Market Overview

The UAE Echocardiography Equipment market is driven by advancements in cardiovascular imaging technology, increasing healthcare investments, and a growing demand for non-invasive diagnostic techniques. The market size for echocardiography equipment is estimated at USD ~ million, with the segment growing due to the rising prevalence of cardiovascular diseases (CVD) in the region, especially among aging populations. The increasing number of hospitals and healthcare facilities investing in high-end diagnostic equipment and growing awareness about early heart disease detection are significant factors contributing to this market size.

The UAE market is predominantly driven by major cities like Dubai and Abu Dhabi, which are home to a significant proportion of the country’s healthcare infrastructure. Dubai’s focus on healthcare tourism and its rapid adoption of advanced medical technologies have contributed to its dominance in the echocardiography equipment sector. Abu Dhabi, being the capital and a central hub for the UAE’s healthcare and research initiatives, also plays a pivotal role in this market’s growth, further bolstered by government healthcare reforms and investments in state-of-the-art medical equipment.

Market Segmentation

By Product Type

The UAE Echocardiography Equipment market is segmented into various product types such as 2D echocardiography, 3D/4D echocardiography, portable echocardiography devices, and Doppler echocardiography. Among these, 2D echocardiography systems are the dominant product type. This is due to their longstanding use in clinical diagnostics, established reliability, and affordability compared to newer technologies like 3D/4D imaging. 2D systems are highly preferred for routine heart disease monitoring, making them widely adopted across various hospitals, clinics, and diagnostic centers.

By Assay Technology

The market is segmented based on end-users, including hospitals, cardiology centers, diagnostic imaging centers, and ambulatory surgical centers. Hospitals remain the dominant end-user segment, driven by the increasing demand for advanced diagnostic technologies within multi-specialty hospitals. As heart disease diagnoses and treatments become more prevalent, hospitals are prioritizing the procurement of echocardiography devices for both in-patient and outpatient care. The rapid growth of healthcare facilities in cities like Dubai and Abu Dhabi also fuels this demand.

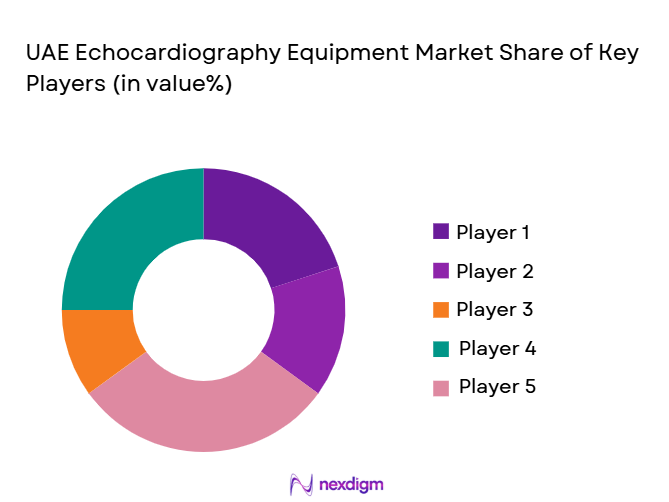

Competitive Landscape

The UAE Echocardiography Equipment market is dominated by several major global players. These include GE Healthcare, Philips Healthcare, Siemens Healthineers, Mindray, and Canon Medical Systems. These companies maintain a competitive edge due to their advanced technological offerings, wide distribution networks, and strong brand recognition in the medical device sector. The market’s competitive landscape reflects both international brands and local distributors, which further consolidate the sector.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Technological Innovations | Market Focus | Distribution Network |

| GE Healthcare | 1892 | USA | ~ | ~ | ~ | ~ |

| Philips Healthcare | 1891 | Netherlands | ~ | ~ | ~ | ~ |

| Siemens Healthineers | 1847 | Germany | ~ | ~ | ~ | ~ |

| Mindray | 1991 | China | ~ | ~ | ~ | ~ |

| Canon Medical Systems | 1937 | Japan | ~ | ~ | ~ | ~ |

UAE Echocardiography Equipment Market Analysis

Growth Drivers

Increasing Burden of Cardiovascular Diseases

The UAE presents a significant burden of cardiovascular diseases (CVD), forming the basis for demand in echocardiography systems essential tools for cardiac diagnosis. According to the American Heart Association and UAE health reports, cardiovascular diseases account for ~36.7% of all deaths in the country, nearly doubling fatalities from cancer, indicating a heavy reliance on imaging equipment to facilitate early diagnosis and treatment planning. This elevated CVD burden, combined with a rapidly aging and urbanised population, accelerates demand for advanced echocardiography equipment in both private and public healthcare facilities, where cardiology departments are expanding capacity and services.

Rising Healthcare Expenditure and Infrastructure Expansion

Healthcare expenditure directly influences the uptake of advanced diagnostic tools like echocardiography. According to World Bank data, the UAE’s per capita healthcare spending reached approximately USD ~ in 2022, rising annually as the country invests in medical infrastructure expansion and cutting‑edge equipment procurement. This investment environment supports the acquisition of high‑end imaging modalities across general hospitals, speciality cardiac centres, and diagnostic imaging facilities. Coupled with the UAE’s status as a high‑income nation with robust healthcare infrastructure, the continuous enhancement of medical service capacity — particularly in metropolitan hubs like Dubai Healthcare City with its 4.1 million square feet of healthcare facilities — underscores the facilitated adoption of echocardiography diagnostics.

Restraints

High Initial Procurement Costs

Echocardiography machines, especially advanced 3D/4D and AI‑integrated systems, represent significant capital investments for healthcare providers. Given that these devices require both substantial upfront purchase costs and rigorous installation protocols, smaller clinics and diagnostic centres face financial barriers to adoption. While aggregate health spending per capita in the UAE is high (USD ~ per individual), the allocation of this spending still prioritises competing areas such as emergency care, surgical facilities, and broader imaging (e.g., MRI, CT systems). This financial dynamic restrains rapid market penetration of top‑tier echocardiography systems across all tiers of healthcare facilities.

Regulatory and Compliance Complexities

Medical imaging equipment in the UAE — including echocardiographs — must comply with rigorous regulatory standards overseen by agencies such as the Ministry of Health & Prevention (MOHAP), Dubai Health Authority (DHA), and Department of Health – Abu Dhabi. These bodies enforce strict safety, efficacy, and quality requirements prior to device approval and use in clinical practice. While this ensures high patient safety standards, it also lengthens market entry for new models and increases administrative overhead for suppliers and healthcare buyers. Additionally, maintaining compliance with periodic recalibration standards and auditing can impose ongoing costs on facilities.

Opportunities

Integration of AI and Telemedicine in Diagnostic Imaging

Adoption of digital health technologies opens new avenues for echocardiography market growth. AI‑based image processing and remote diagnostic platforms allow cardiac images to be acquired in one facility and analysed elsewhere, bridging expertise gaps and supporting telecardiology frameworks. The UAE’s strong digital infrastructure and support for telemedicine cases foster the integration of such technologies, which can expand echocardiography use beyond traditional hospital settings into community clinics and specialised screening programmes.

Expansion of Cardiac Care in Secondary Cities

While Dubai and Abu Dhabi are clear healthcare hubs, secondary emirates are investing to modernise regional healthcare services. As regional hospitals and clinics scale up cardiac care capabilities, demand for diagnostic imaging, including echocardiography, increases. This geographic expansion presents a strategic opportunity for equipment suppliers to tailor offerings for mid‑sized facilities, particularly portable echo systems suited for broader coverage.

Future Outlook

The UAE Echocardiography Equipment market is expected to witness significant growth in the coming years. This growth will be propelled by continuous advancements in imaging technology, increased investments in healthcare infrastructure, and the growing focus on early diagnosis of cardiovascular diseases. The demand for portable and AI-integrated echocardiography systems is also expected to rise, particularly with the increasing preference for mobile healthcare solutions. Additionally, the UAE government’s initiatives to enhance healthcare services will continue to support market growth, particularly in metropolitan areas like Dubai and Abu Dhabi.

Major Players

- GE Healthcare

- Philips Healthcare

- Siemens Healthineers

- Mindray

- Canon Medical Systems

- Fujifilm Healthcare

- Hitachi Healthcare

- Esaote

- Shenzhen Anke High-Tech

- Butterfly Network

- Terason (Konica Minolta)

- Samsung Medison

- Chison Medical

- Carestream Health

- Analogic

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Private and Public Hospitals

- Cardiology Centers and Clinics

- Diagnostic Imaging Centers

- Medical Equipment Distributors

- Healthcare Providers & Healthcare Systems

- Insurance Companies

Research Methodology

Step 1: Identification of Key Variables

The research begins by mapping out the ecosystem of stakeholders in the UAE Echocardiography Equipment market, which includes healthcare providers, medical equipment manufacturers, distributors, and regulators. Desk research is conducted to gather data and define variables influencing the market’s growth.

Step 2: Market Analysis and Construction

Historical data is gathered to evaluate the penetration of echocardiography equipment across hospitals and diagnostic centers. This includes tracking the demand for 2D/3D echocardiography systems and understanding end-user preferences in the UAE.

Step 3: Hypothesis Validation and Expert Consultation

We consult with industry experts, including hospital procurement officers and key players from the medical equipment industry. These consultations help refine our hypotheses and validate the market dynamics.

Step 4: Research Synthesis and Final Output

Data from various sources is consolidated to finalize the report, ensuring comprehensive and accurate insights. Interviews with healthcare facilities and equipment suppliers validate and supplement the gathered data.

- Executive Summary

- UAE Echocardiography Equipment Market Research Methodology

Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising prevalence of cardiovascular diseases

Expansion of advanced cardiac care infrastructure

Growing adoption of non-invasive diagnostic imaging - Market Challenges

High acquisition and maintenance costs

Shortage of trained sonographers and cardiologists

Regulatory approval and compliance requirements - Market Opportunities

Increasing demand for portable and handheld systems

Integration of AI for automated image analysis

Growth of private healthcare and specialty cardiac clinics - Trends

Shift toward 3D and 4D echocardiography imaging

Rising use of point-of-care cardiac ultrasound

Adoption of cloud-based data storage and reporting - Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- UAE Echocardiography Equipment Market Competitive Landscape

Market Share Analysis

CrossComparison Parameters

[Image quality, Technology advancement, Portability, Pricing strategy, Service support]

SWOT Analysis of Key Competitors

Pricing & Procurement Analysis

Key Players

GE HealthCare

Philips Healthcare

Siemens Healthineers

Canon Medical Systems

Fujifilm Healthcare

Samsung Medison

Mindray

Esaote

Hitachi Healthcare

Chison Medical

Edan Instruments

Alpinion Medical Systems

BK Medical

Butterfly Network

Clarius Mobile Health Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value 2019–2024

- By Installed Units 2019–2024

- By Average System Price 2019–2024

- By System Complexity Tier 2019–2024

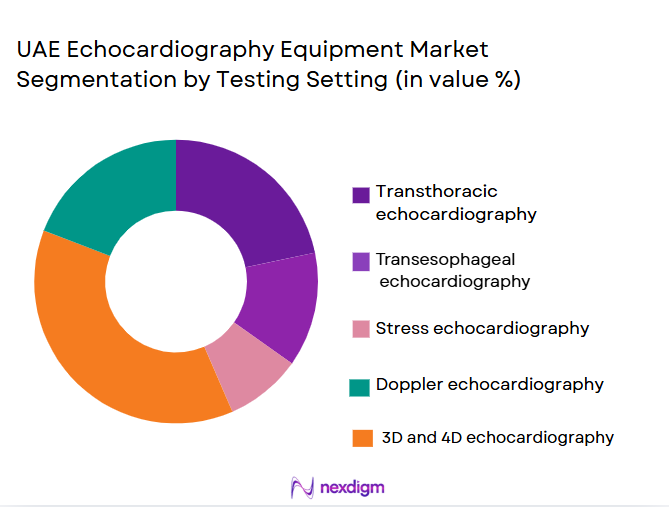

- By System Type (In Value%)

Transthoracic echocardiography systems

Transesophageal echocardiography systems

Stress echocardiography systems

Doppler echocardiography systems

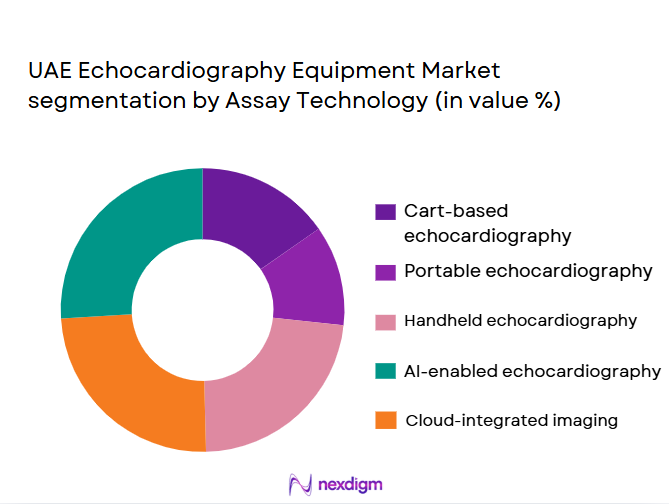

3D and 4D echocardiography systems - By Platform Type (In Value%)

Cart-based echocardiography systems

Portable echocardiography systems

Handheld echocardiography devices

AI-enabled echocardiography platforms

Cloud-integrated imaging platforms - By Fitment Type (In Value%)

Fixed hospital-installed systems

Mobile and wheeled systems

Bedside and point-of-care systems

Integrated cardiovascular lab systems

Standalone diagnostic imaging systems - By EndUser Segment (In Value%)

Hospitals and cardiac centers

Specialty cardiology clinics

Diagnostic imaging centers

Academic and research institutions

Ambulatory care and day surgery centers - By Procurement Channel (In Value%)

Direct OEM procurement

Authorized distributors and resellers

Government and public healthcare tenders

Leasing and managed equipment services

Group purchasing and bulk procurement contracts

- Market Share Analysis

- Cross Comparison Parameters

(Image quality, Technology advancement, Portability, Pricing strategy, Service support) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

GE HealthCare

Philips Healthcare

Siemens Healthineers

Canon Medical Systems

Fujifilm Healthcare

Samsung Medison

Mindray

Esaote

Hitachi Healthcare

Chison Medical

Edan Instruments

Alpinion Medical Systems

BK Medical

Butterfly Network

Clarius Mobile Health

- Hospitals prioritize high-resolution and high-throughput systems

- Clinics demand compact and cost-effective imaging solutions

- Diagnostic centers focus on workflow efficiency and accuracy

- Researchers value advanced analytics and imaging capabilities

- Forecast Market Value 2025–2030

- Forecast Installed Units 2025–2030

- Price Forecast by System Tier 2025–2030

- Future Demand by Platform 2025–2030