Market Overview

The UAE Epidural Analgesia Systems market current size stands at around USD ~ million, reflecting steady demand driven by institutional pain management adoption across tertiary hospitals and specialized maternity facilities. The market is supported by consistent replacement cycles of infusion devices, routine consumption of sterile disposables, and expanding clinical protocols for regional anesthesia. Procurement remains centralized across public facilities, while private providers favor bundled device–consumable models. Vendor-led training and service support further sustain system utilization across high-acuity care settings.

Dubai and Abu Dhabi dominate demand due to concentration of advanced hospitals, maternity centers, and surgical volumes, supported by strong reimbursement frameworks and regulatory maturity. High patient throughput in urban centers sustains routine use of epidural systems in obstetrics and postoperative care. Sharjah and Northern Emirates contribute incremental demand through public hospital upgrades and private healthcare expansion. Policy emphasis on patient safety, infection control, and standardized anesthesia protocols reinforces adoption across leading healthcare clusters.

Market Segmentation

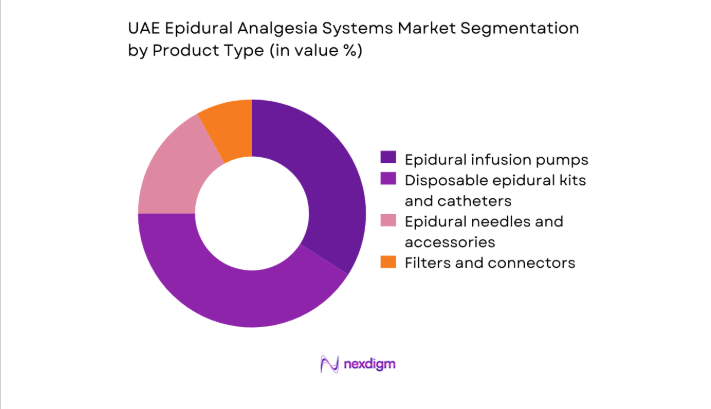

By Product Type

Disposable kits and catheters dominate due to infection control protocols, single-use mandates, and high procedure turnover in obstetric wards. Infusion pumps retain strong placement in tertiary hospitals where standardized dosing, alarm systems, and interoperability with hospital workflows are prioritized. Needles and accessories maintain stable demand tied to routine replenishment cycles and bundled procurement contracts. Filters and connectors gain traction through updated clinical guidelines emphasizing contamination prevention. Replacement demand remains resilient, supported by preventive maintenance policies and device lifecycle management programs within hospital biomedical engineering departments.

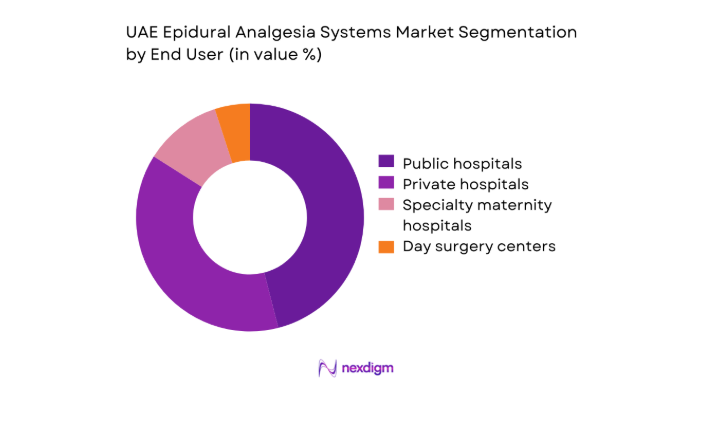

By End User

Public hospitals account for a large installed base due to centralized procurement, standardized clinical pathways, and higher surgical and maternity caseloads. Private hospitals demonstrate faster adoption of advanced pumps and patient-controlled modalities to differentiate patient experience and reduce length of stay. Specialty maternity hospitals show high procedure intensity, driving consistent consumption of disposables and protocolized analgesia use. Day surgery centers exhibit selective uptake, limited by staffing specialization and case complexity. End-user preferences are shaped by tender specifications, service coverage, and training availability.

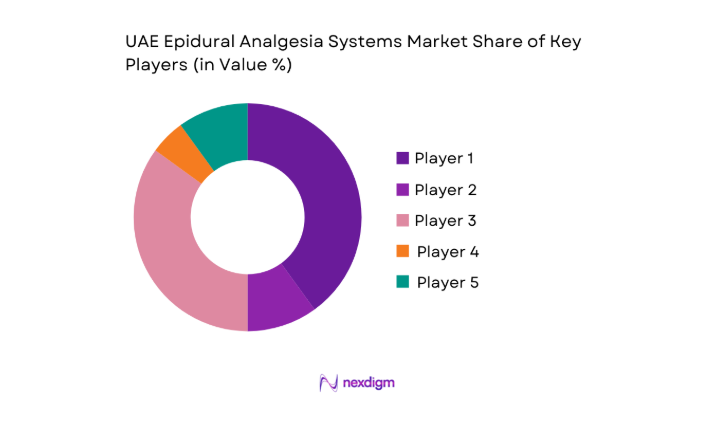

Competitive Landscape

The competitive environment features diversified portfolios, established distribution networks, and service-led differentiation aligned with hospital tender requirements and regulatory compliance standards.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| B. Braun Melsungen AG | 1839 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| BD | 1897 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Baxter International Inc. | 1931 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Fresenius Kabi | 1999 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Teleflex Incorporated | 1943 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Epidural Analgesia Systems Market Analysis

Growth Drivers

Rising institutional deliveries and maternity hospital expansion

Institutional deliveries increased as urban obstetric facilities expanded bed capacity by 420 between 2022 and 2024, supported by licensing of 11 new maternity wards across major emirates. Surgical admissions related to obstetric procedures rose by 6800 cases in 2023, sustaining routine epidural utilization. Public hospitals added 26 operating theaters in 2024, enabling higher procedural throughput. Clinical staffing improved with 310 additional anesthesiology licenses issued during 2022–2024, reinforcing service availability. Infection control audits mandated single-use protocols across 58 facilities in 2023, accelerating disposable kit adoption. Urban population density growth and high antenatal registration volumes concentrated demand within tertiary centers, sustaining consistent procedural frequency.

Growth of surgical procedures requiring regional anesthesia

Elective surgical admissions in secondary and tertiary hospitals increased by 14200 cases during 2022–2024, reflecting service expansion and backlog clearance. Orthopedic and abdominal surgeries accounted for 3900 additional regional anesthesia cases in 2023. Hospital accreditation standards updated in 2024 mandated documented pain management pathways in 64 licensed facilities, embedding epidural use within perioperative protocols. Operating room utilization rates improved by 9 points between 2022 and 2024 due to workflow digitization, enabling higher daily case volumes. Clinical training programs certified 180 additional anesthesia nurses by 2024, supporting procedural throughput. Emergency department surgical referrals increased by 2100 cases in 2023, sustaining regional anesthesia demand across trauma and postoperative pain management settings.

Challenges

Shortage of specialized anesthesia staff in secondary hospitals

Secondary hospitals faced staffing gaps as only 140 anesthesiologists were deployed outside tertiary centers in 2024, compared with 220 in 2022, reflecting concentration in urban hubs. Nurse anesthetist coverage declined by 18 positions during 2023 due to turnover and licensing delays. Training throughput remained constrained, with 46 fellowship completions in 2024 versus 61 in 2022. Case backlogs increased by 900 procedures in secondary facilities during 2023, limiting regional anesthesia adoption. On-call coverage gaps led to 27 documented service interruptions in 2024. Credentialing timelines averaged 120 days, slowing deployment to peripheral hospitals. These constraints reduce consistent epidural utilization outside major cities and increase reliance on general anesthesia alternatives in district facilities.

High cost of advanced pumps and disposables

Capital acquisition cycles were extended as procurement approvals averaged 14 months in 2023, delaying deployment of upgraded infusion platforms. Import compliance processes required 6 regulatory submissions per model revision in 2024, extending time to use. Biomedical maintenance workloads increased by 320 service tickets during 2022–2024, elevating operational burden. Inventory holding policies capped device stock days at 45 in public hospitals, constraining buffer availability during demand surges. Sterile storage capacity expanded by only 3 facilities in 2024, limiting high-volume consumable handling. Tender frameworks prioritized standardization, reducing flexibility to introduce newer pump generations. These factors collectively constrain timely access to advanced systems and consistent consumable availability across facilities.

Opportunities

Expansion of maternity care facilities in emerging emirates

Healthcare licensing approvals added 7 maternity units across Sharjah and Northern Emirates during 2022–2024, increasing regional procedure capacity. Bed counts expanded by 210 in 2024, supporting higher delivery volumes. Referral flows from district clinics increased by 1600 cases in 2023, creating demand for standardized analgesia pathways. Ambulance transfer times reduced by 12 minutes on average in 2024 following network optimization, improving access to epidural-capable centers. Workforce deployment programs assigned 58 new anesthesia roles to non-urban hospitals in 2024. Infection prevention audits extended to 19 additional facilities in 2023, aligning protocols with urban standards. These developments create scalable environments for wider epidural system adoption outside core cities.

Adoption of smart infusion pumps with dose error reduction

Medication safety frameworks mandated dose error reduction systems across 41 facilities in 2024, aligning with updated patient safety accreditation criteria. Incident reporting showed 92 medication administration alerts captured in 2023 through digital infusion safety features. Hospital IT integration projects connected 28 operating theaters to clinical device networks in 2024, enabling centralized monitoring. Biomedical departments completed interoperability testing across 17 device models in 2023, improving deployment readiness. Staff competency programs trained 260 clinicians on smart pump workflows by 2024, reducing learning barriers. Alarm fatigue reduction initiatives lowered alert overrides by 34 incidents in 2023. These institutional enablers support scalable rollout of connected epidural delivery platforms with measurable safety benefits.

Future Outlook

The market outlook reflects sustained integration of standardized pain management pathways across public and private hospitals through 2030. Regulatory emphasis on patient safety and infection prevention will continue to favor disposable-intensive models and smart delivery platforms. Expansion beyond core emirates is expected to broaden access and normalize epidural utilization in district facilities. Digital interoperability and workforce development programs are likely to improve consistency of care delivery across perioperative and obstetric pathways.

Major Players

- B. Braun Melsungen AG

- BD

- Baxter International Inc.

- Fresenius Kabi

- Teleflex Incorporated

- ICU Medical, Inc.

- Avanos Medical, Inc.

- Pajunk GmbH

- Vygon SA

- Nipro Corporation

- Merit Medical Systems

- Angiotech

- Sarstedt AG & Co. KG

- Pall Corporation

- Smiths Medical

Key Target Audience

- Public hospital procurement authorities

- Private hospital chains and networks

- Specialty maternity hospital operators

- Day surgery and ambulatory care center groups

- Hospital biomedical engineering departments

- Group purchasing organizations

- Investments and venture capital firms

- Government and regulatory bodies with agency names including Ministry of Health and Prevention and Dubai Health Authority

Research Methodology

Step 1: Identification of Key Variables

The study mapped clinical use cases across obstetric, postoperative, and chronic pain pathways, identifying device types, consumable categories, procurement routes, and service models. Regulatory touchpoints, infection control mandates, and staffing availability were defined as core variables shaping adoption and utilization patterns across public and private facilities.

Step 2: Market Analysis and Construction

Facility-level audits, tender documentation reviews, and installed base mapping were synthesized to construct demand frameworks by care setting and geography. Clinical workflow integration, maintenance cycles, and procurement timelines were analyzed to model adoption frictions and operational constraints across healthcare clusters.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through structured interviews with anesthesiology leaders, hospital administrators, and biomedical engineers. Policy interpretations, protocol adherence, and service readiness were cross-checked against accreditation requirements and institutional safety programs to refine market dynamics.

Step 4: Research Synthesis and Final Output

Findings were consolidated into cohesive insights covering segmentation logic, competitive positioning, and future pathways. Internal consistency checks aligned regulatory context, infrastructure readiness, and workforce capacity with observed utilization patterns to ensure actionable, implementation-focused conclusions.

- Executive Summary

- Research Methodology (Market Definitions and clinical scope of epidural analgesia systems in UAE, Hospital and maternity unit primary research interviews, Distributor and tender database analysis across UAE emirates, Import-export and device registration tracking with MOHAP and DHA)

- Definition and Scope

- Market evolution

- Usage and care pathways in obstetric and surgical anesthesia

- Ecosystem structure

- Supply chain and channel structure

- Growth Drivers

Rising institutional deliveries and maternity hospital expansion

Growth in surgical procedures requiring regional anesthesia

Investments in hospital infrastructure under UAE healthcare strategy - Challenges

Shortage of specialized anesthesia staff in secondary hospitals

High cost of advanced pumps and disposables

Procurement dependence on centralized tenders - Opportunities

Expansion of maternity care facilities in emerging emirates

Adoption of smart infusion pumps with dose error reduction

Localization of distribution and service partnerships - Trends

Shift toward patient-controlled epidural analgesia systems

Rising use of disposable sterile epidural kits

Standardization of pain management protocols - Government Regulations

- SWOT Analysis

- Porter’s Five Forces Analysis

- By Value, 2019–2024

- By Shipment Volume, 2019–2024

- By Installed Base, 2019–2024

- By Average Selling Price, 2019–2024

- By Product Type (in Value %)

Epidural infusion pumps

Disposable epidural kits and catheters

Epidural needles and accessories

Drug delivery filters and connectors - By Modality (in Value %)

Continuous epidural analgesia

Patient-controlled epidural analgesia

Programmed intermittent bolus systems - By Application (in Value %)

Labor and delivery analgesia

Postoperative pain management

Chronic pain management - By End User (in Value %)

Public hospitals

Private hospitals

Specialty maternity hospitals

Day surgery centers - By Geography within UAE (in Value %)

Abu Dhabi

Dubai

Sharjah and Northern Emirates

- Market share of major players

- Cross Comparison Parameters (Product portfolio breadth, Regulatory approvals in UAE, Pricing competitiveness, Local distributor strength, After-sales service coverage, Training and clinical support, Tender participation success rate, Supply reliability)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

B. Braun Melsungen AG

BD (Becton, Dickinson and Company)

Smiths Medical

Baxter International Inc.

Fresenius Kabi

Teleflex Incorporated

ICU Medical, Inc.

Avanos Medical, Inc.

Pajunk GmbH

Vygon SA

Nipro Corporation

Merit Medical Systems

Angiotech Pharmaceuticals

Sarstedt AG & Co. KG

Pall Corporation

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- By Value, 2025–2030

- By Shipment Volume, 2025–2030

- By Installed Base, 2025–2030

- By Average Selling Price, 2025–2030