Market Overview

The UAE eVTOL (electric vertical takeoff and landing) aircraft market is expected to experience substantial growth in the coming years. The market is valued at USD ~ million in 2025, driven by advancements in aviation technology, government-backed initiatives, and the rising demand for urban air mobility (UAM) solutions. Factors such as the UAE’s commitment to sustainability, the development of advanced eVTOL models, and ongoing infrastructure investments in vertiports and charging stations have further propelled market growth. Additionally, the growing popularity of air taxis and cargo drones adds to the market’s potential, enhancing the adoption of eVTOL technology for urban mobility. The market trajectory is underpinned by rapid urbanization, a favorable regulatory framework, and a supportive ecosystem for electric aviation.

The UAE, particularly Dubai and Abu Dhabi, is poised to dominate the eVTOL market due to its strong infrastructure, government backing, and forward-thinking urban planning. Dubai has been a pioneer in smart city initiatives and aims to introduce air taxis as part of its strategy to become a global leader in sustainable urban mobility. The Dubai Roads and Transport Authority (RTA) has already started testing eVTOL technology for passenger services. Abu Dhabi, with its focus on innovation and sustainability, also supports eVTOL development through investment in advanced air mobility and aviation-related infrastructure. These cities benefit from high disposable incomes, tech-savvy populations, and a strategic geographic location connecting international trade routes, further driving their dominance in the market.

Market Segmentation

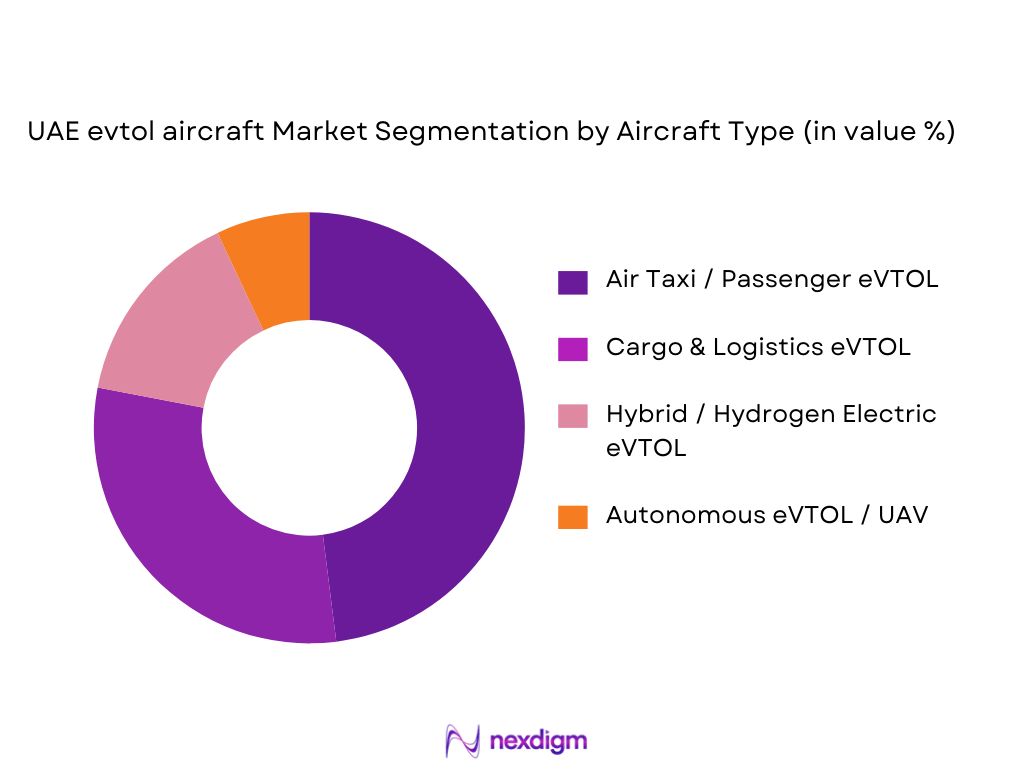

By Aircraft Type

The UAE eVTOL market is segmented into different types of aircraft, including air taxis, cargo eVTOL, hybrid electric eVTOL, and autonomous drones. Among these, the air taxi segment holds the dominant market share. The growing need for fast, eco-friendly, and efficient transportation solutions in urban areas drives the demand for air taxis. Dubai’s ambitious plans to implement autonomous air taxis, backed by investments and favorable regulations, make it the dominant player in the UAE’s eVTOL air taxi market. Additionally, collaborations between eVTOL manufacturers and aviation stakeholders such as Uber Elevate have further solidified the segment’s leadership.

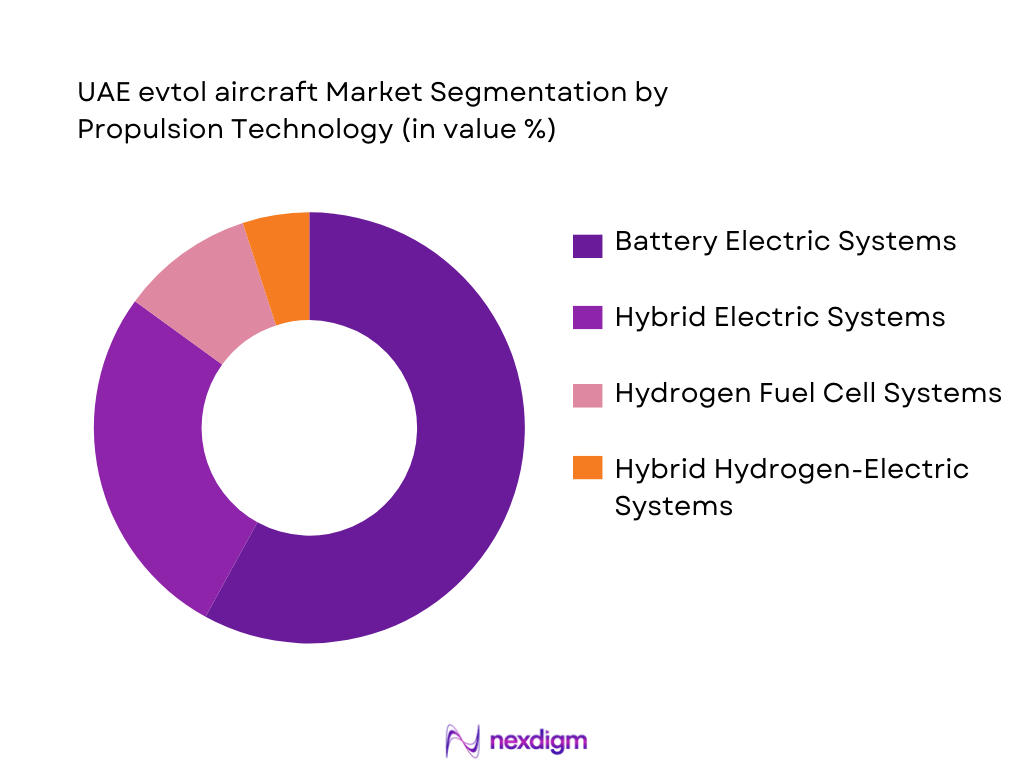

By Propulsion Technology

The propulsion technology segment is dominated by battery electric systems, contributing significantly to the market share in the UAE. The demand for eVTOL aircraft in urban areas aligns well with the advantages of battery electric systems, including minimal environmental impact and ease of scalability for city-based transport networks. The UAE’s focus on sustainability and energy-efficient transportation has further driven the preference for electric propulsion. Hybrid systems are also gaining ground, particularly for long-distance intercity services, but electric-only systems remain the preferred choice for air taxis and short-range operations.

Competitive Landscape

The UAE eVTOL market is currently dominated by several key players that lead in aircraft manufacturing, propulsion technology, and operational planning. Global eVTOL companies like Joby Aviation, Vertical Aerospace, and Volocopter are leading the charge with partnerships and ongoing test flights in the UAE. In addition to these global players, local companies such as EDGE Group, which has invested heavily in autonomous aerial systems, are also gaining prominence in the market.

| Company | Establishment Year | Headquarters | Fleet Size | Technological Edge | Regulatory Approvals | Partnerships | Market Focus | Sustainability Initiatives |

| Joby Aviation | 2009 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Volocopter | 2011 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Vertical Aerospace | 2016 | UK | ~ | ~ | ~ | ~ | ~ | ~ |

| EDGE Group | 2019 | UAE | ~ | ~ | ~ | ~ | ~ | ~ |

| Lilium | 2015 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

UAE evtol Aircraft Market Analysis

Growth Drivers

Urbanisation & Traffic Congestion Solutions

As cities like Dubai and Abu Dhabi experience rapid population growth and urban sprawl, traffic congestion is becoming a major issue. eVTOL aircraft offer an efficient alternative to road transport, enabling fast, congestion-free urban mobility. This is especially crucial in areas with high commuter volumes, making air mobility a compelling solution to ease transportation challenges.

Strategic Government Initiatives (Vision / Smart City Framework)

The UAE government’s Vision 2025 and its Smart City framework emphasize the adoption of cutting-edge technologies to enhance sustainability and improve urban living. These initiatives are directly supporting the development of urban air mobility (UAM), including eVTOL aircraft, with favorable regulations, infrastructure investments, and public-private partnerships aimed at integrating aerial transport systems into the national transportation ecosystem.

Market Challenges

High CapEx and Infrastructure Build‑Out Costs

The capital expenditure required to build a robust infrastructure for eVTOL aircraft, including vertiports, charging stations, maintenance facilities, and air traffic management systems, is substantial. These high upfront costs pose a barrier to market entry and scalability, especially for smaller operators and startups, and can slow the widespread adoption of eVTOL services.

Airspace Regulation Complexity

Integrating eVTOL aircraft into the existing airspace structure is complex, requiring careful management of air traffic, safety protocols, and operational standards. Regulatory bodies like the GCAA (General Civil Aviation Authority) need to develop and enforce specific rules for eVTOL operations, which could take time and limit the pace at which these aircraft can be deployed commercially.

Market Opportunities

Vertiport Infrastructure Expansion

The expansion of vertiport infrastructure is a critical opportunity in the UAE eVTOL market. With government and private sector investments in vertiport construction across cities and strategic hubs, there is potential to create a seamless urban mobility network that connects eVTOL services with other forms of transport, such as buses, taxis, and metro systems, improving accessibility and efficiency.

Regional Cargo & Enterprise eVTOL Services

eVTOL aircraft have the potential to revolutionize cargo transport, particularly for regional and intercity deliveries. By offering faster, more cost-effective solutions for last-mile logistics and enterprise services, eVTOLs could cater to growing demand in e-commerce, healthcare (e.g., medical supplies), and general cargo, creating a new revenue stream in the UAE’s logistics sector.

Future Outlook

Over the next few years, the UAE eVTOL market is poised for rapid expansion, driven by a combination of technological advancements, strategic investments in infrastructure, and growing demand for urban air mobility solutions. Government initiatives such as Dubai’s Smart City and the National Innovation Strategy are expected to fuel this growth, alongside increasing interest from investors in sustainable transport solutions. As the regulatory landscape continues to evolve and more eVTOL models achieve certification, the UAE will likely solidify its position as a global leader in electric aviation. We expect to see increased adoption of air taxis, cargo eVTOLs, and autonomous flight systems in both urban and intercity mobility networks.

Major Players

- EDGE Group (UAE eVTOL R&D & ISR Platforms)

- Joby Aviation (Commercial eVTOL Partner in Dubai)

- Archer Aviation (eVTOL & Powertrain Partner)

- Lilium (Regional Mobility & Strategic Middle East Push)

- EHang (Autonomous eVTOL Platforms)

- Volocopter (Urban AAM Services)

- Vertical Aerospace

- Airbus AAM Division

- Toyota / Wisk Aero (Tech Partners)

- EmbraerX (Advanced AAM Programs)

- Embention (Avionics & Autopilot Facility in UAE)

- LuftCar (Hydrogen & Vertiport Solutions)

- Vista Global (Aviation & Transition Services)

- ADASI (Autonomous Systems & Integration)

- Air Race E (Electric Propulsion Advancements

Key Target Audience

- Investors and Venture Capitalist Firms

- Aerospace & Aviation Manufacturers

- Urban Mobility & Transport Authorities (e.g., RTA, GCAA)

- Government Regulatory Bodies (e.g., UAE Civil Aviation Authority)

- Airline Operators

- Logistics & Cargo Service Providers

- Infrastructure Developers (Vertiports, Charging Stations)

- Electric Propulsion Technology Developers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the UAE eVTOL Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the UAE eVTOL Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIS) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple eVTOL manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the UAE eVTOL market.

- Executive Summary

- Research Methodology (Market definitions, terminology specific to eVTOL/UAM, data sources (primary, secondary), market sizing and forecasting technique, triangulation, vendor interviews, and analytical models)

- Definition & Scope of the UAE evtol Aircraft Market (including UAM, Air Taxi, Cargo eVTOL, AAM ecosystem)

- Genesis and Evolution of eVTOL in UAE transport strategy

- Macro Drivers (urbanisation, Smart Dubai & Vision initiatives, sustainability commitments)

- Business Cycle & Adoption Curve specific to UAE market maturity

- Supply Chain & Value Chain Insights (airframe, propulsion, avionics ecosystem, vertiport infrastructure)

- Growth Drivers

Urbanisation & Traffic Congestion Solutions

Strategic Government Initiatives (Vision / Smart City Framework)

Favorable Regulation and Accelerated Certification Pathways

Infrastructure Investment (vertiports, charging, digital controls)

Air Taxi Agreements (e.g., exclusive operator partners) - Market Challenges

High CapEx and Infrastructure Build‑Out Costs

Airspace Regulation Complexity

Public Perception & Safety Concerns

Energy & Supply Chain Constraints

Integration With Conventional Aviation - Market Opportunities

Vertiport Infrastructure Expansion

Regional Cargo & Enterprise eVTOL Services

Tourism & Premium Mobility Packages

Autonomous Flight Systems

Export Hub Potential for MENA - Market Trends

Hydrogen Electrification Adoption

Digital Air Traffic Management (U‑ATM) Systems

Vertiport Ecosystems as Service Platforms

Integration with Ride‑Hailing and Mobility Apps

Battery Technology & Mission Range Improvements

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Aircraft Type (In Value %)

Air Taxi / Passenger EVTOL (UAM services)

Cargo & Logistics EVTOL

Hybrid / Hydrogen‑Electric EVTOL

Autonomous EVTOL & UAV Versions

Specialised ISR / Defence EVTOL

- By Propulsion Technology (In Value %)

Battery‑Electric Systems

Hybrid Electric Systems

Hydrogen Fuel Cell Electrification

Hybrid Hydrogen‑Electric

- By End‑Use / Application (In Value %)

Urban Commuter Services

Intercity Regional Mobility

Cargo & Logistics (last‑mile, B2B deliveries)

Emergency Services & Medical Evacuation

Defence & Security Support

- By Vertiport & Connectivity Infrastructure (In Value %)

Airport Vertiports (Intermodal)

Urban Vertiports (City Core)

Regional Vertiports (Intercity Networks)

Charging / Maintenance Hubs

Airspace Management & Digital Infrastructure

- By Regulatory & Certification Landscape (In Value %)

GCAA Safety & Operational Standards

Vertiport Space Allocation & Air Traffic Integration

Flight Rules & eVTOL Traffic Management

Insurance & Risk Compliance

Public Acceptance & Policy Incentives

- Market Competitive Structure

Market Share by Revenue and eVTOL Deployments

Public vs Private Operators’ Footprint

Region‑wise Deployment Dynamics (Dubai vs. Abu Dhabi vs. Others) - Cross‑Comparison Parameters (Fleet Size in UAE Market, Vertiport Access Agreement, Operating Permits & License Footprints, Propulsion Tech Deployed, Unit Cost and CapEx Profile, Route Utilization & Load Factors, Safety & Certification Milestones, Strategic Partnerships & Local Alliances)

- SWOT Analysis of Major Competitive Entities

- Pricing & Commercialization Models

- Per Passenger Ticket Pricing

- Subscription & Membership Mobility Models

- Cargo Pricing Structures

- Infrastructure Usage & Access Charges

- Detailed Competitive Profiles

EDGE Group (UAE eVTOL R&D & ISR Platforms)

Joby Aviation (Commercial eVTOL Partner in Dubai)

Archer Aviation (eVTOL & Powertrain Partner)

Lilium (Regional Mobility & Strategic Middle East Push)

EHang (Autonomous eVTOL Platforms)

Volocopter (Urban AAM Services)

Vertical Aerospace

Airbus AAM Division

Toyota / Wisk Aero (Tech Partners)

EmbraerX (Advanced AAM Programs)

Embention (Avionics & Autopilot Facility in UAE)

LuftCar (Hydrogen & Vertiport Solutions)

Vista Global (Aviation & Transition Services)

ADASI (Autonomous Systems & Integration)

Air Race E (Electric Propulsion Advancements

- Demand Drivers (commuters, tourists, enterprise logistics)

- Acceptance Curves & Willingness to Pay

- Fleet Utilisation Metrics & Peak Demand Patterns

- Public vs Corporate Purchase Trends

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035