Market Overview

The UAE Data Integration and Analysis Solutions market is valued at USD ~ million, reflecting its role as a foundational layer of the country’s digital economy. Demand is driven by the need to consolidate fragmented enterprise data, enable real-time insights, and support data-driven decision-making across government and private sectors. As organizations generate increasing volumes of structured and unstructured data, integration and analytics solutions become critical infrastructure, enabling operational efficiency, regulatory reporting, and advanced intelligence across mission-critical workflows.

Within the UAE, Dubai and Abu Dhabi dominate demand due to their concentration of large enterprises, government digital initiatives, and regional headquarters of multinational firms. These cities host advanced cloud infrastructure, innovation hubs, and sector regulators that actively promote data utilization. Global technology ecosystems influence supply through cloud platforms, analytics engines, and AI toolchains developed by leading international vendors, which set architectural standards and accelerate adoption through localized partnerships and delivery models.

Market Segmentation

By Solution Category

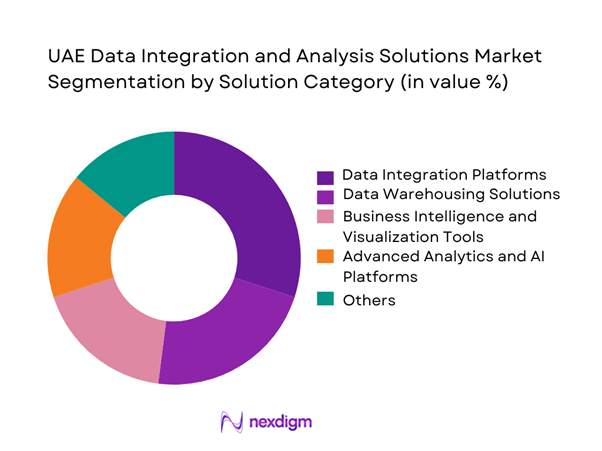

Data integration platforms dominate the UAE market as organizations prioritize unifying disparate data sources across legacy systems, cloud applications, and external data feeds. Enterprises increasingly require scalable tools to ingest, transform, and synchronize data in near real time to support analytics, reporting, and AI use cases. Government entities and regulated industries, in particular, rely on robust integration layers to ensure data consistency, lineage, and auditability. The dominance of integration platforms is further reinforced by multi-cloud strategies, where data must flow seamlessly across environments. As analytics maturity increases, integration becomes a prerequisite investment, anchoring downstream value creation across business intelligence, advanced analytics, and automation initiatives.

By End-Use Industry

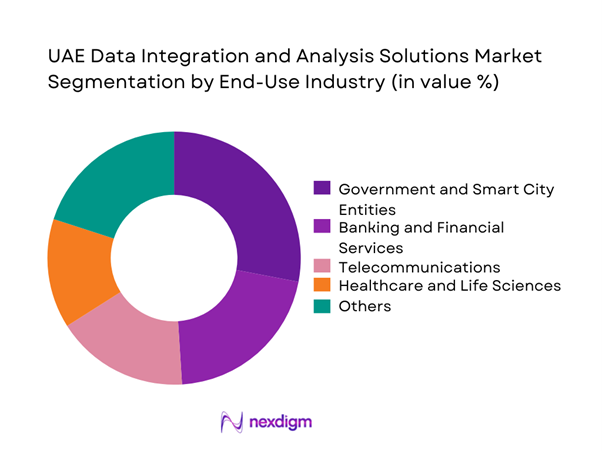

Government and smart city entities represent the largest end-use segment, driven by nationwide digital government agendas and urban intelligence programs. Public sector organizations manage vast datasets spanning citizen services, mobility, utilities, and public safety, necessitating advanced integration and analytics capabilities. These entities demand high standards of data security, interoperability, and long-term scalability, favoring enterprise-grade platforms. Continuous data-driven policy evaluation and service optimization further sustain demand. The strategic role of analytics in governance positions the public sector as a stable and influential buyer, shaping solution requirements and accelerating ecosystem development across the broader market.

Competitive Landscape

The UAE Data Integration and Analysis Solutions market is dominated by a few major players, including SAP and global or regional brands like Oracle, Microsoft, IBM, and SAS Institute. This consolidation highlights the significant influence of these key companies.

| Company | Est. Year | HQ | UAE Cloud/Region Alignment | Core Integration Strength | Analytics Stack Depth | Governance/Catalog | Streaming/Real-time | Key UAE Buyer Fit | Route-to-Market |

| Microsoft | 1975 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| AWS | 2006 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Oracle | 1977 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Informatica | 1993 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Databricks | 2013 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Data Integration and Analysis Solutions Market Analysis

Growth Drivers

Government Digital Transformation Mandates

UAE government entities are actively mandated to digitize public services, improve inter-agency coordination, and enhance data-driven governance. National digital strategies emphasize unified data platforms, real-time reporting, and performance accountability across ministries, municipalities, and regulators. These mandates require robust data integration capabilities to consolidate disparate datasets into centralized or federated architectures. Analytics solutions are increasingly embedded into operational dashboards for service delivery, policy monitoring, and citizen engagement. As e-government platforms scale, demand grows for secure, interoperable, and compliant data pipelines, ensuring sustained investment in enterprise-grade data integration and analytics solutions across the public sector.

Enterprise Data Modernization Initiatives

Enterprises across BFSI, telecom, retail, logistics, and energy sectors are modernizing legacy data estates to support faster decision cycles and advanced analytics. Traditional siloed warehouses and static reporting tools are being replaced with cloud-native and hybrid data architectures. This shift necessitates modern integration frameworks capable of handling structured, semi-structured, and streaming data. Advanced analytics, automation, and AI-ready pipelines become critical enablers of competitiveness and operational efficiency. As organizations pursue agility, scalability, and cross-functional data access, comprehensive data integration and analytics platforms see accelerating adoption.

Challenges

Data Fragmentation Across Legacy Systems

Many UAE organizations continue to operate complex, heterogeneous IT landscapes built over multiple technology generations. Core systems such as ERP, CRM, industry-specific platforms, and custom applications often lack standardized interfaces, creating fragmented data environments. Integrating these systems increases architectural complexity and extends deployment timelines. Data inconsistencies, duplication, and latency further undermine analytics accuracy. Addressing fragmentation requires substantial upfront effort in data modeling, system rationalization, and middleware deployment. These challenges can delay value realization and elevate total cost of ownership, particularly for large enterprises and public-sector entities.

Shortage of Advanced Analytics Talent

Despite strong digital ambition, the availability of skilled data engineers, analytics architects, and data scientists remains constrained. Advanced analytics platforms require expertise in data pipelines, cloud environments, governance frameworks, and statistical modeling. Limited local talent increases dependence on external consultants and system integrators, raising implementation costs and elongating project cycles. Skill gaps also hinder organizations from scaling advanced use cases such as predictive analytics, automation, and AI-driven insights. Without sustained investment in talent development, organizations risk underutilizing deployed platforms and achieving suboptimal returns from analytics initiatives.

Opportunities

Smart City and Urban Analytics Programs

Smart city initiatives across the UAE generate vast volumes of data from transportation, utilities, public safety, and environmental systems. These programs depend on real-time integration of sensor, video, and transactional data to enable cross-domain intelligence. Analytics platforms that support streaming data, geospatial analysis, and centralized governance are critical to urban decision-making. Vendors aligned with smart mobility, energy optimization, and digital citizen services can position themselves as strategic enablers. As urban intelligence programs mature, demand expands for scalable platforms that unify operational and analytical workloads.

Managed Data and Analytics Services

Organizations increasingly adopt managed data and analytics services to overcome internal skill shortages and operational complexity. Managed offerings cover data ingestion, platform operations, governance, and insight delivery under defined service levels. This model reduces operational risk, accelerates deployment, and ensures continuous optimization of analytics environments. For vendors, managed services create recurring revenue streams and long-term client engagement. As enterprises and government entities prioritize outcomes over infrastructure ownership, demand grows for trusted partners capable of delivering end-to-end managed analytics solutions.

Future Outlook

The UAE Data Integration and Analysis Solutions market is expected to strengthen its role as core digital infrastructure, supporting AI-driven decision-making, cross-sector data collaboration, and real-time intelligence. Strategic alignment with national digital agendas and sector-specific solutions will define competitive differentiation and long-term value creation.

Major Players

- SAP

- Oracle

- Microsoft

- IBM

- SAS Institute

- Informatica

- Snowflake

- Cloudera

- Databricks

- Qlik

- Tableau

- Palantir

- TIBCO Software

- Teradata

- Google Cloud

Key Target Audience

- Large government entities and ministries

- Smart city authorities and municipal bodies

- Banking and financial institutions

- Telecommunications operators

- Healthcare providers and networks

- Energy and utility companies

- Investments and venture capitalist firms

- Government and regulatory bodies (UAE-specific)

Research Methodology

Step 1: Identification of Key Variables

Key demand drivers, solution categories, buyer groups, and deployment models were identified to frame the market.

Step 2: Market Analysis and Construction

Segment-level structures were developed to capture value distribution across solutions, industries, and regions.

Step 3: Hypothesis Validation and Expert Consultation

Insights were validated through expert consultations and iterative internal reviews to ensure logical consistency.

Step 4: Research Synthesis and Final Output

Findings were consolidated into a coherent market narrative aligned with client decision-making requirements.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- Data Integration and Analytics Value-Chain Mapping

- Business Cycle and Demand Seasonality

- UAE Data and Analytics Service Delivery Architecture

- Growth Drivers

Government Digital Transformation Mandates

Enterprise Data Modernization Initiatives

Cloud Adoption and Hybrid IT Expansion

Demand for Real-Time Decision Intelligence

AI-Driven Analytics Adoption

Data Compliance and Governance Requirements - Challenges

Data Fragmentation Across Legacy Systems

Shortage of Advanced Analytics Talent

Integration Complexity Across Multi-Vendor Stacks

Data Security and Sovereignty Constraints

High Total Cost of Ownership for Large Deployments

Change Management and User Adoption Resistance - Opportunities

Smart City and Urban Analytics Programs

AI-Powered Predictive and Prescriptive Analytics

Sector-Specific Analytics Solutions

Managed Data and Analytics Services

Industry-Specific Data Platforms

Public–Private Data Collaboration Models - Trends

Shift from ETL to ELT Architectures

Embedded Analytics in Enterprise Applications

Rise of Data Fabric and Data Mesh Models

Automation of Data Governance Processes

Increased Adoption of Streaming Analytics

Convergence of BI and Advanced Analytics - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Solution Revenue Streams, 2019–2024

- By Deployment , 2019–2024

- By Solution Category (in Value %)

Data Integration Platforms

Data Warehousing Solutions

Business Intelligence and Visualization Tools

Advanced Analytics and AI Platforms

Data Governance and Quality Tools

Real-Time Streaming Analytics - By Deployment Model (in Value %)

On-Premise

Private Cloud

Public Cloud

Hybrid Deployment - By Technology / Platform Type (in Value %)

ETL and ELT Tools

Data Lake Platforms

AI and Machine Learning Analytics Engines

Streaming and Event Processing Platforms

Metadata Management Platforms - By Delivery / Commercial Model (in Value %)

Licensed Software

Subscription-Based SaaS

Managed Analytics Services

Project-Based System Integration - By End-Use Industry (in Value %)

Government and Smart City Entities

Banking and Financial Services

Telecommunications

Healthcare and Life Sciences

Energy and Utilities

Retail and E-Commerce - By Region (in Value %)

Dubai

Abu Dhabi

Sharjah

Northern Emirates

- Competition ecosystem overview

- Cross Comparison Parameters (Platform scalability, cloud compatibility, data security controls, integration flexibility, analytics depth, AI enablement, local delivery capability, total cost of ownership)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

SAP

Oracle

Microsoft

IBM

SAS Institute

Informatica

Snowflake

Cloudera

Databricks

Qlik

Tableau

Palantir

TIBCO Software

Teradata

Google Cloud

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Value, 2025–2030

- By Solution Revenue Streams, 2025–2030

- By Deployment, 2025–2030