Market Overview

Based on a recent historical assessment, the UAE Connected Aircraft Market was valued at USD ~ million, supported by verified disclosures from aviation connectivity providers, airline financial filings, and civil aviation infrastructure expenditure records. The market is driven by rapid fleet modernization programs, increasing installation of satellite-based broadband systems, and strong demand for real-time aircraft data services. Airline investments in passenger connectivity, operational efficiency tools, and predictive maintenance platforms contribute significantly. Defense aviation connectivity upgrades and government-backed digital aviation initiatives further reinforce spending momentum across commercial and military fleets operating within the country.

Based on a recent historical assessment, Dubai and Abu Dhabi dominate the UAE Connected Aircraft Market due to their roles as global aviation hubs and defense command centers. Dubai leads through large widebody airline fleets, extensive long-haul connectivity demand, and integration of smart airport ecosystems. Abu Dhabi maintains strength through defense aviation programs, business aviation growth, and state-backed aerospace investments. The UAE overall benefits from strong regulatory clarity, advanced satellite ground infrastructure, and proximity to major satellite service providers, enabling faster adoption of connected aircraft technologies than neighboring regional markets.

Market Segmentation

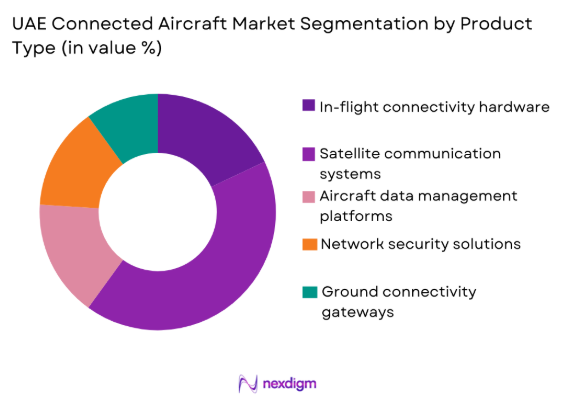

By Product Type

UAE Connected Aircraft Market is segmented by product type into in-flight connectivity hardware, satellite communication systems, aircraft data management platforms, network security solutions, and ground connectivity gateways. Recently, satellite communication systems have a dominant market share due to factors such as fleet-wide retrofit programs, availability of high-throughput satellite coverage, and strong airline preference for scalable bandwidth solutions. National carriers prioritize uninterrupted global coverage for long-haul operations, while defense platforms require secure beyond-line-of-sight communications. Established vendor presence, long-term service contracts, and compatibility with next-generation aircraft further strengthen adoption. Government-backed satellite infrastructure and proven reliability in desert operating environments reinforce dominance.

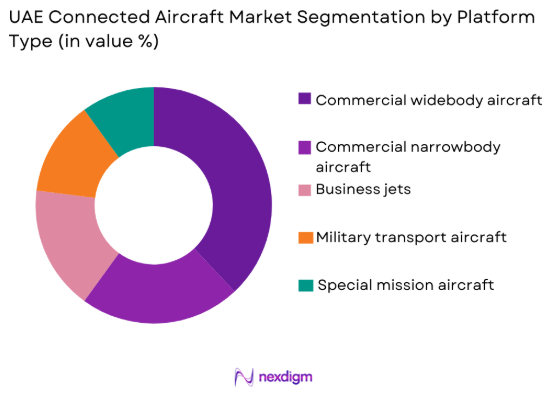

By Platform Type

UAE Connected Aircraft Market is segmented by platform type into commercial widebody aircraft, commercial narrowbody aircraft, business jets, military transport aircraft, and special mission aircraft. Recently, commercial widebody aircraft has a dominant market share due to factors such as long-haul route concentration, premium passenger connectivity demand, and high data usage intensity. UAE-based airlines operate large widebody fleets with continuous global operations requiring robust connectivity solutions. These platforms generate higher recurring service revenues, support advanced cabin services, and integrate sophisticated operational analytics. Strong OEM integration and airline-led digital transformation strategies further sustain dominance across this platform category.

Competitive Landscape

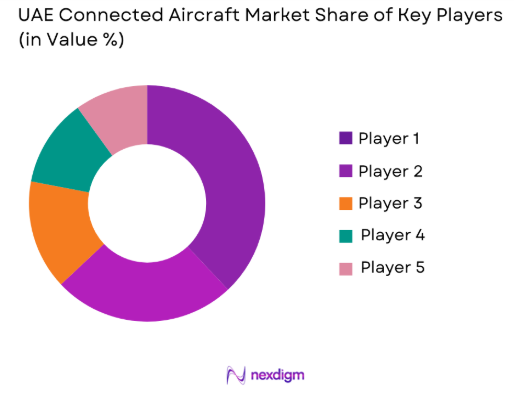

The UAE Connected Aircraft Market is moderately consolidated, with global avionics and satellite communication providers holding strong positions through long-term airline and government contracts. Major players influence technology standards, pricing models, and service availability, while regional partnerships strengthen market access.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Connectivity Coverage |

| Honeywell Aerospace | 1906 | United States | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ |

| Viasat | 1986 | United States | ~ | ~ | ~ | ~ | ~ |

| Inmarsat | 1979 | United Kingdom | ~ | ~ | ~ | ~ | ~ |

UAE Connected Aircraft Market Analysis

Growth Drivers

Expansion of Long-Haul Airline Fleets and Passenger Connectivity Demand

Expansion of long-haul airline fleets and passenger connectivity demand is a primary growth driver shaping the UAE Connected Aircraft Market as national carriers prioritize uninterrupted broadband experiences across intercontinental routes while aligning cabin services with premium travel expectations and digital lifestyle norms. Airlines operating widebody fleets require high-capacity satellite connectivity to support streaming, real-time messaging, and digital commerce services that enhance brand positioning and customer loyalty across competitive global aviation markets. Continuous investment in next-generation aircraft equipped with factory-installed connectivity systems increases baseline adoption while reducing retrofit complexity. The demand for consistent connectivity also extends to operational communications, enabling real-time flight tracking, crew applications, and dynamic route optimization that improve fuel efficiency and punctuality. Regulatory encouragement for digital aviation modernization supports airline investments through streamlined certification pathways and infrastructure coordination. The UAE’s strategic positioning as a global transit hub amplifies connectivity usage intensity due to long flight durations and diverse passenger demographics. Premium cabin differentiation strategies further drive higher bandwidth requirements, increasing average revenue per aircraft for connectivity providers. Long-term service contracts between airlines and satellite operators stabilize revenue visibility and justify sustained capital investment. As airline digital ecosystems mature, connectivity platforms increasingly serve as enablers for data monetization, reinforcing their central role in fleet expansion strategies.

Defense Aviation Modernization and Secure Network-Centric Operations

Defense aviation modernization and secure network-centric operations represent a significant growth driver for the UAE Connected Aircraft Market as military and government operators invest heavily in resilient, encrypted communication architectures to support surveillance, transport, and mission aircraft. Modern defense doctrine emphasizes real-time data exchange between airborne platforms, command centers, and allied forces, increasing reliance on advanced connectivity solutions. Secure satellite links enable beyond-line-of-sight operations across vast operational theaters, supporting intelligence, surveillance, and reconnaissance missions. The UAE’s focus on defense self-reliance and interoperability with allied forces accelerates adoption of standardized, high-assurance communication systems. Government-backed procurement programs provide stable funding streams that encourage suppliers to localize support and integration capabilities. Military transport and special mission aircraft require customized connectivity configurations, driving higher system values per platform. Integration of connectivity with mission systems enhances situational awareness and decision-making speed. Cybersecurity-by-design requirements further elevate system complexity and value. These factors collectively sustain long-term demand for connected aircraft technologies within defense aviation fleets.

Market Challenges

High Satellite Bandwidth Costs and Long-Term Service Commitments

High satellite bandwidth costs and long-term service commitments pose a critical challenge for the UAE Connected Aircraft Market as airlines and operators balance passenger experience expectations with profitability pressures in a competitive aviation environment. Connectivity service fees represent recurring operational expenditures that scale with data consumption, making cost control difficult as usage intensity rises. Airlines must commit to multi-year service contracts to secure coverage and performance guarantees, reducing flexibility in vendor switching. Price sensitivity is heightened during periods of traffic volatility, impacting return on investment calculations. Business aviation operators face similar challenges due to lower fleet scale advantages. Defense platforms encounter high costs associated with secure and dedicated bandwidth requirements. Currency exposure and satellite capacity pricing structures further complicate budgeting. These financial constraints can delay adoption or limit bandwidth allocation strategies. Cost optimization remains a persistent barrier to broader connectivity deployment across all aircraft categories.

Cybersecurity Risks and Certification Complexity

Cybersecurity risks and certification complexity present substantial challenges within the UAE Connected Aircraft Market as increased connectivity expands potential attack surfaces across avionics and cabin networks. Regulatory authorities require rigorous certification to ensure separation between critical flight systems and passenger networks, extending approval timelines. Compliance with international airworthiness and cybersecurity standards adds engineering complexity and cost. Airlines and defense operators demand assurance against data breaches, system interference, and operational disruption. Rapid technological evolution often outpaces regulatory adaptation, creating uncertainty during system upgrades. Integration across mixed aircraft fleets further increases validation requirements. Any cybersecurity incident could trigger reputational damage and regulatory scrutiny. Continuous monitoring and patch management add lifecycle costs. These challenges necessitate sustained investment in security governance and certification expertise.

Opportunities

Integration of Multi-Orbit Satellite Connectivity Architectures

Integration of multi-orbit satellite connectivity architectures presents a significant opportunity for the UAE Connected Aircraft Market as operators seek improved coverage, lower latency, and enhanced redundancy through combined geostationary and low-earth-orbit solutions. Multi-orbit systems enable dynamic bandwidth allocation based on flight phase and geography, improving performance consistency. Airlines benefit from optimized service quality on polar and remote routes. Defense platforms gain resilience against signal disruption and congestion. The UAE’s advanced ground infrastructure supports seamless orbit handover capabilities. Technology convergence encourages innovation in antenna design and network management software. Service differentiation through performance-based offerings becomes feasible. Partnerships between satellite operators and avionics manufacturers accelerate commercialization. This evolution positions the UAE as a regional leader in next-generation aviation connectivity deployment.

Data Monetization and Advanced Aircraft Analytics Platforms

Data monetization and advanced aircraft analytics platforms offer strong growth opportunities within the UAE Connected Aircraft Market as connectivity enables continuous data generation across operational, maintenance, and passenger domains. Airlines can leverage real-time data streams to implement predictive maintenance, reducing unscheduled downtime and maintenance costs. Operational analytics support fuel optimization, route efficiency, and crew management improvements. Passenger data insights enable personalized services and ancillary revenue generation. Defense operators utilize analytics for mission effectiveness and asset utilization monitoring. Cloud-based platforms simplify data integration across fleets. Regulatory acceptance of digital records accelerates adoption. Value creation shifts from connectivity access to data-driven decision support. This transformation expands revenue potential beyond traditional bandwidth services.

Future Outlook

The UAE Connected Aircraft Market is expected to advance steadily over the next five years, supported by airline fleet expansion, defense aviation modernization, and sustained investment in digital infrastructure. Adoption of high throughput satellite connectivity, multi orbit architectures, and cloud based aircraft analytics will reshape service delivery models. Regulatory alignment with global aviation cybersecurity and certification standards will encourage wider deployment. Demand growth will be reinforced by premium passenger experience strategies, operational efficiency requirements, and data driven maintenance practices. Strategic partnerships between airlines, satellite operators, and avionics suppliers will accelerate technology integration, strengthen service resilience across the UAE aviation ecosystem.

Major Players

- Honeywell Aerospace

- Collins Aerospace

- Thales Group

- Viasat

- Inmarsat

- Panasonic Avionics

- Gogo Business Aviation

- L3Harris Technologies

- Safran Electronics & Defense

- Cobham Aerospace Communications

- Leonardo

- ST Engineering Aerospace

- Airbus Defence and Space

- Boeing AvionX

- Rohde & Schwarz

Key Target Audience

- Commercial airlines

- Business jet operators

- Defense aviation authorities

- Aircraft leasing companies

- Investments and venture capitalist firms

- Government and regulatory bodies

- Satellite service providers

- Aircraft OEMs

Research Methodology

Step 1: Identification of Key Variables

The research begins by identifying technical, economic, and operational variables influencing the UAE Connected Aircraft Market. Demand-side drivers, regulatory factors, and technology adoption patterns are mapped. Key performance indicators are defined. Assumptions are validated against industry standards.

Step 2: Market Analysis and Construction

Market structure is constructed using verified financial disclosures and aviation data. Segmentation logic is applied consistently. Cross-validation ensures internal coherence. Market size alignment is confirmed.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are validated through expert interviews and secondary literature. Industry specialists provide qualitative insights. Contradictory findings are reconciled. Assumptions are refined.

Step 4: Research Synthesis and Final Output

Findings are synthesized into a structured narrative. Data integrity checks are applied. Analytical consistency is ensured. Final outputs align with research objectives.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising passenger demand for continuous in flight connectivity

Expansion of UAE based airline fleets with next generation aircraft

Increased adoption of data driven aircraft operations

Government investment in smart aviation infrastructure

Growing emphasis on connected military and special mission aircraft - Market Challenges

High cost of satellite bandwidth and service subscriptions

Complex certification and regulatory compliance requirements

Cybersecurity risks linked to connected avionics

Integration challenges across mixed aircraft fleets

Dependence on satellite coverage reliability - Market Opportunities

Deployment of next generation high throughput satellites

Growth of connected services for business aviation

Integration of connected aircraft systems with smart airports - Trends

Shift toward Ka band and multi orbit satellite solutions

Increased use of real time aircraft health monitoring

Adoption of cloud based aviation IT platforms

Rising focus on cybersecurity by design

Convergence of commercial and defense connectivity technologies - Government Regulations & Defense Policy

Civil aviation connectivity certification mandates

National cybersecurity frameworks for aviation systems

Defense modernization programs supporting network centric operations

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

In-flight connectivity hardware

Satellite communication terminals

Airborne network management systems

Aircraft data analytics platforms

Cybersecurity and encryption modules - By Platform Type (In Value%)

Commercial narrow body aircraft

Commercial wide body aircraft

Business jets

Military transport aircraft

Special mission and ISR aircraft - By Fitment Type (In Value%)

Line fit installations

Retrofit installations

Hybrid upgrade programs

OEM integrated systems

Aftermarket integration kits - By End User Segment (In Value%)

Commercial airlines

Business aviation operators

Military air forces

Government and VIP fleets

Aircraft leasing companies - By Procurement Channel (In Value%)

Direct OEM procurement

Airline direct contracts

System integrator sourcing

Defense procurement agencies

Authorized aftermarket distributors - By Material / Technology (in Value %)

Ka band satellite communication

Ku band satellite communication

Air to ground connectivity

Cloud based aircraft networks

Software defined networking platforms

- Market share snapshot of major players

- Cross Comparison Parameters (Connectivity Bandwidth, Latency, Coverage, Cybersecurity Compliance, Integration Complexity, Lifecycle Cost, Upgradeability, Certification Status, Service Availability)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Honeywell Aerospace

Collins Aerospace

Thales Group

L3Harris Technologies

Viasat

Inmarsat

Panasonic Avionics

Gogo Business Aviation

Safran Electronics and Defense

Boeing AvionX

Airbus Defence and Space

Cobham Aerospace Communications

Leonardo

ST Engineering Aerospace

Rohde and Schwarz

- Airlines prioritizing passenger experience and operational efficiency

- Business aviation operators focusing on premium connectivity

- Military users emphasizing secure and resilient communications

- Leasing firms valuing upgrade ready connected aircraft platforms

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035