Market Overview

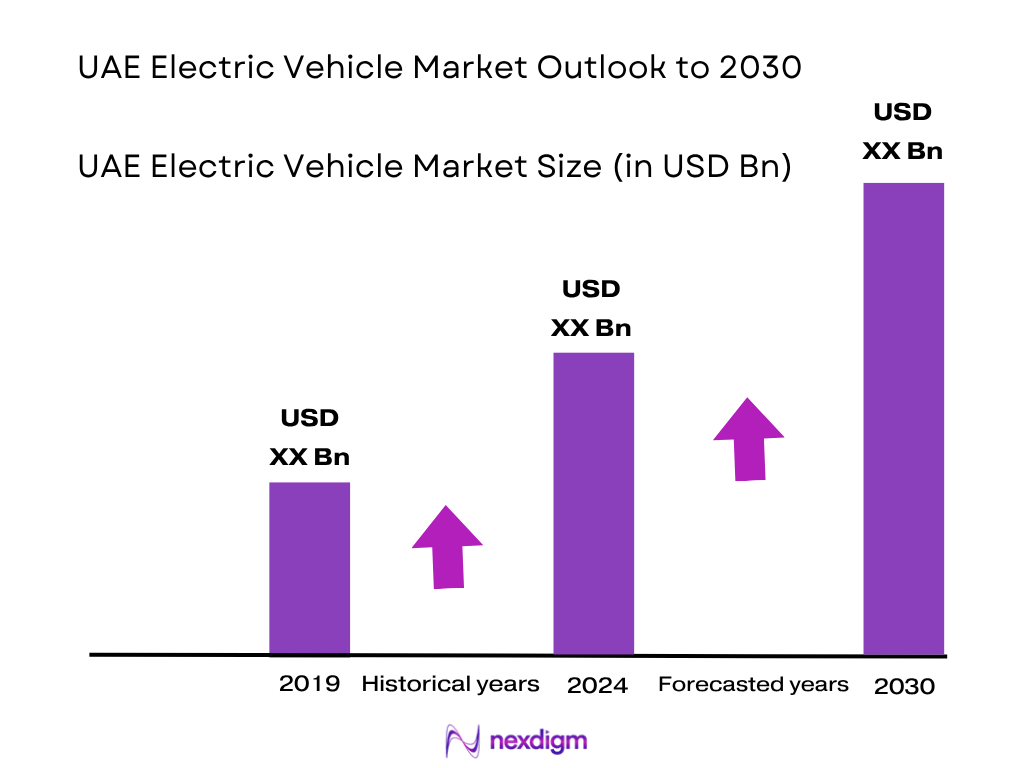

The UAE electric vehicle market is valued at USD 2,220.7 million in 2024. This strong performance reflects rapid electrification trends, particularly in passenger EVs, and is driven by a wide network of over 300 public and private charging stations and rising consumer demand for sustainable transport. The growth is further fueled by government initiatives such as free parking, toll exemptions, and subsidized charging, accelerating EV adoption in both individual and fleet segments.

Dubai and Abu Dhabi dominate UAE EV adoption. Dubai leads due to proactive regulations (e.g., toll exemptions, free charging through DEWA), high urban EV awareness, and an established charging infrastructure. Abu Dhabi’s dominance stems from its strategic long-term investments—plans for approximately 70,000 charging points by 2030—and its integration of EVs within government and commercial fleets. These emirates benefit from focused incentives and infrastructure expansion that together support EV mobility.

Market Segmentation

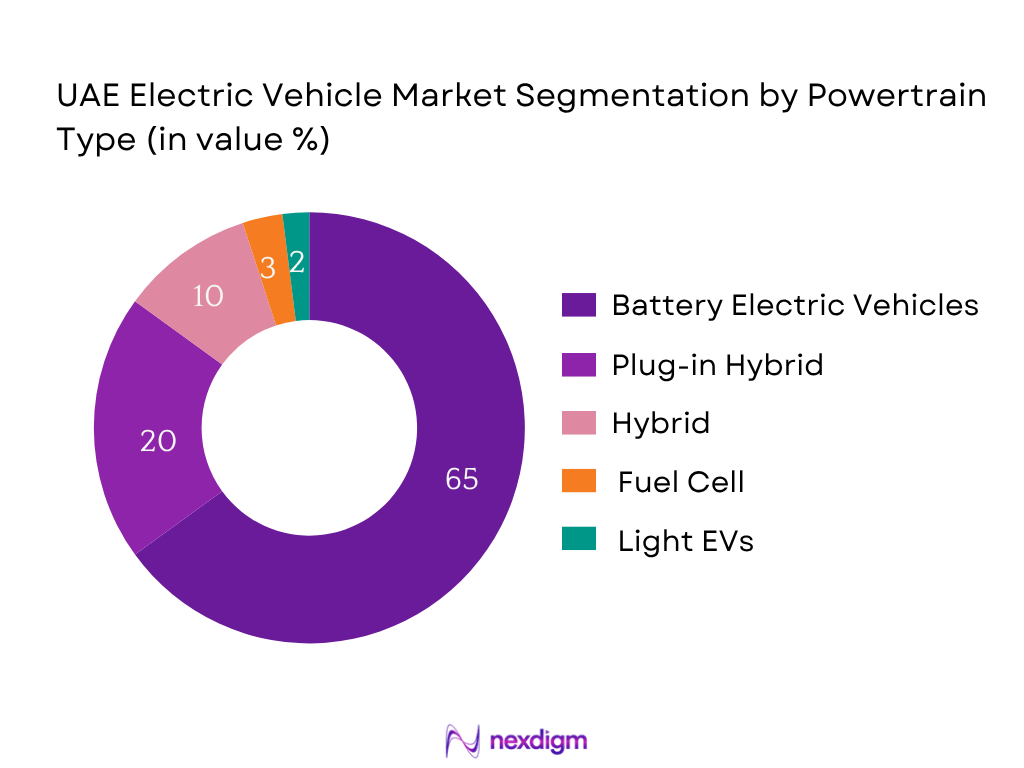

By Powertrain Type

The UAE EV market is segmented into BEVs, PHEVs, HEVs, FCEVs, and LEVs. BEVs dominate with 65% share, driven by stronger incentives for fully electric passenger cars, continuous enhancements in DC fast-charging infrastructure supported by DEWA and ADNOC, and higher consumer preference for zero-tailpipe-emission vehicles. Notably, recent tariffs and growing petrol prices have doubled down on the attractiveness of BEVs.

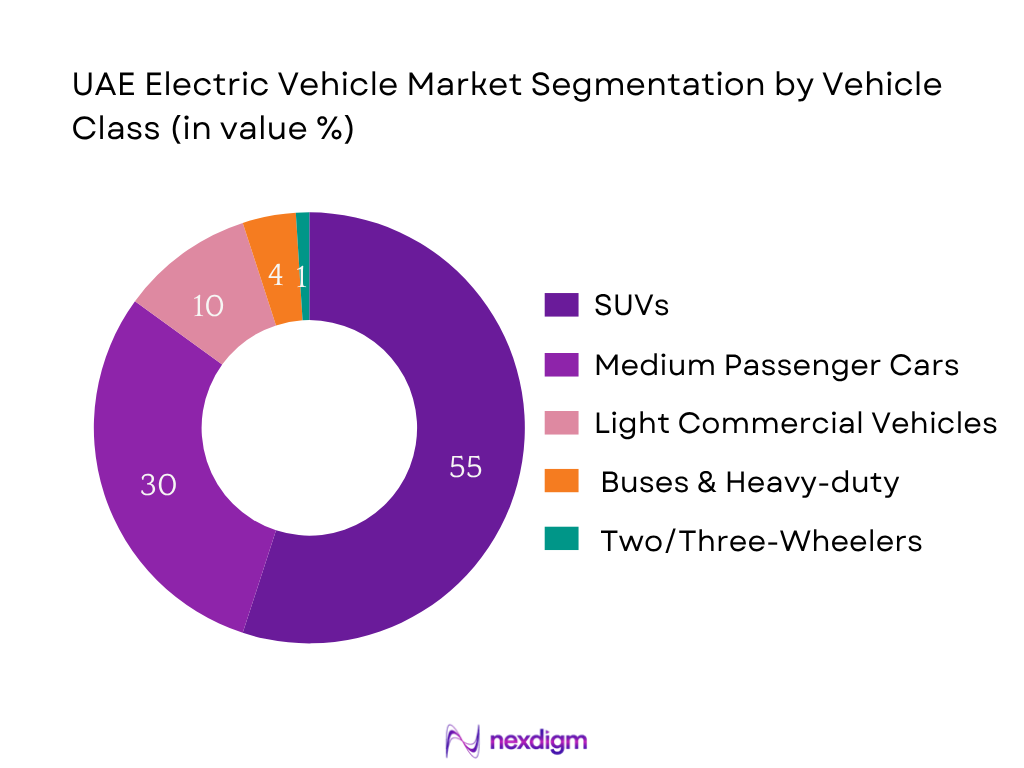

By Vehicle Class

The UAE EV market is also segmented by vehicle class into SUVs/large cars, small/medium cars, light commercial vehicles, buses/heavy-duty, and two/three-wheelers. SUVs and large passenger cars dominate with 55% share, given their popularity in the market and strong alignment with current charging and energy infrastructure. Consumers favor spacious vehicles with substantial range. Strong adoption by rental firms and government entities of EV SUVs further cements this segment’s dominance.

Competitive Landscape

The UAE EV market is characterized by the presence of global OEMs alongside regional partnerships, with competition concentrated among a few key players. Tesla, Mercedes-Benz, BMW, Hyundai, and Lucid dominate the landscape through robust product line-ups, tailored EV financing, charging alliances, and local partnerships.

| Company | Established | Headquarters | Vehicle Range (km) | Battery Tech | Charging Partnerships | UAE-specific Incentives | Direct vs Dealership |

| Tesla | 2003 | Palo Alto, USA | – | – | – | – | – |

| Mercedes-Benz | 1926 | Stuttgart, Germany | – | – | – | – | – |

| BMW | 1916 | Munich, Germany | – | – | – | – | – |

| Hyundai | 1967 | Seoul, S. Korea | – | – | – | – | – |

| Lucid Motors | 2007 | Newark, USA | – | – | – | – | – |

UAE Electric Vehicle Market Analysis

Growth Drivers

Policy Incentives

The UAE’s Federal Corporate Tax and National EV Policy have enabled broad-based incentives—such as free parking, toll exemptions, and subsidized charging—to stimulate EV uptake. As of 2023, the Ministry of Energy and Infrastructure reported 100 new public chargers installed in that year, with plans for 1,000 total chargers across all emirates. Non-oil GDP reaching AED 1.34 trillion in 2024 underscores sustained government capacity to fund such programs via non-oil revenues .

EV Charging Infrastructure Rollout

By end‑2022, Dubai’s DEWA had 350 “EV Green Charger” stations with over 620 connectors, targeting 1,000 by 2025. As of 2023, the UAE hosted approximately 2,000 public EV charging stations—primarily in Dubai, followed by Abu Dhabi—managed by utilities like ADNOC Distribution and Sharjah RTA. This expansion supports over 18 vehicles per public charger currently in use, reflecting the scale and pace of infrastructure build-out.

Market Challenges

High EV Cost

Despite subsidies, base Electric Vehicle models cost AED 150,000–250,000 (~USD 40,800–68,000), far above average car prices. With UAE per-capita GDP at USD 53,900, upfront EV costs remain a significant barrier for private buyers. While non-oil GDP rose to AED 1.34 trillion, disposable spending remains concentrated among high-income expatriates and UAE nationals.

Charging Infrastructure Gaps

Although infrastructure numbers are growing, sufficiency remains low: around 18 EVs per public charger in 2023, compared to under 8 in Saudi Arabia. The ratio signals an infrastructure lag relative to adoption, discouraging inter-emirate travel and hindering fleet electrification.

Opportunities

Green Hydrogen

In February 2024, Britain’s Hycap launched a hydrogen development facility in Abu Dhabi. Meanwhile UAE targets integrating green hydrogen into transport, initially for heavy vehicles and buses. With national energy transition to 44% renewables and nuclear, green hydrogen can be blended into EV-charging frameworks and facilitate future fuel-cell vehicle adoption.

Fleet Electrification

The UAE EV share in total car sales reached 13% in 2023, and 3% of all cars. Government and corporate fleets are prioritizing EVs; logistics operators aim for up to 50% electrification. Strong non-oil growth sectors—transportation, storage—rose 9.6% in 2024, signaling rising demand for electrified commercial fleets.

Future Outlook

Over the next six years, the UAE electric vehicle market is poised for exponential expansion driven by sustained government support, rapid infrastructure deployment, and deepening private-sector participation. Hybrid and plug-in options will compete with BEVs for fleet adoption, while the luxury EV segment—led by Lucid and Tesla—will grow in parallel. Expect continued investment in solar-powered charging, smart-grid integration, and EV‑as‑a‑Service models targeting commercial and logistics sectors.

Major Players

- Tesla

- BMW

- Mercedes-Benz

- Hyundai

- Lucid Motors

- Kia

- MG Motor

- Nissan

- Chevrolet

- Renault

- Volkswagen

- Polestar

- XPeng

- BYD

- Rivian

Key Target Audience

- Sovereign wealth and infrastructure investors

- Investments and venture capitalist firms

- Electric vehicle OEM regional EV division heads

- UAE Ministry of Energy and Infrastructure

- Roads and Transport Authority (RTA) – Dubai

- Abu Dhabi Department of Energy

- Fleet procurement managers (government & corporate)

- Charging network and infrastructure developers

Research Methodology

Step 1: Ecosystem Mapping & Variable Identification

We initiated desk research using secondary and proprietary databases to build a UAE EV market ecosystem (OEMs, chargers, consumers, regulators). Key variables—vehicle volumes, charger counts, policy incentives, and consumer adoption metrics—were defined.

Step 2: Historical Data Analysis

We collected and verified 2018–2023 data on EV sales volume, charger installations, and vehicle class dynamics. Using trend analysis, we reconciled market revenue based on price and volume, supporting the estimated USD 2,220.7 million valuation in 2024.

Step 3: Expert Validation

Our market hypotheses were cross-validated through CATI interviews with industry leaders—OEM regional heads, energy ministry officials, charging infrastructure operators—to obtain real-world insights on pricing, sales, and adoption drivers.

Step 4: Market Synthesis & Verification

A bottom-up build of vehicle forecasts was aligned with top-down revenue estimates. Direct interviews with OEM sales directors and government energy agencies validated charging infrastructure expansion, ensuring consistency across model scenarios.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- EV Market Development Timeline in UAE

- Value Chain and Charging Infrastructure Ecosystem

- Battery Manufacturing and Supply Chain Dynamics

- Regulatory and Incentive Framework for EVs

- Import Dependency and Local Assembly Insights

- EV-related Energy Mix

- Urban vs. Inter-City Mobility Adoption Patterns

- Growth Drivers

Policy Incentives

EV Charging Infrastructure Rollout

Oil Price Volatility

Vision 2030 Objectives - Market Challenges

High EV Cost

Charging Infrastructure Gaps

Limited Local Manufacturing

Battery Disposal & Recycling - Opportunities

Green Hydrogen

Fleet Electrification

Integration with Smart Grids

AI-Enabled Telematics - Market Trends

Luxury EV Uptake

Solar-Powered Charging

Subscription-Based EV Models

EV Financing Innovations - Government Regulation

EV Import Tariffs

Federal Transport Regulations

Renewable Charging Mandates - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value (2019-2024)

- By Volume (2019-2024)

- By Charging Infrastructure Units (2019-2024)

- By Battery Capacity Installed (2019-2024)

- By Import Value (2019-2024)

- By EV Powertrain Type Share (2019-2024)

- By Average Price of EVs (2019-2024)

- By Vehicle Type (In Value %)

Battery Electric Vehicles (BEV)

– Sedans

– SUVs

– Hatchbacks

– Buses and Vans

– Electric Commercial Vehicles

Plug-in Hybrid Electric Vehicles (PHEV)

– Passenger Cars

– Premium and Luxury PHEVs

– Light Commercial PHEVs

Hybrid Electric Vehicles (HEV)

– Mild Hybrid (MHEV)

– Full Hybrid (FHEV)

– Hybrid Buses

Fuel Cell Electric Vehicles (FCEV)

– Hydrogen-Powered Passenger Vehicles

– Hydrogen-Powered Commercial Trucks

– Public Transport (Buses)

Light Electric Vehicles (LEVs)

– E-Scooters

– E-Bikes

– Low-Speed Electric Quadricycles

– Golf Carts - By End-User Type (In Value %)

Individual Consumers

– Private Vehicle Owners

– Early EV Adopters

– Environment-Conscious Buyers

Government Fleets

– Municipality and Utility Vehicles

– Police and Emergency Response Vehicles

– Public Transport Fleets

Corporate Fleets

– Employee Commute Fleets

– Leasing and Rental Companies

– Business Logistics

Ride-Hailing Services

– EV Integration by Operators (Uber, Careem, etc.)

– Subscription-Based EV Usage

Logistics and Delivery Operators

– Last-Mile Delivery EVs

– Urban Delivery Vans

– Micro-Mobility Electric Carts - By Charging Infrastructure Type (In Installed Units %)

AC Level 1

– Residential Wall Sockets

– Low-Capacity Chargers (Up to 2.4 kW)

AC Level 2

– Home Charging Stations

– Office and Parking Lot Chargers

– Malls and Hotel Chargers (7 kW–22 kW range)

DC Fast Chargers

– Public Highway Charging

– Fleet and Commercial Hubs

– High-Speed Urban Chargers (50 kW and above)

Battery Swapping Stations

– Two-Wheelers and LEVs

– Pilot Fleet and Logistics Use Cases

– Compact Urban Hubs

Solar-Based Charging Units

– Smart Solar Charging Canopies

– Eco Parks and Residential Areas

– Off-Grid Charging Installations - By Battery Type (In Value %)

Lithium-ion (LFP – Lithium Iron Phosphate)

Lithium-ion (NMC – Nickel Manganese Cobalt)

Solid-State Battery

Nickel-Metal Hydride

Others - By Emirate (In Value %)

Dubai

Abu Dhabi

Sharjah

Ras Al Khaimah

Others

- Market Share Analysis (By EV Type, By Price Band, By Emirate)

- Cross Comparison Parameters (Company Overview, Vehicle Range, Battery Technology, Charging Network Partnerships, Sales Model (Direct/Dealer), Price Bands, Energy Efficiency (Wh/km), Software/Connectivity Features, Autonomous Readiness Score, UAE-Specific Customizations)

- SWOT Analysis of Major Players

- Pricing Benchmarking

- Detailed Profiles of Major Players

Tesla

BMW

Mercedes-Benz

Hyundai

Kia

MG Motor

Lucid Motors

Nissan

Chevrolet

Rivian

Volkswagen

Renault

Polestar

XPeng

BYD

- EV Penetration in Customer Segments

- Preference for Ownership vs Subscription

- Average Spending on EVs by User Category

- Influencing Purchase Factors

- Fleet Electrification Plans by Large Corporates and Government