Market Overview

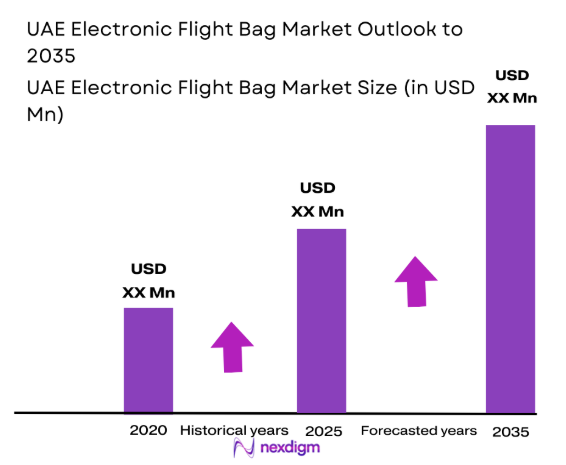

The UAE Electronic Flight Bag market is valued at USD ~ million, driven by the increasing adoption of digital technologies in aviation. The demand is largely fueled by the need for improved operational efficiency and reduced reliance on paper-based systems. The ongoing modernization of aircraft fleets, advancements in EFB technologies, and increasing government regulations for flight operations are significant factors driving market growth. With more airlines and military entities embracing EFB systems, the market continues to expand with a strong growth trajectory.

The UAE is a dominant player in the Middle East due to its strategic location as a major aviation hub. Dubai, in particular, has emerged as a key center for innovation in aviation, with substantial investments from both the government and private sector. The country’s strong regulatory framework, coupled with its high investment in infrastructure, ensures that UAE remains at the forefront of technological advancements in the aviation industry. The region’s favorable economic conditions and support for innovation further solidify its dominance in the market.

Market Segmentation

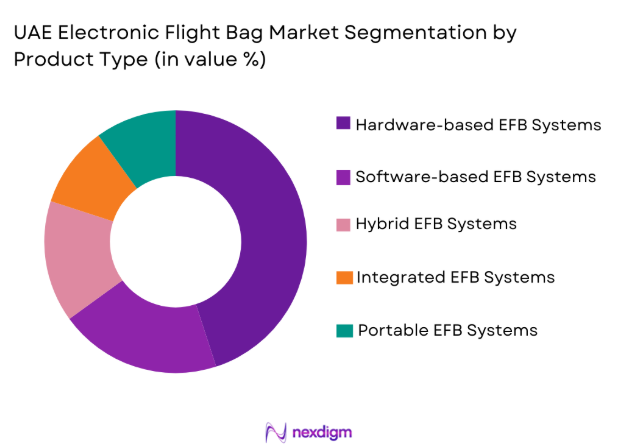

By Product Type:

The UAE Electronic Flight Bag market is segmented by product type into hardware-based EFB systems, software-based EFB systems, hybrid EFB systems, integrated EFB systems, and portable EFB systems. The hardware-based EFB systems currently dominate the market share. This is primarily due to their reliability, extensive infrastructure support, and integration capabilities with existing flight systems. The high cost of software-based solutions and the gradual transition toward hybrid systems have contributed to the preference for hardware-based EFB systems. Additionally, the increasing need for comprehensive data management systems that offer enhanced operational efficiency has led to the growing adoption of hardware-based solutions.

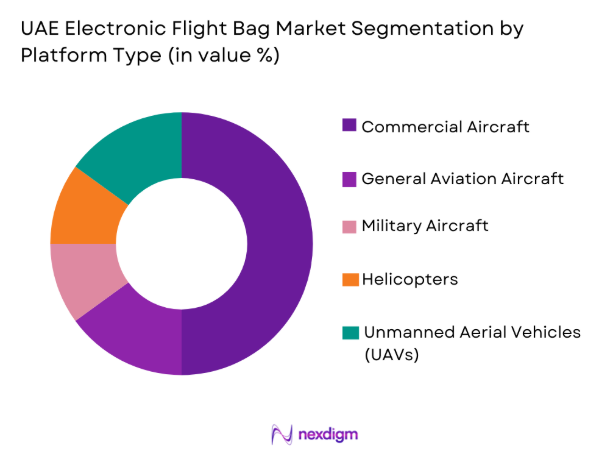

By Platform Type:

The UAE Electronic Flight Bag market is segmented by platform type into commercial aircraft, general aviation aircraft, military aircraft, helicopters, and unmanned aerial vehicles (UAVs). Commercial aircraft dominate the market due to the increasing number of international and domestic flights in the region. The aviation industry’s focus on improving flight safety, reducing operational costs, and enhancing fleet management drives the adoption of EFBs in commercial aircraft. General aviation and military aircraft are expected to show steady growth, but commercial aviation remains the dominant driver due to the size and scale of operations.

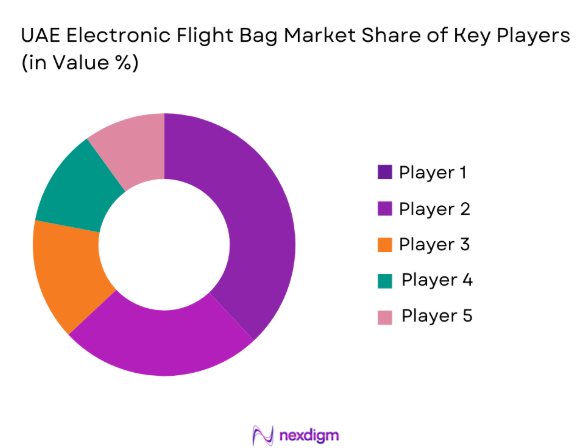

Competitive Landscape

The competitive landscape of the UAE Electronic Flight Bag market is marked by strong consolidation, with a few key players dominating the market. These companies are focused on technological innovation, particularly in the integration of EFB systems with other digital aviation tools. Collaboration with airlines and aviation authorities has also enhanced their market presence. The influence of major players is significant, with constant product updates and technological advancements helping to maintain their competitive edge.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Market-Specific Parameter |

| Honeywell International | 1906 | Morris Plains, USA | ~

|

~

|

~

|

~

|

~

|

| Rockwell Collins | 1933 | Cedar Rapids, USA | ~ | ~

|

~

|

~

|

~

|

| Garmin Ltd. | 1989 | Olathe, Kansas, USA | ~ | ~

|

~

|

~

|

~

|

| Thales Group | 2000 | La Défense, France | ~ | ~

|

~

|

~

|

~

|

| Universal Avionics | 1981 | Tucson, Arizona, USA | ~ | ~

|

~

|

~

|

~

|

UAE Electronic Flight Bag Market Analysis

Growth Drivers

Technological advancements in EFB systems:

The UAE Electronic Flight Bag market is experiencing rapid growth due to technological advancements, including the integration of AI, machine learning, and cloud-based solutions. These innovations enable real-time data synchronization and predictive analytics, which enhance operational efficiency and safety. With the growing demand for digitalization and automation in the aviation sector, EFB systems are becoming increasingly crucial for reducing operational costs, improving workflow, and increasing safety standards. Airlines and military organizations are increasingly investing in these systems as they seek to modernize their fleets and adopt more efficient operational models. The continuous development of more advanced EFB systems, offering predictive insights and better integration with flight management systems, will further drive adoption. As such, technological evolution is one of the key factors driving the expansion of the UAE Electronic Flight Bag market.

Increasing demand for operational efficiency:

Airlines and aviation operators in the UAE are focusing on improving operational efficiency to reduce costs and enhance performance. Electronic Flight Bags have become a key tool in achieving this goal. These systems provide easy access to flight data, streamlining flight planning, reducing paper usage, and enhancing communication between pilots and ground control. The ability to store, manage, and share essential flight information digitally results in time savings, cost reductions, and improved decision-making. Moreover, EFB systems are seen as vital for enhancing flight safety through real-time updates and automated processes. The increasing adoption of EFB solutions is driven by the desire for more streamlined operations and improved regulatory compliance in aviation. This growing emphasis on operational efficiency in both commercial and military aviation sectors contributes to the strong demand for electronic flight bag systems in the region.

Market Challenges

High initial investment:

A major challenge for the UAE Electronic Flight Bag market is the high upfront cost associated with implementing EFB systems. These systems require significant investments in both hardware and software components, which can be a barrier for smaller operators or organizations with limited budgets. While the long-term benefits, such as reduced operational costs and improved efficiency, are clear, the initial capital expenditure remains a major concern. The cost of hardware, such as tablets and display units, along with the integration of software systems into existing infrastructure, can be a substantial financial burden. Additionally, the complexity of retrofitting older aircraft with EFB systems or adopting cloud-based solutions requires further investment in infrastructure. This high initial cost prevents many operators, particularly in general aviation or smaller airline sectors, from adopting EFB systems at the same pace as larger organizations.

Cybersecurity risks:

As the UAE Electronic Flight Bag market continues to grow, the issue of cybersecurity becomes increasingly critical. EFB systems are connected to networks and often rely on cloud-based technologies to manage flight data. This makes them susceptible to cyber threats, such as hacking, data breaches, and ransomware attacks. Given the sensitive nature of the data involved in flight operations, including flight plans, weather information, and navigation details, any breach could lead to serious safety risks. The vulnerability of EFB systems to cyber-attacks presents a significant challenge for market players, as the aviation industry cannot afford to compromise on safety and security. The need for robust cybersecurity measures, including encryption, secure access protocols, and continuous system updates, is paramount to ensuring the reliability and safety of EFB systems. Ensuring compliance with stringent data protection regulations, such as GDPR and other global standards, is also a key challenge in this regard.

Opportunities

Integration with next-gen flight management systems:

A significant opportunity for the UAE Electronic Flight Bag market lies in the integration of EFB systems with next-generation flight management systems (FMS). These integrations enable seamless data exchange between the EFB and flight management systems, allowing for enhanced navigation, real-time data analytics, and predictive maintenance capabilities. This integration can improve flight safety, streamline flight planning processes, and reduce fuel consumption by optimizing flight paths. As airlines and military organizations continue to invest in advanced avionics, the demand for integrated systems is expected to increase, driving the adoption of EFBs. This presents a substantial opportunity for EFB manufacturers to develop more advanced solutions that cater to the growing need for data-driven insights and real-time decision-making tools. Additionally, this integration can support the airline industry’s efforts to meet regulatory requirements for emissions reductions and fuel efficiency.

Growth in general aviation and UAV sectors:

The expansion of general aviation and unmanned aerial vehicles (UAVs) in the UAE presents a major opportunity for the EFB market. While commercial aviation remains the dominant market segment, the increasing demand for general aviation services and the rising adoption of UAVs, particularly in the military and private sectors, are driving growth in the adoption of EFB systems in these segments. As UAVs become more integrated into civilian and military aviation networks, the need for advanced data management and flight operations systems grows. EFB systems are well-suited for integration with UAVs, as they offer enhanced flight data management, real-time updates, and the ability to monitor and adjust flight paths. General aviation operators are also increasingly adopting EFB solutions to streamline operations and improve safety. As these sectors continue to expand, the demand for EFB systems tailored to their specific needs is expected to grow, providing new opportunities for market players.

Future Outlook

The future outlook for the UAE Electronic Flight Bag market is positive, with continued growth expected over the next five years. Technological advancements, including AI, machine learning, and cloud-based systems, will further enhance the capabilities of EFBs, driving their adoption across commercial, military, and general aviation sectors. The push for greener aviation and enhanced safety standards will continue to create demand for EFB systems, while the government’s supportive regulatory environment will facilitate growth. With the ongoing expansion of the UAE’s aviation infrastructure and the increasing need for digitalization, the market will witness significant opportunities for innovation and growth.

Major Players

- Honeywell International

- Rockwell Collins

- Garmin Ltd.

- Thales Group

- Universal Avionics

- L3 Technologies

- Avidyne Corporation

- Jeppesen

- ForeFlight

- Flight Data Systems

- Avionica

- DigiFlight

- Boeing

- Airbus

- Lockheed Martin

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airlines

- MRO service providers

- Aircraft manufacturers

- Military organizations

- Aviation technology integrators

- Aerospace contractors

Research Methodology

Step 1: Identification of Key Variables

We identify key variables influencing market dynamics such as technological trends, customer preferences, and regulatory changes. These variables are essential to understanding market growth drivers and challenges.

Step 2: Market Analysis and Construction

We analyze market data through primary and secondary research, including interviews with industry experts and review of published reports. This analysis helps construct a reliable market framework based on real-world data.

Step 3: Hypothesis Validation and Expert Consultation

We validate our hypotheses by consulting with experts in aviation technology and EFB systems. Their insights help refine the market analysis and ensure its accuracy.

Step 4: Research Synthesis and Final Output

We synthesize the research findings, combine qualitative and quantitative data, and produce a comprehensive market report that offers strategic insights and actionable recommendations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for operational efficiency in aviation

Increase in aircraft fleet size and modernization

Technological advancements in EFB systems - Market Challenges

High initial investment in EFB systems

Regulatory and certification challenges

Cybersecurity concerns related to electronic systems - Market Opportunities

Integration of EFB with AI for enhanced decision-making

Growing demand for electronic data solutions in MRO operations

Emerging market potential in the Middle East and North Africa region - Trends

Shift towards paperless cockpit solutions

Increased adoption of cloud-based EFB systems

Growth in mobile-based EFB applications - Government Regulations

FAA and EASA certification requirements for EFB systems

Data privacy and security regulations for aviation technologies

International airspace usage regulations for UAVs and EFB integration

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Hardware-based EFB Systems

Software-based EFB Systems

Hybrid EFB Systems

Integrated EFB Systems

Portable EFB Systems - By Platform Type (In Value%)

Commercial Aircraft

General Aviation Aircraft

Military Aircraft

Helicopters

Unmanned Aerial Vehicles (UAVs) - By Fitment Type (In Value%)

Cockpit Integration

Cabin Integration

Portable Solutions

Aircraft Retrofit

Onboard Data Systems - By EndUser Segment (In Value%)

Airlines

Charter Operators

Military Organizations

Aircraft Manufacturers

MRO Service Providers - By Procurement Channel (In Value%)

Direct Procurement

Third-party Vendors

OEM Distributors

Online Platforms

Fleet Management Companies

- Market Share Analysis

- CrossComparison Parameters (System Type, Platform Type, End-user Segment, Procurement Channel, Material/Technology, Certification, Software Integration, Hardware Specifications, Region, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Honeywell International

Rockwell Collins

Garmin Ltd.

L3 Technologies

Thales Group

Boeing

Airbus

Avionica

DigiFlight

Universal Avionics Systems Corporation

ForeFlight

EFB Systems

Flight Data Systems

Avidyne Corporation

Jeppesen

- Airlines investing in electronic flight bag upgrades

- Charter operators adopting mobile-based EFB solutions

- Military sectors integrating EFB into defense systems

- Aircraft manufacturers integrating EFB into new aircraft designs

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035