Market Overview

The UAE digital therapeutics market is valued at USD ~ million in the latest reported year, rising from USD ~ million in the prior year. This expansion is driven by the UAE’s high-burden chronic care needs (notably diabetes), structured digitization of clinical data and care pathways, and payer/provider interest in measurable outcomes—adherence, behavior change, and avoidable utilization reduction. The addressable environment is reinforced by the broader UAE digital health ecosystem, which is estimated at USD ~ million in the latest reported year.

Adoption concentrates around Dubai and Abu Dhabi because these emirates combine dense private-provider ecosystems, advanced digital-health governance, and interoperability rails that make DTx integration “clinic-real.” Dubai’s NABIDH enables exchange of medical records across providers, supporting data continuity that DTx programs depend on. Abu Dhabi’s Malaffi connects public/private providers via a unified health record layer, reducing onboarding friction for clinically validated solutions that need longitudinal data. Cross-entity exchange is further strengthened by federal integration progress with Riayati, improving continuity across systems.

Market Segmentation

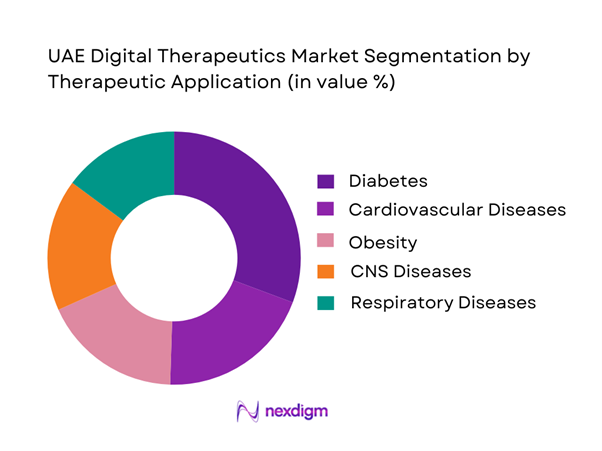

By Therapeutic Application

Diabetes is the leading DTx sub-segment in the UAE because it aligns with the country’s most persistent, high-cost chronic-care pathway and is structurally suited to software-led behavior change. In the UAE, diabetes affects a large adult base—~ adults are recorded as living with diabetes (adult population ~)—creating continuous demand for scalable self-management, coaching, and adherence tools that can sit alongside clinical oversight. Diabetes DTx also fits payer and provider priorities because outcomes can be tracked through standardized metrics (glucose logs, medication adherence patterns, lifestyle engagement signals) and connected-device adjacencies. As clinical systems become more interoperable in Dubai and Abu Dhabi, diabetes programs can be integrated into routine care workflows, improving continuity and patient engagement—key reasons this application remains the commercial anchor for UAE DTx vendors.

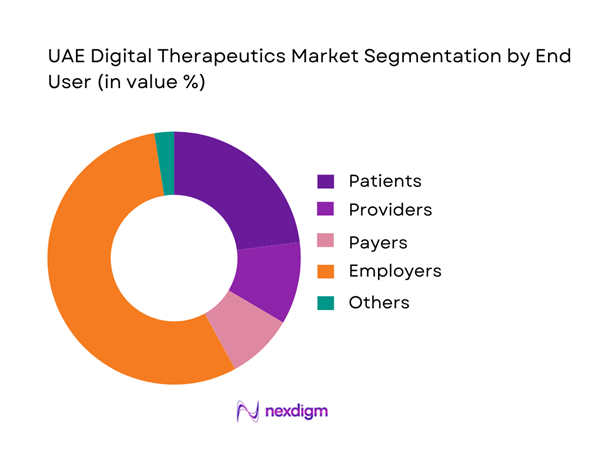

By End User

Patients typically represent the primary demand center for DTx adoption because DTx value realization depends on sustained daily engagement—logging, guided interventions, behavior nudges, and adherence routines that occur outside the clinic. In the UAE, the diabetes burden alone implies a large cohort requiring continuous self-management support, which structurally favors patient-facing DTx programs embedded into routine life. Patient-led adoption also accelerates when solutions plug into established care infrastructure because clinicians can review longitudinal patterns without duplicative manual processes, improving trust and persistence.

As employers and payers seek measurable outcomes, patient engagement becomes the “engine” that produces trackable indicators—completion rates, adherence signals, and lifestyle progression—making patient-centric deployment models the most scalable pathway for DTx commercialization in the UAE.

Competitive Landscape

The UAE digital therapeutics market remains selectively concentrated, with growth shaped by a mix of global DTx innovators and digital-health incumbents extending into therapeutics. Competitive advantage in the UAE is less about “app availability” and more about clinical validation, integration readiness (HIE/EMR), Arabic/English localization, payer/provider partnerships, and regulatory alignment. Players that can demonstrate measurable outcomes in diabetes and cardiometabolic pathways—and operationally integrate into Dubai/Abu Dhabi ecosystems—are better positioned to scale beyond pilots.

| Company | Est. Year | HQ | Primary DTx focus | Delivery model (Rx/OTC/Hybrid) | Evidence orientation | Integration readiness (EMR/HIE) | Remote monitoring adjacency | Localization & accessibility | UAE/GCC partnering posture |

| Teladoc Health (incl. chronic-care programs) | 2002 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| DarioHealth | 2011 | USA/Israel | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Omada Health | 2011 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| ResMed (digital health + respiratory adjacency) | 1989 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| WellDoc | 2005 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Digital Therapeutics Market Analysis

Growth Drivers

Escalating Prevalence of Chronic Diseases

The UAE’s digital therapeutics (DTx) demand is structurally anchored in high chronic-disease care intensity and the operational need to scale behavior change, medication adherence, and remote monitoring across a fast-growing, urban, clinically diverse population of ~ people. This chronic load matters commercially because UAE payers and providers must manage repeat touchpoints (education, lifestyle coaching, titration support, comorbidity tracking) without over-consuming clinic capacity. Macroeconomically, the UAE operates at scale (GDP, current prices: USD ~ billion), supporting sustained investment in digital care pathways that reduce episodic dependence on in-person visits and create measurable outcomes in high-burden cohorts such as diabetes, cardiometabolic risk, and mental health comorbidity.

Shift Toward Preventive and Value-Based Care Models

DTx adoption in the UAE is accelerated by the economics of prevention in a system where insurer-administered claims and government health spending are already operating at very high transaction volumes. Dubai’s payer rails show the scale of “treat + pay + audit” workflows that preventive DTx can plug into: the electronic healthcare insurance portal processed transaction value exceeding AED ~ billion, received ~ transactions, and processed ~ insurance claims. With the UAE economy sized at USD ~ billion (current prices), prevention-led models that reduce avoidable admissions and repeated acute visits become a board-level efficiency lever—DTx products that can evidence outcomes (glycemic control support, hypertension coaching, sleep/weight programs, mental health interventions) align directly with payer utilization management and provider pathway redesign.

Challenges

Regulatory Approval and Compliance Complexity

DTx in the UAE must clear a multi-layer compliance stack: federal privacy requirements, health-data–specific localization and controls, and emirate operational rules for care delivery and data exchange. At the federal level, the UAE Personal Data Protection Law is Federal Decree-Law No. (~) of ~, and executive regulations are referenced as Cabinet Decision No. ~ of ~—creating concrete compliance obligations around lawful basis, data subject rights, and cross-border transfers. This legal layering increases time-to-market for DTx products that want “clinical-grade” positioning because product, hosting, security, consent, and integration architecture must be validated to UAE requirements. The scale of connected ecosystems—Riayati: ~ facilities and ~ providers; NABIDH: ~ facilities—also means compliance isn’t a one-off approval; it becomes continuous operational governance across many endpoints.

Limited Reimbursement Frameworks

A core UAE DTx bottleneck is turning clinical value into reimbursable utilization—especially for software-delivered interventions where coding, claims validation, and coverage rules are still evolving by payer and emirate. Dubai’s insurance rails show enormous claims throughput: transaction value exceeding AED ~ billion, ~ portal transactions received, and ~ insurance claims processed. Yet DTx reimbursement requires tighter definitions: what qualifies as a medical benefit versus wellness, what documentation is needed, how outcomes are audited, and how providers are compensated for digital follow-up time. In Abu Dhabi and broader UAE coverage, large insurers create distribution leverage but also standard-setting friction—Daman reports coverage for more than ~ members and a network of over ~ healthcare providers, giving it the ability to scale or slow new reimbursement models. The result is that many DTx deployments begin as employer-funded or provider-led pilots, then face a second hurdle translating pilots into standardized payer benefit design.

Opportunities

Integration with National Digital Health Platforms

The clearest UAE DTx growth unlock is to productize around national and emirate platforms so DTx becomes part of standard care pathways rather than a parallel digital channel. Riayati’s integration scale—~ medical records for ~ patients, with access for ~ providers across ~ facilities—creates a ready-made substrate for eligibility identification, clinician prescription triggers, and outcomes reporting back into the patient longitudinal record. Commercially, integration reduces customer acquisition pressure because DTx can be prescribed inside insured pathways: Dubai’s insurance umbrella served ~ individuals and processed ~ claims through the portal, signaling the magnitude of payer-linked distribution once reimbursement logic matures.

The opportunity is therefore to align DTx with UAE’s data rails, design for local governance, and monetize through payer and provider contracts instead of purely consumer app adoption.

Strategic Partnerships Between Tech Firms and Healthcare Providers

UAE DTx is structurally partnership-led: the fastest routes to scale are through integrated hospital groups, payers, and national platforms that can standardize clinical pathways and distribution. The insurance-provider backbone is already concentrated enough to support DTx rollouts via platform partners—Daman alone reports ~ members and a network of ~ providers. On the provider-data side, DHA’s NABIDH connects ~ healthcare facilities and unifies ~ patient records, which creates a practical integration hub for digital therapeutics that need clinician dashboards, outcome documentation, and referrals into in-person care when needed. On the macro funding side, the UAE federal budget approved expenditure of AED ~ billion for the subsequent fiscal year, reinforcing the policy environment that sustains digitization and system-wide programs that DTx can attach to.

Future Outlook

Over the next five to six years, the UAE digital therapeutics market is expected to expand rapidly as healthcare systems operationalize hybrid care models—combining in-person clinical oversight with continuous, software-guided interventions. Market momentum should be strongest where DTx directly reduces avoidable utilization and improves chronic outcomes, particularly in diabetes and cardiometabolic risk. Scaling will favor vendors that can align with multi-authority governance across emirates, integrate into HIE and EMR workflows, and demonstrate measurable outcomes that payers and providers can operationalize. The forecast growth trajectory reflects this shift from pilots to structured deployments.

Major Players

- Teladoc Health

- DarioHealth

- Omada Health

- WellDoc

- ResMed

- Kaia Health

- Click Therapeutics

- Akili Interactive

- Pear Therapeutics

- Big Health

- SilverCloud Health

- mySugr

- Happify Health

- Propeller Health

Key Target Audience

- Investments and venture capitalist firms

- Health insurers and TPAs

- Hospital groups and integrated delivery networks

- Large outpatient clinic chains and specialty networks

- Employers and corporate wellness procurement teams

- Pharma and medical device companies

- Digital health platform vendors and EMR/HIS providers

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We begin by mapping the UAE DTx ecosystem across regulators, providers, payers, employers, and vendors, and defining variables such as therapeutic focus, deployment model, evidence standards, and integration readiness. This step is grounded in structured secondary research and systematic compilation of UAE healthcare digitization rails, ensuring market boundaries reflect UAE realities.

Step 2: Market Analysis and Construction

We consolidate market sizing datapoints from credible published sources and align them to UAE-specific segmentation (application and end use). We then structure the market model to reflect real buying centers—provider-led deployments, payer programs, and employer-sponsored pathways—while validating the role of interoperability infrastructure in scaling.

Step 3: Hypothesis Validation and Expert Consultation

We validate hypotheses through structured expert conversations with stakeholders across provider informatics teams, payer program owners, and DTx product leaders. This phase focuses on procurement triggers, clinical workflow fit, engagement persistence, and barriers such as evidence thresholds, integration timelines, and governance requirements.

Step 4: Research Synthesis and Final Output

We synthesize findings using triangulation across published market datapoints, stakeholder interviews, and ecosystem benchmarks. Output includes opportunity mapping by therapeutic area, competitive positioning by integration and evidence readiness, and commercialization pathways tailored to Dubai and Abu Dhabi scaling dynamics and federal interoperability direction.

- Executive Summary

- Research Methodology (Market Boundaries and Definitions, Assumptions, Primary Research Framework, Secondary Research Sources, Market Estimation and Forecasting Approaches, Data Triangulation and Validation Techniques, Limitations and Future Considerations)

- Definition and Scope

- Genesis and Evolution of Digital Therapeutics in UAE Healthcare

- Healthcare Digital Transformation Ecosystem

- Healthcare Delivery and Continuum of Care Impact

- Value Chain and Stakeholder Landscape

- Growth Drivers

Escalating Prevalence of Chronic Diseases

Shift Toward Preventive and Value-Based Care Models

Government Push for Digital Health Adoption

Advancements in AI-Driven Personalized Therapeutics - Challenges

Regulatory Approval and Compliance Complexity

Limited Reimbursement Frameworks

Provider Awareness and Clinical Integration Barriers

Data Privacy and Interoperability Concerns - Opportunities

Integration with National Digital Health Platforms

Strategic Partnerships Between Tech Firms and Healthcare Providers

Expansion of Employer-Sponsored Digital Therapeutics Programs

Localization of Digital Therapeutics for Cultural and Language Alignment - Trends

Rise of Prescription Digital Therapeutics

Growth in Mental Health and Behavioral Therapy Platforms

Increased Use of Remote Monitoring and Continuous Patient Engagement - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Therapeutic Application Revenue Share, 2019–2024

- By End-User Adoption, 2019–2024

- By Delivery Model, 2019–2024

- By Fleet Type (in Value %)

Prescription Digital Therapeutics

Over-the-Counter Digital Therapeutics

Integrated Digital Therapeutics Platforms

AI-Based Adaptive Therapeutics - By Application (in Value %)

Diabetes and Metabolic Disorders

Mental Health and Behavioral Therapy

Cardiovascular and Hypertension Management

Respiratory Conditions

Obesity and Weight Management - By Technology Architecture (in Value %)

Mobile Application-Based Therapeutics

Cloud-Native Therapeutic Platforms

AI and Machine Learning-Based Therapeutics

Wearable-Integrated Therapeutic Systems - By Connectivity Type (in Value %)

Standalone Offline Solutions

Connected Cloud-Based Solutions

IoT and Wearable-Connected Solutions - By End-Use Industry (in Value %)

Hospitals and Healthcare Networks

Clinics and Specialty Care Centers

Health Insurance Providers and Payers

Corporate and Employer Wellness Programs

Individual Patients and Caregivers - By Region (in Value %)

Abu Dhabi

Dubai

Sharjah and Northern Emirates

- Market Share Analysis by Value and Adoption Metrics

- Cross Comparison Parameters (Company Strategic Focus, Therapeutic Area Coverage, Regulatory Approvals, Clinical Evidence Strength, Technology and AI Integration, Partnership Network Strength, Distribution and Healthcare Network Penetration, Pricing and Reimbursement Strategy)

- Competitive Positioning Matrix

- Pricing and Value Proposition Benchmarking

- Company Profiles

Omada Health

Pear Therapeutics

WellDoc

Livongo

Akili Interactive

DarioHealth

Biofourmis

Kaia Health

SilverCloud Health

Propeller Health

mySugr

Happify Health

Big Health

Click Therapeutics

- Patient Demand and Engagement Behavior

- Provider Adoption and Clinical Workflow Integration

- Payer Incentives and Reimbursement Considerations

- Employer Procurement and Wellness ROI Expectations

- Digital Literacy and Adoption Barriers

- By Value, 2025–2030

- By Therapeutic Application, 2025–2030

- By End-User, 2025–2030

- By Delivery Model, 2025–2030