Market Overview

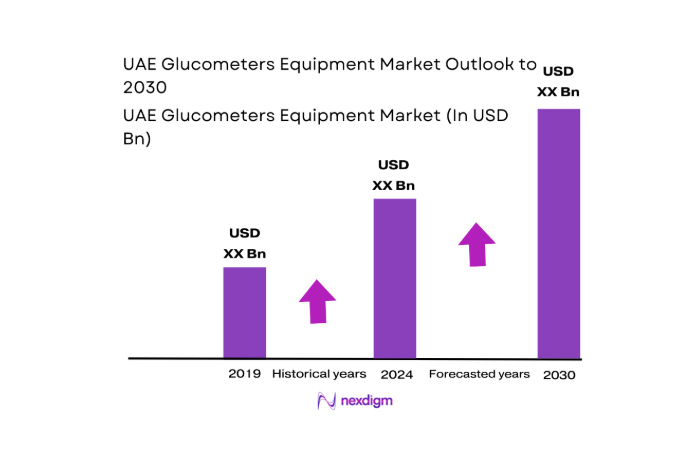

The UAE Glucometers Equipment market is valued at USD ~ and driven by the increasing prevalence of diabetes in the country. The demand for blood glucose monitoring devices continues to rise due to heightened health awareness, the need for effective diabetes management, and increasing healthcare accessibility. The market encompasses a wide range of devices, including Self-Monitoring Blood Glucose Meters (SMBG), Continuous Glucose Monitoring (CGM) systems, and connected glucometers. These devices are integral to helping patients track glucose levels, manage diabetes more effectively, and improve overall health outcomes. As healthcare professionals and patients continue to prioritize real-time monitoring solutions, the demand for advanced glucometers is expected to grow substantially.

Dubai and Abu Dhabi lead the UAE Glucometers Equipment market, driven by their advanced healthcare infrastructure and high-income population. These cities boast sophisticated medical facilities and are home to large expatriate populations who demand modern healthcare solutions. Additionally, Dubai’s position as a regional healthcare hub and Abu Dhabi’s well-established public and private healthcare systems play a crucial role in shaping market dynamics. The adoption of innovative glucose monitoring technologies, such as Continuous Glucose Monitoring (CGM) and mobile-integrated devices, is predominantly concentrated in these urban areas due to their higher access to technology and healthcare services.

Market Segmentation

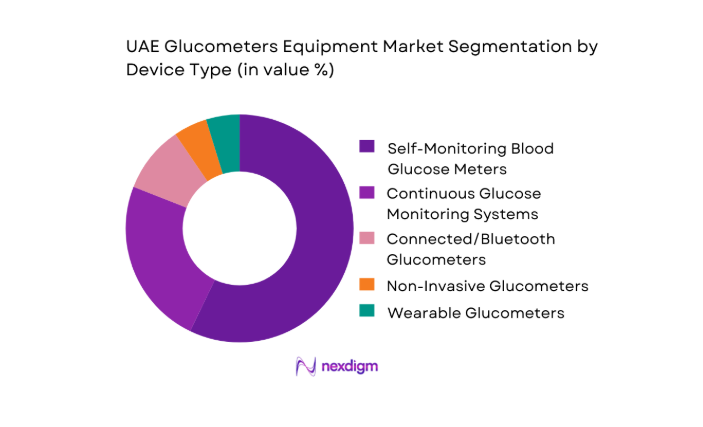

By Device Type

The UAE Glucometers market is segmented by device type, with Self-Monitoring Blood Glucose Meters (SMBG) currently dominating the market. This dominance can be attributed to the widespread use of SMBG devices, which are cost-effective, easy to use, and available in numerous retail channels. Additionally, SMBG devices are well-suited for home care, where convenience is paramount for users. The affordability of these devices, coupled with their broad availability in pharmacies and hospitals, ensures that SMBG continues to lead the market. The ease of access and established market presence of brands like Accu-Chek and OneTouch contribute significantly to SMBG’s dominant share.

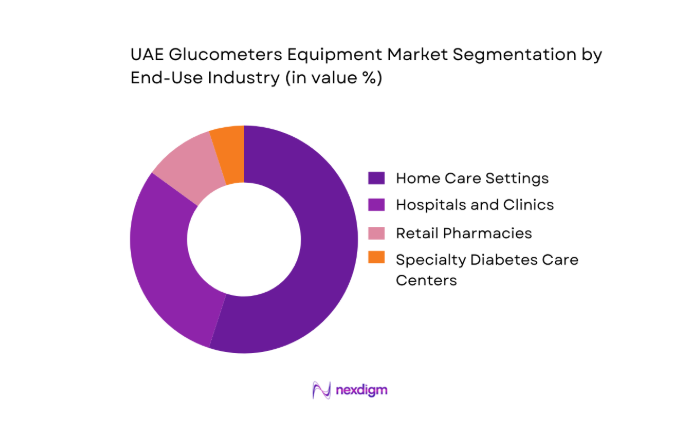

By End-Use Industry / Customer Type

The Home Care Settings segment dominates the UAE Glucometers market. This is driven by the increasing shift towards managing chronic diseases, such as diabetes, at home rather than in hospitals or clinics. Patients in home care settings prefer devices that are easy to use, affordable, and allow them to monitor glucose levels independently. Additionally, the growing adoption of connected and smartphone-integrated glucometers enables better tracking of glucose levels remotely, facilitating more convenient diabetes management. Retail pharmacies and e-commerce platforms also contribute to the segment’s growth by providing access to a range of glucometers and consumables for home care users.

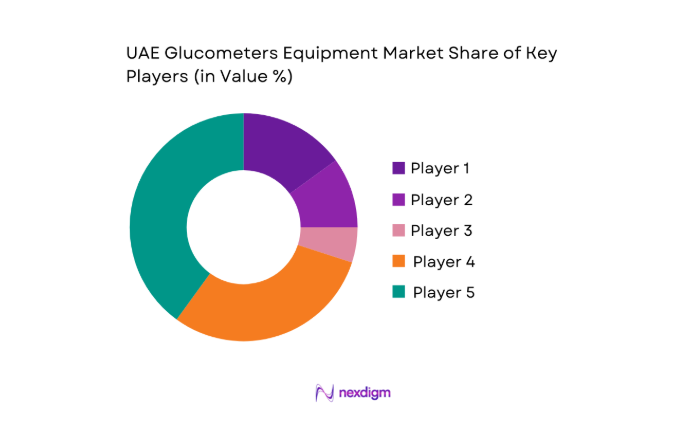

Competitive Landscape

The UAE Glucometers Equipment market is dominated by a few major players, including Abbott Laboratories, Roche Diabetes Care, and Medtronic. These companies have a strong presence due to their established brands, wide distribution networks, and technological advancements. Their ability to innovate and integrate connected devices into their product portfolios has allowed them to maintain their dominance in the market. Global brands, as well as local players, contribute to the competitive landscape by offering products tailored to the needs of the UAE’s diverse population.

| Company | Establishment Year | Headquarters | Device Types Offered | Product Portfolio | Market Reach | Annual Revenue | Distribution Channels |

| Abbott Laboratories | 1888 | USA | ~ | ~ | ~ | ~ | ~ |

| Roche Diabetes Care | 1896 | Switzerland | ~ | ~ | ~ | ~ | ~ |

| Medtronic | 1949 | Ireland | ~ | ~ | ~ | ~ | ~ |

| LifeScan, Inc. | 1981 | USA | ~ | ~ | ~ | ~ | ~ |

| Dexcom | 1999 | USA | ~ | ~ | ~ | ~ | ~ |

UAE Glucometers Equipment Market Analysis

Growth Drivers

Rising Diabetes Prevalence and Lifestyle Disease Burden

The increasing prevalence of diabetes and other lifestyle-related diseases is a major growth driver for the glucose monitoring market. As sedentary lifestyles, unhealthy diets, and rising obesity rates continue to contribute to higher diabetes incidence, there is a growing demand for effective tools to manage blood glucose levels. Both Type 1 and Type 2 diabetes cases are rising globally, and the need for regular blood sugar monitoring is becoming more critical. This surge in diabetes cases directly drives the demand for advanced glucose monitoring devices, including glucometers, to help individuals manage their condition and improve their quality of life.

Expansion of Home-Based Chronic Disease Management

With the shift towards home-based healthcare and patient self-management, there is a growing demand for devices that allow patients to monitor chronic diseases like diabetes in the comfort of their homes. As healthcare systems move towards more patient-centered care models, home-based chronic disease management solutions are gaining prominence. The convenience, accessibility, and affordability of home monitoring devices, including glucometers, have driven this growth, allowing patients to track their health metrics more frequently and with greater ease. This trend creates a large market opportunity for glucose monitoring solutions as part of the broader move toward personalized healthcare.

Challenges

Price Sensitivity and Reimbursement Limitations

Price sensitivity remains a significant barrier to the widespread adoption of advanced glucose monitoring devices, particularly in price-conscious markets. Many consumers, especially in developing regions or lower-income households, may find high-end devices expensive, limiting access to optimal healthcare solutions. Additionally, reimbursement limitations for certain devices can discourage patients from opting for newer, more advanced models. Healthcare providers and insurers may offer limited coverage for non-essential or high-tech monitoring solutions, further hindering market growth. Manufacturers must navigate these cost-related challenges while ensuring affordability and accessibility to drive broader adoption of their devices.

High Competition from Low-Cost Imported Devices

The glucose monitoring market faces significant competition from low-cost imported devices, particularly from countries with lower manufacturing costs. These devices often provide basic functionalities at a fraction of the cost of premium models, making them attractive to price-sensitive consumers. While these devices meet the basic needs of blood glucose monitoring, they typically lack the advanced features found in higher-end glucometers, such as connectivity and integrated health management. The availability of cheaper alternatives poses a challenge to premium device manufacturers, who must balance innovation with affordability to remain competitive in a price-driven market.

Opportunities

Premiumization through Connected and Smart Glucometers

There is a growing opportunity for the premiumization of glucose monitoring devices through the development of connected and smart glucometers. These devices offer advanced features such as Bluetooth connectivity, real-time data syncing with mobile apps, and integration with health tracking platforms, providing users with a more personalized and data-driven approach to managing diabetes. By offering added value such as automated tracking, trend analysis, and reminders for medication or testing, these devices can appeal to tech-savvy consumers and those seeking more convenience in their diabetes management. This trend is expected to drive growth in the high-end segment of the market.

Integration with Chronic Disease Management Platforms

The integration of glucose monitoring devices with broader chronic disease management platforms presents a significant opportunity for growth. As the healthcare sector increasingly embraces digital health solutions, glucose meters that can connect to comprehensive disease management platforms provide a more holistic approach to patient care. These platforms allow for seamless data sharing between patients, healthcare providers, and caregivers, enabling better-informed decisions and more coordinated care. By integrating glucometers into these platforms, manufacturers can offer a more comprehensive, interconnected health management solution, increasing the appeal of their products to both patients and healthcare providers looking for efficient, integrated care solutions.

Future Outlook

The future of the UAE Glucometers Equipment market looks promising as advancements in CGM technology and the increasing integration of mobile applications into glucose monitoring devices continue to drive innovation. Additionally, the growing shift toward digital health solutions and remote patient monitoring is expected to further expand the market. Healthcare policies that support diabetes management and innovative device adoption will also play a significant role in shaping the future landscape.

Major Players

- Abbott Laboratories

- Roche Diabetes Care

- Medtronic

- LifeScan, Inc.

- Dexcom

- Ypsomed AG

- Ascensia Diabetes Care

- Sanofi

- Novo Nordisk

- Johnson & Johnson

- Becton Dickinson

- Omron Healthcare

- GlucoMe

- Senseonics Holdings

- Arkray

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Diabetes healthcare providers

- Hospitals and healthcare centers

- Pharmaceutical retailers

- Distributors of medical devices

- Medical device manufacturers

- Health insurance providers

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the critical factors that influence the UAE Glucometers Equipment market, such as technological innovations, patient preferences, and regulatory policies.

Step 2: Market Analysis and Construction

We will analyze historical data and existing market trends to estimate the current market size and growth potential for glucometers in the UAE.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses about the market drivers, challenges, and opportunities will be validated through expert consultations with healthcare professionals, device manufacturers, and distributors.

Step 4: Research Synthesis and Final Output

The final research phase involves synthesizing data from primary and secondary sources to provide a comprehensive view of the UAE Glucometers Equipment market, ensuring that the findings are accurate and actionable.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, terminology and abbreviations, glucometer equipment taxonomy, market sizing logic by device sales and active user base, revenue attribution across devices strips and lancets, primary interview program with hospitals pharmacies distributors and OEMs, data triangulation and validation approach, assumptions limitations and data gaps)

- Definition and Scope

- Market Genesis and Evolution of Blood Glucose Monitoring in UAE

- Diabetes Burden and Screening Landscape

- Care Pathway Mapping Across Hospitals Clinics and Home Care

- Import Dependence and Authorized Distributor Ecosystem

- Growth Drivers

Rising diabetes prevalence and lifestyle disease burden

Expansion of home-based chronic disease management

Government focus on early screening and preventive care - Challenges

Price sensitivity and reimbursement limitations

High competition from low cost imported devices

User adherence issues in long term monitoring - Opportunities

Premiumization through connected and smart glucometers

Integration with chronic disease management platforms

Expansion of subscription models for strips and lancets - Trends

Shift from standalone devices to connected ecosystems

Growing adoption of mobile health apps for glucose tracking - Regulatory & Policy Landscape

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2019–2024

- By Device Unit Sales, 2019–2024

- By Active User Base, 2019–2024

- By Consumables Revenue Contribution, 2019–2024

- By Fleet Type (in Value %)

Public hospitals and government clinics

Private hospital networks

Independent diagnostic laboratories - By Application (in Value %)

Type 1 diabetes monitoring

Type 2 diabetes routine monitoring

Gestational diabetes management - By Technology Architecture (in Value %)

Standard fingerstick glucometers

Bluetooth enabled smart glucometers

Non coding glucometer systems - By Connectivity Type (in Value %)

Standalone offline glucometers

Mobile app connected glucometers

Cloud based patient monitoring systems - By End-Use Industry (in Value %)

Hospitals and clinics

Pharmacies and retail chains

Home care service providers

Corporate wellness program operators

- Market Share of Major Players

- Cross Comparison Parameters (measurement accuracy and ISO compliance, test strip cost per test, device memory and data storage capacity, mobile app compatibility, integration with diabetes management platforms, warranty and replacement policy, local service network strength, lifetime cost of ownership)

- SWOT analysis of major players

- Pricing and benchmarking

- Detailed Profiles of Major Companies

Roche Diabetes Care

Abbott Diabetes Care

Ascensia Diabetes Care

LifeScan

B. Braun

Acon Laboratories

i-SENS

Nipro Diagnostics

ARKRAY

Trividia Health

Beurer

Omron Healthcare

Sinocare

ForaCare

Ypsomed

- Physician and diabetes educator influence on device choice

- Pharmacy led recommendation dynamics

- Patient preference drivers and brand loyalty factors

- Procurement models in public hospitals and clinics

- Cost sensitivity and total ownership perception among users

- By Value, 2025–2030

- By Device Unit Sales, 2025–2030

- By Active User Base, 2025–2030

- By Consumables Revenue Contribution, 2025–2030