Market Overview

The UAE digital health market, which includes mobile health apps and telehealth platforms, is valued at USD ~ million based on a five-year historical analysis. This market’s expansion is driven by government investments in healthcare digital transformation, nationwide adoption of mobile and broadband technologies, and rising demand for remote healthcare solutions from consumers and providers alike. Strong infrastructure, high smartphone penetration, and regulatory backing have accelerated adoption across clinical and wellness use cases.

Dubai and Abu Dhabi lead the UAE health apps market due to their advanced healthcare ecosystems, high digital literacy, and proactive government strategies toward healthcare innovation. Both cities host major healthcare facilities and digital health accelerators, driving demand for integrated health solutions. Their strong regulatory frameworks and investment incentives attract global health app developers, contributing to higher deployment and user engagement compared to other emirates.

Market Segmentation

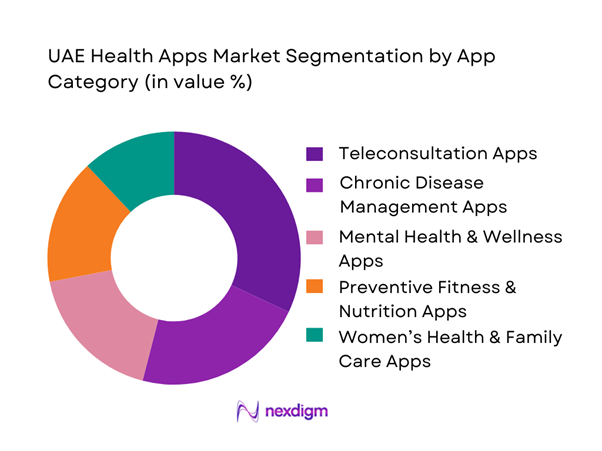

By App Category

UAE health apps are segmented into teleconsultation, chronic disease management, mental health & wellness, preventive fitness & nutrition, and women’s health & family care. Currently, teleconsultation apps dominate the health apps market share due to widespread adoption by consumers and providers seeking convenient care access, particularly for primary consultations and specialist referrals. Major healthcare systems and insurers in the UAE have integrated teleconsultation features in apps to reduce clinic congestion and cut operational costs. Chronic disease management apps hold the second position because high prevalence of lifestyle diseases like diabetes and hypertension has highlighted the need for continuous remote self-care tools. Mental health and wellness apps are gaining traction owing to rising awareness and destigmatization of mental wellbeing. Preventive fitness and nutrition platforms benefit from the UAE’s focus on lifestyle disease prevention, while women’s health apps cater to specialized lifecycle care needs.

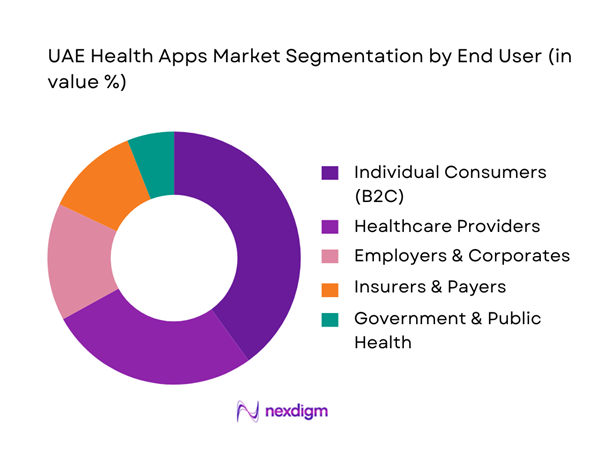

By End User

The UAE health apps market can also be segmented by end users into individual consumers, healthcare providers, employers & corporates, insurers & payers, and government & public health agencies. Individual consumers constitute the largest share due to high smartphone usage and consumer demand for convenient care and lifestyle management features. Healthcare providers are the next significant segment as hospitals and clinics adopt integrated applications for patient engagement, appointment booking, telemonitoring, and digital records access. Employers & corporates increasingly deploy health apps as part of wellness and insurance packages to improve workforce productivity and reduce healthcare costs. Insurers & payers use digital apps for claims automation and member engagement, while government & public health bodies leverage them for national health campaigns and population health insights.

Competitive Landscape

The UAE health apps landscape is characterized by both local digital health platforms and international telehealth brands expanding regionally. A mix of teleconsultation, chronic care, and wellness solutions compete on app features, interoperability, regulatory compliance, and payer partnerships. This competitive structure reflects increasing consolidation and collaboration between healthcare providers, insurers, and tech vendors in the UAE.

| Company | Establishment Year | Headquarters | Primary Market Focus | Regulatory Compliance | App Reach (Users) | Integration with Providers | Partnerships |

| Okadoc | 2016 | UAE | ~ | ~ | ~ | ~ | ~ |

| TruDoc 24×7 | 2017 | UAE | ~ | ~ | ~ | ~ | ~ |

| Teladoc Health | 2002 | US | ~ | ~ | ~ | ~ | ~ |

| Altibbi | 2011 | Jordan | ~ | ~ | ~ | ~ | ~ |

| HealthHub UAE | 2018 | UAE | ~ | ~ | ~ | ~ | ~ |

UAE Health Apps Market Analysis

Growth Drivers

DHA & DOH Telehealth Framework Expansion

Dubai and Abu Dhabi are structurally policy-led digital health markets: the UAE’s high-income base with GDP per capita USD ~ and a large resident base of ~ people creates scale for regulated virtual care pathways that can be embedded into routine access models. In Dubai, DHA’s ecosystem has accelerated data liquidity and virtual workflow readiness through NABIDH, unifying ~ million patient records and connecting more than ~ healthcare facilities, with ~ of Dubai’s healthcare professionals actively connected, enabling e-prescriptions, referrals, lab ordering, and continuity across provider apps. In Abu Dhabi, the DOH-led interoperability layer is reinforced by Malaffi’s scale milestones, including ~ clinical records, which reduces fragmentation risk for health apps integrating longitudinal data. In short, health apps win faster in UAE when they ride DHA and DOH governance rails rather than operating as standalone consumer utilities, because regulated pathways reduce clinical risk, improve provider acceptance, and make insurer-provider partnerships easier to operationalize at city scale.

Employer-Led Preventive Healthcare Spending

Employer-paid coverage and claims digitization create a practical distribution engine for preventive and wellness-linked health apps such as screening reminders, chronic-care nudges, coaching, mental wellbeing modules, and care navigation. Dubai’s insurance operations show the scale of digitally routed utilization, with the electronic portal processing ~ transactions and ~ insurance claims in a single year, indicating coverage depth and high-frequency administrative touchpoints extendable to app-based pre-authorization flows and preventive program enrollment. DHA has also stated its digital health insurance portal serves more than ~ people, making employer-sponsored lives the easiest cohort to activate for preventive app programs. Macro conditions support this model, with GDP per capita above USD ~ and a population above ~, enabling dense employer clusters in Dubai and Abu Dhabi to roll out standardized digital benefits at scale. As a result, B2B2C engagement is often faster than pure B2C in the UAE.

Challenges

Fragmented Regulatory Approvals

Despite national digital momentum, the UAE health apps market still faces practical multi-rulebook friction because healthcare licensing and oversight are emirate-specific for many operational aspects. Apps touching clinical workflows or patient data often need alignment with Dubai, Abu Dhabi, and federal layers, and must design around local data governance constructs. Dubai’s NABIDH alone connects more than ~ facilities and has unified ~ million patient records, meaning any app integrating clinical data must meet strict onboarding, access control, and audit expectations at scale. Abu Dhabi’s Malaffi ecosystem includes ~ facilities and ~ electronic medical record systems, making integration and validation operationally heavy. With UAE PASS exceeding ~ users, regulators expect enterprise-grade security, consent, and standardized patient identification, making approval and integration sequencing a core competitive capability.

Low Long-Term Engagement Retention

Health apps in the UAE often achieve strong downloads and initial activation, but sustained retention is difficult when journeys are fragmented across providers, insurers, and emirate platforms. Dubai’s NABIDH spans more than ~ facilities and ~ million patient records, while Abu Dhabi’s ecosystem spans ~ facilities and ~ EMR systems, causing frequent switching between hospital apps, insurer apps, and standalone wellness apps. UAE PASS expansion from ~ users to more than ~ users has raised expectations for seamless, single-login experiences. Apps requiring repeated verification, multiple consents, or manual data entry struggle to maintain engagement compared to those embedded into insurer claims flows, provider scheduling, and eRx refill loops. High-income macro conditions alone do not solve retention; integration depth into routine health events remains the key determinant.

Opportunities

Insurer-Driven Digital Therapeutics Adoption

The UAE’s strongest near-term growth path for advanced health apps is payer-linked, where insurers can scale programs tied to claims pathways, chronic care utilization management, and measurable clinical outcomes. Dubai’s payer infrastructure processes ~ transactions and ~ claims via the electronic portal, creating a practical channel to embed digital therapeutics-style programs within benefits design. The disease burden supports this approach, with ~ adults living with diabetes, making diabetes pathways an obvious anchor for outcomes-based digital programs. As DHA and DOH digital rails expand, insurers increasingly demand integration-grade capabilities such as data capture, engagement analytics, provider referrals, and adherence workflows, prioritizing vendors that demonstrate reduced avoidable utilization without requiring new consumer payment behavior.

AI-Based Triage & Care Navigation Apps

AI-based triage and navigation represent a high-potential opportunity because the UAE system combines high service density, high digital adoption, and large claims and encounter volumes. Dubai’s insurance portal throughput of ~ transactions and ~ claims indicates frequent care events requiring navigation across benefits eligibility, network routing, and site-of-care decisions. Dubai’s NABIDH network, spanning over ~ facilities and ~ million unified patient records, combined with national identity scale growing from ~ users to more than ~ users, enables secure, consented navigation flows. A high-income economy with GDP per capita above USD ~ and a resident base above ~ supports enterprise procurement of navigation tools. The practical opportunity is to embed AI triage inside regulated workflows rather than launching standalone consumer bots.

Future Outlook

The UAE health apps market is expected to experience strong growth over the next several years as digital health adoption deepens across both consumer and enterprise segments. Enhancements in ~ connectivity, AI and ML-driven personalization, and integration with national health IDs and electronic records will underpin market innovation. Government initiatives aimed at healthcare digital transformation and increased telehealth reimbursement policies are likely to accelerate demand from providers, payers, and end users alike. Rising prevalence of chronic diseases and increased focus on preventive health will further expand the use of mobile health solutions into advanced care management, analytics, and remote diagnostics realms.

Major Players

- Okadoc

- TruDoc 24×7

- Teladoc Health

- Altibbi

- HealthHub UAE

- Vezeeta regional bookings and telehealth

- MyHealth App provider-linked patient engagement

- Doctoruna MENA healthcare platform

- vHealth UAE

- Medcare Digital Platforms

- InstaPract HealthTech

- Health at Hand

- Doxy.me LLC telehealth

- Malaffi health data integration

- Nabidh Dubai health platform

Key Target Audience

- Healthcare Providers & Hospital Systems

- Health Insurers and Payer Organizations

- Employers and Corporate Wellness Departments

- Healthcare Technology Investors & Venture Capitalist Firms

- Government and Regulatory Bodies

- Telecommunication & Digital Infrastructure Firms

- Healthcare Service Operators and Telehealth Platform Developers

- Pharmaceutical and Chronic Care Product Manufacturers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved constructing an ecosystem map of the UAE health apps market, encompassing stakeholders such as providers, insurers, tech developers, and government bodies. This step relied on secondary research from industry databases and proprietary market reports to identify critical variables influencing demand, adoption, and revenue streams.

Step 2: Market Analysis and Construction

Historical data on revenue, user adoption, app categories, and payer integration were compiled and analyzed. Market penetration metrics and segment performance indicators were evaluated to ensure accuracy in estimating the total addressable market and segment sizes.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed around adoption drivers, regulatory influence, and technology integration, then validated through interviews with industry practitioners, app developers, and healthcare executives. These consultations were crucial for refining projections and verifying assumptions.

Step 4: Research Synthesis and Final Output

In the final phase, direct engagement with key digital health vendors and healthcare institutions provided detailed insights on app performance, user behavior, and future growth vectors. These engagements helped validate the quantitative models and ensured a comprehensive representation of the UAE health apps market.

- Executive Summary

- Research Methodology (Market Definitions & Scope Delimitation, UAE Health App Taxonomy Framework, Key Assumptions & Exclusions, Abbreviation Index, Market Engineering & Validation Logic, Bottom-Up Revenue Modeling, Platform-Level Primary Interviews, Stakeholder Triangulation, Regulatory Cross-Verification, Data Limitations & Forward Assumptions)

- Definition and Scope

- Market Genesis and Digital Health Evolution in UAE

- Timeline of Platform, Regulator, and Ecosystem Milestones

- Business Cycle and Monetization Maturity Curve

- Health App Value Chain and Platform Stack Analysis

- Growth Drivers

DHA & DOH Telehealth Framework Expansion

Employer-Led Preventive Healthcare Spending

Rising Chronic Disease Burden & Lifestyle Disorders

Smartphone Penetration and Digital Identity Infrastructure - Challenges

Fragmented Regulatory Approvals

Low Long-Term Engagement Retention

Monetization Resistance in B2C Segment

Data Privacy & Hosting Constraints - Opportunities

Insurer-Driven Digital Therapeutics Adoption

AI-Based Triage & Care Navigation Apps

Arabic-First and Culturally Localized Health Apps

Government Preventive Care Digitization - Trends

Shift from Appointment Apps to Care Platforms

Integration of Remote Monitoring & Wearables

Outcome-Linked Reimbursement Models

Employer-Centric Health App Procurement - Regulatory & Policy Landscape

DHA & DOH Telehealth App Approval Frameworks

UAE Health Data Protection & Hosting Mandates

Clinical Responsibility & Practitioner Licensing

Cross-Border Consultation Restrictions - SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- Installed Base, 2019–2024

- Service Revenue Mix, 2019–2024

- By Application (in Value %)

Teleconsultation & Virtual Care Apps

Chronic Disease Management Apps

Mental Health & Behavioral Therapy Apps

Fitness, Nutrition & Preventive Care Apps

Women’s Health & Family Care Apps - By Technology Architecture (in Value %)

Clinically Validated / Prescription-Linked

Physician-Moderated

Consumer Wellness-Oriented

Hybrid Care Apps - By End-Use Industry (in Value %)

Individual Consumers

Employers & Corporate Wellness Buyers

Insurance Companies & TPAs

Hospitals & Health Systems

Government & Semi-Government Entities - By Connectivity Type (in Value %)

Standalone Consumer Apps

Provider-Integrated Apps

Insurer-Integrated Platforms

Government-Linked Digital Health Apps - By Region (in Value %)

Dubai

Abu Dhabi

Northern Emirates

- Market Share Analysis

- Cross Comparison Parameters (Clinical Coverage Breadth, Regulatory Approval Status, Insurer Integration Depth, EHR Interoperability, Monetization Model, Active User Retention, Data Hosting & Security Compliance, Enterprise Client Penetration)

- SWOT Analysis of Key Players

- Pricing & Monetization Benchmarking

- Detailed Company Profiles

Okadoc

TruDoc 24×7

SEHA

PureHealth

Altibbi

HealthHub

Vezeeta

Doctoruna

MyHealth

Teladoc Health

BetterHelp

Headspace

Cleveland Clinic Abu Dhabi App

Malaffi

- Demand Patterns & Use-Case Adoption

- Purchasing Authority & Budget Ownership

- Compliance & Procurement Constraints

- Pain Points, Drop-Off Triggers & Retention Barriers

- Decision-Making Journey & Vendor Selection Criteria

- By Value, 2025–2030

- Installed Base, 2025–2030

- Service Revenue Mix, 2025–2030