Market Overview

The UAE crashworthy aircraft seats market size is valued in billions of USD, driven by increasing demand for air travel safety and the evolving aviation standards. The market has seen substantial growth, bolstered by rigorous government regulations that enforce high safety standards in the aviation sector. Major players in the market continue to innovate with lightweight and crash-resistant materials, further fueling market expansion. The technological advancements in seat design and materials, alongside the expanding aviation industry, significantly contribute to the market’s growth.

Key cities and countries in the UAE, such as Dubai and Abu Dhabi, play a dominant role in the region’s aircraft seat market. These cities act as aviation hubs, with increasing investments in both commercial and military aviation sectors. The dominance of these regions is supported by the strong presence of airlines, growing defense procurement, and a high demand for private aviation. Furthermore, the UAE government’s focus on enhancing air travel safety continues to influence the market positively.

Market Segmentation

By System Type

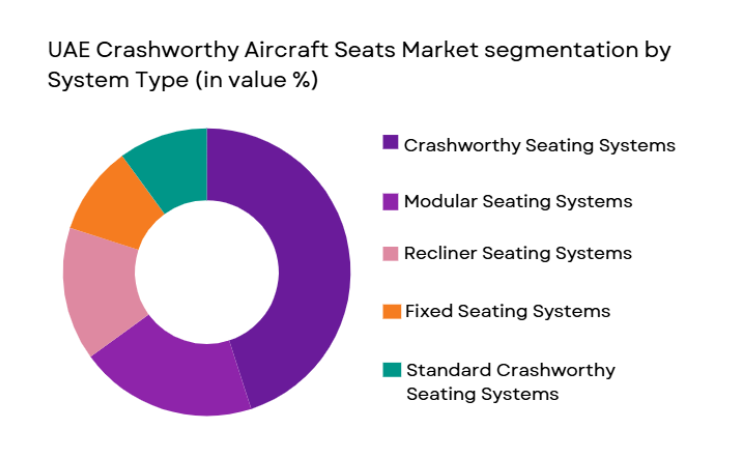

The UAE crashworthy aircraft seats market is segmented by system type into crashworthy seating systems, modular seating systems, recliner seating systems, fixed seating systems, and standard crashworthy seating systems. Recently, the crashworthy seating systems have been dominating the market share due to the increasing emphasis on passenger safety and stringent regulatory requirements for seat designs. Crashworthy seating systems are designed to absorb the impact during a crash, providing enhanced safety for passengers. These seats are increasingly adopted by commercial airlines and military aircraft, where safety is a top priority. Furthermore, the significant investments in technology to improve seat performance and the growing awareness of safety features have fueled their dominance in the market. Additionally, the integration of crash-resistant materials, including advanced composites and lightweight metals, has also helped this sub-segment capture a larger share of the market.

By Platform Type

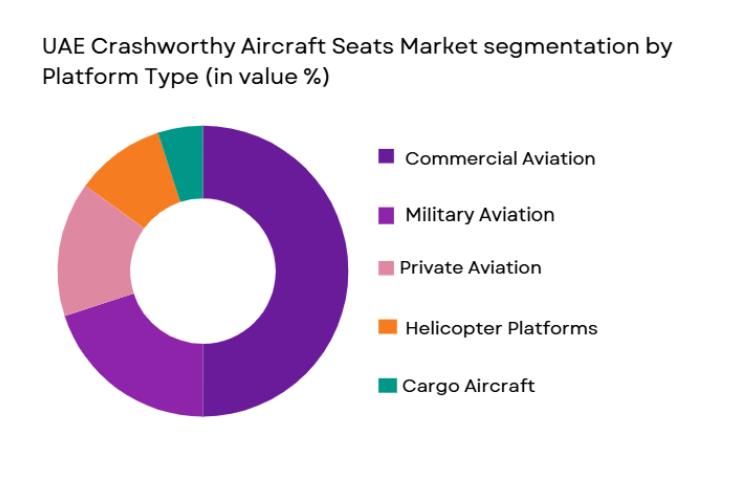

The UAE crashworthy aircraft seats market is segmented by platform type into commercial aviation, military aviation, private aviation, helicopter platforms, and cargo aircraft. Recently, commercial aviation has emerged as the dominant platform type due to the rapid expansion of air travel in the region. As the demand for air travel grows, commercial airlines have increased their fleet sizes, creating a strong demand for crashworthy seats. The UAE’s strategic position as a global hub for airlines like Emirates and Etihad Airways further propels the demand for enhanced safety in passenger aircraft. The continued expansion of low-cost carriers and increased investments in aircraft fleets have made commercial aviation the leading platform for crashworthy seating systems. Additionally, government regulations, such as those enforced by the UAE General Civil Aviation Authority (GCAA), ensure compliance with stringent crash safety standards, further supporting the growth of this segment.

Competitive Landscape

The competitive landscape of the UAE crashworthy aircraft seats market is influenced by several key players specializing in innovative seating technologies and safety features. Major players dominate through strategic collaborations, technological advancements, and robust distribution networks. The market is increasingly consolidating as companies focus on improving their product offerings and meeting stringent regulatory standards. The competition is primarily driven by the need for lightweight, durable, and safe seating systems that comply with global aviation safety standards.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Key Growth Area |

| Airbus | 1970 | Toulouse, France | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ | ~ |

| Safran | 2005 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 1934 | Charlotte, USA | ~ | ~ | ~ | ~ | ~ |

| Recaro Aircraft Seating | 1906 | Schwaebisch Hall, Germany | ~ | ~ | ~ | ~ | ~ |

UAE Crashworthy Aircraft Seats Market Analysis

Growth Drivers

Technological Advancements in Safety Standards

The increasing adoption of innovative technologies in the UAE crashworthy aircraft seats market is primarily driven by the need to meet evolving safety standards. Governments and aviation authorities across the region, such as the UAE’s General Civil Aviation Authority (GCAA), enforce rigorous crash safety standards that ensure high-performance aircraft seating systems. These regulations compel manufacturers to focus on enhancing the structural integrity of seats, leading to significant investments in research and development (R&D). Furthermore, advancements in materials such as carbon composites and high-strength alloys play a crucial role in enhancing the crashworthiness of seats, making them lighter and stronger. The development of energy-absorbing technologies in seat design further drives the growth of this market. Additionally, airlines and aircraft manufacturers are increasingly prioritizing passenger safety, which boosts demand for crashworthy seating systems. Technological advancements also support the trend of retrofit installations, where older aircraft are equipped with modern crash-resistant seats to meet safety requirements.

Government Regulations on Passenger Safety

Stringent government regulations on passenger safety have been a key driver of the UAE crashworthy aircraft seats market. Aviation authorities worldwide, including the GCAA, enforce standards that require seats to provide enhanced protection in the event of an accident. These regulations mandate the installation of crashworthy seats that can withstand impact forces, protecting passengers from injuries during a crash. Additionally, regulatory bodies encourage innovation in seat design, ensuring manufacturers prioritize safety while integrating comfort features. The UAE, being a regional leader in aviation, has also implemented strict safety protocols for both commercial and military aviation, which has led to higher demand for crashworthy seats in these sectors. The combination of regulatory pressure and the growing emphasis on aviation safety among passengers and industry stakeholders is expected to continue driving the market’s expansion.

Market Challenges

High Costs of Crashworthy Seating Systems

One of the major challenges facing the UAE crashworthy aircraft seats market is the high cost of manufacturing and implementing advanced seating systems. Crashworthy seats, while essential for passenger safety, require advanced materials and technologies, making them significantly more expensive than standard seating options. These seats must be engineered to meet strict safety standards, which involves rigorous testing and compliance with regulatory requirements. The use of lightweight, durable materials, such as carbon fiber and titanium alloys, adds to the production cost, making crashworthy seats expensive for airlines, particularly low-cost carriers. As a result, many smaller airlines or those with budget constraints may face difficulties in affording the necessary seating upgrades, particularly for older aircraft fleets. Additionally, the retrofit process can be costly, further limiting the ability of some airlines to comply with regulatory standards.

Lack of Standardization Across Aircraft Models

Another challenge in the UAE crashworthy aircraft seats market is the lack of standardization across different aircraft models. Each aircraft type has unique seat configuration requirements, making it challenging to design a one-size-fits-all solution. Aircraft manufacturers, such as Boeing and Airbus, often have distinct seat layout and fitting specifications, which require seating manufacturers to develop customized solutions for each model. The absence of standardized seating systems creates inefficiencies in the production and installation processes, increasing costs for both manufacturers and airlines. Additionally, retrofitting older aircraft with modern crashworthy seats can be complicated, as older models may not be compatible with newer seat designs. This challenge hinders the widespread adoption of crashworthy seats, especially in regions where the fleet comprises a mix of newer and older aircraft.

Opportunities

Retrofit Market for Older Aircraft

An emerging opportunity in the UAE crashworthy aircraft seats market lies in the retrofit market for older aircraft. Many airlines operating in the region have older fleets that require upgrades to meet the latest safety standards. Retrofitting these aircraft with modern crashworthy seating systems allows airlines to enhance passenger safety without having to replace their entire fleet. This presents a significant growth opportunity for manufacturers of crashworthy seats, as older aircraft will need to be equipped with seats that meet the latest crash safety regulations. The retrofit process also allows airlines to improve the comfort and overall passenger experience while ensuring compliance with regulatory standards. As the demand for air travel continues to rise, airlines in the UAE and the broader Middle East region are expected to invest in retrofit solutions, driving the demand for crashworthy seats.

Growth in Military Aviation Contracts

The UAE’s strategic focus on expanding its military capabilities presents a unique opportunity for the crashworthy aircraft seats market. The government continues to invest in defense and military aircraft, which require specialized seating systems that can withstand high-impact forces during a crash. The military sector’s demand for crashworthy seating systems is expected to grow as defense procurement programs increase. Additionally, as the UAE strengthens its position as a global defense hub, there is potential for local manufacturers to capitalize on this demand by providing tailored seating solutions for military aircraft. This presents an opportunity for companies specializing in crashworthy aircraft seats to expand their reach and develop products that meet the specific needs of the military sector.

Future Outlook

The future outlook for the UAE crashworthy aircraft seats market is highly positive, with significant growth expected over the next five years. The increasing demand for air travel, bolstered by government investments in aviation infrastructure, will continue to drive market expansion. Technological advancements in seating materials and designs will enhance seat safety, comfort, and efficiency, contributing to market growth. Additionally, as global regulatory bodies enforce stricter safety regulations, the demand for crashworthy seats is expected to remain strong. The UAE’s strategic location as a hub for both commercial and military aviation will further support the market’s development, with growing investments in both sectors fueling demand for high-performance seating solutions.

Major Players

- Airbus

- Boeing

- Safran

- Collins Aerospace

- Recaro Aircraft Seating

- GE Aviation

- Zodiac Aerospace

- B/E Aerospace

- Sichuan Airlines

- Diehl Aviation

- Aviointeriors

- Hondajet

- Avic Cabin Systems

- Arconic

- C&D Zodiac

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Commercial airlines

- Military aviation contractors

- Private aviation firms

- Aircraft maintenance organizations

- Aviation safety and compliance experts

- Aircraft manufacturers

Research Methodology

Step 1: Identification of Key Variables

Research focuses on identifying critical variables affecting the UAE crashworthy aircraft seats market, such as technological innovations, regulatory standards, and consumer trends.

Step 2: Market Analysis and Construction

This step involves analyzing the market’s current landscape, segmenting it by product type, platform, and fitment type, and constructing models for forecasting future trends.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations are conducted with industry professionals and stakeholders to validate hypotheses, refine market assumptions, and ensure data accuracy.

Step 4: Research Synthesis and Final Output

The final output synthesizes findings from multiple sources, resulting in a comprehensive market report that outlines key insights and forecasts for the UAE crashworthy aircraft seats market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased focus on passenger safety

Rise in military and defense aircraft procurement

Technological advancements in seat materials

Regulatory requirements for seat safety

Growth in the private aviation sector - Market Challenges

High costs associated with crashworthy seat manufacturing

Stringent regulatory standards and compliance issues

Lack of standardization across different aircraft types

Challenges in seat customization for diverse aircraft fleets

Limited availability of skilled labor for manufacturing - Market Opportunities

Growing demand for retrofit and replacement seat systems

Advancements in lightweight materials for improved fuel efficiency

Expansion of military and defense contracts in the region - Trends

Innovative materials for crash-resistant seats

Increasing automation in seat manufacturing

Focus on sustainability in seat production

Integration of crashworthy technology with seat comfort features

Growing partnerships between aircraft manufacturers and seating suppliers - Government Regulations & Defense Policy

Stringent aviation safety standards

Regulatory frameworks for crashworthiness

Government initiatives for defense sector procurement - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Crashworthy seating systems

Standard crashworthy seating systems

Modular seating systems

Recliner seating systems

Fixed seating systems - By Platform Type (In Value%)

Commercial aviation

Military aviation

Private aviation

Helicopter platforms

Cargo aircraft - By Fitment Type (In Value%)

OEM installations

Aftermarket installations

Replacement seat systems

Retrofit seat systems

Maintenance and upgrade fitments - By EndUser Segment (In Value%)

Commercial airlines

Military and defense agencies

Private jet owners

Cargo carriers

Government agencies - By Procurement Channel (In Value%)

Direct purchases from manufacturers

Third-party distributors

Online procurement platforms

Aerospace OEM channels

Government procurement contracts - By Material / Technology (In Value%)

Titanium-based seats

Aluminum-based seats

Carbon fiber-based seats

Polymer composite seats

Integrated crashworthiness technologies

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (Price, Quality, Innovation, Supply Chain, Delivery Time, Customization, Brand Recognition, After-Sales Service, Regulatory Compliance)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Airbus

Boeing

Safran

Collins Aerospace

Recaro Aircraft Seating

GE Aviation

Zodiac Aerospace

B/E Aerospace

Sichuan Airlines

Diehl Aviation

Aviointeriors

Hondajet

Avic Cabin Systems

Arconic

C&D Zodiac

- Adoption of crashworthy seats by commercial airlines

- Military demand for high-performance crashworthy seats

- Customization needs for private aviation owners

- Rising retrofit opportunities for outdated fleets

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035