Market Overview

The UAE crew oxygen systems market recorded an estimated market size of USD ~ million based on a recent historical assessment, driven primarily by sustained defense aviation spending, fleet modernization programs, and mandatory crew safety compliance across military and special mission aircraft. Demand is strongly supported by the operational requirement for reliable oxygen delivery systems in high-altitude and long-endurance missions, including fighter aircraft, transport platforms, and rotary-wing operations. Continuous upgrades of legacy aircraft, adoption of onboard oxygen generation systems, and lifecycle replacement of aging components further support market expansion across fixed-wing and rotary aviation fleets.

Abu Dhabi and Dubai dominate the UAE crew oxygen systems market due to their concentration of military airbases, aerospace MRO facilities, and defense procurement authorities. Abu Dhabi benefits from hosting major air force commands, indigenous defense manufacturing initiatives, and aviation certification bodies that accelerate procurement and integration activities. Dubai plays a complementary role through its advanced aerospace maintenance ecosystem, logistics infrastructure, and proximity to global suppliers. Strong government backing, streamlined procurement processes, and sustained investments in aviation readiness reinforce the UAE’s leadership position in this specialized aerospace subsystem market.

Market Segmentation

By Product Type

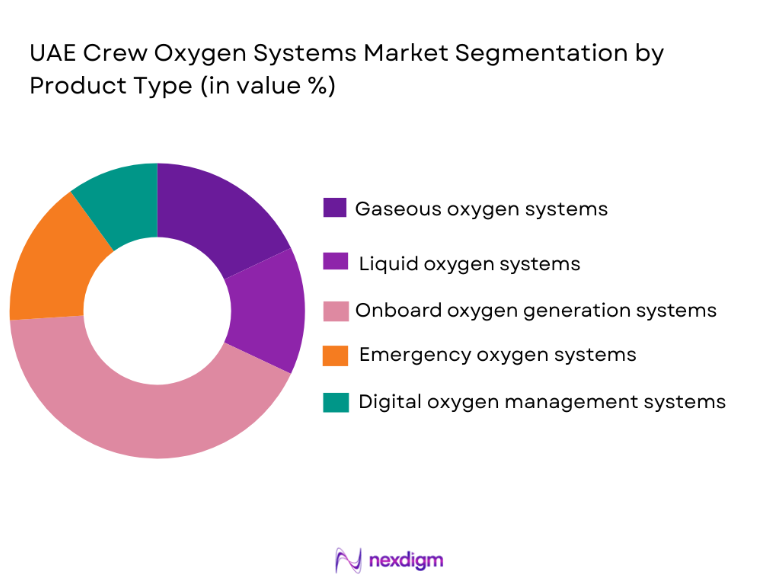

The UAE crew oxygen systems market is segmented by product type into gaseous oxygen systems, liquid oxygen systems, onboard oxygen generation systems, emergency oxygen systems, and integrated digital oxygen management systems. Recently, onboard oxygen generation systems have held a dominant market share due to their operational efficiency, reduced logistical burden, and suitability for modern combat and transport aircraft. These systems eliminate the need for frequent cylinder refilling, improving mission readiness and lowering long-term maintenance complexity. Increasing adoption new aircraft programs and retrofits of existing fleets has accelerated demand. Their compatibility with high-altitude operations, enhanced safety monitoring, and alignment with modern airworthiness standards further reinforce dominance, particularly within advanced fighter and special mission platforms operating across the UAE.

By Platform Type

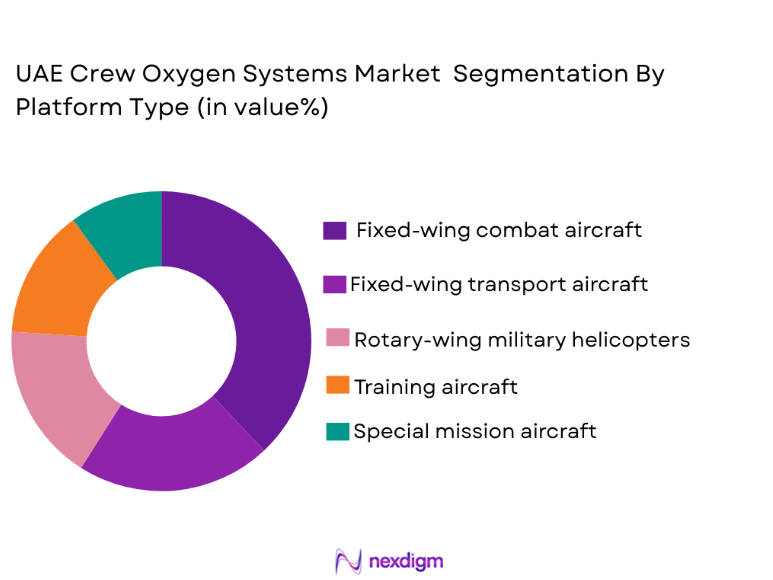

The UAE crew oxygen systems market is segmented by platform type into fixed-wing combat aircraft, fixed-wing transport aircraft, rotary-wing military helicopters, training aircraft, and special mission aircraft. Fixed-wing combat aircraft dominate the market due to their intensive operational profiles, high-altitude mission requirements, and stringent pilot safety standards. These platforms require highly reliable and redundant oxygen delivery solutions capable of supporting sustained high-performance maneuvers. Continuous upgrades to fighter fleets, integration of advanced life-support technologies, and longer mission durations significantly increase system utilization rates. Additionally, combat aircraft modernization programs prioritize advanced oxygen systems as part of broader avionics and survivability upgrades, reinforcing their leading position within the overall market structure.

Competitive Landscape

The UAE crew oxygen systems market is moderately consolidated, with a limited number of global aerospace suppliers controlling core technologies and system certifications while local entities focus on integration and sustainment. Major players benefit from long-term defense contracts, strong OEM relationships, and proven compliance with military airworthiness standards. High entry barriers, driven by certification complexity and safety-critical requirements, limit new entrants and reinforce the influence of established suppliers across procurement and retrofit programs.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Military Certification Scope |

| Honeywell Aerospace | 1906 | United States | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ | ~ |

| Safran Aerosystems | 1924 | France | ~ | ~ | ~ | ~ | ~ |

| Cobham Aerospace | 1934 | United Kingdom | ~ | ~ | ~ | ~ | ~ |

| Diehl Aviation | 2006 | Germany | ~ | ~ | ~ | ~ | ~ |

UAE Crew Oxygen Systems Market Analysis

Growth Drivers

Military Aviation Fleet Modernization and Readiness Programs

Military aviation fleet modernization and readiness programs represent a critical growth drive for the UAE crew oxygen systems market because the country continues to invest heavily in upgrading fighters, transport, and rotary-wing aircraft to maintain regional air superiority and operational readiness. These modernization efforts require replacement of legacy oxygen systems with advanced, lighter, and more reliable solutions that meet current military airworthiness standards. New aircraft acquisitions integrate onboard oxygen generation systems as standard equipment, while existing fleets undergo retrofit programs to enhance safety and reduce maintenance burdens. The emphasis on extended mission endurance and high-altitude operations further amplifies demand for robust crew oxygen solutions. Government-backed defense procurement programs ensure stable funding and long-term planning visibility for suppliers. Local sustainment initiatives also increase replacement cycles and system upgrades. Integration with advanced avionics and pilot health monitoring technologies reinforces the importance of oxygen systems. As operational tempo increases, system utilization rates rise, accelerating wear and replacement demand. Collectively, these factors create a structurally strong demand environment supporting sustained market growth.

Stringent Airworthiness, Safety, and Mission Endurance Requirements

Stringent airworthiness, safety, and mission endurance requirements significantly drive the UAE crew oxygen systems market by mandating high reliability and redundancy in all life-support equipment installed on military aircraft. Regulatory authorities enforce strict compliance with oxygen purity, delivery consistency, and fail-safe mechanisms to protect aircrew during high-risk operations. High-altitude missions, extended patrol durations, and extreme environmental conditions place additional performance demands on oxygen systems. As aircraft performance envelopes expand, traditional oxygen solutions become insufficient, necessitating advanced systems with digital monitoring and automated control. Safety-driven procurement decisions prioritize proven technologies from certified suppliers, reinforcing replacement and upgrading demand. Training and operational standards also require frequent system testing and maintenance, increasing aftermarket activity. Mission endurance requirements push adoption of onboard oxygen generation solutions that reduce logistical dependency. These safety-driven imperatives ensure oxygen systems remain a non-negotiable investment area.

Market Challenges

High Certification Complexity and Compliance Costs

High certification complexity and compliance costs pose a major challenge for the UAE crew oxygen systems market because these systems are classified as safety-critical aerospace components subject to rigorous military airworthiness standards. Certification processes require extensive testing, documentation, and validation across multiple aircraft platforms, significantly increasing development timelines and costs. Suppliers must demonstrate reliability under extreme conditions, including altitude variation, vibration, and temperature extremes. Any design modification or retrofit adaptation often triggers re-certification requirements. These processes limit supplier flexibility and slow innovation cycles. Smaller suppliers face barriers entering the market due to financial and technical resource constraints. Delays in certification can also impact procurement schedules. Compliance costs are further elevated by the need to align with both local and international military standards. Collectively, these factors constrain competitive dynamics and increase overall system costs.

Dependence on Imported Critical Subsystems

Dependence on imported critical subsystems represents another key challenge for the UAE crew oxygen systems market, as advanced components such as sensors, regulators, and digital control units are predominantly sourced from foreign suppliers. This reliance exposes the market to supply chain disruptions, export control regulations, and geopolitical risks. Lead times for specialized components can be extended, affecting aircraft availability and maintenance schedules. Limited local manufacturing capability for high-precision oxygen system components restricts rapid substitution options. Cost volatility linked to foreign sourcing impacts procurement budgets. Technology transfer restrictions further complicate localization efforts. Maintenance and repair activities may also depend on overseas technical support. These dependencies introduce operational and financial uncertainties across the supply chain.

Opportunities

Localization of Assembly, Testing, and Sustainment Capabilities

Localization of assembly, testing, and sustainment capabilities presents a strong opportunity for the UAE crew oxygen systems market as national defense strategies increasingly emphasize domestic industrial participation. Establishing local integration and testing facilities reduces dependence on foreign suppliers and shortens maintenance turnaround times. Localization supports workforce development and enhances technical self-reliance. It also improves supply chain resilience and cost control. Government incentives and offset programs encourage global OEMs to partner with local entities. Sustainment-focused localization creates long-term revenue streams through maintenance and upgrade contracts. Improved proximity to end users enhances responsiveness and customization. Over time, localized capabilities can expand into component manufacturing, strengthening the overall ecosystem.

Integration of Digital Health Monitoring and Predictive Maintenance

Integration of digital health monitoring and predictive maintenance features offers a significant opportunity within the UAE crew oxygen systems market as aviation operators seek to improve safety and operational efficiency. Advanced sensors and data analytics enable real-time monitoring of oxygen system performance and crew physiological parameters. Predictive maintenance reduces unplanned failures and aircraft downtime. Digital integration aligns with broader aircraft health monitoring initiatives. These technologies support condition-based maintenance models, lowering lifecycle costs. Adoption enhances regulatory compliance and safety assurance. Suppliers offering digitally enabled solutions gain competitive differentiation. As data-driven aviation management expands, demand for smart oxygen systems is expected to rise.

Future Outlook

The UAE crew oxygen systems market is expected to experience steady growth over the next five years, supported by continued military aviation modernization and rising operational requirements. Technological developments such as onboard oxygen generation and digital monitoring will shape procurement priorities. Regulatory support for enhanced aircrew safety will sustain replacement demand. Increasing localization initiatives and long-term sustainment contracts are likely to strengthen market stability and supplier participation

Major Players

- Honeywell Aerospace

- Collins Aerospace

- Safran Aerosystems

- Cobham Aerospace

- Diehl Aviation

- RTX Aerospace

- AMETEK Aerospace

- Aviation Oxygen Systems Inc

- Zodiac Aerospace

- B/E Aerospace

- Marshall Aerospace

- Kongsberg Defence & Aerospace

- Elbit Systems

- Thales Aerospace

- L3Harris Technologies

Key Target Audience

- Defense procurement agencies

- Military aviation commands

- Aerospace OEMs

- Aircraft MRO providers

- Defense system integrators

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aviation safety equipment suppliers

Research Methodology

Step 1: Identification of Key Variables

Key demand, supply, regulatory, and technology variables were identified through secondary research and industry databases. Market boundaries and system definitions were established. Data relevance and reliability were assessed.

Step 2: Market Analysis and Construction

Historical procurement patterns, fleet data, and subsystem integration trends were analyzed. Market segmentation and sizing frameworks were constructed. Assumptions were validated against industry benchmarks.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through expert interviews and technical reviews. Feedback was incorporated to refine assumptions. Data inconsistencies were resolved.

Step 4: Research Synthesis and Final Output

Findings were synthesized into a structured market model. Insights were cross verified. Final outputs were reviewed for accuracy and consistency.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Military aviation fleet modernization programs

Rising operational tempo and flight hours

Stringent crew safety and airworthiness standards

Adoption of high-altitude and long-endurance missions

Expansion of domestic MRO and sustainment capabilities - Market Challenges

High certification and compliance requirements

Dependence on imported critical subsystems

Complex integration across multiple aircraft platforms

Long procurement and approval cycles

Skilled manpower constraints for maintenance activities - Market Opportunities

Localization of assembly and testing capabilities

Integration of digital health monitoring features

Long-term sustainment and upgrade contracts - Trends

Shift toward on-board oxygen generation systems

Increasing use of lightweight composite materials

Digital monitoring and predictive maintenance adoption

Standardization across multi-platform fleets

Focus on redundancy and fail-safe system architectures - Government Regulations & Defense Policy

Military airworthiness and safety compliance mandates

Defense localization and industrial participation policies

Long-term aviation capability development programs - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Gaseous oxygen storage and delivery systems

Liquid oxygen based crew systems

On-board oxygen generation systems

Emergency oxygen backup systems

Integrated digital oxygen management systems - By Platform Type (In Value%)

Fixed-wing combat aircraft platforms

Fixed-wing transport and tanker aircraft

Rotary-wing military helicopter platforms

Training and advanced trainer aircraft

Special mission and ISR aircraft platforms - By Fitment Type (In Value%)

Line-fit installations for new aircraft

Retrofit and upgrade installations

Modular replacement systems

Mission-specific temporary fitments

Training aircraft adapted systems - By End User Segment (In Value%)

Air force fighter squadrons

Transport and logistics aviation units

Rotary-wing and helicopter units

Flight training academies

Government and special mission aviation units - By Procurement Channel (In Value%)

Direct government defense procurement

Aircraft OEM integrated procurement

Maintenance and sustainment contracts

Upgrade and retrofit tenders

Emergency spares and lifecycle support procurement - By Material / Technology (in Value%)

Composite high-pressure oxygen cylinders

Lightweight aluminum alloy components

Digital flow control and monitoring systems

Sensor-integrated oxygen delivery interfaces

Redundant safety valve and control technologies

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (system reliability, weight efficiency, certification compliance, platform compatibility, lifecycle support, digital integration capability, retrofit flexibility, cost efficiency)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Cobham Aerospace Communications

Safran Aerosystems

Collins Aerospace

Honeywell Aerospace

L3Harris Technologies

Diehl Aviation

RTX Oxygen Systems Division

AMETEK Aerospace

Aviation Oxygen Systems Inc

Zodiac Aerospace

Air Liquide Advanced Technologies

B/E Aerospace

Marshall Aerospace and Defence Group

Kongsberg Defence & Aerospace

Elbit Systems Aerospace Division

- Air force focus on reliability for high-performance missions

- Training units prioritizing cost efficiency and ease of maintenance

- Helicopter operators emphasizing compact and vibration-resistant systems

- Special mission units requiring customized and mission-adaptable solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035