Market Overview

The UAE Commercial Helicopters Market recorded a market size of USD ~ million based on a recent historical assessment, supported by fleet registration data from the General Civil Aviation Authority, operator financial disclosures, and OEM delivery records. Market demand is driven by offshore oil and gas transportation contracts, expanding emergency medical aviation services, VIP and corporate mobility requirements, and infrastructure support missions. Stable government aviation spending, long-term charter agreements, and high annual flight-hour utilization sustain revenue consistency. Premium aircraft acquisition values, intensive maintenance cycles, and aftermarket services further contribute to overall market valuation.

Based on a recent historical assessment, Abu Dhabi and Dubai dominate the UAE Commercial Helicopters Market due to concentrated offshore energy activity, advanced heliport infrastructure, and the presence of major fleet operators. Abu Dhabi benefits from proximity to offshore oilfields and state-backed aviation operators supporting energy logistics. Dubai leads in VIP, tourism, and corporate helicopter usage driven by luxury travel demand and dense urban heliport networks. Centralized aviation regulation, political stability, and advanced maintenance ecosystems reinforce national dominance.

Market Segmentation

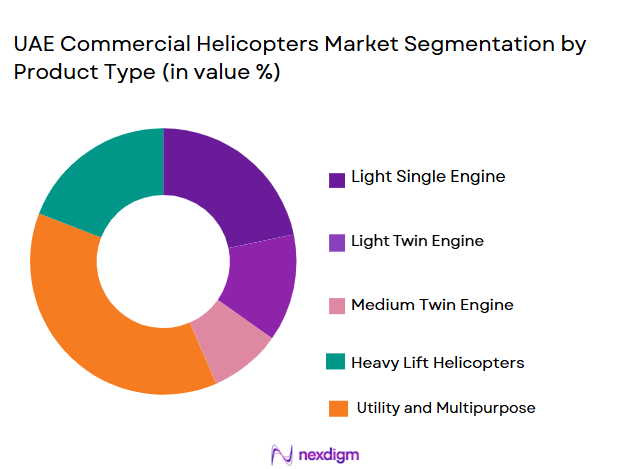

By Product Type

The UAE Commercial Helicopters Market is segmented by product type into light helicopters, medium helicopters, heavy helicopters, twin-engine helicopters, and utility helicopters. Recently, twin-engine helicopters have a dominant market share due to stringent offshore safety requirements, higher redundancy standards, and regulatory preferences for multi-engine platforms. Offshore oil and gas operators rely on twin-engine aircraft for extended overwater operations and payload reliability. Emergency medical service providers favor these platforms for all-weather capability and higher dispatch success rates. Strong OEM support, spare availability, and standardized maintenance infrastructure further reinforce adoption across major fleets.

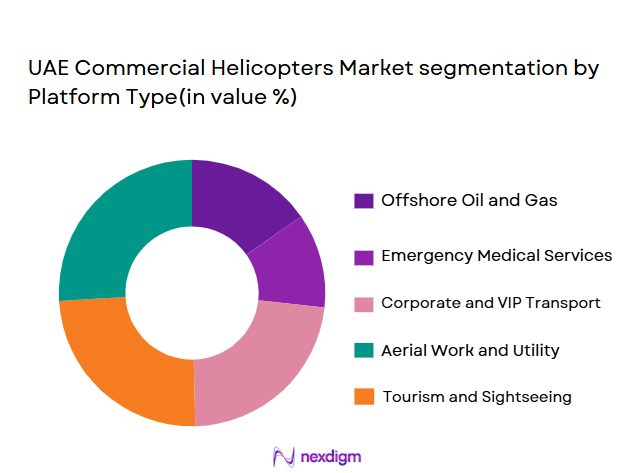

By Platform Type

The UAE Commercial Helicopters Market is segmented by platform type into offshore oil and gas transport, emergency medical services, VIP transport, aerial work, and tourism operations. Recently, offshore oil and gas transport has a dominant market share due to sustained offshore production activity, long-term charter agreements, and high mission-critical flight intensity. Continuous crew rotation, equipment transfer, and logistics support create predictable demand for helicopter services. Contract-based operations ensure stable cash flows, enabling fleet expansion and modernization investments by operators across the UAE.

Competitive Landscape

The UAE Commercial Helicopters Market demonstrates moderate consolidation, with a small number of large operators controlling substantial fleet capacity through long-term energy and government contracts. OEMs exert influence through aftersales support networks, while regional operators shape pricing and fleet deployment strategies.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Market-Specific Parameter (Fleet Size) |

| Airbus Helicopters | 1992 | France | ~ | ~ | ~ | ~ | ~ |

| Leonardo Helicopters | 1948 | Italy | ~ | ~ | ~ | ~ | ~ |

| Bell Textron | 1935 | USA | ~ | ~ | ~ | ~ | ~ |

| Sikorsky Aircraft | 1923 | USA | ~ | ~ | ~ | ~ | ~ |

| Abu Dhabi Aviation | 1976 | UAE | ~ | ~ | ~ | ~ | ~ |

UAE Commercial Helicopters Market Analysis

Growth Drivers

Offshore Energy Logistics Expansion:

Offshore energy logistics expansion remains a central growth driver for the UAE Commercial Helicopters Market as offshore oil and gas production continues to rely on rotary-wing aviation for safe and uninterrupted operations. Helicopters provide the only viable means for rapid crew rotation, equipment transfer, and emergency response to offshore platforms located far from shore-based infrastructure. National energy operators maintain long-duration service contracts with helicopter providers, ensuring stable utilization levels and predictable revenue flows. Harsh marine conditions and strict safety standards reinforce dependence on twin-engine and medium-to-heavy class helicopters. Continuous offshore field maintenance activities sustain high annual flight hours. Investments in offshore infrastructure directly translate into aviation demand. Aftermarket services, including maintenance and parts replacement, further amplify revenue contribution. The strategic importance of energy security ensures long-term continuity of helicopter-supported logistics.

Emergency Medical and Critical Services Aviation Growth:

Emergency medical and critical services aviation growth strongly supports market expansion as healthcare systems prioritize speed, reliability, and nationwide coverage. Helicopters enable rapid medical evacuation from highways, offshore installations, and remote areas to advanced trauma centers. Government-backed healthcare spending supports dedicated air ambulance fleets and long-term operational contracts with aviation providers. Urban congestion and geographic dispersion increase reliance on aerial transport to meet critical response time thresholds. Integration of advanced onboard medical systems increases aircraft value and operational complexity. Regulatory frameworks actively support medical aviation operations with dedicated airspace access. Continuous readiness requirements drive high utilization rates. Partnerships between hospitals, government agencies, and helicopter operators ensure sustained demand across the UAE.

Market Challenges

High Operating and Lifecycle Cost Structure:

High operating and lifecycle cost structure represents a significant challenge for the UAE Commercial Helicopters Market due to the intensive nature of commercial helicopter operations and the demanding operating environment. Offshore missions expose aircraft to corrosive marine conditions, accelerating component wear and increasing inspection frequency. Scheduled and unscheduled maintenance requirements raise direct operating costs and reduce aircraft availability. OEM spare parts pricing, often denominated in foreign currencies, adds further financial pressure on operators. Skilled pilot and technician shortages increase labor costs and constrain operational scalability. Fuel price volatility directly affects mission economics, particularly for high-utilization offshore fleets. Compliance with strict airworthiness directives and service bulletins adds recurring expenditure. Smaller operators face limited bargaining power with suppliers, compressing margins. Long-term cost recovery depends heavily on contract structures that may not fully offset rising expenses.

Regulatory Compliance and Operational Constraints:

Regulatory compliance and operational constraints pose ongoing challenges as aviation authorities enforce stringent safety, certification, and operational oversight standards. Operators must continuously comply with pilot training mandates, simulator currency requirements, and crew duty time regulations, increasing administrative and operational complexity. Aircraft certification, modification approvals, and import clearances often involve lengthy processes that delay fleet deployment. Cross-border operations require multiple regulatory clearances, adding procedural burden. Continuous audits and inspections increase documentation workloads and operational rigidity. Regulatory updates necessitate frequent procedural adjustments and retraining programs. Smaller operators face disproportionate compliance costs relative to fleet size. Delays in regulatory approvals can impact contract fulfillment timelines. While essential for safety, regulatory intensity reduces flexibility and slows rapid response to changing market demand.

Opportunities

Fleet Modernization and Technology Upgrade Cycles:

Fleet modernization and technology upgrade cycles represent a major opportunity for the UAE Commercial Helicopters Market as operators increasingly prioritize safety, efficiency, and long-term cost optimization. A significant portion of the active fleet operates under high-utilization profiles, accelerating aging and driving replacement requirements. New-generation helicopters offer improved fuel efficiency, lower maintenance intervals, enhanced avionics, and reduced noise footprints, making them attractive for offshore, medical, and VIP missions. Regulatory encouragement for newer, safer platforms further supports replacement demand. OEMs are actively promoting upgrade pathways, retrofit programs, and favorable financing structures to stimulate fleet renewal. Advanced health and usage monitoring systems improve operational availability and reduce unscheduled downtime. Modern cabin configurations enhance passenger comfort and mission adaptability. Sustainability objectives and emission considerations also push operators toward newer aircraft technologies, reinforcing long-term modernization demand across the UAE.

Expansion of Leasing, Charter, and Service-Based Business Models:

Expansion of leasing, charter, and service-based business models presents a strong opportunity as operators and end users seek flexibility and reduced capital exposure. Helicopter leasing allows operators to scale fleet capacity in line with contract demand without heavy upfront investment. Energy companies, healthcare providers, and government agencies increasingly prefer service-based aviation contracts over asset ownership, transferring operational and maintenance risks to specialized operators. Financial institutions and OEM-backed lessors are expanding regional portfolios to support this shift. Shorter lease tenures enable faster adoption of newer aircraft technologies. Charter-based models support seasonal and project-specific demand, particularly in tourism and infrastructure inspection missions. Leasing improves balance sheet efficiency for operators and lowers barriers for market entry. As procurement strategies evolve, flexible access to helicopter capacity is expected to gain importance, creating sustained opportunity for lessors and service providers.

Future Outlook

The UAE Commercial Helicopters Market is expected to witness steady growth over the next five years supported by offshore energy continuity, expanding emergency medical aviation networks, and sustained VIP transport demand. Fleet modernization, efficiency-driven technology adoption, and regulatory stability will reinforce market resilience. Government-backed infrastructure development and long-term service contracts are expected to sustain demand momentum.

Major Players

- Airbus Helicopters

- Leonardo Helicopters

- Bell Textron

- Sikorsky Aircraft

- Boeing Defense

- Russian Helicopters

- Kawasaki Aerospace

- MD Helicopters

- NHIndustries

- Hindustan Aeronautics

- Abu Dhabi Aviation

- Falcon Aviation

- Gulf Helicopters

- Rotortrade

- HeliUnion

Key Target Audience

- Offshore oil and gas operators

- Emergency medical service providers

- Helicopter fleet operators

- Aviation leasing companies

- Aircraft OEMs

- Investments and venture capitalist firms

- Government and regulatory bodies

- Infrastructure developers

Research Methodology

Step 1: Identification of Key Variables

Key variables including fleet size, utilization rates, contract duration, and maintenance cycles were identified. Demand and supply indicators were mapped. Regulatory frameworks were reviewed. Data relevance was validated.

Step 2: Market Analysis and Construction

Primary and secondary data were analyzed to structure the market. Operator financials and fleet data were assessed. Revenue streams were evaluated. Market structure was constructed.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through expert consultations with operators and industry specialists. Feedback was incorporated. Data inconsistencies were reconciled. Findings were refined.

Step 4: Research Synthesis and Final Output

Validated data were synthesized into structured insights. Analytical consistency was ensured. Findings were reviewed for accuracy. Final outputs were generated.

- Executive Summary

- UAE Commercial Helicopters Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expansion of offshore oil and gas activities

Rising demand for emergency medical aviation services

Growth in VIP and corporate air mobility

Infrastructure development in remote regions

Increasing tourism-driven aerial mobility demand - Market Challenges

High acquisition and lifecycle maintenance costs

Stringent aviation regulatory compliance requirements

Limited availability of trained pilots and technicians

Operational constraints due to harsh climatic conditions

Dependence on imported aircraft and spare parts - Market Opportunities

Fleet modernization and replacement demand

Growth in helicopter leasing and charter services

Adoption of advanced avionics and efficiency technologies - Trends

Shift toward twin-engine safety compliance

Increased use of composite materials

Integration of digital maintenance monitoring

Rising preference for leasing over ownership

Focus on noise reduction and sustainability - Government Regulations & Defense Policy

Civil aviation safety and airworthiness regulations

Operational standards for offshore and EMS missions

National aviation localization and capability policies - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Light Single Engine Helicopters

Light Twin Engine Helicopters

Medium Twin Engine Helicopters

Heavy Lift Helicopters

Utility and Multipurpose Helicopters - By Platform Type (In Value%)

Offshore Oil and Gas Transport

Emergency Medical Services

Corporate and VIP Transport

Aerial Work and Utility Services

Tourism and Sightseeing Operations - By Fitment Type (In Value%)

Factory-Fitted Configurations

Mission-Configured Retrofits

Cabin Reconfiguration Kits

Avionics Upgrade Fitments

Performance Enhancement Fitments - By EndUser Segment (In Value%)

Oil and Gas Operators

Emergency Medical Service Providers

Government and Public Agencies

Corporate Charter Operators

Tourism and Leisure Operators - By Procurement Channel (In Value%)

Direct OEM Procurement

Authorized Dealer Procurement

Operating Lease Agreements

Wet Lease and Charter Contracts

Government Tender Procurement - By Material / Technology (in Value %)

Composite Airframe Structures

Advanced Turboshaft Engines

Glass Cockpit Avionics

Fly-by-Wire Flight Controls

Noise and Emission Reduction Technologies

- Market structure and competitive positioning

- Market share snapshot of major players

CrossComparison Parameters (Fleet Size, Aircraft Type Portfolio, Service Network Coverage, Maintenance Capability, Delivery Lead Time, Leasing Options, Aftermarket Support, Regulatory Compliance, Localization Presence) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Airbus Helicopters

Leonardo Helicopters

Bell Textron

Sikorsky Aircraft

Boeing Defense, Space & Security

Russian Helicopters

Kawasaki Heavy Industries Aerospace

MD Helicopters

Hindustan Aeronautics Limited

NHIndustries

Textron Aviation Defense

Rotortrade

Abu Dhabi Aviation

Falcon Aviation Services

Gulf Helicopters

- Operational focus on safety and mission reliability

- Preference for versatile multi-mission platforms

- Emphasis on rapid response and availability

- Growing reliance on outsourced aviation services

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035