Market Overview

The UAE Coronary Artery Imaging Equipment Market is valued at USD ~ million. This market is being driven by the increasing prevalence of coronary artery diseases (CAD), along with growing demand for non-invasive diagnostic technologies. With healthcare becoming a key priority for the government, large investments are directed toward advanced medical imaging infrastructure. This has led to rapid adoption of cutting-edge coronary imaging technologies, including CT coronary angiography (CTA) and intravascular ultrasound (IVUS). Furthermore, the UAE’s healthcare system is evolving rapidly, with both public and private sectors focusing on world-class medical care, further propelling the demand for coronary artery imaging systems. The market is primarily driven by a rise in the aging population and an increase in CAD cases.

Dubai and Abu Dhabi are the dominant cities for coronary artery imaging in the UAE. These cities house the most advanced medical centers, such as Cleveland Clinic Abu Dhabi and Mediclinic City Hospital, which are equipped with state-of-the-art coronary imaging technologies. Additionally, both cities attract medical tourists from across the region, further fueling demand for the latest diagnostic tools. The high concentration of healthcare infrastructure, strong regulatory support, and government funding for healthcare advancements make these cities the primary drivers of market growth. Meanwhile, global technological influence from countries like Germany, the United States, and Japan continues to shape the supply of advanced imaging devices in the UAE.

Market Segmentation

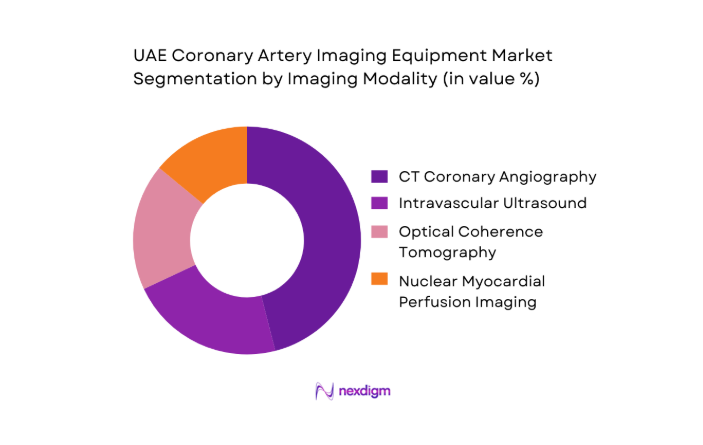

By Imaging Modality

CT Coronary Angiography (CTA) dominates the UAE coronary artery imaging equipment market due to its non-invasive nature, providing high-resolution images for precise diagnosis of coronary artery disease. CTA’s popularity is enhanced by its ability to produce detailed 3D images, reducing the need for invasive procedures like coronary angiography. Innovations in CTA technology, including low radiation dose imaging, have made it more accessible and safer for patients. This has contributed significantly to its market dominance.

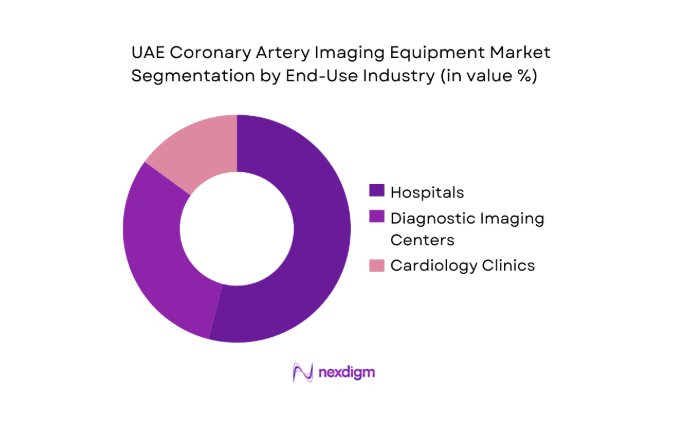

By End-Use Industry / Customer Type

Hospitals are the dominant end-user of coronary artery imaging equipment in the UAE. Hospitals, especially those with dedicated cardiology departments, account for the largest share of market demand. These institutions have the financial resources and infrastructure to implement advanced imaging technologies such as CT coronary angiography and IVUS. Moreover, hospitals often integrate imaging systems with their existing cardiac care protocols, improving diagnostic accuracy and enhancing patient outcomes. As the primary healthcare service providers in the region, hospitals are poised to continue leading this market segment.

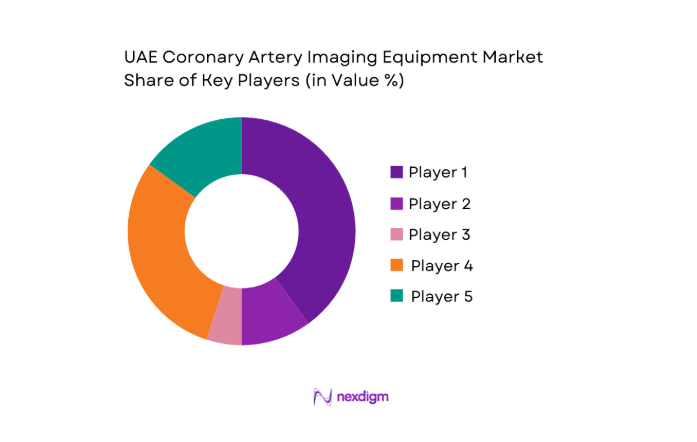

Competitive Landscape

The UAE Coronary Artery Imaging Equipment market is dominated by a few major players, including Siemens Healthiness and global brands like GE Healthcare, Philips, and Canon Medical Systems. This consolidation highlights the significant influence of these key companies, which leverage their technological expertise and global presence to maintain a competitive edge. These companies continue to innovate, offering a wide range of imaging solutions tailored to the needs of UAE healthcare providers.

| Company | Establishment Year | Headquarters | CT & Coronary Imaging Portfolio Strength | AI & Advanced Diagnostics | Installed Base in UAE (& MEA) | Service & Support Infrastructure | Regulatory Approvals (Global/Local) | Partnerships & System Integrations |

| Siemens Healthineers | 1847 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| GE HealthCare | 1892 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Philips Healthcare | 1891 | Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

| Canon Medical Systems | 1930 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Fujifilm Holdings | 1934 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Coronary Artery Imaging Equipment Market Analysis

Growth Drivers

Rising Coronary Artery Disease Burden and Procedure Volumes

The increasing prevalence of coronary artery disease (CAD) and the corresponding rise in procedure volumes, such as percutaneous coronary interventions (PCI), are significant growth drivers for the cardiology sector. As lifestyle changes and an aging population contribute to a higher CAD burden, the demand for advanced diagnostic and interventional technologies continues to rise. With more patients requiring catheterization procedures, the need for state-of-the-art equipment, such as advanced imaging platforms in cath labs, is growing. This surge in procedure volumes directly drives the demand for better, more efficient solutions in interventional cardiology.

Expansion of Tertiary Hospitals and Cath Lab Capacity

The expansion of tertiary hospitals and the increase in cath lab capacity across both public and private healthcare facilities in KSA are driving the growth of cardiology services. With a focus on providing comprehensive care, hospitals are increasing their capacity to perform complex procedures, such as PCI and coronary angiography, to meet rising patient demand. This expansion is often coupled with upgrading or modernizing cath labs, thus creating opportunities for the adoption of advanced imaging systems, including those for intravascular ultrasound (IVUS) and optical coherence tomography (OCT), as hospitals seek to improve diagnostic accuracy and patient outcomes.

Challenges

High Capital Expenditure and Tender-Based Procurement Cycles

The high capital expenditure required for purchasing advanced imaging systems, such as IVUS and OCT platforms, presents a significant challenge for healthcare providers. These systems often come with substantial initial costs, which can deter investment, especially in regions with budget constraints or limited funding for healthcare infrastructure. Furthermore, the procurement process in healthcare systems often follows a tender-based cycle, which can delay purchasing decisions and affect the timely adoption of new technologies. The lengthy and competitive nature of procurement processes can make it difficult for companies to secure contracts and maintain a steady revenue stream from their products.

Long Approval and Credentialing Cycles for New Platforms

Another significant challenge is the lengthy approval and credentialing processes for new platforms in healthcare settings. Before a new system can be implemented in a cath lab, it must undergo a rigorous review process by regulatory authorities, hospital boards, and medical professionals. These approval cycles can be slow, especially for innovative technologies that have not yet gained widespread adoption. Additionally, each new system must be thoroughly tested for compatibility with existing medical protocols and undergo extensive training before it can be widely used, which can further delay the speed at which new platforms are deployed in clinical environments.

Opportunities

Cath Lab Modernization Programs and Replacement Demand

Cath lab modernization programs present a significant opportunity for growth in the cardiology imaging sector. As hospitals aim to improve diagnostic capabilities and provide better patient care, they are increasingly investing in modern, advanced cath lab equipment. This creates a demand for the latest imaging technologies, including IVUS and OCT, which are essential for performing complex cardiovascular procedures. Additionally, as older equipment reaches the end of its lifecycle, there is a replacement demand for upgraded platforms, offering opportunities for suppliers of new imaging technologies to capture market share and meet the evolving needs of healthcare providers.

Growth of IVUS and OCT Adoption for Complex PCI

The growing adoption of intravascular ultrasound (IVUS) and optical coherence tomography (OCT) in complex percutaneous coronary interventions (PCI) represents a significant opportunity. These advanced imaging technologies provide detailed, real-time insights into coronary artery conditions, which help interventional cardiologists plan and execute procedures more effectively. As the complexity of PCI procedures increases, the demand for these high-resolution imaging platforms is expected to rise. This presents an opportunity for vendors to expand their market presence by offering state-of-the-art IVUS and OCT systems, which are essential for improving procedural outcomes and enhancing patient safety in complex cases.

Future Outlook

The UAE coronary artery imaging equipment market is set to experience continued growth, driven by ongoing advancements in technology and increasing healthcare investments. The adoption of non-invasive diagnostic modalities will continue to rise, especially as imaging systems become more cost-effective and accessible to a wider range of healthcare providers. The UAE’s ambition to become a global healthcare hub will also drive the need for cutting-edge imaging technologies, ensuring sustained demand in the coming years.

Major Players

- Siemens Healthineers

- GE Healthcare

- Philips

- Canon Medical Systems

- Hitachi Medical Corporation

- Medtronic

- Abbott Laboratories

- Boston Scientific

- Fujifilm Holdings

- Toshiba Medical Systems

- Carestream Health

- Esaote

- Agfa-Gevaert Group

- Shimadzu Corporation

- Accuray Incorporated

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Medical device manufacturers

- Healthcare providers

- Private healthcare facilities

- Medical imaging equipment distributors

- Medical insurance companies

- Cardiologists and healthcare professionals

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying and defining the critical variables that influence the UAE coronary artery imaging market. This includes reviewing industry-level information and mapping out the key drivers, challenges, and market trends.

Step 2: Market Analysis and Construction

In this phase, historical data is compiled and analyzed to construct the market size and growth trajectory. This involves assessing the adoption of coronary imaging technologies in UAE hospitals and clinics, along with evaluating service quality and diagnostic accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations will be conducted with cardiologists, healthcare providers, and industry practitioners to validate the market hypotheses. These interviews will offer valuable insights into operational challenges, growth opportunities, and technological innovations.

Step 4: Research Synthesis and Final Output

The final phase synthesizes all gathered data and expert insights, cross-referencing market data and expert feedback to ensure a comprehensive and accurate report on the UAE coronary artery imaging equipment market.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, terminology and abbreviations, coronary imaging equipment taxonomy, sizing logic by installed base and procedure volume, revenue attribution by modality and consumables, primary interview program with hospitals distributors and OEMs, data triangulation and validation, assumptions limitations and data gaps)

- Definition and Scope

- Market Genesis and Evolution of Coronary Imaging in UAE

- Cath Lab Infrastructure and Care Pathway Mapping

- Coronary Imaging Workflow Across Diagnostic Angiography and PCI

- Import Dependence and Authorized Distributor Model in UAE

- Growth Drivers

Rising coronary artery disease burden and procedure volumes

Expansion of tertiary hospitals and cath lab capacity

Preference for minimally invasive interventional cardiology pathways - Challenges

High capital expenditure and tender based procurement cycles

Long approval and credentialing cycles for new platforms - Opportunities

Cath lab modernization programs and replacement demand

Growth of IVUS and OCT adoption for complex PCI

AI enabled workflow optimization and reporting automation - Trends

Shift toward image guided PCI standard of care in complex cases

Growing adoption of IVUS and OCT in high acuity procedures - Regulatory & Policy Landscape

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2019–2024

- By Installed Base and New Installations, 2019–2024

- By Procedure Linked Consumables Revenue, 2019–2024

- By ASP and Service Contract Attach, 2019–2024

- By Fleet Type (in Value %)

Public sector hospitals and cardiac centers

Private hospital networks

Specialty heart hospitals and institutes - By Application (in Value %)

Diagnostic coronary angiography

Percutaneous coronary intervention guidance

Complex lesion assessment and optimization - By Technology Architecture (in Value %)

Fixed cath lab angiography systems

Mobile C arm and hybrid OR angiography

Intravascular ultrasound systems - By Connectivity Type (in Value %)

Standalone imaging workstations

PACS and RIS integrated imaging

Hemodynamic system integrated workflows - By End-Use Industry (in Value %)

Interventional cardiology departments

Radiology departments supporting cath labs

Cardiac surgery and hybrid operating rooms

- Market Share of Major Players

- Cross Comparison Parameters (image resolution and spatial accuracy, detector size and frame rate, radiation dose optimization capability, contrast injection and injector compatibility, IVUS and OCT platform interoperability, AI enabled measurement and reporting features, service response time and uptime SLA, total cost of ownership including consumables)

- SWOT analysis

- Detailed Profiles of Major Companies

Philips

Siemens Healthineers

GE HealthCare

Canon Medical Systems

Shimadzu

Fujifilm Healthcare

Abbott

Boston Scientific

Terumo

Nipro

ACIST Medical Systems

Opsens Medical

CathWorks

HeartFlow

Medis Medical Imaging

- Cath lab director priorities and clinical governance drivers

- Procurement models for capital equipment and consumables

- Biomedical engineering evaluation criteria and acceptance testing

- Service level expectations and downtime tolerance

- By Value, 2025–2030

- By Installed Base and New Installations, 2025–2030

- By Procedure Linked Consumables Revenue, 2025–2030

- By ASP and Service Contract Attach, 2025–2030