Market Overview

The UAE digital thermometers equipment market is valued at approximately USD ~ million in 2024. Growth is driven by increasing adoption of non-contact and mercury-free devices in home-care and institutional screening, heightened health awareness among consumers and healthcare providers, and the post-pandemic surge in screening protocols across public and private settings in the UAE.

Major Emirate cities such as Dubai, Abu Dhabi and the Northern Emirates dominate the market due to the presence of advanced healthcare infrastructure, high disposable incomes, strong import-driven device procurement, and a large expatriate population attuned to digital health technologies. Government initiatives and airport/venue screening operations also concentrate in these urban centres, strengthening demand for digital thermometer equipment.

Market Segmentation

By Product Type (Value %)

By product type, the UAE digital thermometers equipment market is segmented into contact, non-contact/infrared, ear, forehead and other types. Recently, the non-contact/infrared digital thermometers sub-segment has become dominant, accounting for around 45 % of value share. This dominance is due to several factors: the increasing emphasis on hygienic, rapid temperature screening in institutional settings (airports, schools, workplaces) coupled with consumer preference for non-invasive options in home use. Infrared non-contact devices offer speed and convenience, which is particularly valued in a high-mobility, screening-oriented UAE market. Meanwhile, the forehead and ear segments also maintain significant shares as they bridge consumer and clinical uses, but they are being challenged by the non-contact surge.

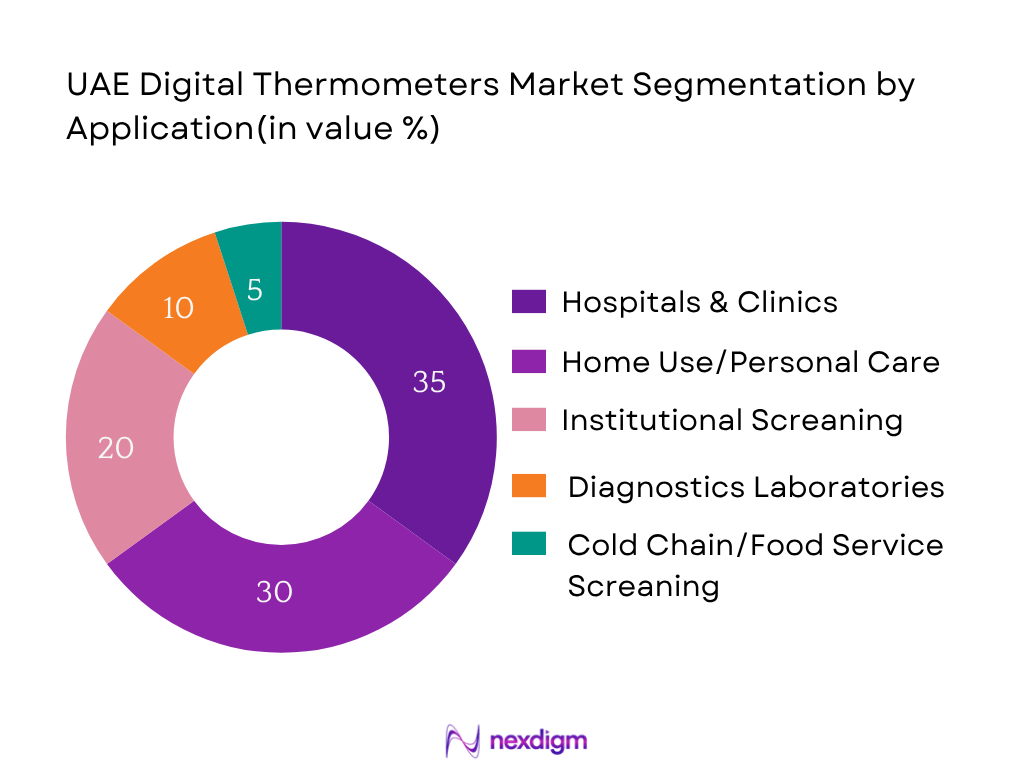

By End-Use / Application (Value %)

By end-use, the market is segmented into hospitals & clinics, home-use/personal care, diagnostic/outpatient centres, institutional screening and industrial/food-chain screening. In recent times the hospitals & clinics segment has the largest share (≈ 35 %) owing to strong institutional procurement of digital thermometers for patient monitoring, screening and replacement of older mercury-based devices. The home-use/personal care segment is close behind (≈ 30 %) as UAE consumers increasingly purchase digital thermometer equipment for household health monitoring, due to rising health awareness and disposable incomes. Institutional screening (≈ 20 %) is also a key segment — airport/venue screening, school health programmes and workplace health checks significantly boost demand for non-contact and rapid digital thermometers. Diagnostics labs and outpatient centres follow, while the industrial/food-service screening segment, though growing, remains small but offers high growth potential.

Competitive Landscape

The competitive ecosystem in the UAE digital thermometers equipment market features global medical-device firms and regional distributors/importers specialising in digital thermometer solutions. Institutional procurement and accreditation matter significantly.

Major players include global brands with established product portfolios, distribution networks in the Middle East and service infrastructure aligned with UAE regulatory requirements. Market consolidation has occurred around firms that can supply non-contact/infrared thermometers, meet Gulf Cooperation Council (GCC) device registration, and support after-sales calibration/maintenance.

| Company | Establishment Year | Headquarters | Product Portfolio Strength | GCC Registration Status | Distribution Footprint in UAE | After-Sales/Service Network |

| Microlife Corporation | 1981 | Switzerland | – | – | – | – |

| Omron Corporation | 1933 | Japan | – | – | – | – |

| Braun GmbH | 1921 | Germany | – | – | – | – |

| Exergen Corporation | 1984 | USA | – | – | – | – |

| A&D Company, Limited | 1977 | Japan | – | – | – | – |

UAE Digital Thermometers Equipment Market Analysis

Growth drivers

Rising home healthcare adoption and consumer health awareness

The UAE’s current health expenditure stands at 5.2 % of GDP in 2023, with total current health expenditure in Dubai alone recorded at AED 22.24 billion in 2023, up from AED 21.39 billion in 2022. This expansion of health-sector spending reflects stronger household and institutional investment in health tools and devices. Furthermore, the UAE home healthcare market generated revenue of USD 618.1 million in 2024, with the equipment component identified as the most rapidly growing sub-segment. As consumers increasingly monitor health at home and institutional budgets shift to preventive care, demand for digital thermometer equipment rises accordingly—enabling the market to tap into the home-use and personal-health segments.

Institutional screening mandatory (schools/workplaces/airports) post-pandemic era

The UAE’s aviation sector handled 86.9 million passengers in 2023 at its major airport, with passenger volumes returning to pre-pandemic highs and driving screening infrastructure needs. With airports, schools, workplaces and public venues increasingly integrating health-screening protocols, the demand for non-contact digital thermometers has surged. Additionally, regulatory frameworks such as the requirement for real-time tracking and monitoring in the health-device supply chain underscore institutional emphasis on screening. Institutional demand (screening of staff/visitors/patients) therefore acts as a strong driver for the digital thermometers equipment market.

Market challenges

Price competition and margin erosion in commoditised segments

While health-care spending in the UAE remains robust (for example, total current health expenditure reached around AED 22.24 billion in Dubai alone in 2023) many digital thermometer devices have become commoditised, especially entry-level home-use models. This leads to pricing pressure, shrinking margins for importers/distributors, and drives competition based on cost rather than value-added features. The replacement of mercury thermometers opens volume opportunities, but the prevalence of low-cost offerings forces premium vendors to differentiate via features (connectivity, memory, multi-mode) or services, adding cost complexity and margin squeeze.

Regulatory compliance burden and import-licensing complexities

The UAE’s medical-device regulatory environment is evolving: for example, the new Federal Decree-Law No. 38 of 2024 on medical products sets out revised regulatory oversight for medical devices and establishments. Coupled with Cabinet Resolution No. 90 of 2023 which specifically targets measuring devices (including thermometers) importers and distributors must fulfil rigorous registration, conformity, verification and documentation requirements. Such regulatory burden increases time-to-market and cost of compliance, especially in a market driven by replacement cycles and rapid institutional procurement, thus acting as a challenge to market growth and product rollout.

Market opportunities

Smart digital thermometer integration with tele-health platforms

The UAE’s healthcare ecosystem is leaning strongly toward digital health: health-spending as a share of GDP is around 5 % and the country aims for global competitive healthcare standards. Within home-healthcare equipment revenue (USD 618.1 million in 2024) the equipment segment was highlighted as the most lucrative component. This indicates that integrating digital thermometers with tele-health monitoring platforms, Bluetooth/WiFi connectivity and remote patient monitoring offers a major opportunity. Devices that feed data to health-apps or institutional dashboards can command premium positioning, differentiating from commoditised models and enhancing value in both consumer and clinical markets.

Adoption in non-traditional end-uses (industrial food, cold-chain monitoring)

While clinical and home-use segments dominate today, a significant opportunity lies in non-traditional applications of digital thermometers, such as industrial food-safety screening, cold-chain logistics monitoring and workplace safety in manufacturing/logistics hubs. The UAE’s logistics sector is robust—air-cargo volumes and airport throughput are rising (e.g., UAE handled 75.4 million passengers in first half of 2025) cold-chain integrity is increasingly demanded. Leveraging digital thermometers with data-logging, connectivity and compliance features in such environments represents an adjacent growth frontier beyond medical/consumer health niches.

Future Outlook

Over the forecast period to 2030, the UAE digital thermometers equipment market is expected to register moderate growth, supported by continued digital health initiatives, increasing consumer health-monitoring behaviour, and expanding institutional screening programmes. Technology enhancements — such as integration with mobile apps, connectivity (Bluetooth/WiFi) and further penetration of non-contact infrared devices — are expected to drive incremental value growth. Import-reliance and price sensitivity may act as constraints, but opportunities lie in smart features and IoT-enabled health monitoring solutions.

Based on current available data (market size USD 22.8 million in 2024) and reference growth of ~5.9 % CAGR for the thermometer market in UAE from 2025-2030. Projecting equivalent CAGR from 2024-2030 (for illustration only): the market could reach approximately USD 32 million by 2030. Continued diversification into home-connected devices, remote patient monitoring, and institutional screening are key growth levers.

Major Players

- Microlife Corporation

- Omron Corporation

- Braun GmbH

- Exergen Corporation

- A&D Company, Limited

- Terumo Corporation

- 3M Company

- American Diagnostic Corporation

- Beurer GmbH

- Medline Industries Inc.

- Innovo Medical Inc.

- Kinsa Inc.

- Welch Allyn Inc.

- Panasonic Corporation

- Citizen Watch Co., Ltd.

Key Target Audience

The report is tailored for the following market-specific audiences:

- Digital thermometer equipment manufacturers and suppliers

- Institutional procurement teams at hospitals & clinics

- Retail chain and pharmacy buyers in UAE

- Healthcare equipment distributors and importers

- Home-care device companies targeting UAE consumer segments

- Government and regulatory bodies (e.g., UAE Ministry of Health and Prevention; Dubai Health Authority)

- Investment and venture-capital firms looking at MedTech/connected health in GCC

- Airport/venue screening solution providers and workplace health-safety departments

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the UAE digital thermometer equipment market—manufacturers, importers/distributors, institutional and consumer end-users. This is underpinned by extensive desk research, utilising secondary databases (trade statistics, device registration data) and proprietary databases to gather comprehensive industry-level information.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyse historical UAE market data pertaining to digital thermometers—such as import volumes, unit shipments, value of institutional procurement—and assess average selling price (ASP) dynamics. An evaluation of device adoption across end-use segments (hospitals vs home vs screening) will ensure reliability of the value estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses (for example, growth rate assumptions, segment dominance) will be developed and subsequently validated through telephone and virtual interviews (CATI/CATI) with industry experts such as hospital procurement managers in Dubai/Abu Dhabi, importers of medical devices in UAE, and regional distributors. These consultations provide operational and financial insights directly from practitioners in the UAE market, refining the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple device manufacturers/distributors servicing the UAE to acquire detailed insights into their product portfolio (digital thermometers range), sales performance in UAE, consumer/ institutional preferences, and regulatory details. This interaction verifies and complements the data derived from bottom-up and top-down approaches, ensuring a comprehensive, accurate and validated analysis of the UAE digital thermometers equipment market.

- Executive Summary

- Research Methodology (Market definitions and equipment scope, Assumptions and base year parameters, Market sizing approach, Data sources (primary interviews with healthcare providers, importers, distributors; secondary databases; trade-statistics), Forecast modelling, Limitations and future research directions)

- Definition and scope of digital thermometer equipment in UAE healthcare/consumer context

- Market genesis and evolution in UAE

- Value chain & supply chain structure

- Business cycle specific to digital thermometers

- Regulatory & reimbursement environment

- Market drivers, restraints and trend snapshot

- Growth Drivers

Rising home healthcare adoption and consumer health awareness

Institutional screening mandatory (schools/workplaces/airports) post-pandemic era

Shift from mercury to digital/non-contact technologies - Market Challenges

Price competition and margin erosion in commoditised segments

Regulatory compliance burden and import-licensing complexities - Market Opportunities

Smart digital thermometer integration with tele-health platforms

Adoption in non-traditional end-uses - Market trends

Surge in non-contact/infrared thermometers for screening

Rise of personal digital health devices with connected features

Competitiveness & value-chain dynamics - SWOT analysis

- Porter’s Five Forces analysis

- Stakeholder Ecosystem (manufacturers, distributors, regulatory bodies, end-users)

- By value (AED or USD), 2019-2024

- By volume (units), 2019-2024

- Average selling price (ASP), 2019-2024

- By product type (value %)

Contact digital thermometers

Non-contact/infrared digital thermometers

Ear digital thermometers

Forehead digital thermometers

Others (probe digital thermometers, multi-mode) - By end-use/application (value %)

Hospitals & clinics

Home-use / personal care

Diagnostics laboratories & outpatient centres

Institutional screening

Other end-uses - By distribution channel (value %)

Hospital/clinic direct procurement

Retail pharmacies and medical device stores

E-commerce / online platforms

Government tenders & bulk purchase - By region within UAE (value %)

Dubai & Northern Emirates

Abu Dhabi

Sharjah & other Emirates - By price band / feature set (value %)

Basic digital thermometers (no memory/connectivity)

Mid-premium (memory recall, accelerated response)

Premium/connected (Bluetooth/WiFi, IoT integration)

- Market share of major players (value/volume) at latest year

- Cross-comparison parameters for major players (Company overview; Business strategy; Recent developments; Strengths; Weaknesses; Product portfolio (digital thermometers range); Distribution footprint; Service & support network; Pricing strategy; Revenues; Gross margins; Product certifications; R&D investment; Connectivity/IoT capabilities; After-sales service)

- Detailed Profiles of Major Companies

Microlife Corporation

Omron Corporation

3M Company

Terumo Corporation

Braun GmbH

Beurer GmbH

American Diagnostic Corporation

Exergen Corporation

A&D Company, Limited

Welch Allyn Inc.

Medline Industries Inc.

Panasonic Corporation

Citizen Watch Co., Ltd.

Innovo Medical Inc.

Kinsa Inc.

Pricing analysis (unit ASP by SKU / region) for major players

New-product pipeline and innovation mapping

- Demand dynamics and utilisation across end-use segments

- Budget allocation and procurement cycles at hospital/institution level

- Consumer purchase behaviour (home-use segment)

- Pain-points, needs and decision-making criteria

- Post-purchase support service requirements

- By value (USD/AED), 2025-2030

- By volume (units) for forecast period, 2025-2030

- By average selling price movement (ASP), 2025-2030