airlines focus on lifecycle cost and reliability

- MRO providers prioritize fast replacement availability

- Leasing firms emphasize certified retrofit compatibility

- Government operators require enhanced durability standards

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035