Market Overview

The UAE Digital Stethoscopes Market is valued at a little over USD ~ million, based on a recent country-specific horizon analysis that benchmarks it within a broader Middle East & Africa digital stethoscope revenue pool of about USD ~ million. Demand is being pulled by rapid expansion of digital health, with the UAE’s digital health spending already above USD ~ million and moving toward multi-billion-dollar levels over the current planning horizon, driven by telemedicine, remote patient monitoring, and AI-enabled diagnostics in cardiology and respiratory care.

Within the UAE Digital Stethoscopes Market, Dubai and Abu Dhabi dominate device deployment and procurement. Both cities concentrate the bulk of the country’s over 160 hospitals and thousands of healthcare facilities, alongside high private insurance coverage and strong medical tourism inflows. Dubai alone hosts more than 35 hospitals and has integrated telemedicine across ~ facilities, with healthcare institutions delivering over ~ telemedicine consultations in a recent year—creating a natural backbone for digital stethoscope use in remote auscultation and virtual clinics.

Market Segmentation

By Product Architecture

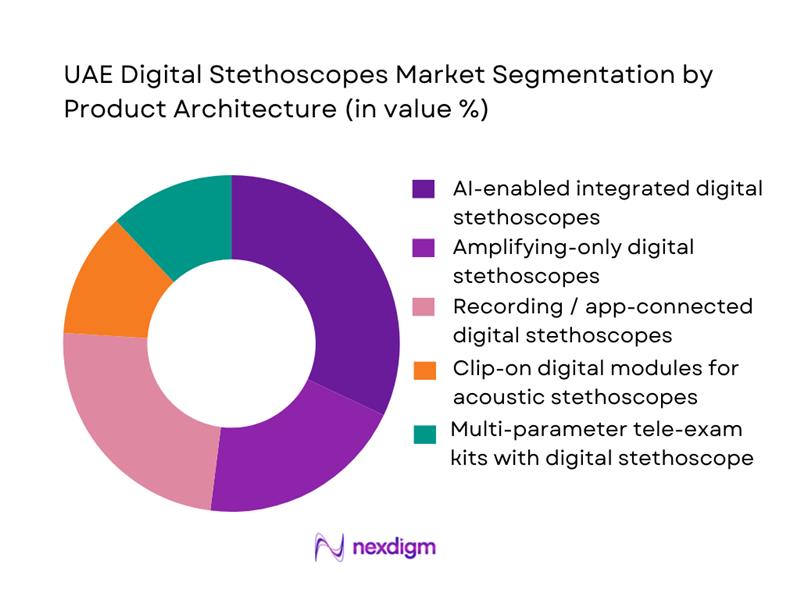

The UAE Digital Stethoscopes Market is segmented by product architecture into AI-enabled integrated digital stethoscopes, amplifying devices, recording/app-connected models, clip-on digital modules, and multi-parameter tele-exam kits. AI-enabled integrated digital stethoscopes currently hold the dominant share in this segmentation. Their strength comes from alignment with the UAE’s national digital health vision and aggressive roll-out of AI-driven diagnostics across public and private systems. With the UAE digital health market expected to more than quadruple over the medium term, hospitals and telehealth providers increasingly prefer stethoscopes that combine high-fidelity acoustics with murmur, arrhythmia and lung-sound algorithms, cloud connectivity and EMR integration, rather than simple amplification alone.

By End User & Care Setting

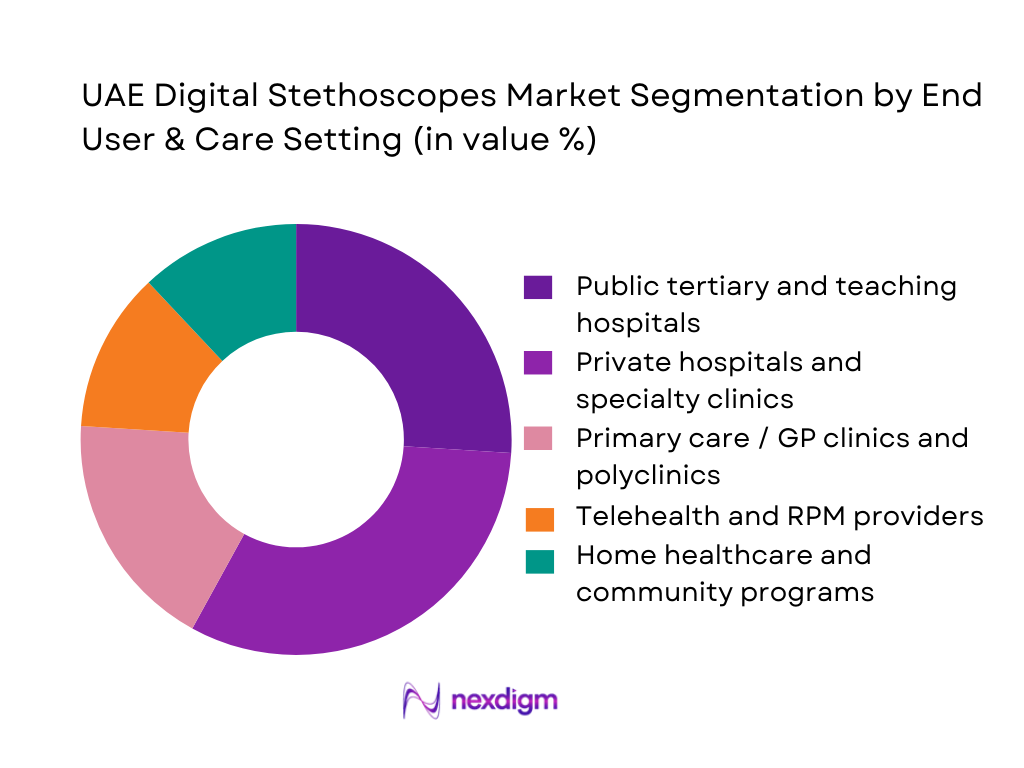

The UAE Digital Stethoscopes Market is segmented by end user and care setting into public tertiary and teaching hospitals, private hospitals and specialty clinics, primary care and GP clinics, telehealth and RPM providers, home healthcare programs, and academic/simulation centers. Private hospitals and specialty clinics dominate this segmentation. Dubai and Abu Dhabi host a dense cluster of high-end private facilities and international hospital brands, competing on patient experience, teleconsultation offerings and advanced diagnostics. These providers are at the forefront of digital health adoption and are deeply involved in medical tourism, making digital stethoscopes a natural fit for cardiology, pulmonology and pre-travel screening services, as well as premium executive health packages.

Competitive Landscape

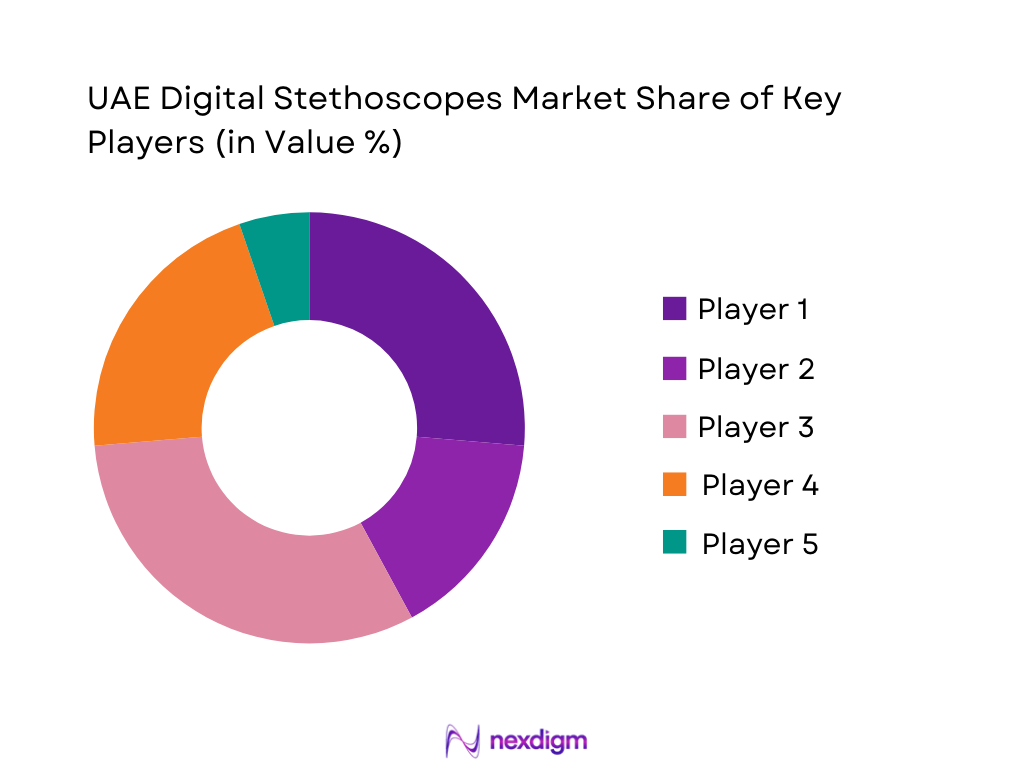

The UAE Digital Stethoscopes Market is shaped by a mix of global OEMs and regional digital health players. International manufacturers such as 3M Littmann (via Eko), Eko Health, Thinklabs and TytoCare provide clinically validated devices and AI platforms, while newer innovators like Ayu Devices supply retrofit modules that appeal to cost-conscious physicians. Local distributors, telemedicine integrators and digital health platforms act as key channel partners, bundling digital stethoscopes into teleconsultation carts, RPM kits and home-health offerings for major hospital groups in Dubai and Abu Dhabi. Competition revolves around audio quality, AI depth, ease of integration with EMR and telehealth platforms, after-sales service and localized training.

| Company | Establishment Year | Headquarters | Core Offering in UAE | Key Technology Focus | Connectivity / Integration Focus | UAE Channel / Go-to-Market Model | Primary End-User Focus in UAE | Notable Market-Specific Feature |

| Eko Health | 2013 | Emeryville, California, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| 3M Littmann (3M) | 1902 | Maplewood, Minnesota, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Thinklabs | 1991 | Centennial, Colorado, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| TytoCare | 2012 | Netanya, Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Ayu Devices | ~2015 | Mumbai, India | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Digital Stethoscopes Market Analysis

Growth Drivers

Burden of cardiovascular and respiratory disease

Non-communicable diseases are a core structural driver for the UAE digital stethoscopes market. In a population of about ~ million in the UAE, four major NCDs – cancer, diabetes, cardiovascular disease and chronic respiratory illness – cause roughly ~ deaths each year and account for ~ percent of all deaths, with cardiovascular disease alone responsible for 34 percent. WHO data show ischaemic heart disease and stroke together contribute more than 40 percent of mortality in the country. A recent study reports COPD prevalence between 3.7 and 5.3 and asthma prevalence around 12.3 in the UAE adult population. Combined with current health expenditure of about ~ US dollars per capita in 2022, this sustained cardiopulmonary burden underpins demand for more sensitive, connected auscultation tools that can support earlier detection and longitudinal follow-up in high-risk cohorts.

Telemedicine expansion

Rapid telehealth adoption in Dubai and other emirates is directly increasing the addressable base for connected stethoscopes. The Dubai Health Authority recorded nearly 375,000 telehealth consultations in 2023, a rise of 28 percent over the previous year, while electronic prescriptions exceeded 230,000 – more than doubling versus 2022. DHA also licenses more than 140 telehealth providers across the emirate. With mobile connections at about 200.9 percent of the UAE population in early 2023 and internet use at effectively 100 percent of residents in 2023, teleconsultations increasingly mirror in-clinic encounters. Digital stethoscopes that stream high-fidelity heart and lung sounds into virtual visits allow cardiologists, pulmonologists and primary-care physicians in major hubs such as Dubai and Abu Dhabi to extend specialist auscultation into home, rural and workplace settings, aligning with government strategies for tech-enabled, patient-centric care.

Challenges

Physician adoption barriers

Despite strong digital infrastructure, translating it into everyday digital stethoscope use requires shifting clinician behaviour. Federal Competitiveness and Statistics Centre data show an upward physician density trend, from around 23–24 doctors per 10,000 population in 2021–2022 to close to 27–30 per 10,000 more recently. In Abu Dhabi, over 45,640 clinicians have been given access to the Malaffi exchange, yet industry analyses highlight that many hospitals still under-utilise available digital capabilities and lack advanced cybersecurity or workflow optimisation. Clinicians trained on traditional acoustic stethoscopes often perceive limited incremental value from digitisation unless integration into EMR, telehealth and AI tools is seamless. In a system where roughly 4,800 annual deaths are attributable to the four key NCDs, resistance or slow adoption by senior cardiology and respiratory consultants can materially delay the scaling of digital auscultation across hospital networks and outpatient clinics.

Device cost

Affordability remains a structural friction point even in a relatively high-income healthcare system. The UAE’s current health expenditure per capita reached about ~ US dollars in 2022, with health spending representing 4.7 percent of GDP. Public sources account for 59.2 percent of health expenditure, mandatory health insurance 22.1 percent and out-of-pocket spending 12.3 percent. While nominal GDP stood around ~ billion US dollars in 2023, budgets inside government hospitals, semi-government providers and private chains must cover high fixed costs – including infrastructure, workforce and pharmaceuticals – before investing in connected devices for every ward, clinic and ambulance. In such an environment, procurement teams evaluate digital stethoscopes against competing capital items like ultrasound probes and remote vital-signs carts. Without clear evidence of reduced admissions, shorter consultation times or fewer repeat visits – all quantifiable against the ~ annual NCD deaths and rising outpatient load – payers may limit roll-outs to flagship centres instead of system-wide deployment.

Opportunities

School and workplace screening

The UAE’s concentrated student and working-age populations create sizeable pockets for structured cardiopulmonary screening using digital stethoscopes. Dubai alone has ~ private schools enrolling ~ students according to the 2024-25 landscape published by the Knowledge and Human Development Authority, while national estimates put total student enrolment around ~ million in the 2023-24 academic cycle. Dubai’s education strategy includes building ~ new affordable private schools by 2033 to add approximately ~ extra seats, further expanding the captive paediatric and adolescent base. On the workforce side, reports indicate the number of employed persons in the UAE has reached about ~ million, with labour-force participation around 77.7 percent. Embedding digital stethoscope screening into mandatory school health checks and corporate wellness programmes in sectors such as aviation, logistics and oil & gas would allow early detection of rheumatic heart disease, congenital defects and occupational lung patterns at population scale, feeding structured auscultation data into EMRs and HIEs and driving recurring device utilisation.

Community remote patient monitoring (RPM)

The UAE’s digital-health foundations strongly favour expansion of community-based RPM pathways anchored by connected stethoscopes. Malaffi’s ~ billion clinical records and ~ million unique patient profiles already give providers longitudinal visibility over chronic-disease cohorts, while its earlier milestone of ~ billion records from ~ million patients in just three and a half years underscores how quickly data capture at scale has become routine. Telehealth consultations in Dubai reached nearly ~ in 2023, demonstrating patient willingness to shift routine care out of hospitals. With mobile connections equalling about 200.9 percent of the population and internet access effectively universal, home-based RPM models using digital stethoscopes can be layered onto virtual clinics and home-care teams to follow heart-failure, COPD and post-COVID patients between appointments. Linking auscultation trends with national NCD strategies – which currently respond to approximately ~ deaths annually from four major NCDs – positions digital stethoscope-enabled RPM as a practical mechanism for reducing avoidable emergency visits and hospital stays while supporting the UAE’s broader shift towards preventive, community-centred care.

Future Outlook

Over the next six years, the UAE Digital Stethoscopes Market is expected to expand steadily in line with a forecast CAGR of about 5.7% between 2024 and 2030. Uptake will be reinforced by strong national commitments to digital health and telemedicine, where spending is already rising sharply and teleconsultations are now embedded in mainstream care pathways in Dubai and Abu Dhabi. As remote patient monitoring and AI-assisted diagnostics shift from pilots to scaled programs, digital stethoscopes will increasingly be specified not just as optional devices, but as standard components of tele-exam kits, home-care bags and hospital bedside monitoring workflows.

Technologically, the market will move from basic amplification toward broader deployment of AI-enabled devices with FDA/CE-cleared algorithms, integrated cardiopulmonary workflows and combined ECG-stethoscope units. OEMs that can demonstrate validated clinical outcomes, rock-solid cybersecurity and seamless interoperability with UAE’s EMR and digital health platforms will capture disproportionate value. The expansion of medical tourism, high-acuity cardiac and pulmonary services, and structured screening programs in schools and workplaces will further broaden the use-cases beyond traditional hospital wards, embedding digital auscultation into population health strategies and corporate wellness offerings.

Major Players

- 3M Littmann

- Eko Health

- Thinklabs Medical

- TytoCare

- Ayu Devices

- Contec Medical Systems

- HD Medical

- eKuore

- Cardionics / 3B Scientific

- Sonavi Labs

- Local UAE

- Telemedicine cart and RPM solution providers

- Regional e-commerce channels and online medical marketplaces

- Digital health platforms

Key Target Audience

- Medical device manufacturers and OEMs

- Hospital groups and integrated health systems

- Digital health, telemedicine and RPM platform providers

- Investments and venture capitalist firms

- Government and regulatory bodies

- Health insurance companies and payers

- Telecommunications and cloud infrastructure providers

- Corporate wellness, occupational health and medical tourism operators

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a detailed ecosystem map for the UAE Digital Stethoscopes Market, covering OEMs, distributors, hospital groups, telemedicine platforms, regulators and payers. Extensive desk research is conducted using secondary and proprietary databases, as well as leading market research reports on digital stethoscopes, UAE digital health and telemedicine. This enables us to identify critical variables such as product architecture, connectivity type, end-user categories, pricing tiers and AI-feature depth.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical revenue and volume data specific to UAE digital stethoscopes, cross-checking country-level figures against Middle East & Africa regional totals and global digital stethoscope benchmarks. We assess penetration across hospitals, clinics, telehealth programs and home-health providers, and align this with UAE healthcare expenditure, hospital services and digital health investments from sources such as WHO and World Bank.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses on segment shares, adoption curves and price bands are validated through structured interviews with clinicians (cardiologists, pulmonologists, intensivists), biomedical engineers, procurement heads and digital health leaders in the UAE. These consultations, conducted via calls and virtual meetings, provide operational insights on real-world device usage, integration pain points, AI-acceptance levels, and expected replacement cycles. The feedback is used to refine segmentation, adjust the competitive landscape and calibrate forecasts for 2024–2030.

Step 4: Research Synthesis and Final Output

The final phase synthesizes quantitative and qualitative findings into a cohesive market model, combining bottom-up estimates (facility-level adoption, device density per department, telehealth program roll-outs) with top-down checks from regional market reports. Direct engagement with leading OEMs, distributors and telemedicine integrators helps validate product-mix assumptions and confirms positioning around AI capabilities, integration features and pricing strategies. The outcome is a robust, triangulated assessment of the UAE Digital Stethoscopes Market, including market size for 2024, segment-wise shares, competitive benchmarking and a forecast CAGR for 2024–2030.

- Executive Summary

- Research Methodology (Market Definition & Scope, Data Sources & Triangulation, Market Sizing & Forecasting Approach, Sample Profile & Stakeholder Coverage, Assumptions, Limitations & Sensitivity Checks)

- Definition, Scope and Classification

- Evolution of Auscultation & Digitalization in UAE

- Role of Digital Stethoscopes in Telemedicine & Remote Patient Monitoring

- Positioning within UAE Diagnostic & Monitoring Device Portfolio

- Business Cycle: Adoption, Replacement and Upgrade Behaviour

- Growth Drivers

Burden of cardiovascular and respiratory disease

Telemedicine expansion

EMR penetration

Clinician productivity

AI screening demand - Challenges

Physician adoption barriers

Device cost

Data privacy concerns

IT integration complexity - Opportunities

School and workplace screening

Community RPM

AI-assisted triage

Cross-border teleconsults

Medical tourism - Trends

Noise cancellation

Bandwidth

AI algorithms

ECG + stethoscope combos

Wireless audio streaming - Regulatory & Compliance Landscape

- Stakeholder Ecosystem & Partnership Models

- Porter’s Five Forces Analysis

- Market-Level SWOT Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- Installed Base & Active Connected Devices, 2019-2024

- Average Realization per Device & by Configuration, 2019-2024

- Mix of New Installations vs Replacement / Upgrade Purchases, 2019-2024

- By Product Architecture (in Value %)

Amplifying Digital Stethoscopes

Recording & Waveform-Visualizing Stethoscopes

Wireless / Bluetooth Clip-On Modules for Conventional Stethoscopes

Integrated AI-Enabled Digital Stethoscopes

Multi-Parameter Tele-Exam Kits with Digital Stethoscope Head - By Connectivity & Integration Level (in Value %)

Standalone Digital Stethoscopes without App Integration

Smartphone / Tablet App-Connected Devices

EMR-Integrated Stethoscopes

Telehealth & RPM Platform-Integrated Stethoscopes

Hearing-Assistive Compatible Digital Stethoscopes - By Clinical Application (in Value %)

Cardiology & Heart Failure Clinics

Pulmonology, Respiratory and Critical Care

Primary Care, Family Medicine & GP Clinics

Pediatrics & Neonatology

Medical Education, Simulation Labs & Skills Centres - By End User & Care Setting (in Value %)

Public Tertiary Hospitals and University-Affiliated Teaching Centers

Private Hospital Chains & Specialized Clinics

Primary Health Centers, Polyclinics & Standalone GP Practices

Home Health Agencies, Community Programs & Remote Screening Initiatives

Medical Colleges, Nursing Schools & Simulation Centres - By Procurement & Commercial Model (in Value %)

Direct Capital Purchase by Hospitals & Clinics

Group Purchasing & Centralized Tenders

Telehealth-as-a-Service Bundles

Subscription / Leasing Models with Managed Service

Retail & E-Commerce Purchases by Individual Physicians

- Market Share Analysis

Strategic Positioning Map - Cross Comparison Parameters (Auscultation Audio Performance, AI & Decision-Support Capabilities, Telehealth, EMR & RPM Integrations, Data Security, Encryption & Hosting Model, Regulatory & Quality Status, Localization, Training & Clinical Support in UAE, Service, Warranty & Lifecycle Economics, Pricing, Bundling & Commercial Models)

- Pricing & SKU Benchmarking

- Detailed Profiles of Major Companies

3M Littmann

Eko Health

Thinklabs Medical

Stemoscope

Ayu Devices

HD Medical

eKuore

Cardionics / 3B Scientific

Contec Medical Systems

TytoCare

Sonavi Labs

Safemed Medical Supplies

Ubuy UAE & Regional E-Commerce Channels

Medical Equipment Trading & Telemedicine Integrators

- Public Tertiary Hospitals & Academic Centers

- Private Hospital Groups & Specialty Clinics

- Primary Care, Polyclinics & GP Practices

- Home Health, Remote Monitoring & Teleconsult Providers

- Medical Colleges, Nursing Schools & Simulation Labs

- By Value, 2025-2030

- By Volume, 2025-2030

- Installed Base & Active Connected Devices, 2025-2030

- Average Realization per Device & by Configuration, 2025-2030

- Mix of New Installations vs Replacement / Upgrade Purchases, 2025-2030