Market Overview

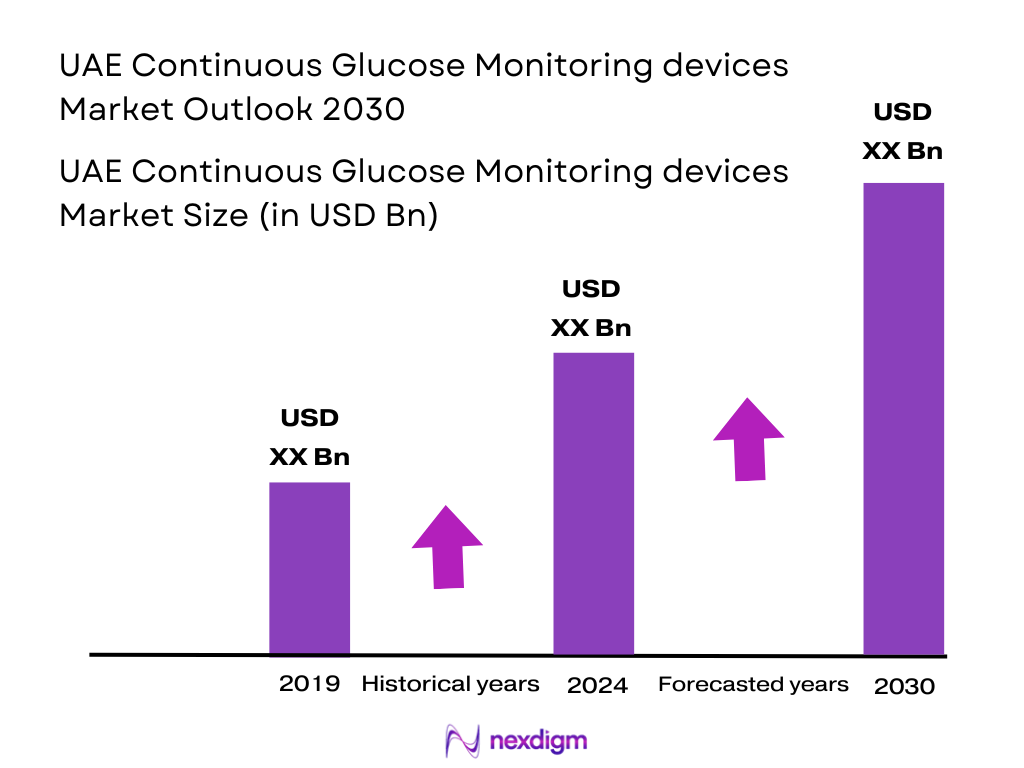

The UAE continuous glucose monitoring (CGM) devices market has witnessed substantial growth, with a significant valuation of USD ~ million in 2025. This growth is driven by increasing diabetes prevalence in the UAE, alongside technological advancements in CGM devices, which enhance patient management. Additionally, the rising healthcare awareness and improved access to medical devices have significantly contributed to market growth. The introduction of mobile app integrations and real-time monitoring features has also spurred demand, making CGM devices more accessible and user-friendly for consumers and healthcare professionals alike.

Dubai and Abu Dhabi dominate the UAE CGM devices market due to their well-established healthcare infrastructure and high disposable incomes. These cities are also home to world-class hospitals and medical institutions that foster rapid adoption of advanced medical technologies. The government’s strong focus on improving healthcare services, alongside initiatives such as the UAE’s National Diabetes Strategy, positions these cities as leaders in the market. The integration of CGM devices into national diabetes management programs has further strengthened their position in the market.

Market Segmentation

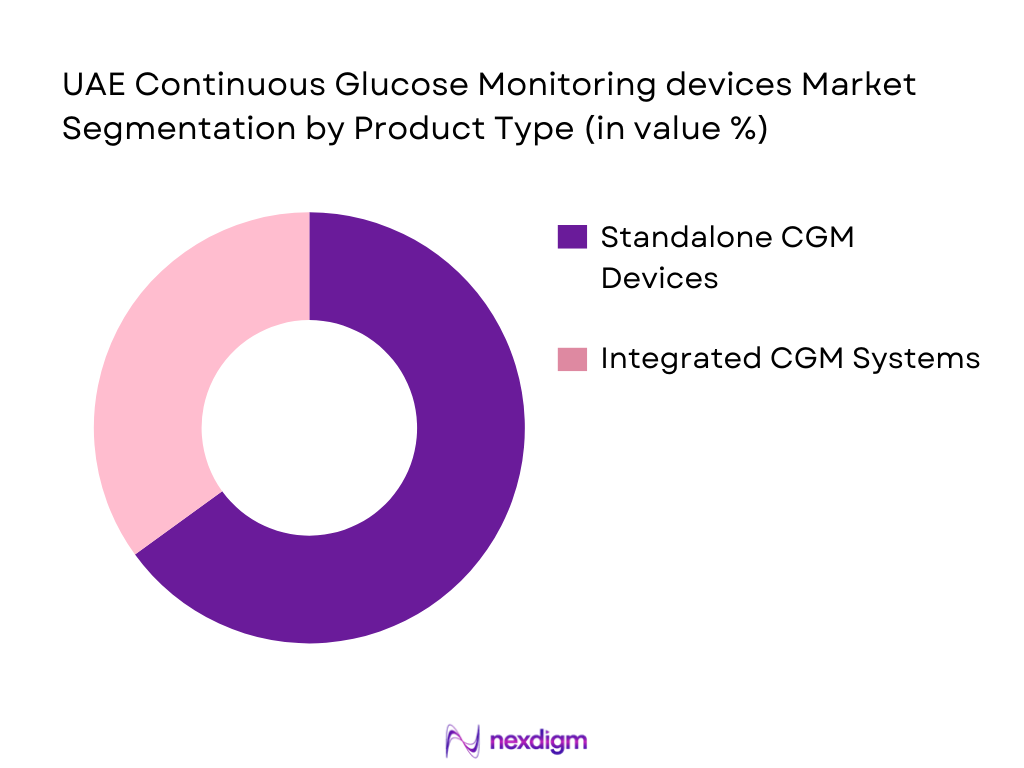

By Product Type

The UAE CGM market is segmented into standalone CGM systems and integrated systems (combining CGM with insulin pumps). Standalone CGM systems dominate the market, primarily due to their ease of use and widespread availability. They are frequently used by diabetic patients who require continuous monitoring but do not rely on insulin pumps. The increasing availability of these devices in pharmacies and healthcare settings has enhanced their adoption, especially among Type 1 and Type 2 diabetic patients who prefer discreet, non-invasive solutions.

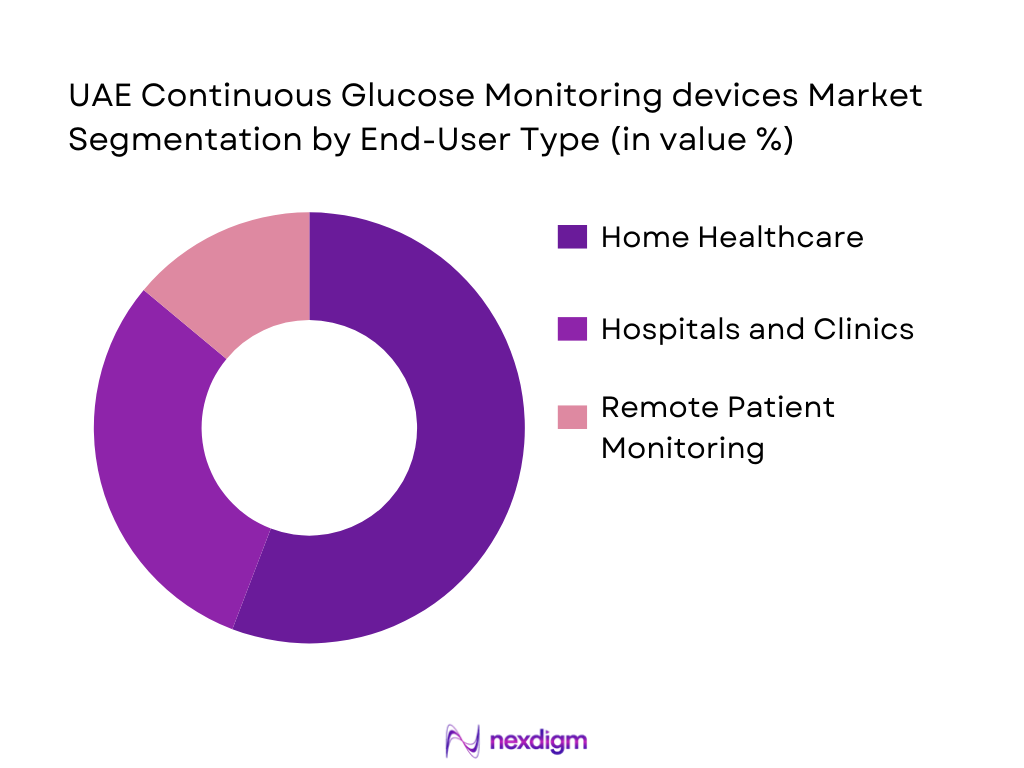

By End User

The UAE CGM market is segmented by end users into hospitals and clinics, home healthcare, and remote patient monitoring programs. Home healthcare is the dominant end-user segment due to the increasing number of individuals with chronic conditions who require continuous monitoring in the comfort of their homes. The growing trend toward self-management of diabetes, along with the high adoption rate of wearable CGM devices, has empowered patients to monitor their glucose levels at home, reducing hospital visits and improving patient outcomes.

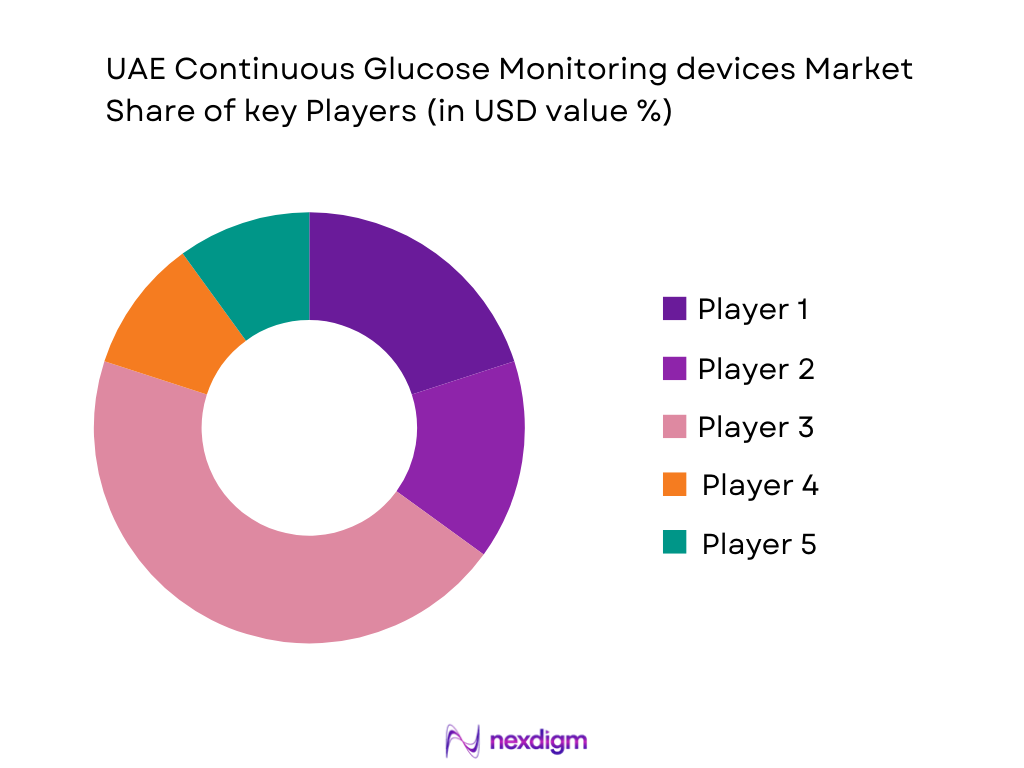

Competitive Landscape

The UAE CGM market is dominated by both international and regional players, with key brands including Dexcom, Abbott, and Medtronic. These companies hold significant market share due to their established product portfolios, strong brand recognition, and advanced product offerings. Local distributors and healthcare providers have also strengthened their position by collaborating with these global manufacturers to expand access to CGM technology in the UAE.

| Company | Establishment Year | Headquarters | Product Portfolio | R&D Capabilities | Market Position | Partnerships |

| Dexcom | 1999 | USA | ~ | ~ | ~ | ~ |

| Abbott | 1888 | USA | ~ | ~ | ~ | ~ |

| Medtronic | 1949 | Ireland | ~ | ~ | ~ | ~ |

| Roche | 1896 | Switzerland | ~ | ~ | ~ | ~ |

| Senseonics | 1996 | USA | ~ | ~ | ~ | ~ |

UAE Continuous Glucose Monitoring Devices Market Analysis

Growth Drivers

Urbanization

The rapid urbanization in the UAE is a significant growth driver for the continuous glucose monitoring (CGM) devices market. As of 2025, approximately ~ % of the UAE population resides in urban areas, predominantly in cities like Dubai and Abu Dhabi (UAE National Bureau of Statistics). This high urbanization rate directly contributes to the increased demand for healthcare devices, including CGM systems. Urban centers offer better access to advanced medical technologies, including CGM systems, driven by enhanced healthcare infrastructure and growing health awareness among urban populations. Additionally, as the UAE continues to develop smart city initiatives, the integration of digital health technologies such as CGMs is becoming a key focus for improving overall healthcare management.

Industrialization

The ongoing industrialization in the UAE has contributed to the country’s economic diversification, which in turn increases the demand for advanced healthcare solutions like continuous glucose monitoring devices. As of 2025, the UAE’s industrial sector has grown by ~ %, with manufacturing contributing significantly to the country’s GDP (World Bank). As the industrial sector expands, there is a growing middle-class population that has more disposable income and a heightened awareness of health and wellness. This sector’s development is pivotal in the increasing availability and affordability of CGM devices, as more individuals become proactive in managing diabetes and other chronic health conditions through advanced technologies.

Restraints

High Initial Costs

The high initial costs of continuous glucose monitoring devices continue to be a restraint in the UAE market. While the adoption of CGM devices is growing, their prices remain a barrier for a large segment of the population. The average cost of a CGM system can range from AED ~ to AED ~ , depending on the type and brand. In addition to the initial cost of purchasing the device, there are also recurring expenses for sensors and other related accessories. This cost factor limits widespread adoption, particularly in lower-income households. As of 2025, the median household income in the UAE was approximately AED ~ per month, which is often insufficient to cover the full expense of CGM devices for many citizens.

Technical Challenges

Continuous glucose monitoring devices, although highly effective, face certain technical challenges that hinder their wider adoption in the UAE. These challenges include the need for regular calibration and potential inaccuracies in readings due to factors like skin conditions or sensor malfunctions. In 2025, nearly ~ of CGM users in the UAE reported experiencing issues with sensor calibration, which can disrupt accurate glucose monitoring (UAE Diabetes Council). Additionally, there is a lack of standardization in the technical specifications of CGM devices across manufacturers, which poses challenges for both healthcare providers and users. This technical inconsistency impacts the efficiency and trust of CGM systems among diabetic patients.

Opportunities

Technological Advancements

The ongoing technological advancements in continuous glucose monitoring devices present a significant opportunity for market growth in the UAE. In recent years, innovations in sensor technology, including improved accuracy and integration with smartphones and other wearable devices, have made CGMs more appealing to a broader audience. In 2025, approximately ~ % of new CGM systems in the UAE were integrated with smartphone applications, making it easier for patients to track their glucose levels in real time. Furthermore, developments in non-invasive CGM technologies are anticipated to address some of the current limitations related to skin irritation and calibration issues. These advancements are likely to drive further adoption, particularly in a tech-savvy market like the UAE, where the population is highly receptive to new health technologies.

International Collaborations

International collaborations in the healthcare sector provide ample opportunities for the UAE CGM market to expand further. The UAE has become a hub for medical tourism, attracting patients from across the MENA region who seek access to advanced healthcare technologies. In 2025, the UAE’s healthcare sector attracted over ~ medical tourists, with many seeking diabetes management solutions (UAE Ministry of Health). Collaboration between local healthcare providers and global CGM manufacturers like Abbott and Medtronic has led to the increased availability of these advanced devices in the country. These partnerships are expected to enhance the distribution networks and drive down costs, enabling more patients to benefit from CGM systems in the coming years.

Future Outlook

Over the next 5 years, the UAE Continuous Glucose Monitoring Devices market is expected to experience steady growth, driven by advancements in sensor technology, increased healthcare spending, and the rising prevalence of diabetes. The market will also benefit from the growing trend toward home-based healthcare and the adoption of digital health solutions. The UAE government’s continuous support for healthcare innovation and diabetes management is expected to further fuel the demand for CGM devices.

Major Players

- Dexcom

- Abbott

- Medtronic

- Roche

- Senseonics

- Ypsomed

- Ascensia

- Insulet Corporation

- Nipro Diagnostics

- Lifescan

- Tandem Diabetes Care

- Animas Corporation

- Glucometrix

- Glooko

- Novo Nordis

Key Target Audience

- Diabetes Management Organizations

- Hospitals and Healthcare Providers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Healthcare Equipment Distributors

- Insurance Companies

- Retail and E-commerce Channels

- Pharmaceutical Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying the primary variables affecting the UAE CGM market, including market drivers like diabetes prevalence and advancements in CGM technology. Secondary research is performed using industry reports, databases, and company financials.

Step 2: Market Analysis and Construction

Historical data is compiled, focusing on market growth patterns, segment breakdowns, and customer trends. This information is then analyzed to build a comprehensive market model and evaluate past performance.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts, including healthcare professionals, device manufacturers, and distributors. These insights refine the market model and provide clarity on future trends.

Step 4: Research Synthesis and Final Output

Final insights are generated by combining data from primary and secondary research, which are then validated with key market stakeholders. These conclusions are synthesized into a final, comprehensive market report.

- Executive Summary

- Research Methodology (Market Definitions & Diagnostic Framework, Device Classifications, CGM vs SMBG, Insulin Management Integration)

- Definition and Scope

- Market Genesis & Adoption Timeline (CGM Introduction to UAE)

- Healthcare System & Diabetes Management Context

- Diabetes Prevalence & CGM Penetration Levels

- Timeline of Regulatory & Policy Milestones

- Regulatory Approvals (MOHAP, DHA)

- Reimbursement & Insurance Frameworks

- Healthcare Delivery Channel Mapping

- Clinical, Retail, Direct to Consumer (DTC), Telehealth Channels

- Import, Distribution, Retail & Logistics Flows

- Growth Drivers

Diabetes Prevalence & Awareness Levels

Healthcare Infrastructure Expansion

Technological Advancements (Sensor Accuracy, Wearables)

Telehealth & Remote Monitoring Adoption - Market Challenges

Device Cost & Insurance Reimbursement Gaps

Data Privacy & Protection in CGM Systems

Regulatory Barriers for New Entrants - Opportunity Assessment

Non‑Diabetic Wellness & Preventive CGM Use

Real‑World Evidence & AI‑Assisted Predictive Monitoring - Trend Analysis

Hybrid System Adoption (CGM + Insulin Pumps)

Integration with Digital Platforms & Health Apps - Regulatory & Policy Landscape

Device Registration and Approval Standards

Reimbursement Policy Overview - Value Chain & Channel Ecosystem

- Stakeholder Roles: Manufacturers, Distributors, Retailers, Providers

- Competitive Forces (Porter’s Five Forces)

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price of Platforms/Services, 2019-2025

- By Product Architecture (In Value %)

Standalone CGM Devices (Wearables, Sensor Staple)

Integrated CGM + Insulin Delivery Systems

- By Technology Platform (In Value %)

Electrochemical Sensors

Optical / Non‑Invasive Sensors

Connectivity (Bluetooth, Smartphone Integration)

- By End User (In Value %)

Hospitals & Clinics

Home Healthcare

Remote Patient Monitoring Programs

Pharmacies & Retail

- By Distribution Channel (In Value %)

Retail Pharmacies

Online/E‑commerce

Hospital Procurement

Direct Sales/Telehealth Providers

- Market Share – Device Revenue & Unit Volume

Regional vs UAE‑Specific Player Footprint

Segment Share by Device Type - Cross‑Comparison Parameters (Product Portfolio Breadth (Sensor Life, Compatibility), Distribution & Channel Penetration Intensity, Regulatory Approvals / Country Registrations, Pipeline (New Sensors, Hybrid Systems), Brand Equity & Provider Preference, Price Positioning & ASPs, Digital Integration Capabilities (App/Data Platforms), After‑Sales Support & Warranty Structures)

- Company SWOT Summaries – CGM Providers

- Price Benchmarking Across SKUs (Stationary & Wearable)

- Detailed Company Profiles

Dexcom, Inc.

Abbott Laboratories

Medtronic plc

Senseonics Holdings, Inc.

Roche Diabetes Care

Ascensia Diabetes Care

Ypsomed

GluCare / Regional Distributors

Insulet Corporation

Bayer Healthcare

Nipro Diagnostics

Glooko (Digital Platforms)

Livongo (Teladoc Health)

Sanofi (Connected Solutions)

Local UAE Distributor Consortium

- Adoption Patterns, Demographic Usage Profiles

- Prescription vs OTC / Direct Purchase Behavior

- Clinical Efficacy Perceptions & Training Gaps

- Healthcare Provider Incentive Structures

- Future Market Size by Value, 2026-2030

- Future Market Size by Volume, 2026-2030

- Average Frame Cost Outlook, 2026-2030