Market Overview

The UAE ECG Machines Equipment market current size stands at around USD ~ million, reflecting a mature diagnostic equipment category embedded within hospital cardiology, emergency care, and outpatient screening pathways. Demand is supported by sustained equipment replacement cycles, rising deployment across multispecialty facilities, and expanding ambulatory diagnostics. Procurement is shaped by centralized tenders, distributor-led channel structures, and service contract bundling, with recurring upgrades driven by interoperability requirements and clinical workflow digitization.

Demand concentration is strongest across Abu Dhabi, Dubai, and Sharjah, anchored by tertiary hospitals, specialty cardiac centers, and dense private clinic networks. These hubs benefit from advanced infrastructure, consolidated procurement ecosystems, and established distributor service footprints. Ecosystem maturity is reinforced by regulatory clarity, standardized device registration processes, and structured maintenance frameworks. Peripheral emirates exhibit growing uptake driven by public hospital expansions, mobile diagnostics deployment, and outreach screening programs aligned with preventive care policy priorities.

Market Segmentation

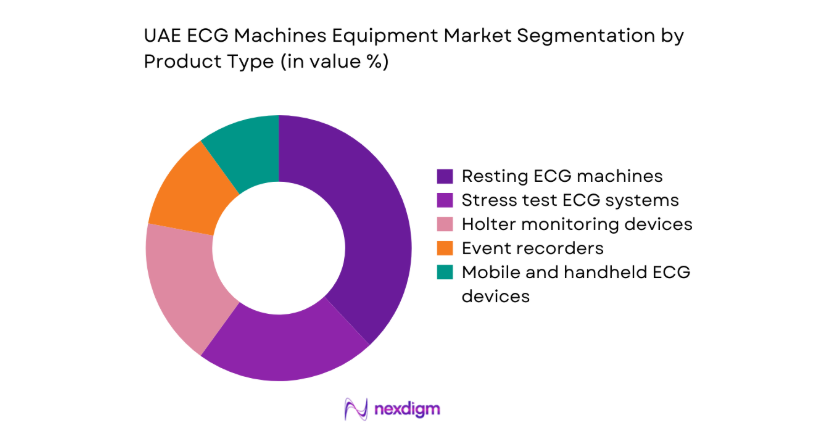

By Product Type

Resting ECG systems dominate procurement due to routine screening needs in emergency departments, outpatient cardiology, and pre-operative assessments, ensuring steady replacement demand across public and private facilities. Stress ECG systems are concentrated in tertiary cardiac centers where ischemia assessment and functional testing are standardized, while Holter and event monitoring adoption is rising through ambulatory diagnostics and follow-up care pathways. Mobile and handheld ECG devices are expanding in home care and corporate wellness programs, supported by telehealth integration and clinician acceptance. Portfolio breadth across these categories enables procurement flexibility for multi-site hospital groups seeking standardized platforms with modular expansion and service coverage alignment.

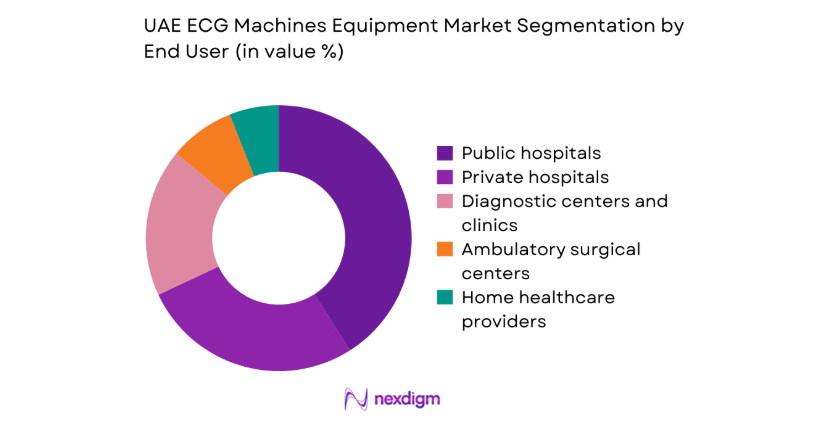

By End User

Public hospitals account for the largest procurement volumes due to centralized tenders, fleet standardization programs, and periodic replacement cycles across emergency and inpatient cardiology departments. Private hospitals prioritize high-throughput systems to support premium cardiac services, medical tourism workflows, and rapid patient turnover. Diagnostic centers and clinics emphasize compact and portable platforms aligned with screening packages and occupational health contracts. Ambulatory surgical centers deploy ECG systems for perioperative monitoring, while home healthcare providers increasingly integrate mobile devices to support remote cardiac surveillance and post-discharge continuity of care, strengthening longitudinal patient management across care settings.

Competitive Landscape

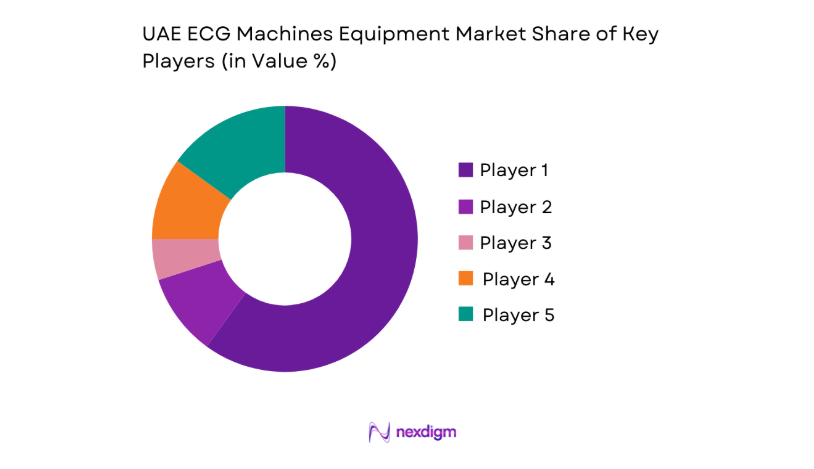

The competitive landscape reflects a mix of multinational manufacturers and established regional distributors competing on portfolio breadth, service coverage, regulatory readiness, and tender participation capabilities. Differentiation is driven by interoperability with hospital systems, uptime commitments, training support, and localized service infrastructure aligned with procurement frameworks.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| GE HealthCare | 1892 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Philips Healthcare | 1891 | Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

| Siemens Healthineers | 1847 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Nihon Kohden | 1951 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Mindray Medical | 1991 | China | ~ | ~ | ~ | ~ | ~ | ~ |

UAE ECG Machines Equipment Market Analysis

Growth Drivers

Rising cardiovascular disease burden and screening programs

Cardiovascular morbidity in the UAE remains elevated, supported by clinical registries reporting over 400,000 patients receiving long-term cardiac care across hospital networks in 2023. Emergency departments in major emirates documented more than 120,000 annual chest pain triage cases requiring ECG screening, while public health campaigns expanded routine screening within primary care clinics to over 1,200 sites nationwide during 2024. Institutional guidelines from federal health authorities mandate ECG availability in emergency rooms and perioperative units, increasing device density per facility. Workforce expansion added 2,800 cardiology nurses and technicians between 2022 and 2024, supporting higher utilization volumes and continuous equipment deployment.

Expansion of tertiary and specialty cardiac centers

Between 2022 and 2024, the UAE licensed 9 new tertiary cardiac centers and expanded catheterization laboratories across 14 hospitals, increasing ECG utilization points across inpatient and procedural settings. Bed capacity additions exceeded 1,500 across cardiac wards, intensifying monitoring needs in step-down units and recovery rooms. Accreditation requirements mandate bedside ECG access in critical care areas, reinforcing equipment density targets per ward. Institutional funding approvals supported large-scale facility upgrades in 2023, while regional health authorities approved 27 new specialized outpatient cardiology clinics in 2024. These expansions structurally increase baseline ECG deployment across clinical pathways without referencing market size.

Challenges

High price sensitivity in public tenders and pricing caps

Public procurement frameworks impose ceiling thresholds on device acquisition and service contracts, compressing supplier margins and limiting configuration flexibility. Tender cycles in 2023 averaged 210 days across multiple emirates, delaying fleet refresh programs and creating gaps in standardized deployments. Framework agreements prioritize lowest compliant bids, constraining adoption of premium configurations and advanced connectivity modules. Contractual penalties tied to uptime requirements increased service risk exposure, while delayed budget releases in 2024 affected delivery schedules for over 3,000 devices across hospital clusters. These constraints challenge long-term planning for maintenance coverage and technology refresh cadence under fixed-price procurement structures.

Lengthy tender cycles and procurement bureaucracy

Procurement governance requires multi-tier approvals involving hospital committees, regional authorities, and centralized purchasing units, extending decision timelines. In 2024, average pre-award processing exceeded 180 days for multi-site tenders, creating operational gaps in replacement planning for aging ECG fleets. Documentation requirements expanded to include cybersecurity attestations and interoperability certifications, adding compliance burden. Vendor prequalification cycles are renewed every 24 months, increasing administrative overhead. Delays in contract finalization disrupt installation sequencing across wards, while staggered deliveries complicate training schedules for over 900 technicians annually. These procedural frictions slow technology upgrades and limit rapid scaling of new deployments.

Opportunities

Expansion of ambulatory and home-based cardiac monitoring

Ambulatory care expansion accelerated in 2023 with 62 new day-care cardiac units licensed nationwide, increasing demand for portable ECG systems across short-stay pathways. Home healthcare registrations surpassed 480 providers in 2024, broadening post-discharge monitoring coverage for cardiac patients. Federal telehealth regulations enacted in 2022 enable remote ECG data transmission under approved platforms, expanding eligible use cases. Post-acute care referrals increased by 28,000 patients in 2024, reinforcing demand for mobile monitoring. Workforce training programs certified 1,100 home care nurses in cardiac telemetry competencies between 2022 and 2024, strengthening service readiness for distributed ECG deployment.

Penetration of wearable and smartphone-linked ECG devices

Digital health adoption expanded following 2022 guidelines enabling clinician review of patient-generated ECG data under supervised protocols. By 2024, over 160 telecardiology programs operated within hospital networks, integrating mobile ECG workflows into outpatient management. Smartphone penetration exceeds 9,000,000 active subscriptions nationwide, supporting patient engagement with wearable monitoring solutions. Regulatory sandboxes approved 14 pilot programs for AI-assisted arrhythmia screening in 2023, accelerating clinician familiarity with consumer-grade ECG adjuncts. Clinical pathways increasingly include remote rhythm assessment for follow-up visits, reducing in-clinic congestion while expanding monitoring frequency and longitudinal data capture.

Future Outlook

The market trajectory through 2030 will be shaped by continued hospital capacity expansion, wider ambulatory adoption, and integration of digital cardiology workflows. Policy alignment around telehealth and interoperability will accelerate distributed monitoring. Replacement cycles for legacy fleets will remain a steady demand anchor, while service-led commercial models gain traction. Regional care decentralization is expected to broaden access beyond major cities.

Major Players

- GE HealthCare

- Philips Healthcare

- Siemens Healthineers

- Nihon Kohden

- Mindray Medical

- Schiller AG

- Fukuda Denshi

- BPL Medical Technologies

- Edan Instruments

- Spacelabs Healthcare

- Cardioline

- Welch Allyn

- Hillrom

- Medtronic

- AliveCor

Key Target Audience

- Public hospital procurement departments

- Private hospital groups and specialty cardiac centers

- Diagnostic center chains and clinic networks

- Home healthcare service providers

- Medical device distributors and channel partners

- Health system integrators and IT vendors

- Investments and venture capital firms

- Government and regulatory bodies with agency names including Ministry of Health and Prevention, Department of Health Abu Dhabi, Dubai Health Authority

Research Methodology

Step 1: Identification of Key Variables

Clinical use cases, care settings, and workflow integration points were mapped across emergency, inpatient, outpatient, and home care pathways. Regulatory pathways, device classification, and registration requirements were defined. Channel structures and service coverage models were outlined. Installed base dynamics and replacement triggers were identified.

Step 2: Market Analysis and Construction

Demand nodes across major emirates were assessed through facility counts, bed capacity expansion, and specialty clinic licensing. Procurement frameworks, tender cadences, and distributor networks were analyzed. Technology adoption patterns across resting, stress, Holter, and mobile ECG modalities were structured to reflect utilization pathways.

Step 3: Hypothesis Validation and Expert Consultation

Clinical administrators, biomedical engineers, and procurement leads provided validation on utilization intensity, service expectations, and interoperability constraints. Policy stakeholders confirmed regulatory timelines and telehealth enablement. Service partners validated maintenance models and uptime requirements influencing deployment feasibility.

Step 4: Research Synthesis and Final Output

Findings were synthesized into market structure, segmentation logic, competitive positioning, and opportunity mapping. Assumptions were stress-tested against institutional indicators and regulatory frameworks. Outputs were refined to ensure consistency across demand drivers, constraints, and forward-looking themes.

- Executive Summary

- Research Methodology (Market Definitions and clinical use-case scoping for ECG modalities, Primary interviews with UAE hospital cardiology heads and biomedical engineers, Distributor and tender database analysis for MoHAP DHA DOH procurements)

- Definition and Scope

- Market evolution

- Usage or care pathways

- Ecosystem structure

- Supply chain or channel structure

- Growth Drivers

Rising cardiovascular disease burden and screening programs

Expansion of tertiary and specialty cardiac centers

Government investment in public hospital infrastructure - Challenges

High price sensitivity in public tenders and pricing caps

Lengthy tender cycles and procurement bureaucracy

Dependence on imports and exposure to currency fluctuations - Opportunities

Expansion of ambulatory and home-based cardiac monitoring

Penetration of wearable and smartphone-linked ECG devices

Upgrades of legacy ECG fleets in public hospitals - Trends

Shift toward wireless and cloud-connected ECG systems

Bundling of ECG equipment with service and maintenance contracts - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2019–2024

- By Shipment Volume, 2019–2024

- By Installed Base, 2019–2024

- By Average Selling Price, 2019–2024

- By Product Type (in Value %)

Resting ECG machines

Stress test ECG systems

Holter monitoring devices

Event recorders

Mobile and handheld ECG devices - By Technology (in Value %)

Analog ECG systems

Digital ECG systems

Wireless and Bluetooth-enabled ECG systems

Cloud-connected ECG platforms - By Lead Type (in Value %)

3-lead ECG systems

5-lead ECG systems

12-lead ECG systems - By Portability (in Value %)

Fixed ECG systems

Portable ECG carts

Handheld and wearable ECG devices - By End User (in Value %)

Public hospitals

Private hospitals

Diagnostic centers and clinics

- Market share of major players

- Cross Comparison Parameters (product portfolio breadth, clinical accuracy and validation, integration with HIS and EMR, local service coverage and uptime SLAs, pricing and tender competitiveness, distributor network strength, training and education support, regulatory approvals and certifications)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

GE HealthCare

Philips Healthcare

Siemens Healthineers

Fukuda Denshi

Nihon Kohden

Schiller AG

Mindray Medical

BPL Medical Technologies

Edan Instruments

Spacelabs Healthcare

Cardioline

Welch Allyn

Hillrom

Medtronic

AliveCor

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- By Value, 2025–2030

- By Shipment Volume, 2025–2030

- By Installed Base, 2025–2030

- By Average Selling Price, 2025–2030