Market Overview

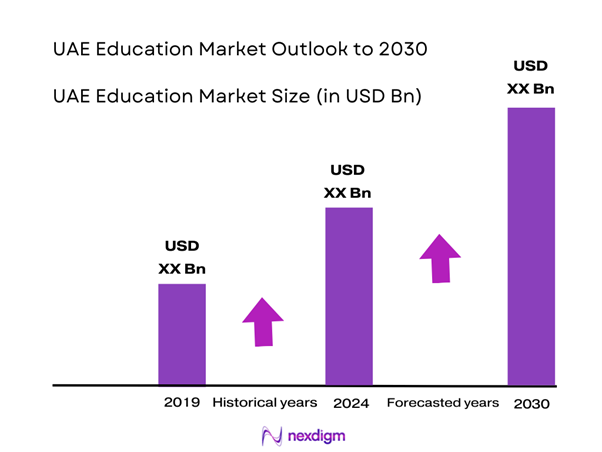

The UAE education market is valued at USD 9.2 billion, based on a comprehensive analysis of recent trends and historical growth patterns. This market expansion is driven by the increasing demand for quality education services as a result of rapid population growth, urbanization, and significant government investments in educational infrastructure. The UAE government aims to deliver a high-quality education system, enhancing the skills and employability of its workforce while attracting foreign investment and innovation in the education sector.

The dominant cities in the UAE education market include Dubai and Abu Dhabi, which contribute significantly to the overall market size due to their advanced infrastructure and a diverse expatriate population seeking quality educational options. Dubai, in particular, has positioned itself as a global knowledge hub with a multitude of international schools and universities, while Abu Dhabi’s investments in education reform and infrastructure have solidified its role as a key player in the education sector.

In recent years, the UAE government has committed more than AED 10 billion towards educational reforms and infrastructure development, significantly enhancing the quality and accessibility of education. The government has introduced several initiatives aimed at increasing investments in education, including partnerships with international educational institutions aimed at modernizing curricula and teaching practices.

Market Segmentation

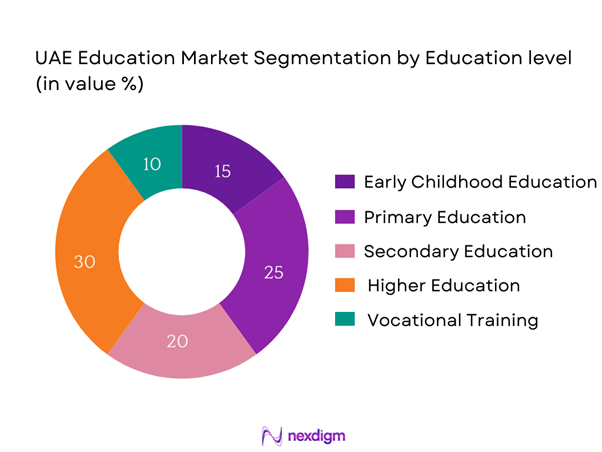

By Educational Level

The UAE education market is segmented by educational level into Early Childhood Education, Primary Education, Secondary Education, Higher Education, and Vocational and Adult Education. Among these, Higher Education maintains a dominant market share due to the presence of numerous prestigious institutions offering a wide range of programs. The appeal of higher education in the UAE can largely be attributed to the country’s international partnerships with renowned global universities, leading to a rich diversity of academic offerings and campuses. With a growing number of expatriates seeking advanced degrees and local citizens pursuing higher education, institutions such as Abu Dhabi University and the American University of Sharjah are at the forefront of this segment, catering to a substantial local and international student body.

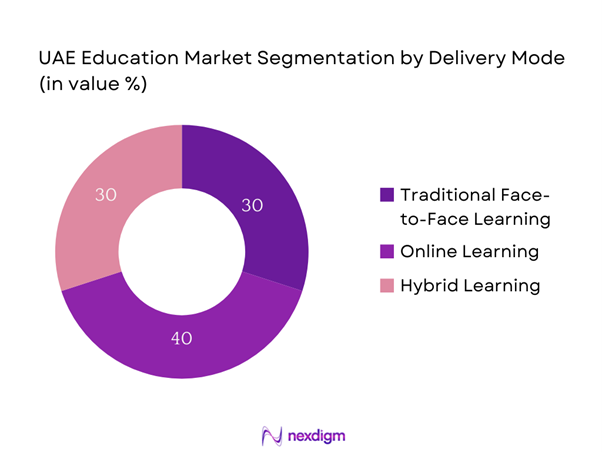

By Delivery Mode

Another significant segmentation in the UAE education market is by delivery mode, including Traditional Face-to-Face Learning, Online Learning, and Hybrid Learning. The Online Learning sub-segment is currently dominating the market share, spurred by the rapid digitization of education. This growth in online learning is significantly driven by technological advancements and the increasing adoption of digital tools within educational institutions. The COVID-19 pandemic further accelerated this trend, compelling schools and universities to adapt and enhance their online offerings, making education more accessible. Institutions are increasingly investing in e-learning platforms, offering diverse courses and flexibility to meet the varied needs of students. Companies like Knowledge E and the UAE’s own universities are capitalizing on this demand, reinforcing the growing preference for online education.

Competitive Landscape

The UAE education market is characterized by a competitive landscape that is heavily influenced by both local and international players. Key market entities, including GEMS Education and the American University of Sharjah, play a pivotal role in shaping the educational landscape. As these institutions shape market trends through innovations in teaching methods and curriculum development, the consolidation of major players highlights their substantial influence in the region.

| Company | Establishment Year | Headquarters | Number of Campuses | Programs Offered | Online Learning Platforms | Market Penetration Strategies |

| GEMS Education | 1959 | Dubai | – | – | – | – |

| Abu Dhabi University | 2003 | Abu Dhabi | – | – | – | – |

| American University of Sharjah | 1997 | Sharjah | – | – | – | – |

| British International School | 2004 | Dubai | – | – | – | – |

| Knowledge E | 2004 | Dubai | – | – | – | – |

UAE Education Market Analysis

Growth Drivers

Rising Expat Population

The UAE’s dynamic and diverse expat population reached approximately 8.84 million in 2023 and is projected to continue growing, driven by the country’s economic stability and job opportunities. This influx contributes significantly to the demand for high-quality educational institutions, as expatriates often seek international curricula and quality standards for their children. As a result, schools and educational facilities catering to this demographic have witnessed unprecedented growth, with over 700 international schools operating in the UAE, fulfilling the academic needs of this growing population.

Technological Advancements and E-Learning

The demand for technological integration in education has surged, especially with the rise of e-learning platforms. In 2023, the number of internet users in the UAE surpassed 9 million, promoting widespread access to online educational resources. The UAE government has endorsed digital transformation in education through various initiatives, such as the “Smart Learning” program, which aims to integrate advanced technologies into classrooms. The increased focus on STEM and digital skills training reflects a strategic emphasis on preparing students for the future workforce in a technology-driven world.

Market Challenges

Regulatory Compliance Issues

The UAE education market faces stringent regulatory compliance requirements, which pose significant challenges for educational institutions. Schools must adhere to rigorous accreditation standards set forth by the UAE Ministry of Education and the Knowledge and Human Development Authority (KHDA), ensuring quality and relevancy in their educational offerings. Failure to comply with these regulations can result in penalties or revocation of licenses. Furthermore, upcoming changes in the education regulatory framework may require institutions to adjust their curricula and operational practices to maintain compliance, leading to increased operational costs.

Competition among Institutions

With over 650 schools and numerous private and public universities operating in the UAE, competition within the education sector is intense. Institutions are continually striving to attract students, leading to a focus on enhancing their curricula and extracurricular offerings. This heightened competition often results in price wars, which may negatively impact smaller institutions’ viability. Moreover, quality assurance pressure forces schools and universities to constantly innovate and refine their programs, which can strain resources and operational capacities.

Opportunities

Expanding EdTech Solutions

The rapid integration of technology into the education sector presents significant opportunities for growth. As of 2023, over 60% of educational institutions in the UAE have adopted some form of digital learning solutions. The increasing reliance on virtual classrooms and online assessments creates a demand for innovative EdTech solutions, particularly in areas like artificial intelligence and personalized learning systems. With government support for digital transformation, the EdTech market is seeing substantial investments, shaping the future of education in the UAE.

Demand for Skilled Workforce Training

The UAE’s Vision 2021 has put a strong focus on creating a knowledge-based economy, which can only be achieved through a skilled workforce. Currently, approximately 40% of companies in the UAE report difficulty in finding skilled candidates for technical positions. This gap emphasizes the urgent need for vocational and technical training programs that align with market needs. Educational institutions that can effectively bridge this gap by providing tailored training programs will be well-positioned to thrive in the evolving job market.

Future Outlook

Over the next five years, the UAE education market is expected to experience substantial growth fueled by progressive government policies, ongoing investments in educational infrastructure, and an increasing demand for diverse learning pathways. The trend towards digitization alongside personalized learning experiences will further enhance the attractiveness of educational offerings in the region. As institutions continue to innovate and adapt to new technologies, the integration of Artificial Intelligence and blended learning methodologies will likely shape the future landscape of the UAE education market. The ongoing focus on enhancing the quality of education and aligning it with labor market demands will drive sustainable growth and attract both local and international students looking for high-quality educational experiences.

Major Players

- GEMS Education

- Abu Dhabi University

- American University of Sharjah

- British International School

- Knowledge E

- Dubai International Academy

- Emirates International School

- Sharjah American International School

- International School of Arts & Sciences

- Lycee Francais International Georges Pompidou

- Al Ain University

- University of Sharjah

- International Community School

- Manchester Business School

- The British University in Dubai

Key Target Audience

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Ministry of Education, Knowledge and Human Development Authority)

- Educational Technology Companies

- Curriculum Developers

- International Institutions Looking to Establish Branches

- Educational NGOs and Foundations

- Corporate Training and Development Departments

- Parents of School-Age Children

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the ecosystem of the UAE education market by identifying all major stakeholders, such as local and international educational institutions, government agencies, and service providers. Extensive desk research is conducted using a combination of secondary and proprietary databases to gather comprehensive data on current trends and developments in the education sector. This step aims to clarify and define the critical variables that impact market dynamics, including regulatory frameworks and technological advancements.

Step 2: Market Analysis and Construction

This phase includes the compilation and analysis of historical data relevant to the UAE education market, assessing key metrics such as enrollment figures, program diversity, and revenue generation. Current market penetration rates are compared with the growth of service providers to portray an accurate snapshot. This information is further supplemented by evaluating service quality ratings to ensure the reliability and validity of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses that emerge from the preliminary analysis will be validated through computer-assisted telephone interviews (CATIs) with industry experts across various educational institutions and organizations. These consultations provide a rich source of operational insights, financial details, and perspectives that contribute to the further development and refinement of market data and forecasts based on real-world experience.

Step 4: Research Synthesis and Final Output

The final phase involves engaging with multiple key players in the education sector to obtain in-depth insights into product offerings, educational trends, student preferences, and institutional performance. This direct interaction helps verify and complement the quantitative data collected through secondary research, ensuring a well-rounded and accurate analysis of the UAE education market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Dynamics

- Historical Context and Growth Patterns

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Expat Population

Government Investments in Education

Technological Advancements and E-Learning - Market Challenges

Regulatory Compliance Issues

Competition among Institutions - Opportunities

Expanding EdTech Solutions

Demand for Skilled Workforce Training - Trends

Increasing Focus on STEAM Programs

Enhanced Personalization in Learning - Government Regulations

Accreditation Standards

Tuition Fee Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Enrollment Numbers, 2019-2024

- By Investment Levels, 2019-2024

- By Educational Level (In Value %)

Early Childhood Education

Primary Education

Secondary Education

Higher Education

Vocational and Adult Education - By Delivery Mode (In Value %)

Traditional Face-to-Face Learning

Online Learning

Hybrid Learning - By Curriculum Type (In Value %)

National Curriculum

International Curriculum

– British Curriculum (IGCSE, A-Levels)

– American Curriculum (SAT, AP)

– Indian Curriculum (CBSE, ICSE)

– International Baccalaureate (PYP, MYP, DP)

Examination Boards

– CBSE (Central Board of Secondary Education – India)

– Edexcel and Cambridge (UK)

– International Baccalaureate Organization (IBO)

– College Board (SAT, AP – US) - By Region (In Value %)

Abu Dhabi

Dubai

Sharjah

Ajman

Ras Al Khaimah - By Type of Institution (In Value %)

Public Schools

Private Schools

International Schools

- Market Share of Major Players by Value/Volume, 2024

Market Share Analysis by Educational Segment, 2024 - Cross Comparison Parameters (Institution Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Organizational Structure, Revenue Streams, Enrollment Numbers, Number of Campuses and Locations, Types of Programs Offered)

- SWOT Analysis of Key Institutions

- Pricing Analysis Across Different Educational Levels

- Detailed Profiles of Major Competitors

GEMS Education

Abu Dhabi University

American University of Sharjah

Dubai International Academy

British International School

Al Ain University

Sharjah American International School

International School of Arts & Sciences

Manchester Business School

UAE University

The British University in Dubai

Asia International School

Emirates International School

International Community School

Lycee Francais International Georges Pompidou

- Market Demand Assessment

- Consumer Preferences and Trends

- Budget Allocations and Expenditure Analysis

- Needs and Pain Points Analysis

- Decision-Making Process Analysis

- Future Market Value Projections, 2025-2030

- Future Enrollment Numbers Projections, 2025-2030

- Future Investment Levels Projections, 2025-2030