Market Overview

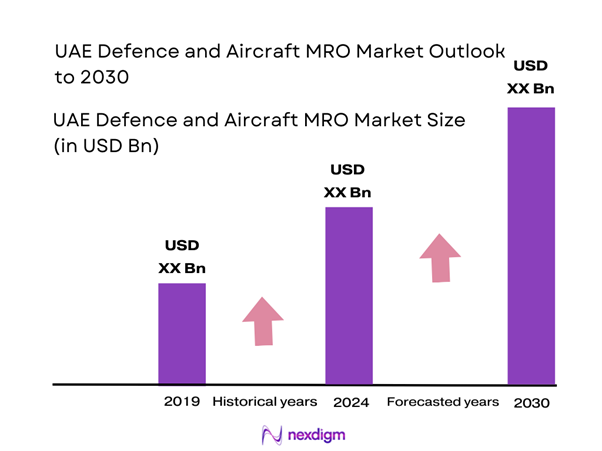

The UAE Defence and Aircraft MRO Market is valued at USD 10.04 Billion in 2025 with an approximated compound annual growth rate (CAGR) of 5.06% from 2024-2030, drawing significance from the region’s strategic geopolitical position, diversified investments, and growth in military modernization efforts. The market is primarily driven by increased defense budgets and investments in advanced aircraft technology, which require robust maintenance and repair operations to ensure operational efficiency and safety.

Dominant cities within the UAE, particularly Abu Dhabi and Dubai, significantly shape the Defence and Aircraft MRO market due to their status as pivotal hubs for the aviation and defense sectors. Abu Dhabi houses major military and civilian aircraft maintenance facilities, while Dubai boasts a highly developed logistics framework and connectivity that caters to both regional and international clients.

The UAE aviation sector is closely regulated, with safety and compliance standards enforced by the General Civil Aviation Authority (GCAA) and aligned with international bodies such as the International Civil Aviation Organization (ICAO). In recent years, the GCAA has enhanced regulations around certification processes and maintenance practices, leading to the issuance of approximately 70 new guidelines in 2023. These stringent standards are designed to improve operational safety and efficiency, driving MRO providers to invest in quality assurance systems.

Market Segmentation

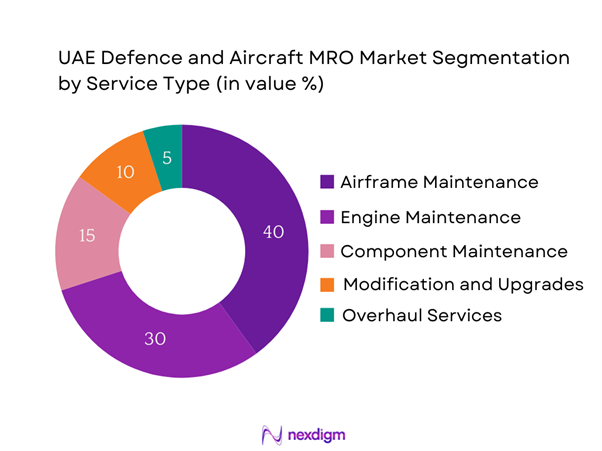

By Service Type

The UAE Defence and Aircraft MRO market is segmented by service type into airframe maintenance, engine maintenance, component maintenance, modifications and upgrades, and overhaul services. Airframe maintenance currently leads the segment due to the operational necessity of ensuring the structural integrity and safety of aircraft. This service often demands a skilled workforce and advanced technical equipment, gradually leading to higher demand from military and commercial users alike. The complexity and importance of airframe maintenance processes, including inspections and repairs, make it the most critical MRO type, thus capturing the majority share in the current market landscape.

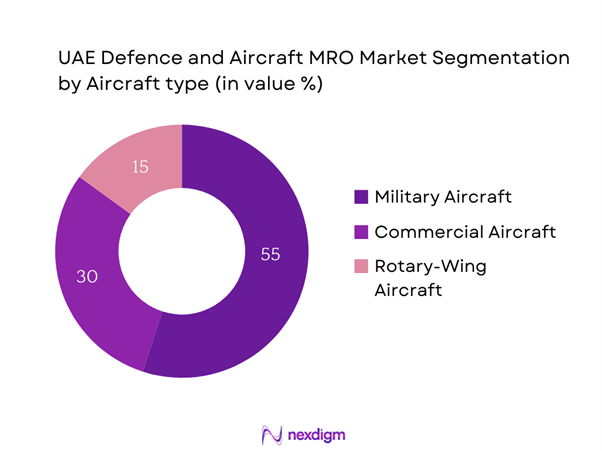

By Aircraft Type

The UAE Defence and Aircraft MRO market is also segmented by aircraft type, comprising military aircraft, commercial aircraft, and rotary-wing aircraft. Military aircraft maintenance dominates this segment, primarily due to significant defense contracts and the high operational tempo of armed forces in the region. The reliance on advanced aircraft platforms such as fighter jets and surveillance aircraft necessitates rigorous maintenance protocols to ensure readiness for potential operational deployments. The increasing investment by the UAE government into military capabilities further fuels this sub-segment, thereby maintaining its strong presence in the market.

Competitive Landscape

The UAE Defence and Aircraft MRO market is dominated by several major players, including local enterprises and international aerospace giants. Leading companies such as Mubadala Aerospace and Etihad Airways Engineering hold significant market shares due to their established reputations and extensive service networks. The competitive landscape demonstrates a high level of performance driven by innovation, efficiency, and technological advancements in maintenance practices, further solidifying the industry’s growth trajectory.

| Major Players | Establishment Year | Headquarters | Market Focus | Service Range | Workforce | Technology Used |

| Mubadala Aerospace | 2006 | Abu Dhabi | – | – | – | – |

| Etihad Airways Engineering | 2004 | Abu Dhabi | – | – | – | – |

| Advanced Military Maintenance, Repair & Overhaul Centre (AMMROC) | 2010 | Abu Dhabi | – | – | – | – |

| Dubai Aerospace Enterprise | 2006 | Dubai | – | – | – | – |

| Boeing | 1916 | Chicago, USA | – | – | – | – |

UAE Defence and Aircraft MRO Market Analysis

Market Drivers

Increasing Defence Budgets

UAE’s defense budget for 2023 stands at approximately USD 23.1 billion, reflecting the nation’s commitment to enhancing its military capabilities amid increasing regional tensions. This robust expenditure is aimed at modernizing defense technologies and increasing procurement of advanced military systems, driving the demand for comprehensive MRO services. With ongoing investments, the UAE is projected to maintain a strong defense posture, which in turn supports the growth of the MRO sector to ensure that military assets remain operationally effective. The UAE government also announced an increase in defense spending by 5% for the coming years, further solidifying the need for ongoing maintenance and repair services.

Rise in Air Traffic and Fleet Growth

The UAE’s aviation sector is projected to serve over 300 million passengers by end of 2025, underpinned by the country’s ambitions to be a global aviation hub. This growth necessitates an expanding fleet of aircraft, with the number of commercial aircraft registered in the UAE estimated to reach 400 by end of 2025. Such fleet expansion is driven by increasing air travel demand, fueled by the UAE’s strategic location and significant investment in infrastructure, which together create a substantial demand for aircraft maintenance and MRO services to support this growing market.

Market Challenges

Regulatory Constraints

The aircraft maintenance sector within the UAE operates under stringent regulatory frameworks set by the General Civil Aviation Authority (GCAA). Compliance with regulations extending from international safety standards (such as those of the International Civil Aviation Organization) can be intricate, particularly for service providers adapting to new operational norms. Non-compliance could result in severe penalties, affecting revenue streams. In 2022, the GCAA imposed new compliance measures that increased operational requirements, making the industry more challenging for MRO providers who must ensure adherence to these evolving regulations.

High Operational Costs

The cost of operations for MRO providers in the UAE is escalating, driven by labor costs, the necessity for advanced equipment, and compliance with international safety regulations. As of 2023, labor costs in the aviation sector have seen a rise of around 15%, making it increasingly difficult for smaller companies to sustain profitability. Additionally, the costs associated with procuring cutting-edge technologies needed for modern MRO operations often deter smaller firms from competing effectively. A detailed analysis indicates that operational costs for MRO providers have increased by USD 1.2 million annually over the past three years, constraining their ability to invest further in service innovation.

Opportunities

Joint Ventures with Global MRO Providers

International collaborations and joint ventures between UAE-based MRO providers and global players present significant market opportunities. As of 2023, approximately 60% of MRO service providers in the UAE are in partnerships with international firms. Such alliances are aimed at integrating technology transfers, enhancing service capabilities, and expanding operational scale. For example, recent agreements have allowed local services to leverage advanced technologies and international standards, thereby increasing their competitive edge in servicing both military and civilian aircraft sectors. This ongoing trend indicates a clear pathway for growth and improved service offerings within the UAE market.

Growing Importance of Sustainment Solutions

The trend towards sustainable aviation practices is creating opportunities for MRO providers to develop and offer eco-friendly solutions. In 2022, the UAE government announced sustainability initiatives targeting the reduction of carbon emissions across the aviation sector, aiming for a 30% reduction by 2030. With these initiatives, there is a clear shift towards sustainment solutions that encompass maintenance practices designed to lower environmental impact while optimizing operational efficiency. Consequently, MRO providers are encouraged to adopt greener technologies and practices, which not only contribute to corporate responsibility but also align with global sustainability targets.

Future Outlook

Over the next several years, the UAE Defence and Aircraft MRO market is expected to showcase substantial growth propelled by continuous government support, advancements in aviation technology, and the rising demand for efficient maintenance solutions. As the need for regional and global military preparedness expands, investment in high-quality MRO services will become increasingly essential. Additionally, growing partnerships with international aerospace companies are anticipated to enhance the capabilities and technological advancements within the local MRO sector, ensuring it remains competitive on a global scale.

Major Players

- Mubadala Aerospace

- Etihad Airways Engineering

- Advanced Military Maintenance, Repair & Overhaul

- Dubai Aerospace Enterprise

- Boeing

- Lockheed Martin

- Northrop Grumman

- General Dynamics

- Safran

- Rolls-Royce

- Airbus

- BAE Systems

- Thales Group

- Leonardo S.p.A.

- L3Harris Technologies

- Raytheon Technologies

- Honeywell Aerospace

Key Target Audience

- Government and Regulatory Bodies (Ministry of Defence; General Civil Aviation Authority)

- Aerospace and Defence Manufacturers

- Airlines and Aircraft Operators

- MRO Service Providers

- Logistics and Supply Chain Companies

- Investments and Venture Capitalist Firms

- Private Sector Corporations (defense-focused)

- Research and Development Firms

Research Methodology

Step 1: Identification of Key Variables

This phase begins with constructing a comprehensive ecosystem map that encompasses all major stakeholders in the UAE Defence and Aircraft MRO market. It involves extensive desk research utilizing various secondary and proprietary databases to gather prevailing industry-level information. The primary focus is to identify and define critical variables influencing the market dynamics, including regulatory frameworks and technological advancements.

Step 2: Market Analysis and Construction

In this stage, we compile and analyze historical data concerning the UAE Defence and Aircraft MRO market. This includes assessing market penetration levels, understanding the ratio of service providers to marketplace demands, and evaluating resultant revenue generation figures. Additionally, we examine statistics regarding service quality to ensure the reliability and accuracy of projected revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Here, market hypotheses are developed based on researched data and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a broad spectrum of companies like aircraft manufacturers, MRO service providers, and defense contractors. These consultations are crucial for garnering operational insights and financial perspectives directly from market practitioners, bolstering the integrity of the data analysis.

Step 4: Research Synthesis and Final Output

The final phase involves engaging with various Defence and Aircraft MRO stakeholders to gain comprehensive insights into product segments, sales performance, consumer needs, and relevant market dynamics. This interaction helps verify and enrich the statistics derived from the bottom-up approach, ensuring the final market analysis is thorough and accurately reflects the UAE Defence and Aircraft MRO landscape.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Historical Overview

- Timeline of Major Players

- Business Cycle Analysis

- Supply Chain and Value Chain Assessment

- Market Drivers

Increasing Defence Budgets

Rise in Air Traffic and Fleet Growth

Technological Advancements - Market Challenges

Regulatory Constraints

High Operational Costs - Opportunities

Joint Ventures with Global MRO Providers

Growing Importance of Sustainment Solutions - Trends

Use of Big Data and Analytics

Sustainable Practices in MRO - Government Regulation

Safety and Compliance Standards

Defence Procurement Policies - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Number of aircraft serviced per year, 2019-2024

- By Average Price, 2019-2024

- By Service Type (In Value %)

Airframe Maintenance

– Structural Inspections and Repairs

– Corrosion Prevention & Control

– Paint & Coating Services

– Line Maintenance

Engine Maintenance

– Engine Overhaul

– Performance Restoration

– Engine Test Services

– On-wing Services

Component Maintenance

– Avionics

– Landing Gear

– Hydraulics and Pneumatics

– Fuel Systems

Modifications and Upgrades

– Avionics Modernization

– Cabin Reconfiguration

– Weapons System Upgrades (for military aircraft)

– Communication and Navigation Enhancements

Overhaul Services

– Heavy Maintenance (C and D Checks)

– Life Extension Programs

– Retrofit Solutions - By Aircraft Type (In Value %)

Military Aircraft

– Fixed-Wing Combat Aircraft

– Surveillance & Reconnaissance Aircraft

– Transport Aircraft

Commercial Aircraft

– Narrow-Body Aircraft

– Wide-Body Aircraft

– Regional Jets

Rotary-Wing Aircraft

– Military Helicopters

– Civilian Helicopters (VIP, utility, emergency services) - By Region (In Value %)

Abu Dhabi

Dubai

Sharjah and Northern Emirates - By End-User (In Value %)

Government Entities

– UAE Armed Forces

– Ministry of Defense

– State-Owned Aviation Companies

Private Sector

– Private Charter Operators

– Commercial Airlines (e.g., Emirates, Etihad)

– Leasing and Maintenance Service Providers - By Technology Adoption (In Value %)

Traditional Practices

– Manual Inspection & Logbook Recording

– Paper-Based Workflow Systems

– Standard MRO Planning Systems

Digital MRO Solutions

– Predictive Maintenance (IoT-based sensors)

– AI-Driven Diagnostics

– Digital Twin and 3D Modeling

– Blockchain for Parts Traceability

– Augmented Reality for Maintenance Support

- Market Share of Major Players on the Basis of Value, 2024

Market Share of Major Players by Type of Defence and Aircraft MRO Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strategic Partnerships, Certifications & Accreditations, Total Revenue, Revenue from MRO Services, Revenue by Service Type, Order Backlog or Pipeline, Number of MRO Facilities, Fleet Serviced, Turnaround Time (TAT) Benchmarks, Key Clients, Distribution Channels, Number of Touchpoints, Unique Value Proposition, others)

- SWOT Analysis of Major Players

- Pricing Analysis of Major MRO Services

- Detailed Profiles of Key Companies

Mubadala Aerospace

Etihad Airways Engineering

Advanced Military Maintenance, Repair & Overhaul Centre (AMMROC)

Emirates Engineering

Boeing

Lockheed Martin

Northrop Grumman

General Dynamics

BAE Systems

Thales Group

Safran

Rolls-Royce

Airbus

Leonardo S.p.A.

Raytheon Technologies

- Market Demand and Utilization Rates

- Budget Allocations and Financial Constraints

- Regulatory and Compliance Necessities

- Needs and Pain Points Overview

- Decision-Making Processes and Influencers

- By Value, 2025-2030

- By Number of aircraft serviced per year, 2025-2030

- By Average Price, 2025-2030