Market Overview

The UAE Event Monitors Equipment market current size stands at around USD ~ million and reflects steady demand anchored in expanding cardiac diagnostics capacity, wider deployment of remote patient monitoring, and institutional adoption across acute and ambulatory settings. Procurement cycles favor clinically validated systems integrated with digital platforms, while service coverage and interoperability shape purchasing decisions. The ecosystem benefits from maturing distributor networks, standardized clinical protocols, and growing clinician familiarity with ambulatory rhythm monitoring in routine care pathways.

Demand concentrates in metropolitan healthcare clusters with dense tertiary hospitals and specialty cardiac centers, supported by strong referral networks and telehealth infrastructure. Urban care networks exhibit higher utilization due to integrated diagnostic pathways, established reimbursement workflows, and digital health readiness. Peripheral emirates show accelerating uptake driven by networked care models, mobile diagnostics, and hub-and-spoke service delivery. Policy emphasis on digital health integration, cybersecurity compliance, and clinical quality standards reinforces procurement discipline and system interoperability across provider tiers.

Market Segmentation

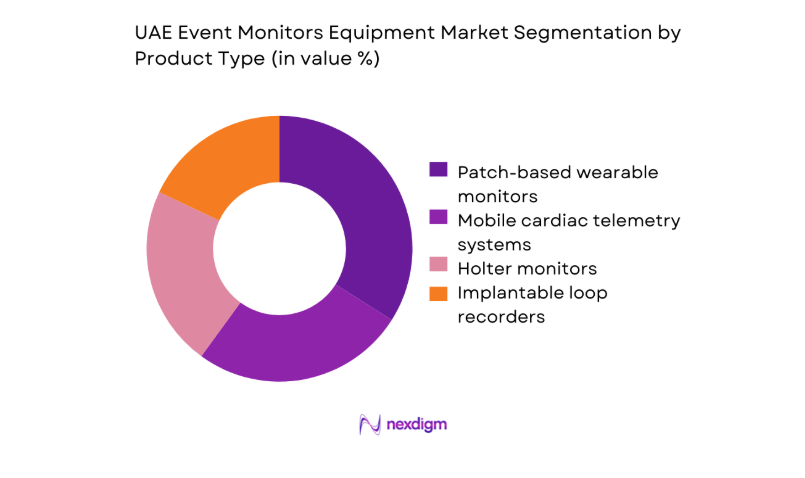

By Product Type

Product mix is shaped by clinical acuity, monitoring duration requirements, and workflow integration. Patch-based wearables dominate ambulatory pathways due to patient adherence, simplified logistics, and streamlined data ingestion into clinician dashboards. Mobile telemetry systems see rising preference in post-procedural surveillance where continuous oversight and rapid triage are prioritized. Traditional Holter devices retain relevance in cost-sensitive settings and short-duration diagnostics. Implantable recorders are selectively adopted for unexplained syncope pathways in tertiary centers with electrophysiology capability.

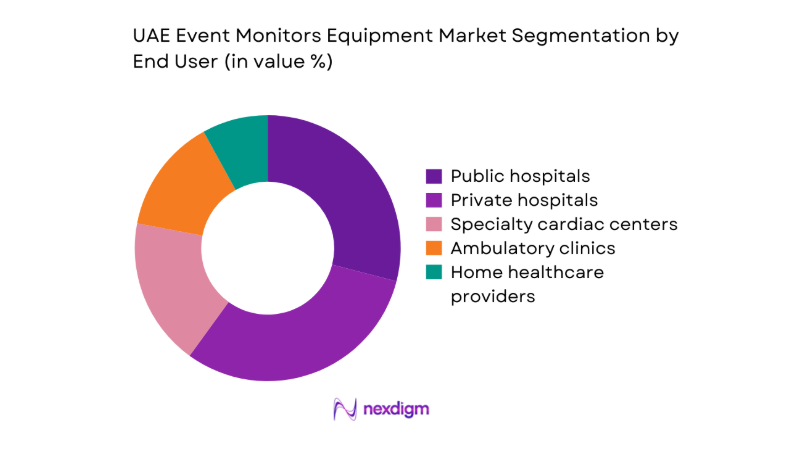

By End User

Utilization patterns vary by care setting maturity, procurement autonomy, and pathway complexity. Tertiary public hospitals anchor complex diagnostics and post-intervention surveillance due to electrophysiology labs and integrated EMR workflows. Private hospitals emphasize patient experience and rapid turnaround, accelerating adoption of wireless and cloud-connected platforms. Specialty cardiac centers prioritize advanced analytics and long-duration monitoring for arrhythmia management programs. Ambulatory clinics focus on throughput and referral coordination, favoring wearable solutions with quick onboarding.

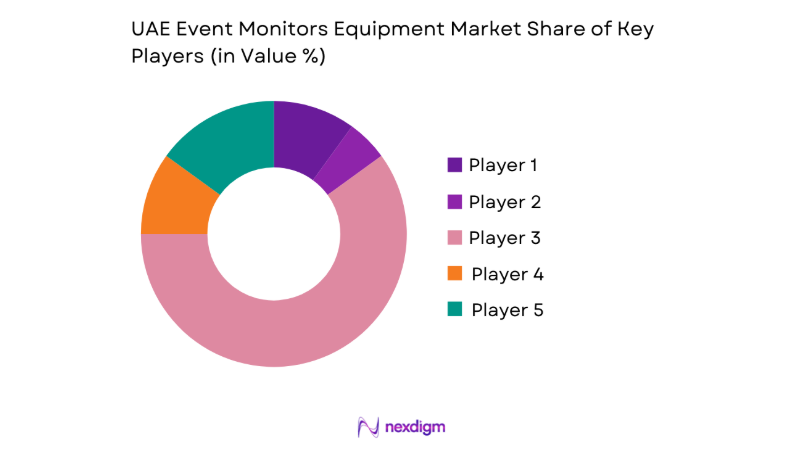

Competitive Landscape

The competitive environment is characterized by differentiated portfolios, service-led contracting, and platform interoperability as primary positioning levers. Procurement decisions prioritize regulatory readiness, cybersecurity compliance, and service coverage across emirates, alongside clinician training and lifecycle support.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Philips Healthcare | 1891 | Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

| GE HealthCare | 1994 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Medtronic | 1949 | Ireland | ~ | ~ | ~ | ~ | ~ | ~ |

| Nihon Kohden | 1951 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Biotronik | 1963 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Event Monitors Equipment Market Analysis

Growth Drivers

Rising cardiovascular disease prevalence in UAE

Clinical registries report 2023 admissions linked to rhythm disorders across tertiary networks reached 18432 cases, up from 16210 in 2022, indicating sustained diagnostic demand. Outpatient cardiology visits in 2024 exceeded 412000 encounters, driven by screening programs and chronic disease management pathways. National noncommunicable disease strategies expanded primary referrals by 2023 through 247 facilities, accelerating ambulatory diagnostics. Emergency department triage protocols in 2024 routed 12890 syncope presentations to rhythm evaluation pathways. Remote monitoring enrollment across public networks reached 3620 patients in 2023, improving continuity of care and driving device utilization across ambulatory and home settings.

Government investments in digital health and smart hospitals

Public sector digital health programs expanded interoperability frameworks across 2023 with 64 hospital systems connected to national exchange layers, improving data ingestion from monitoring devices. In 2024, cybersecurity compliance audits covered 119 clinical applications, enabling procurement of cloud-connected diagnostics. Smart hospital retrofits across 2023 included 27 tertiary facilities adopting remote monitoring workflows integrated into EMR modules. Telehealth utilization volumes in 2024 reached 189000 virtual cardiology consults, increasing reliance on continuous rhythm data. National standards bodies issued 14 technical guidance notes in 2023 to harmonize device connectivity, accelerating procurement approvals and clinical adoption.

Challenges

High upfront device and platform costs

Capital approval cycles in 2023 averaged 214 days across public procurement committees, delaying deployment of monitoring fleets within hospital networks. Budget caps in 2024 constrained replacement cycles, with biomedical inventories showing 38 percent of deployed devices exceeding manufacturer service intervals. Platform onboarding required 19 technical integrations per hospital in 2023, extending implementation timelines. Cybersecurity accreditation in 2024 added 11 compliance checkpoints prior to go-live. Training capacity across networks in 2023 reached only 420 certified technicians nationwide, slowing scale-up. These constraints collectively temper deployment velocity despite rising clinical demand for continuous rhythm monitoring services.

Reimbursement limitations for ambulatory monitoring

Coverage policies in 2023 recognized limited outpatient monitoring pathways, leading to 7460 deferred referrals within public payer programs. Coding updates in 2024 expanded eligible indications by 3 clinical categories, yet reimbursement approval times remained 62 days on average. Private payer preauthorization requests in 2023 exceeded 21800 submissions, creating administrative friction for clinics. Ambulatory clinics reported 2024 no-show rates of 17 for device fitting appointments due to coverage uncertainty. Provider finance teams processed 9 documentation checkpoints per case in 2023, increasing operational overhead and discouraging broader program enrollment across non-acute settings.

Opportunities

Expansion of remote monitoring programs by public health authorities

National care transformation roadmaps in 2023 designated remote monitoring across 41 community clinics, creating new deployment nodes for event monitoring workflows. Home care referrals in 2024 reached 28600 patients with chronic cardiac conditions, expanding continuity pathways beyond hospital walls. Integration pilots across 2023 connected 22 primary care centers to specialist cardiology hubs, enabling shared dashboards for rhythm alerts. Emergency follow-up protocols in 2024 mandated 72-hour monitoring for syncope discharges, increasing utilization across ambulatory kits. Workforce upskilling programs certified 610 nurses in 2023 to manage remote monitoring escalations, supporting sustainable scale.

Adoption of AI-driven arrhythmia analytics in clinical workflows

Clinical informatics programs in 2023 validated algorithmic triage across 18 cardiology departments, reducing manual review queues. Average report turnaround in 2024 decreased to 9 hours following workflow automation across tertiary networks. National interoperability standards in 2023 approved structured rhythm data fields across 24 EMR modules, enabling AI ingestion. Clinical governance committees in 2024 authorized 6 protocol updates for automated alerting thresholds. Training cohorts in 2023 certified 380 clinicians on analytics dashboards, supporting adoption. These enablers position advanced analytics to improve throughput, triage accuracy, and clinician productivity across care settings.

Future Outlook

The outlook through 2030 reflects continued integration of remote monitoring into standard cardiology pathways, expanding coverage across ambulatory and home settings. Regulatory harmonization and interoperability standards will streamline adoption of connected platforms. Urban networks will lead scale-up, while peripheral emirates accelerate via hub-and-spoke models. Workforce upskilling and protocol standardization will support sustainable utilization growth.

Major Players

- Philips Healthcare

- GE HealthCare

- Medtronic

- Abbott Laboratories

- Boston Scientific

- Biotronik

- iRhythm Technologies

- Preventice Solutions

- Bardy Diagnostics

- AliveCor

- Hillrom

- Schiller AG

- Nihon Kohden

- ZOLL Medical

- MicroPort CRM

Key Target Audience

- Hospital procurement departments

- Public hospital networks

- Private hospital groups

- Specialty cardiac centers

- Ambulatory care and diagnostic clinic chains

- Home healthcare providers

- Investments and venture capital firms

- Ministry of Health and Prevention and national regulatory authorities

Research Methodology

Step 1: Identification of Key Variables

Clinical pathways, device categories, data interoperability requirements, and service models were mapped to define the analytical frame. Regulatory readiness and cybersecurity controls were included to reflect procurement constraints. End-user workflows across acute and ambulatory settings were codified to anchor utilization drivers.

Step 2: Market Analysis and Construction

Supply chain structures, channel dynamics, and service coverage across emirates were synthesized. Adoption pathways were constructed across care settings, aligning technology maturity with clinical protocols. Institutional indicators informed demand concentration across metropolitan networks and hub-and-spoke delivery models.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated with clinicians, biomedical engineering leads, and health IT program managers. Implementation barriers, interoperability requirements, and training capacity were stress-tested. Regulatory alignment and cybersecurity compliance workflows were reviewed to refine deployment feasibility.

Step 4: Research Synthesis and Final Output

Findings were integrated into a cohesive narrative linking policy direction, clinical demand, and technology readiness. Cross-sectional insights were reconciled to ensure internal consistency. Outputs were structured for decision use across procurement, service design, and program scale-up.

- Executive Summary

- Research Methodology (Market Definitions and clinical event monitoring device taxonomy, Primary interviews with UAE hospital biomedical engineers and clinicians, Distributor and systems integrator channel mapping in UAE)

- Definition and Scope

- Market evolution

- Clinical usage pathways

- Ecosystem structure

- Supply chain and channel structure

- Growth Drivers

Rising cardiovascular disease prevalence in UAE

Government investments in digital health and smart hospitals

Expansion of ambulatory and home-based cardiac monitoring

Rising private healthcare capacity and cardiac specialty clinics - Challenges

High upfront device and platform costs

Reimbursement limitations for ambulatory monitoring

Data privacy and cybersecurity concerns in cloud-connected devices - Opportunities

Expansion of remote monitoring programs by public health authorities

Adoption of AI-driven arrhythmia analytics in clinical workflows

Partnerships with telehealth platforms and homecare providers - Trends

Shift toward patch-based and wearable cardiac monitors

Increased use of mobile cardiac telemetry for long-term monitoring - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2019–2024

- By Shipment Volume, 2019–2024

- By Installed Base, 2019–2024

- By Average Selling Price, 2019–2024

- By Product Type (in Value %)

Holter monitors

Cardiac event recorders

Mobile cardiac telemetry systems

Implantable loop recorders - By Modality (in Value %)

Wired event monitors

Wireless and Bluetooth-enabled monitors

Patch-based continuous monitors - By Technology (in Value %)

Single-lead ECG

Multi-lead ECG

AI-enabled arrhythmia detection

Cloud-connected remote monitoring platforms - By End User (in Value %)

Public hospitals

Private hospitals

Specialty cardiac centers

Ambulatory care and diagnostic clinics

Home healthcare providers - By Application (in Value %)

Arrhythmia detection

Syncope and palpitations assessment

Post-ablation and post-intervention monitoring

- Market share of major players

- Cross Comparison Parameters (product breadth, monitoring duration capability, AI analytics maturity, cloud platform integration, local service coverage, pricing competitiveness, regulatory approvals in UAE, distributor network strength)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

Philips Healthcare

GE HealthCare

Medtronic

Abbott Laboratories

Boston Scientific

Biotronik

iRhythm Technologies

Preventice Solutions

Bardy Diagnostics

AliveCor

Hillrom

Schiller AG

Nihon Kohden

ZOLL Medical

MicroPort CRM

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- By Value, 2025–2030

- By Shipment Volume, 2025–2030

- By Installed Base, 2025–2030

- By Average Selling Price, 2025–2030