Market Overview

The UAE general aviation market is valued in billions ~ USD, driven by significant growth in private and business aviation sectors. Based on a recent historical assessment, this market benefits from increasing demand for both commercial and private aircraft services. The UAE government has supported this expansion through strategic investments in aviation infrastructure and regulatory reforms, contributing to a steady rise in fleet size and technological advancements in avionics and aircraft management systems.

Dubai, Abu Dhabi, and Sharjah dominate the general aviation landscape due to their advanced airport infrastructure, business-friendly environment, and robust tourism and corporate sectors. These cities attract both private and business aviation users due to their strategic geographical location as aviation hubs in the Middle East. Additionally, government-backed initiatives in infrastructure development and aviation regulations further cement their leadership positions in the regional market.

Market Segmentation

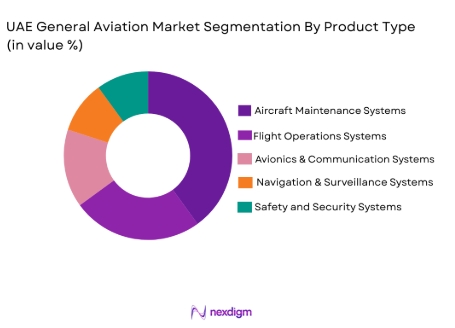

By Product Type:

The UAE general aviation market is segmented by product type into aircraft maintenance systems, flight operations management systems, avionics and communication systems, navigation and surveillance systems, and safety and security systems. Recently, avionics and communication systems have dominated market share due to advancements in technology, improving efficiency in communication, and navigation. These systems are essential for ensuring safety, reliable connectivity, and operational effectiveness, which are in high demand across various sectors including private aviation, government agencies, and commercial operators.

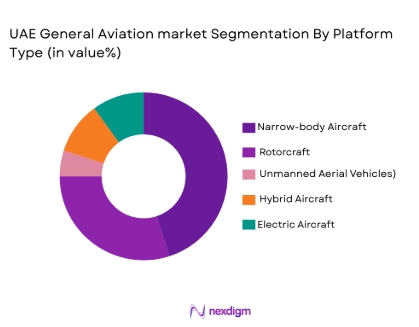

By Platform Type:

The UAE general aviation market is segmented by platform type into fixed-wing aircraft, rotorcraft, unmanned aerial vehicles (UAVs), hybrid aircraft, and electric aircraft. Recently, fixed-wing aircraft have captured the largest market share, driven by their versatility and essential role in both commercial and private aviation operations. Fixed-wing aircraft are highly favored for long-distance travel, offering reliability and operational efficiency, particularly in corporate and government fleets, which have further increased their demand.

Competitive Landscape

The UAE general aviation market features intense competition, with both established and emerging players vying for market share. The influence of major players is significant, as they continue to push for consolidation, form partnerships, and expand their technology portfolios to remain competitive. This dynamic leads to continuous innovation, with players focusing on upgrading fleets and developing advanced systems for aviation safety and management.

|

Company Name |

Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Emirates Aviation | 1985 | Dubai, UAE | ~ | ~ | ~ | ~ | ~ |

| Abu Dhabi Aviation | 1981 | Abu Dhabi, UAE | ~ | ~ | ~ | ~ | ~ |

| Gulfstream Aerospace | 1958 | Savannah, USA | ~ | ~ | ~ | ~ | ~ |

| Bombardier | 1942 | Montreal, Canada | ~ | ~ | ~ | ~ | ~ |

| Textron Aviation | 1923 | Wichita, USA | ~ | ~ | ~ | ~ | ~ |

UAE General Aviation Market Analysis

Growth Drivers

Rising demand for private and business aviation:

The demand for private and business aviation in the UAE has surged significantly, driven by the rapid expansion of both sectors. As one of the most prominent hubs for international business and tourism, the UAE has become an attractive destination for private owners who require efficient, flexible transportation options. The rise of luxury tourism, fueled by the growing number of high-net-worth individuals, has further intensified this demand, as these individuals seek personalized travel experiences that offer convenience and comfort. The UAE’s strategic location, coupled with its world-class infrastructure, makes it a prime location for private and business aviation services. The increasing need for customized travel solutions is a key factor driving this growth, as businesses and affluent individuals require highly specialized services that meet their operational and leisure needs. In addition, corporate fleets are expanding as companies realize the benefits of having dedicated, on-demand transportation to improve operational efficiency, privacy, and flexibility. As businesses continue to grow, the demand for private aviation services is expected to rise, encouraging more companies to invest in aviation capabilities, fleet expansions, and customized aviation solutions. This rising demand reflects a broader global trend of seeking time-efficient, secure, and flexible transportation options, and the UAE is positioned to benefit from this shift toward more personalized aviation experiences.

Strategic government initiatives in aviation:

The UAE government has played an essential role in driving market growth through its proactive investments in aviation infrastructure and regulatory reforms. By continually expanding and modernizing key airport facilities, the government ensures that the country remains a leading hub for aviation services, accommodating growing demand for both commercial and private aviation. The government’s focus on expanding existing airports, building new terminals dedicated to private aviation, and upgrading air traffic control systems highlights its commitment to strengthening its aviation sector. Additionally, the UAE government has introduced several policies aimed at attracting foreign investment and fostering the development of aviation-related businesses. These policies include favorable tax regimes, reduced regulatory barriers, and incentives for international companies to set up operations in the country. The government’s consistent efforts to create a business-friendly environment, coupled with its focus on world-class infrastructure, have made the UAE an increasingly attractive destination for private aviation operators and international aviation-related investments. The government’s strategic initiatives ensure that the UAE remains a competitive player in the global aviation market, providing an environment conducive to the continued growth of private and business aviation services. These efforts, along with continued support for the private aviation sector, contribute to the UAE’s dominance in the Middle East’s aviation landscape and make it a key player on the global stage.

Market Challenges

High operational costs:

The high operational costs associated with running general aviation services remain a significant challenge for operators in the UAE. These expenses encompass a range of factors, including the maintenance and repair of aircraft, which are critical for ensuring safety and operational efficiency. Fuel costs also represent a major financial burden, particularly with fluctuating global oil prices that can affect the overall cost structure. Moreover, the need for highly skilled personnel, including pilots, engineers, and support staff, further adds to the operational overheads, as the aviation sector requires specialized training and certifications. This is particularly challenging for small and medium-sized operators who often lack the financial flexibility of larger players. These operators may struggle to absorb these high costs, limiting their ability to expand their fleets or service offerings. Furthermore, the capital-intensive nature of the aviation industry—requiring significant investment in aircraft, maintenance facilities, and regulatory compliance—exacerbates the difficulty for new entrants to gain a foothold in the market. For many, achieving profitability becomes a long-term challenge, and only the most financially robust companies can manage the rising costs while maintaining competitive pricing. With increasing competition from both established players and new entrants, the ability to manage operational costs effectively becomes a critical factor for survival and growth in the UAE’s general aviation market.

Regulatory hurdles and compliance issues:

While the UAE has made considerable progress in creating a favorable environment for general aviation, operators face an intricate landscape of regulations that can significantly hinder operational efficiency. These regulations cover a wide range of aspects, including stringent safety standards, certification requirements, and air traffic management protocols, which vary across different aircraft types and platforms. Navigating through these regulatory frameworks can be time-consuming and often requires specialized legal and compliance teams, resulting in added administrative costs. Furthermore, as general aviation services often involve international operations, operators are also required to comply with a complex set of international aviation laws and standards. The challenge of coordinating these diverse regulations from different jurisdictions can create bottlenecks in operations, affecting the timeliness of services and increasing operational risks. Additionally, changes in regulations or the introduction of new compliance measures can result in unexpected costs for operators, who may need to invest in new equipment, training, or legal consultations to meet evolving standards. As a result, regulatory hurdles not only increase the financial burden on operators but can also limit the ability of smaller businesses to scale up their operations or enter the market. The complexity and constant evolution of these regulatory frameworks mean that compliance is an ongoing challenge that can hinder the smooth operation and long-term growth prospects of general aviation companies within the UAE.

Opportunities

Development of electric and hybrid aircraft technology:

One of the most promising opportunities in the UAE general aviation market is the development and adoption of electric and hybrid aircraft technologies. These advancements are expected to revolutionize the aviation industry by reducing both operational costs and environmental impact, making them an attractive option for stakeholders looking to decrease their carbon footprint and energy consumption. As global awareness of environmental issues continues to rise, there is increasing pressure on the aviation sector to embrace sustainable technologies. Electric-powered aircraft, in particular, present an opportunity to significantly reduce fuel consumption and emissions, which could lead to lower operating costs for aviation operators. The potential for electric and hybrid aircraft to deliver shorter and more efficient flights with less maintenance compared to traditional fuel-powered aircraft further enhances their appeal. This growing demand for eco-friendly aviation solutions is especially relevant in the UAE, where there is a strong push to diversify its economy and become a global leader in sustainability initiatives. The UAE government’s proactive stance on supporting green technologies through favorable regulatory frameworks, incentives, and research funding also sets the stage for the country to become a leader in the adoption of electric and hybrid aviation technologies. By investing in these innovations, the UAE has the potential to attract eco-conscious consumers and businesses, positioning itself as a pioneering market for sustainable aviation solutions. As the global aviation industry continues to shift toward greener solutions, the UAE’s commitment to electric and hybrid aircraft could strengthen its position as a key player in the Middle East’s aviation sector.

Growth in regional tourism driving aviation demand:

The UAE’s expanding role as a premier global tourist destination presents significant opportunities for growth in the general aviation market, particularly in the private and business aviation sectors. With the continued growth of international tourism and an increasing number of regional travelers flocking to the UAE for both leisure and business, the demand for high-quality, efficient, and flexible aviation solutions is expected to rise substantially. This surge in demand for personalized and high-end travel options is bolstered by the UAE’s strategic position as a gateway between the East and West, along with its status as a global business hub and a luxury tourism hotspot. As the number of high-net-worth individuals and business executives visiting the region continues to grow, so does the need for private aviation services that can offer more seamless, convenient, and personalized travel experiences. The UAE government has been instrumental in fostering this growth through substantial investments in state-of-the-art airports and world-class infrastructure dedicated to private aviation. These efforts include the development of luxurious terminals, upgraded facilities, and enhanced services tailored to the needs of affluent travelers, which cater to the rising demand for private aircraft, charter flights, and customized aviation services. Additionally, the UAE’s continued focus on enhancing tourism initiatives, such as hosting global events like the World Expo and other large-scale conferences, drives even greater demand for efficient transportation solutions. The expansion of regional tourism provides operators with the opportunity to diversify their fleet offerings and enhance their service portfolio to cater to the growing demand for private and business aviation services. With the government’s ongoing support for aviation-related infrastructure and services, the UAE’s aviation sector is well-positioned to capitalize on the rising tourism trends and cater to the needs of travelers seeking personalized, efficient, and luxurious travel experiences.

Future Outlook

The UAE general aviation market is expected to continue growing rapidly over the next five years. Demand for private and business aviation services is anticipated to increase as the tourism and corporate sectors expand. Technological advancements in electric and hybrid aircraft will also play a pivotal role in shaping the market, alongside government support for infrastructure development and regulatory reform. Increasing demand for sustainable aviation options and investments in modern aircraft technologies will drive the market forward.

Major Players

- Emirates Aviation Group

- Abu Dhabi Aviation

- Gulfstream Aerospace

- Bombardier

- Textron Aviation

- Cessna

- Raytheon Technologies

- Boeing

- Honeywell Aerospace

- Airbus

- Leonardo

- Dassault Aviation

- Gulf Air

- Lockheed Martin

- Sikorsky Aircraft

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Private aviation companies

- Aircraft manufacturers

- Aviation fleet operators

- Corporate and luxury service providers

- Airports and ground service providers

- Aviation infrastructure developers

Research Methodology

Step 1: Identification of Key Variables

In this step, key market variables are identified based on the scope of the research. This involves determining which factors influence the market and categorizing them into measurable parameters for analysis.

Step 2: Market Analysis and Construction

The next phase involves analyzing market data from secondary and primary sources to construct a comprehensive market model. This includes evaluating trends, market size, and growth drivers.

Step 3: Hypothesis Validation and Expert Consultation

At this stage, the initial findings are validated through consultation with industry experts and stakeholders to refine the analysis and confirm the validity of hypotheses.

Step 4: Research Synthesis and Final Output

The final stage synthesizes the research into actionable insights and recommendations, culminating in the delivery of the final report that provides a clear view of market dynamics.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for private and business aviation services

Expansion of tourism and leisure sectors driving flight needs

Government investment in aviation infrastructure development - Market Challenges

High operational costs for general aviation

Lack of sufficient airspace and aviation infrastructure

Regulatory hurdles and compliance challenges - Market Opportunities

Development of electric and hybrid aircraft technology

Integration of AI and automation in flight operations

Strategic partnerships for aircraft fleet expansions - Trends

Rising demand for urban air mobility solutions

Advancements in aviation safety technologies

Growing use of AI and big data in flight management - Government Regulations & Defense Policy

Introduction of regulations for urban air mobility

Government support for aviation industry expansion

Policies to promote green aviation technologies - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Aircraft Maintenance Systems

Flight Operations Management Systems

Avionics & Communication Systems

Navigation & Surveillance Systems

Safety and Security Systems - By Platform Type (In Value%)

Fixed-wing Aircraft

Rotorcraft

Unmanned Aerial Vehicles (UAVs)

Hybrid Aircraft

Electric Aircraft - By Fitment Type (In Value%)

OEM Systems

Aftermarket Solutions

Retrofit Systems

Modular Systems

Integrated Systems - By EndUser Segment (In Value%)

Private Owners

Commercial Operators

Airports & Ground Service Providers

Government Agencies

Corporate Fleets - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Auction/Online Bidding Platforms

Third-party Distributors - By Material / Technology (In Value%)

Carbon Fiber Composites

Advanced Avionics Technologies

Lightweight Alloys

Lithium-ion Batteries

Aerostructure Materials

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Material / Technology, Geographic Presence, Service Offerings)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Emirates Aviation Group

Al Habtoor Group

Abu Dhabi Aviation

Dubai Aviation Corporation

Falcon Aviation Services

Maximus Air

Airbus

Boeing

Honeywell Aerospace

Dassault Aviation

Gulfstream Aerospace

Bombardier

Cessna

Textron Aviation

- Increasing adoption of private aircraft among high-net-worth individuals

- Growing role of government in regulating and developing the aviation sector

- corporate fleets expanding their aircraft operations

- Airports and ground services providers investing in modernization

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035