Market Overview

The UAE HbA1c monitoring devices market is valued at USD ~ million in 2025. This market is driven by the increasing prevalence of diabetes and the growing demand for non-invasive and easy-to-use blood glucose monitoring devices. The demand for reliable and cost-effective solutions for managing diabetes, coupled with the UAE’s healthcare system modernization, significantly contributes to the market’s expansion. Furthermore, government initiatives focusing on healthcare improvements and rising healthcare awareness among the population continue to drive growth in this segment. With the growing adoption of digital health solutions, the market is expected to witness consistent growth over the coming years.

The UAE is dominated by key urban centers like Dubai and Abu Dhabi due to their advanced healthcare infrastructure, high disposable income, and early adoption of innovative healthcare solutions. Dubai’s role as a global healthcare hub fosters the growth of cutting-edge medical technologies, including HbA1c monitoring devices. These cities’ strong healthcare networks, coupled with the increasing number of diabetes patients, make them the epicenter of HbA1c monitoring device adoption. Government-backed healthcare reforms and health insurance coverage in these cities also contribute to the market’s dominance.

Market Segmentation

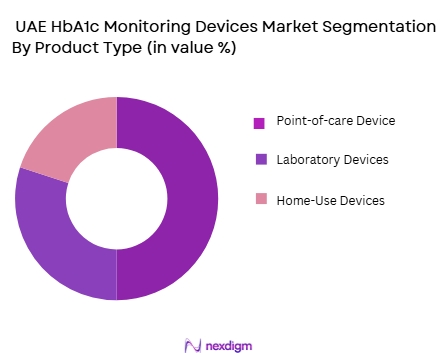

By Product Type

Devices market is segmented by product type into point-of-care devices, laboratory devices, and home-use devices. Among these, point-of-care devices currently dominate the market due to their convenience, speed, and accuracy, especially in emergency healthcare settings and outpatient care. These devices have found widespread use in clinics, hospitals, and even home care settings because they provide rapid results, facilitating immediate treatment decisions. As the demand for non-invasive and patient-centric healthcare solutions continues to rise, point-of-care devices are poised for continued dominance in the market.

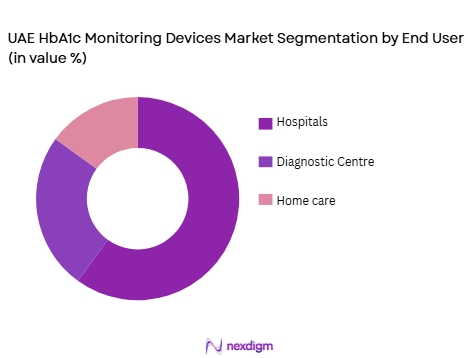

By End-User

The market is also segmented by end-user into hospitals, diagnostic centers, and home care. The hospital segment holds the largest share, primarily due to the high volume of patients diagnosed with diabetes and the increasing use of HbA1c testing for disease management. Hospitals, being the primary point for diagnosis and long-term care, use advanced HbA1c monitoring devices to manage chronic diseases like diabetes. With the growing healthcare investments in the UAE and the focus on expanding hospital infrastructure, hospitals are expected to continue driving the demand for these devices.

Competitive Landscape

The UAE HbA1c monitoring devices market is dominated by a few key global players and regional companies. Leading companies such as Abbott Laboratories, Roche Diagnostics, Siemens Healthiness, and Dexcom, dominate the market due to their extensive product portfolios, technological innovations, and strong distribution networks. These companies benefit from their established market presence, brand reputation, and focus on integrating digital solutions into their products. The market is highly competitive, with constant advancements in non-invasive and wearable HbA1c monitoring devices driving innovation.

| Company Name | Establishment Year | Headquarters | Device Portfolio | R&D Investment | Global Reach | Strategic Partnerships |

| Abbott Laboratories | 1888 | United States | ~ | ~ | ~ | ~ |

| Roche Diagnostics | 1896 | Switzerland | ~ | ~ | ~ | ~ |

| Siemens Healthiness | 1847 | Germany | ~ | ~ | ~ | ~ |

| Dexcom | 1999 | United States | ~ | ~ | ~ | ~ |

| Life Scan | 1981 | United States | ~ | ~ | ~ | ~ |

UAE HbA1c Monitoring Devices Market Analysis

Growth Drivers

Industrialization

Indonesia’s ongoing industrialization has been a key driver for air quality monitoring systems. As of 2022, the manufacturing sector contributed nearly ~ to Indonesia’s GDP, emphasizing the country’s industrial growth. Industrial zones, especially in Jakarta and Surabaya, are major contributors to pollution, which in turn increases the demand for efficient monitoring systems. The government has implemented stricter emission standards for industrial activities, prompting businesses to install more sophisticated air quality monitoring technologies to ensure compliance with regulations. This industrial growth, paired with environmental concerns, has accelerated the adoption of these systems.

Urbanization

The UAE has one of the world’s highest rates of urbanization, with the vast majority of its population living in cities such as Dubai, Abu Dhabi and Sharjah. High urban population density increases demand for convenient, accessible healthcare services including routine HbA1c monitoring.

Challenges

Technical Challenges

Technical challenges related to the calibration, accuracy, and maintenance of air quality monitoring systems are substantial barriers to market growth in Indonesia. Environmental factors such as humidity, temperature fluctuations, and particulate buildup can affect the performance of sensors, leading to inaccuracies in the data collected. For instance, in 2022, a study by the Ministry of Environment and Forestry indicated that around ~of air quality monitoring stations experienced malfunctions due to environmental conditions. The complexity of maintaining these systems contributes to the slow adoption of high-quality systems in many regions. Source: Ministry of Environment and Forestry, Indonesia

Inconsistent reimbursement

Inconsistent reimbursement policies and limited insurance coverage for advanced monitoring devices in UAE healthcare plans. High cost of advanced HbA1c monitoring technologies limiting adoption among smaller clinics and individual patients .Shortage of trained healthcare professionals proficient in operating and interpreting results from point‑of‑care HbA1c devices. Regulatory hurdles and lengthy approval timelines for new device entries affecting market introduction speed.Patient adherence issues due to preference for traditional lab testing over device‑based self‑monitoring.Limited integration of HbA1c device data with electronic health records and telehealth systems.Competitive pressure from low‑cost traditional laboratory testing providers reducing market share for point‑of‑care devices.Concerns regarding device accuracy and calibration consistency across different makes/models affecting clinician confidence.

Opportunities

Technological Advancements

Technological advancements present substantial opportunities for growth in Indonesia’s air quality monitoring system market. The development of low-cost, high-precision sensors and IoT-enabled systems has made air quality monitoring more affordable and accessible. The use of artificial intelligence for real-time data analysis is also gaining traction, making it easier for cities and industries to monitor air quality continuously. In 2022, the Indonesian government began collaborating with tech companies to integrate AI-based solutions into monitoring systems, improving the accuracy and efficiency of data interpretation. These technological innovations are expanding the potential applications of monitoring systems across various sectors. Source: World Bank

International Collaborations

International collaborations between Indonesia and global environmental organizations present significant growth opportunities for the air quality monitoring market. In 2022, Indonesia entered into a partnership with the United Nations Environment Programmed (UNEP) to improve air quality management systems. This collaboration involves sharing knowledge, technology, and resources to help Indonesia enhance its monitoring capabilities. Additionally, international funding for environmental projects is helping the country scale up its monitoring infrastructure. These partnerships ensure the transfer of cutting-edge technology and best practices, driving the adoption of more advanced air quality monitoring solutions. Source: United Nations Environment Programmed

Future Outlook

Over the next six years, the UAE HbA1c monitoring devices market is expected to show substantial growth, driven by advancements in healthcare technology, an increase in diabetes prevalence, and a stronger emphasis on preventive healthcare. The ongoing modernization of the UAE’s healthcare system, coupled with rising consumer awareness about the benefits of early disease detection and management, is set to push the demand for HbA1c monitoring devices. Additionally, the integration of AI, machine learning, and remote monitoring technology will likely further enhance the capabilities and appeal of these devices in both clinical and home settings.

Major Players

- Abbott Laboratories

- Roche Diagnostics

- Siemens Healthiness

- Life Scan

- Dexcom

- Medtronic

- Bayer Healthcare

- Ascensia Diabetes Care

- Psalmed

- Nova Biomedical

- Trivedi Health

- Philips Healthcare

- Johnson & Johnson (Janssen Diagnostics)

Key Target Audience

- Healthcare Providers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Medical Device Manufacturers

- Private Health Insurers

- Pharmaceutical Companies

- Medical Equipment Distributors

- Diabetes Research Organizations

Research Methodology

Step 1: Identification of key Variables

This phase involves mapping out all major stakeholders in the UAE HbA1c monitoring devices market, utilizing secondary data from industry reports, government publications, and proprietary databases. The primary aim is to define and identify key market dynamics such as demand drivers, competitive trends, and technological innovations.

Step 2: Market Analysis and Construction

In this phase, we analyze historical market data from industry sources and government databases. The analysis includes understanding market growth trends, device adoption rates, and the impact of regulatory changes. We also assess the influence of socioeconomic factors like urbanization and healthcare infrastructure.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market drivers and challenges are validated by conducting interviews with industry experts from hospitals, manufacturers, and distributors. These expert consultations are critical for refining market predictions and enhancing the reliability of our analysis.

Step 4: Research Synthesis and Final Output

The final output is synthesized by integrating market data, expert insights, and product performance metrics. The comprehensive report is developed through collaboration with leading manufacturers to ensure the analysis reflects real-time developments and the competitive landscape.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis of the HbA1c Monitoring Devices Market in the UAE

- Market Development Timeline and Key Milestones

- Business Cycle and Technological Evolution

- Supply Chain and Value Chain Analysis – Distributor

UAE HbA1c Monitoring Devices Market Analysis

- Growth Drivers

Rising Prevalence of Diabetes in the UAE

Increasing Demand for Non-invasive Monitoring Devices

Government Initiatives for Health and Wellness Promotion

Advancements in HbA1c Monitoring Technology

- Market Challenges

Regulatory Hurdles and Compliance in the UAE Healthcare Sector

High Costs of Advanced HbA1c Monitoring Devices

Limited Awareness in Certain Demographics - Market Opportunities

Expansion of Home-Use HbA1c Devices. Strategic Partnerships with Healthcare Providers

Technological Innovations in Wearable HbA1c Monitors

growth in Digital Health Solutions and Remote Monitoring Integration of AI and Machine Learning in HbA1c Devices

Regulatory Lands

UAE FDA Regulations for HbA1c Devices Import Tariffs and Policies on Medical Devices - Market Trends

Rising Adoption of Point‑of‑Care and Portable HbA1c Devices

Growth of Non‑Invasive and Wearable Monitoring Technologies

Integration of Digital Health and Remote Monitoring Platforms

Use of Artificial Intelligence (AI) and Machine Learning for Clinical Insight

Increased Patient Demand for Personalized Diabetes Monitoring

Telehealth and Hybrid Care Models Amplifying Device Adoption

- SWOT Analysis

- Porter’s Five Forces Analysis

- By Size, 2019-2025

- By Volume, 2019-2025

- By Device Type, 2019-2025

- By End-User, 2019-2025

- By Average Price Trends, 2019-2025

- By Product Type, 2026-2030

Point-of-Care Devices

Laboratory Devices

Home Use Devices

Integrated Systems - By End-User, 2026-2030

Hospitals and Healthcare Facilities|

Diagnostic Centers

Home Care

Clinical Research Laboratories - By Distribution Channel (in value%)

Online Retailers

Healthcare Providers & Clinics

Medical Device Distributors - By Region, (in value%)

Dubai

Abu Dhabi

Sharjah

Northern Emirates - By Application, (in value%)

Diabetes Management

Preventive Health Monitoring

Disease Diagnostics in Healthcare Settings

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Revenues by Device Type, Market Presence, Distribution Channels, Number of Dealers and Distributors, Margins, Production Capacity, R&D Investment, Unique Value Offering)

- SWOT Analysis of Major Players

- Pricing Analysis for Major Players

- Detailed Profiles of Leading Companies

Abbott Laboratories

Roche Diagnostics

Siemens Healthiness

Life Scan

Dexcom

Medtronic

Bayer Healthcare

Ascensia Diabetes Care

Ypsomed

Nova Biomedical

Trividia Health

Philips Healthcare

Johnson & Johnson

Panasonic Healthcare

ACON Laboratories

- UAE HbA1c Monitoring Devices End-User Analysis

- Market Demand and Utilization by End-User Type

- Regulatory and Compliance Requirements by End-User

- Needs, Desires, and Pain Point Analysis for Healthcare Providers

- Purchasing Power and Budget Allocations within

- Healthcare Systems

- Decision-Making Process for Device Procurement in Healthcare Facilities

- Market Value Forecast, 2026-2030

- Market Volume Forecast, 2026-2030

- Pricing Trends and Future Device Costs, 2026-2030