Market Overview

The UAE CPAP market, as part of the broader positive airway pressure (PAP) and sleep-apnea devices landscape, is valued at approximately USD ~ million in 2024. This figure reflects revenues from CPAP and related PAP devices deployed and sold across homecare providers, clinics, hospitals and direct-to-consumer channels. The growth is being driven by increasing diagnosis of sleep apnea, rising awareness of respiratory health, and a shift toward home-based therapy devices as patients seek convenience and chronic care solutions outside hospitals.

Geographically, major urban centres such as Dubai, Abu Dhabi, and Sharjah dominate the UAE CPAP market — driven by higher population density, greater healthcare infrastructure, and concentration of private and expatriate populations. These emirates host the bulk of hospitals, sleep clinics, and homecare providers, which supports higher CPAP adoption, resulting in these cities being the primary demand drivers.

Market Segmentation

By Device Type

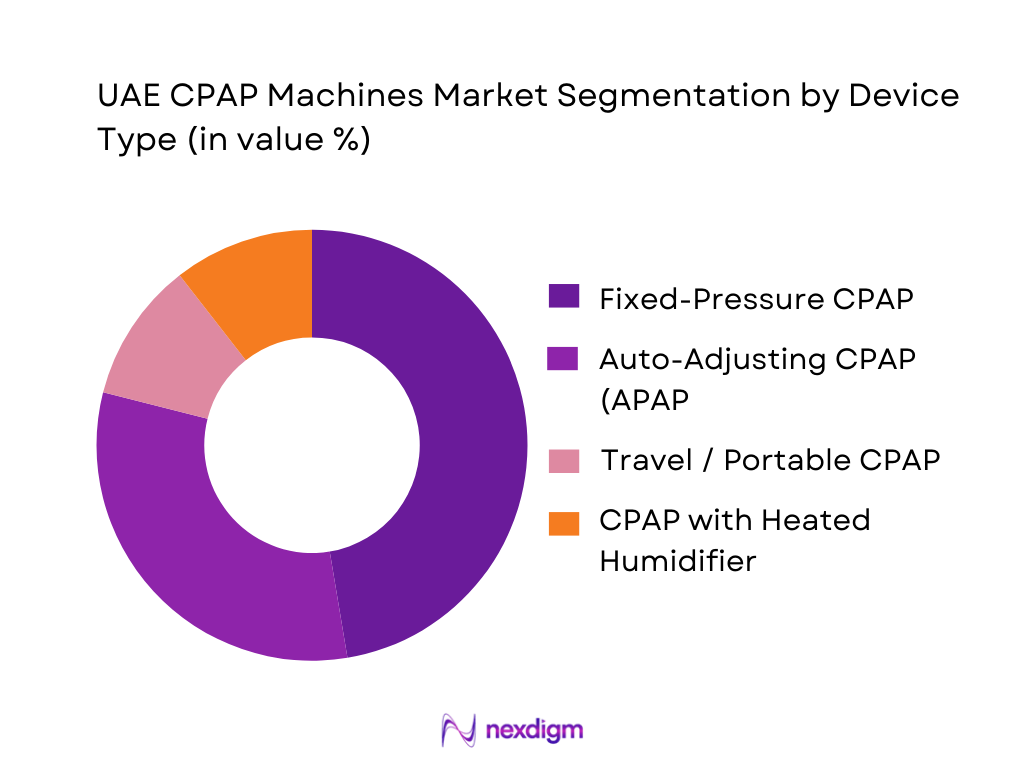

The UAE CPAP market is segmented into fixed-pressure CPAP, auto-adjusting (APAP), travel/portable CPAP, CPAP with heated humidification, and CPAP with oxygen-compatibility or specialized features. Currently, fixed-pressure CPAP devices hold the dominant share, owing to their cost effectiveness, ease of use, and widespread clinician familiarity. Many providers and homecare distributors prefer fixed-pressure CPAP for standard obstructive sleep apnea cases — making them the default choice especially among first-time users and patients requiring stable, maintenance therapy. The lower upfront cost compared to APAP or humidified models also facilitates adoption among expatriates and self-pay patients.

By End-User Setting

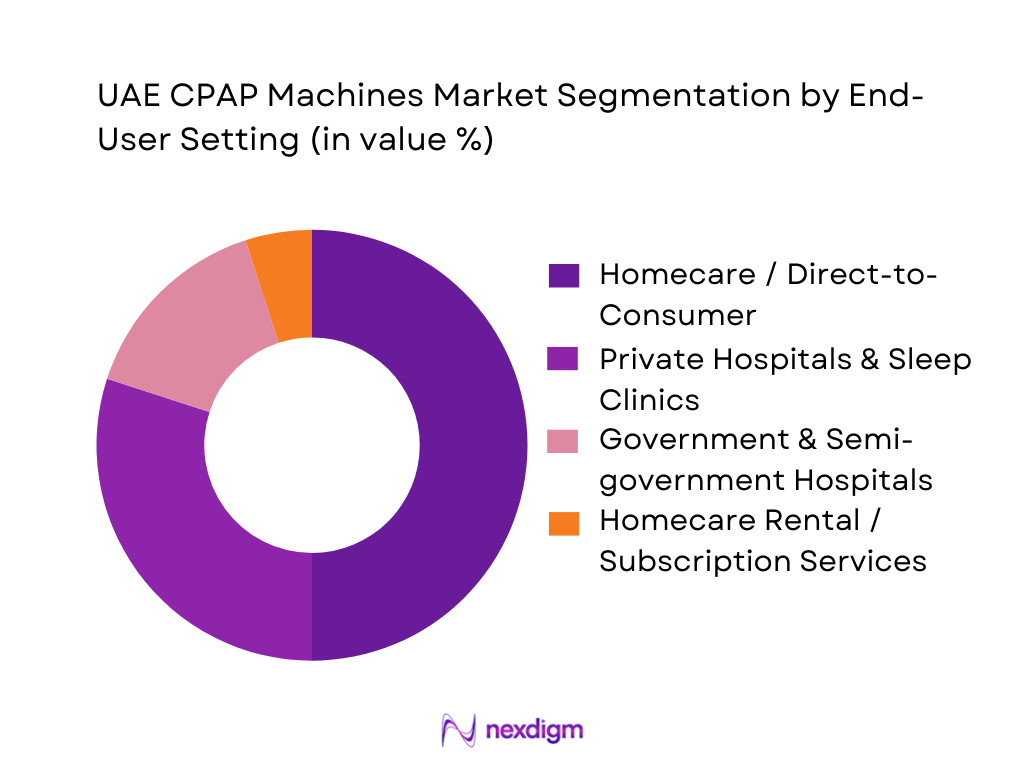

The market is primarily driven by homecare and direct-to-consumer sales, which together account for half of 2024 market volume. This dominance is attributable to rising patient preference for home-based therapy, convenience, privacy, and the expatriate population’s demand for self-managed healthcare solutions. Private hospitals and dedicated sleep clinics constitute the second largest share: they supply CPAP during initiation phases (e.g., after diagnosis), while some continue into follow-up and mask replacement. Government and semi-government hospitals occupy a smaller share, as institutional PAP therapy in UAE has traditionally focused on acute care rather than chronic home ventilation; their use of CPAP is more limited to inpatient or diagnostic-phase usage. Rental and subscription-based homecare services remain nascent but are gradually emerging among price-sensitive or short-term therapy patients.

Competitive Landscape

The UAE CPAP machines market features a mix of global OEMs, regional distributors, and specialized homecare providers. The competitive landscape is moderately consolidated, with a handful of major players leading distribution and device adoption. Below is a summary of key players:

The UAE CPAP Machines Market is dominated by a few major global and regional firms, including long-established OEMs and local homecare providers. This consolidation reflects both the technical requirements for CPAP therapy reliability and the need for strong after-sales, service networks and mask/accessory support.

| Company | Establishment Year | Headquarters | Product Portfolio Breadth | Connectivity / Telemonitoring Support | UAE Distribution Network (Emirates Coverage) | After-sales & Service Infrastructure | Device Price Positioning / Market Focus |

| ResMed | 1989 | San Diego, USA | ~ | ~ | ~ | ~ | ~ |

| Philips Respironics | 1954 | Amsterdam, Netherlands | ~ | ~ | ~ | ~ | ~ |

| Fisher & Paykel Healthcare | 1934 | Auckland, New Zealand | ~ | ~ | ~ | ~ | ~ |

| Drive DeVilbiss Healthcare | 1888 | Somerset, USA | ~ | ~ | ~ | ~ | ~ |

| Breas Medical | 2003 | Lund, Sweden | ~ | ~ | ~ | ~ | ~ |

UAE CPAP Machines Market Analysis

Growth Drivers

Rising Burden of Obesity and Metabolic Syndrome in UAE Adult Population

The UAE has a small but highly urbanized population of 10,876,981 people and a GDP of USD ~ billion, which supports calorie-dense, sedentary lifestyles that directly increase obstructive sleep apnea (OSA) risk. National analyses show overweight and obesity in adults at 67.9%, with obesity alone around 27.8%. In Dubai, 57.6% of adults are overweight or obese, 17.8% are obese, and obesity in UAE nationals reaches 39.6%. Type 2 diabetes, a major OSA correlate, affects about 16.4% of adults, far above global averages. Among Emirati adults, 16.58% already fall into a high-risk OSA category on validated questionnaires, indicating a large future CPAP-eligible pool as diagnosis pathways mature.

Increasing Screening and Diagnosis of Sleep Apnea

Recent UAE cohort work shows 16.58% of Emirati adults at high risk for OSA and 7.60% at intermediate risk, confirming sleep-disordered breathing as a sizable chronic-disease burden sitting atop one of the world’s highest diabetes prevalences at 16.4%. Earlier primary-care data from Dubai found 21% of adult citizens at high OSA risk, with 57% of obese respondents falling into this category, reinforcing strong risk clustering in metabolic and cardiovascular clinics. As the healthcare system spends roughly 4–5% of GDP on health, supported by per-capita health expenditure above USD ~, pulmonary, endocrinology, and cardiology practices are increasingly incentivized to embed STOP-Bang and similar tools into routine chronic-disease screening, expanding the funnel of patients formally diagnosed and eligible for CPAP titration.

Market Challenges

Under-Diagnosis and Low Screening Rates among High-Risk Cohorts

Despite high measured risk, formal OSA diagnosis and CPAP initiation remain modest compared with the underlying disease pool. Emirati cohort data shows 16.58% of adults at high risk for OSA, and primary-care work in Dubai reports 21% high-risk prevalence, yet only a limited number of tertiary centers operate full polysomnography laboratories in Abu Dhabi, Dubai and Sharjah. With a national population of 10,876,981 people and overweight and obesity affecting well over half of adults, the current sleep-lab capacity and fragmented screening in primary care cannot realistically process all eligible cases. This gap is reinforced by concentration of advanced sleep facilities in large urban hospitals, while many high-risk expatriate workers live and seek care in peripheral emirates with fewer specialist services, leaving significant latent CPAP demand untapped.

Upfront Device Cost, Limited Reimbursement, and Co-Pay Sensitivities

While the UAE has one of the region’s highest per-capita health expenditures at around USD 1,843–2,191 and total health outlays of roughly AED ~ billion, financing is split between government, compulsory insurance, corporate schemes and households, with private health expenditure around 39% and household out-of-pocket contributions about 11% of total health spending. For middle-income expatriates and uninsured dependents, these co-pays are material when combined with diagnostic sleep studies and long-term consumables. Health Accounts data for Dubai shows household out-of-pocket spending rising again from 2022 to 2023 after prior declines, indicating renewed cost pressures. In such a financing structure, CPAP devices compete for limited household budgets alongside other chronic-disease therapies, delaying adoption and encouraging patients to postpone titration or opt for cheaper, less effective alternatives such as basic oral appliances or untreated snoring.

Opportunities

Managed CPAP Programs Bundling Device, Mask, Coaching, and Data Analytics

Total health expenditure in the UAE increased from AED ~ billion to AED ~ billion over four years, while per-capita spending rose from AED ~ to AED ~, signalling payer appetite to invest in high-value chronic-disease programs. At the same time, nearly 11 million residents live in a system where diabetes affects 16.4% of adults and obesity in nationals is close to 40%, creating a huge addressable population for risk-stratified OSA management. As Dubai’s latest health-accounts report flags a rebound in household out-of-pocket spending between 2022 and 2023, bundled CPAP programs that include device, mask replacements, coaching and data-driven adherence monitoring become attractive levers for insurers to control long-term cardiovascular and metabolic costs. By tying reimbursement to nightly usage data collected via connected devices and offering tiered packages aligned to disease severity, providers can convert diffuse CPAP sales into structured, recurring care contracts, supporting sustained volume growth for manufacturers and service partners.

Remote Monitoring, Teleconsultation, and Algorithm-Based Adherence Management

The UAE’s digital backbone—100% internet use, ~ million mobile connections and around ~ active mobile broadband subscriptions per 100 inhabitants—creates ideal conditions for remote CPAP monitoring at scale. Dubai’s telemedicine pilots already demonstrated dramatic growth in digital visits, increasing from 188 to 11,757 consultations within a few months, while later analyses processed more than 241,000 telehealth records, proving both clinician readiness and patient acceptance. For a population of 10,876,981 with high OSA risk and heavy international travel through hubs like Dubai International Airport, connected CPAP platforms that stream usage, leak and residual AHI data into hospital EMRs or payer dashboards can underpin AI-driven adherence algorithms and automated outreach. Insurers can then stratify thousands of patients by risk, trigger digital coaching for those falling below adherence thresholds, and quantify reductions in emergency cardiovascular events or hypertensive crises. This transforms CPAP from a standalone device into a core component of the UAE’s broader digital-health and chronic-care-management strategy

Future Outlook

Over the next five to six years, the UAE CPAP Machines Market is expected to see steady growth, driven by increasing sleep-disorder diagnosis, rising awareness among expatriates and locals, and expansion of homecare and remote monitoring solutions. As healthcare infrastructure matures and insurers or corporate health schemes begin to recognize long-term management of sleep apnea, CPAP adoption for home therapy is likely to rise.

Projected growth for 2024–2030 suggests a compound annual growth rate (CAGR) of approximately 5.9% for the broader UAE sleep apnea devices market — which includes CPAP devices. This growth will be supported by increasing uptake of auto-adjusting and connected devices, expansion of homecare services, and growing expatriate demand.

Major Companies

- ResMed

- Philips Respironics

- Fisher & Paykel Healthcare

- Drive DeVilbiss Healthcare

- Breas Medical

- BMC Medical

- Löwenstein Medical

- GE Healthcare

- Medtronic

- ICU Medical

Key Target Audience

- Hospital procurement departments

- Homecare providers and durable medical equipment (DME) distributors

- Corporate health-benefit managers and expatriate healthcare services

- Large private insurers and TPA networks covering sleep therapy

- Medical device importers and distributors seeking entry/expansion in UAE

- Device manufacturers planning launches or expansion in GCC region

- Investors and venture capital firms focusing on med-tech and sleep-health solutions

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We defined the scope of the UAE CPAP Machines Market — including device types (CPAP, APAP, humidified, portable), end-user settings (home, hospitals, clinics), geography (emirate-level), and market metrics (value, volume, installed base, therapy starts). This mapping was based on secondary data from public-market reports, import registries, and stakeholder lists.

Step 2: Market Analysis and Construction

Using available historical data from regional reports and industry sources, we compiled revenue figures, device adoption rates, and growth trends. We estimated installed base and therapy starts using diagnosis prevalence data for sleep apnea extrapolated to UAE population and adjusted with market penetration assumptions.

Step 3: Hypothesis Validation and Expert Consultation

To validate trends and assumptions (e.g., homecare uptake, preferred device types), we plan to conduct structured interviews with UAE-based stakeholders: pulmonologists, sleep clinic operators, homecare providers, and DME distributors. These will be complemented by anonymized telephone surveys and expert feedback to calibrate the model.

Step 4: Research Synthesis and Final Output

Finally, we combine bottom-up derived estimates with top-down data from regional PAP and respiratory device markets. We reconcile differences, normalize for pricing and currency fluctuations, and produce the consolidated market size, segmentation breakdowns, and growth forecasts, ensuring consistency and transparency in methodology.

- Executive Summary

- Research Methodology (Market Definition and Scope, Key Assumptions and Normalizations, Data Sources and Triangulation, Demand-Side Primary Research Approach, Supply-Side Primary Research Approach, Market Sizing and Forecasting Framework, Validation, Sensitivity, and Scenario Analysis, Study Limitations and Data Gaps)

- Definition, Clinical Role, and Device Taxonomy

- Evolution of Sleep Apnea Management and CPAP Adoption in UAE

- CPAP in the Context of UAE Respiratory Care Devices and PAP Markets

- Key Clinical Indications and Patient Cohorts Addressed by CPAP

- Business Cycle of CPAP Devices

- Growth Drivers

Rising Burden of Obesity and Metabolic Syndrome in UAE Adult Population

Increasing Screening and Diagnosis of Sleep Apnea

Shift from Hospital-Centric Care to Home-Based Respiratory Therapy

Technological Advancements in Quiet, Connected, Travel-Friendly CPAP Platforms

Growing Awareness Through Pulmonology, ENT, and Cardiology Referral Pathways - Challenges

Under-Diagnosis and Low Screening Rates among High-Risk Cohorts

Upfront Device Cost, Limited Reimbursement, and Co-Pay Sensitivities

Patient Discomfort, Mask Intolerance, and Long-Term Adherence Issues

Shortage of Trained Sleep Technologists, Respiratory Therapists, and CPAP Coaches

Fragmented After-Sales Service and Data Management Across Channels - Opportunities

Managed CPAP Programs Bundling Device, Mask, Coaching, and Data Analytics

Remote Monitoring, Teleconsultation, and Algorithm-Based Adherence Management

CPAP Penetration into Cardiology, Bariatric, and Occupational Health Pathways

Rental, Subscription, and Pay-per-Use CPAP Models for Price-Sensitive Segments

Pediatric and Special-Needs CPAP Solutions in Tertiary Centers - Trends

Adoption of Ultra-Portable CPAP for Frequent Travelers and Pilgrimage-Linked Demand

Integration of CPAP Data into Hospital EMR and Remote Monitoring Platforms

Bundling of CPAP with Oxygen Concentrators and Comorbidity Management Kits

Growth of Specialist Online CPAP Stores and Marketplaces with Same-Day Delivery

Sustainability, Refurbished Devices, and Mask Recycling Initiatives - Regulatory, Licensing, and Compliance Landscape

- Reimbursement, Coding, and Benefit Design

- Stakeholder and Ecosystem Mapping

- Porter’s Five Forces: UAE CPAP Machines Market

- SWOT Analysis for UAE CPAP Machines Market

- By Value, 2019-2024

- By Volume of Units, 2019-2024

- Installed CPAP Device Base and Annual Therapy Starts, 2019-2024

- Average Selling Price and Realized Net Price by Channel, 2019-2024

- CPAP Share within UAE Positive Airway Pressure Devices, 2019-2024

- By Device Type (in Value %)

Fixed-Pressure CPAP Devices

Auto-Adjusting CPAP (APAP) Devices

Travel and Ultra-Portable CPAP Devices

CPAP with Integrated Heated Humidification

CPAP with Integrated Oxygen Port - By Connectivity and Monitoring Layer (in Value %)

Non-Connected / Basic CPAP Devices

SIM / Cellular-Enabled CPAP Devices

Wi-Fi / App-Enabled CPAP Devices

Fully Integrated Telemonitoring Platforms with Clinician Dashboards - By Patient Profile and Indication Severity (in Value %)

Mild Obstructive Sleep Apnea Patients on CPAP

Moderate Obstructive Sleep Apnea Patients on CPAP

Severe Obstructive Sleep Apnea Patients on CPAP

CPAP Use in Overlap Syndromes and Comorbid Cardio-Metabolic Conditions - By End-User Setting (in Value %)

Government and Semi-Government Hospitals and Sleep Labs

Private Multispecialty Hospitals and Day Surgery Centers

Standalone Pulmonology and Sleep Clinics

Homecare and Durable Medical Equipment Providers

Direct-to-Consumer E-Commerce and Retail Pharmacies - By Mask and Interface Type (in Value %)

Nasal Masks

Nasal Pillow Masks

Full-Face / Oro-Nasal Masks

Hybrid and Minimal-Contact Interfaces

Pediatric and Specialty Masks - By Emirate and Catchment Cluster (in Value %)

Abu Dhabi and Al Ain Corridor

Dubai and Northern Growth Corridor

Sharjah and Ajman

Ras Al Khaimah, Fujairah, and Umm Al Quwain

Cross-Border and Medical Tourist Demand Captured in UAE - By Payer and Funding Model (in Value %)

Government Health Schemes and Semi-Government Payers

Large Private Insurers and Corporate Plans

TPA-Managed Schemes and Restricted Networks

Self-Pay Expatriate Segment

Medical Tourism and Out-of-Pocket International Patients

- Market Share of Major Players by Value and Volume

Competitive Positioning by Channel - Cross Comparison Parameters (Installed CPAP Device Base and Annual Therapy Starts Supported, Breadth of Portfolio Across CPAP/APAP/BiPAP, Masks, and Accessories, Share of Connected Devices and Depth of Telemonitoring Platforms, Local Service Infrastructure, Turnaround Time, and Preventive Maintenance Coverage, Strength in Government and Large Private Tenders, Channel Penetration Across Emirates and E-Commerce Readiness, Patient Adherence Programs, Coaching Tools, and Outcome Tracking, Innovation Roadmap: Travel Devices, Noise Reduction, Comfort Features, AI-Driven Titration)

- Pricing and Contracting Benchmarks

- Marketing, KOL Engagement, and Patient Education Strategies

- SWOT Snapshots of Key Players in UAE CPAP Machines Market

- Detailed Company Profiles

ResMed Inc.

Koninklijke Philips N.V.

Fisher & Paykel Healthcare

BMC Medical Co., Ltd.

Löwenstein Medical SE & Co. KG

Drive DeVilbiss Healthcare

Breas Medical

Yuwell

Apex Medical

React Health / 3B Medical

CPAP Store Dubai / CPAP Dubai

CPAP UAE / CPAP Shop Dubai

Sehaaonline

LifeKare Medical Equipment

- Government and Semi-Government Hospitals

- Private Hospital Groups and Day Surgery Centers

- Standalone Sleep Clinics and Pulmonology Practices

- Homecare and DME Providers

- Direct-to-Consumer Channel

- By Value, 2025-2030

- By Volume of Units, 2025-2030

- Installed CPAP Device Base and Annual Therapy Starts, 2025-2030

- Average Selling Price and Realized Net Price by Channel, 2025-2030

- CPAP Share within UAE Positive Airway Pressure Devices, 2025-2030