Market Overview

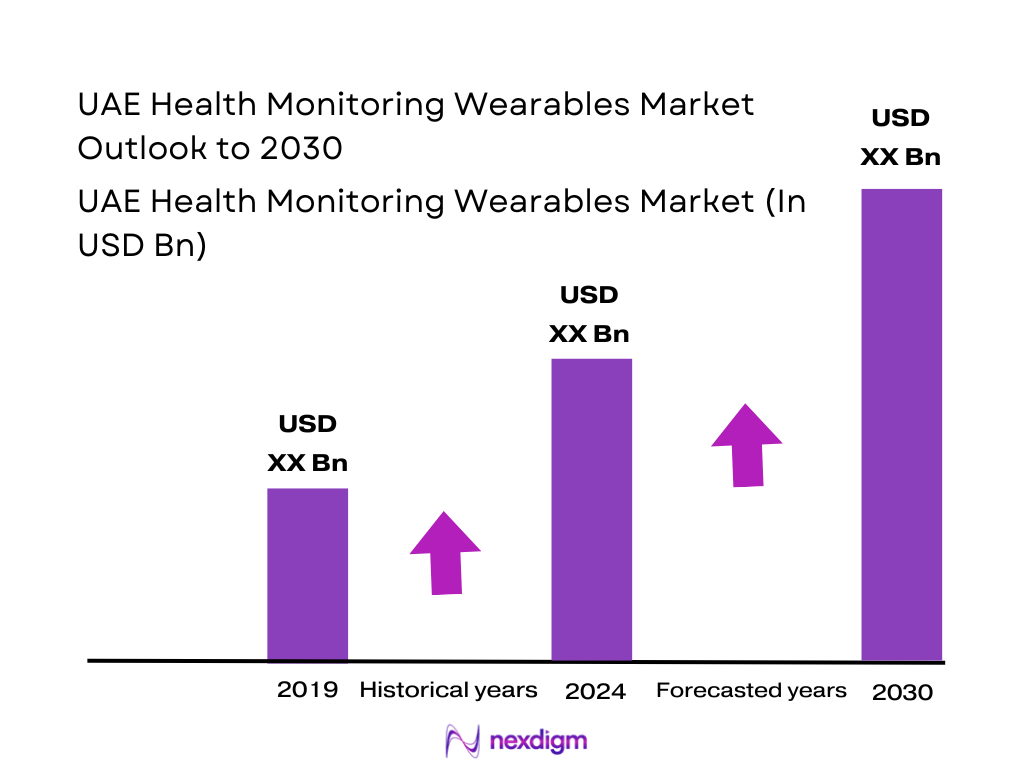

The UAE health monitoring wearables market is valued at USD ~ million, supported by strong consumer electronics pull and a fast-maturing digital health ecosystem. In the preceding year, a closely aligned wearables category recorded USD ~ million, indicating a step-up in demand for connected devices that measure activity, heart-rate, sleep, oxygen saturation, and glucose-linked insights as prevention and self-management behaviors expand. Momentum is reinforced by stricter device registration pathways for regulated products entering the market.

Dominance in adoption and commercialization is concentrated in Dubai and Abu Dhabi, driven by stronger premium retail density, higher propensity to buy flagship devices, and more advanced health data infrastructure. Dubai’s NABIDH health information exchange pushes interoperability and digital workflows across providers, while Abu Dhabi’s Malaffi acts as a large-scale exchange layer enabling real-time sharing of patient health information across public and private networks—conditions that make provider-linked remote monitoring programs easier to deploy. On the supply side, the market is shaped by ecosystem leaders headquartered in the United States, South Korea, and China due to their device platforms, app ecosystems, and channel partnerships.

Market Segmentation

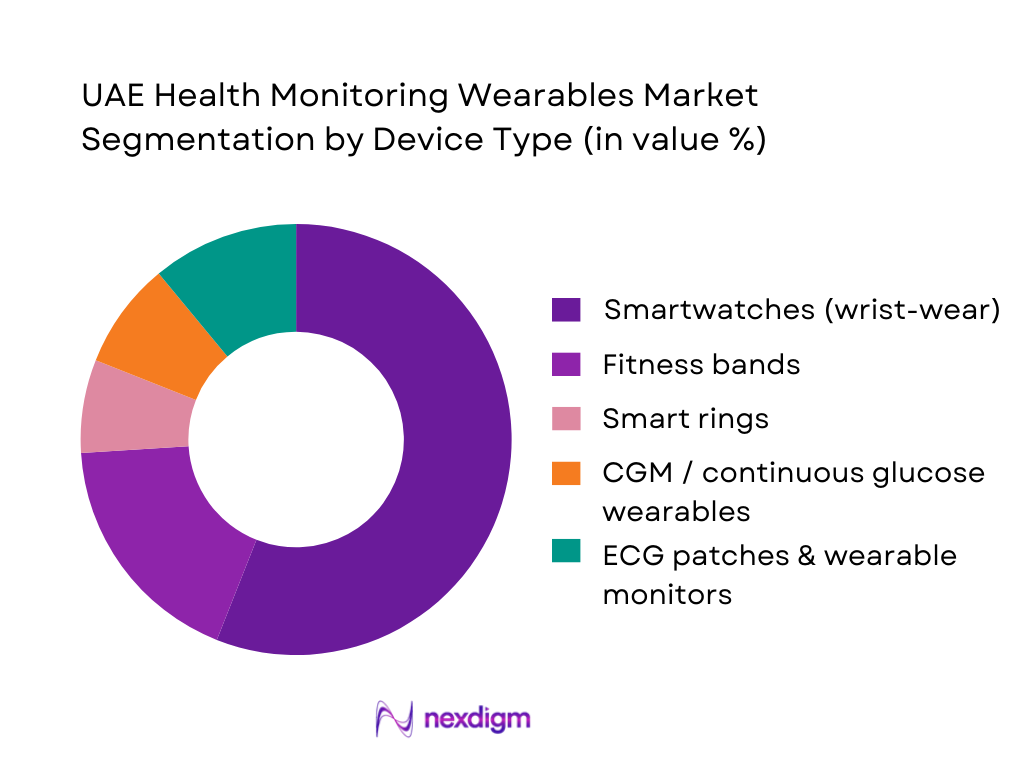

By Device Type

UAE health monitoring wearables are segmented by device type into smartwatches, fitness bands, smart rings, CGM/continuous glucose wearables, ECG/arrhythmia patches & wearable monitors, and smart clothing/other biosensors. Wrist-wear is the largest revenue-generating category, which aligns with smartwatch-led demand because smartwatches bundle multi-parameter sensing (PPG heart-rate, SpO₂, sleep staging), notifications, payments, and app ecosystems in a single product. In the UAE, smartwatch dominance is reinforced by, strong gifting culture for high-end electronics, and retail-led education that reduces perceived complexity. Additionally, smartwatch platforms increasingly act as the “front door” to wellness subscriptions, coaching, and partner apps—driving higher lifetime value versus single-purpose trackers. For chronic-condition users, wrist devices are often the first step before moving into condition-specific devices like CGMs, making smartwatches the highest-volume gateway segment.

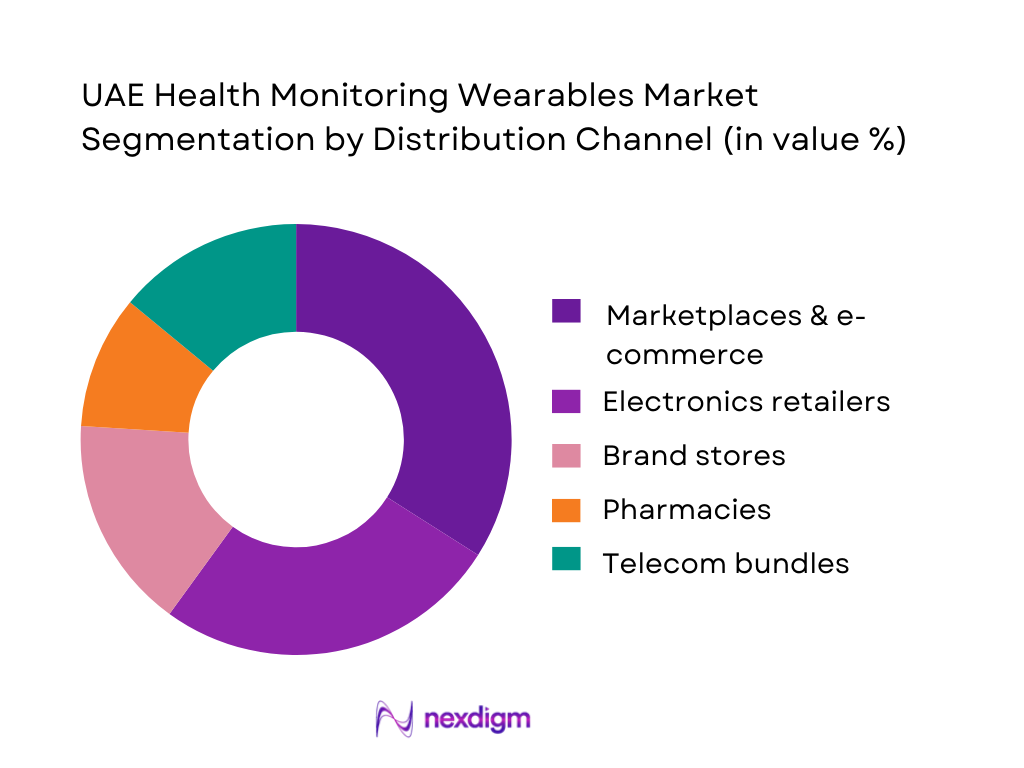

By Distribution Channel

UAE health monitoring wearables are segmented by distribution channel into marketplaces & e-commerce, electronics retail chains, brand stores, telecom bundles, pharmacies, and healthcare/procurement-driven channels. The marketplace & e-commerce sub-segment is increasingly dominant because it offers SKU depth (multiple variants, straps, warranty options), faster price discovery, and promotion-led conversion during mega-sale events—while still enabling premium devices to maintain perceived value through official stores and authorized sellers. Meanwhile, electronics retail remains critical for experiential demos and upselling higher ASP models, but online tends to win on convenience and broader assortment. Pharmacies are gaining relevance for health-centric devices and regulated accessories, especially as device registration and medical device trading requirements push formalization of channels.

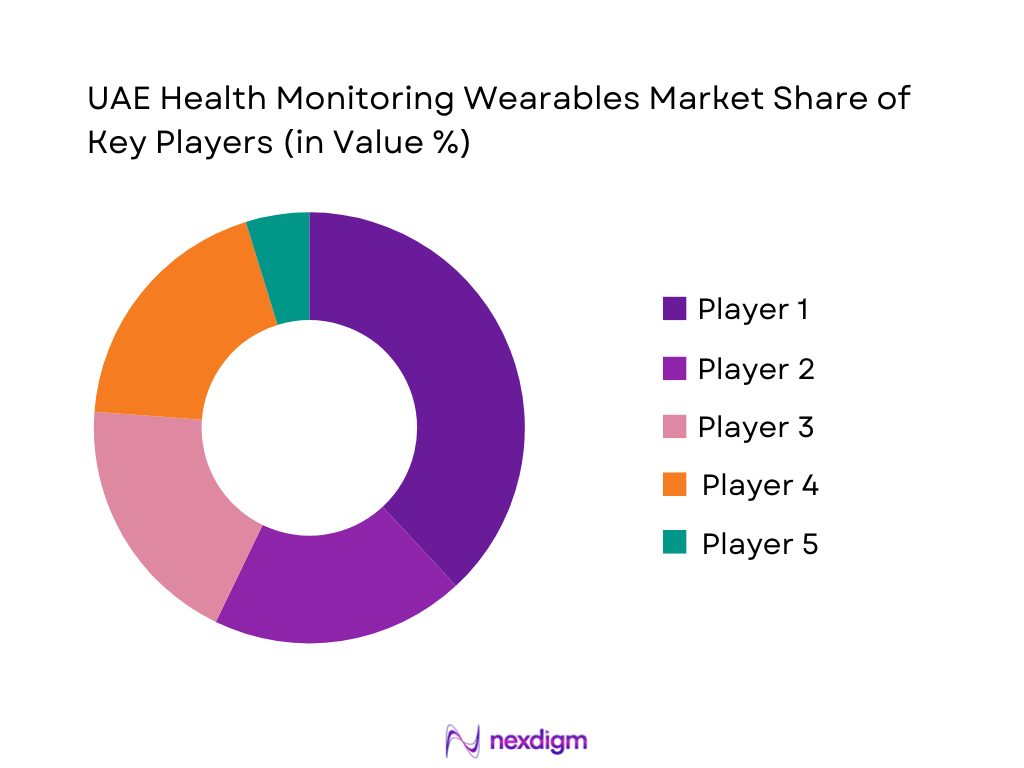

Competitive Landscape

The UAE health monitoring wearables market is led by a cluster of global ecosystem players that control device OS layers, app stores, and accessory ecosystems—creating high switching costs and strong loyalty. Apple, Samsung, and Huawei anchor the premium-to-upper-mid tiers through flagship smartwatches, while Garmin and Fitbit (Google) are influential in performance fitness, health insights, and subscription-driven engagement. Competitive intensity is shaped by ecosystem lock-in, sensor credibility, after-sales reliability, and distribution strength across Dubai–Abu Dhabi retail and regional e-commerce. Regulated health use-cases add another layer of differentiation due to registration, privacy expectations, and provider integration readiness.

| Company | Establishment Year | Headquarters | Core UAE Device Focus | Key Health Sensors/Signals | App/Ecosystem Strength | Channel Strength in UAE | Pricing Tier Positioning | After-sales / Warranty Footprint | Integration/Compliance Readiness* |

| Apple | 1976 | USA (Cupertino) | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Samsung | 1969 | South Korea (Suwon) | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Huawei | 1987 | China (Shenzhen) | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Garmin | 1989 | USA (Olathe) | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Google Fitbit | 2007 | USA (California) | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Health Monitoring Wearables Market Dynamics and Industry Analysis

Growth Drivers

Chronic disease management demand

The UAE’s addressable need for continuous health tracking is anchored in a large chronic-disease base that benefits from wearables measuring glucose trends, heart rhythm signals, sleep quality, and activity. Reports indicate ~ adults living with diabetes in the UAE and a total adult population of ~, creating sustained demand for monitoring behaviors that complement clinical care. This demand is reinforced by the country’s scale and purchasing capacity, with UAE GDP of USD ~ billion and GDP per capita of USD ~, supporting higher adoption of connected devices and subscriptions than many peer markets. As providers and payers seek measurable engagement, wearables increasingly become daily data streams to support medication adherence, activity targets, and sleep-risk flags—particularly relevant in diabetes and cardio-metabolic populations where continuous behavioral feedback improves care continuity and reduces avoidable escalation.

Remote patient monitoring expansion

The UAE’s digital-health backbone is now large enough to operationalize remote monitoring at scale, making wearables more actionable for providers. Dubai’s health information exchange NABIDH unified over ~ patient records and connected more than ~ healthcare facilities, enabling clinicians to access longitudinal data across a broad provider network. In Abu Dhabi, Malaffi reported ~ clinical records representing ~ unique patient records, indicating deep digitization that supports alerts, stratification, and pathway-based follow-up. Service volumes also point to normalization of virtual care, with nearly ~ telehealth consultations and over ~ electronic prescriptions in Dubai in a single year, showing that remote workflows are already embedded in care delivery. With UAE GDP at USD ~ billion, health systems and insurers can justify investments in device-enabled monitoring where it reduces churn in follow-up and improves adherence.

Challenges

Clinical validation and accuracy expectations

As wearables move from wellness gadgets to clinical-adjacent tools, expectations for accuracy and clinical integration rise—especially in cardiology, diabetes, and sleep-related risk monitoring. UAE’s clinical workforce density sets a high bar for device credibility, with physicians per ~ population rising to ~, implying more clinicians who will scrutinize device performance, false alerts, and pathway alignment before recommending wearables for patient monitoring. Meanwhile, Abu Dhabi’s Malaffi is already operating at massive data scale, with ~ clinical records and ~ unique patient records, so integrating consumer wearables into clinical records requires structured data standards and validated signal quality to avoid noise in a high-volume environment. On macro fundamentals, UAE GDP per capita of USD ~ supports premium device uptake, but premium buyers also tend to demand credible health claims. This creates a challenge for brands that rely on generic wellness messaging without clinical evidence, local regulatory readiness, or transparent performance documentation.

Data residency and privacy requirements

Wearables generate persistent, high-frequency personal health data (sleep, heart rhythm trends, activity, glucose-linked signals), making governance and data-handling requirements more stringent than typical consumer electronics. The operational reality is the UAE already runs health-information exchanges at very large scale, with Dubai’s NABIDH unifying ~ patient records across ~ healthcare facilities, and Malaffi reporting ~ clinical records representing ~ unique patient records in Abu Dhabi. At this scale, privacy, consent, cross-entity access controls, and secure data storage become non-negotiable, especially when consumer apps begin connecting to provider ecosystems or insurer programs. Macro capacity raises the stakes, with UAE GDP of USD ~ billion supporting rapid digitalization, cloud adoption, and platform integration—but also raising regulatory expectations for privacy-by-design implementations in health data flows. For wearable brands, this translates into real implementation burden involving data localization strategy, auditability, secure APIs, and clarity on what can be shared into clinical systems versus retained in consumer apps.

Opportunities

Medical-grade wearables in cardiology and endocrinology

The UAE’s measurable burden of cardio-metabolic disease creates a strong foundation for scaling medical-grade wearables (ECG-capable watches, validated patches, and glucose wearables) through provider pathways and payer programs. Reports indicate ~ adult diabetes cases in the UAE, representing an immediate clinical population where glucose-linked wearables and behavior feedback loops can be embedded into endocrinology workflows. Care delivery rails are already capable of handling longitudinal data, with Abu Dhabi’s Malaffi reporting ~ clinical records representing ~ unique patient records, and Dubai’s NABIDH unifying ~ records across ~ facilities, meaning data-sharing infrastructure can support provider-led monitoring at scale when programs are designed correctly. On capacity, UAE’s macro fundamentals, with GDP per capita of USD ~, support higher adoption of regulated devices and service models. The near-term opportunity is not more devices, but more clinical-grade deployments—validated signal quality, defined eligibility criteria, and integration into endocrinology and cardiology follow-up and medication titration pathways.

Employer wellness expansion

Employer-led wellness programs can scale faster in the UAE than many markets because the ecosystem already supports large-scale digital engagement through cities, payers, and public initiatives. Dubai’s flagship wellness campaign recorded ~ participants, demonstrating that mass behavior-change programs can mobilize millions—an ideal environment for wearables-driven challenges, sleep coaching, and activity-based incentives implemented through employers. The payer rails needed to manage benefits and engagement already operate at enormous administrative volume, with ~ transactions received and ~ insurance claims processed through the electronic portal in a single year, providing evidence of a system capable of managing rules, eligibility, and digital participation programs at scale. On macro fundamentals, UAE GDP of USD ~ billion and population of ~ support a large, economically active workforce base and strong corporate participation capacity. The opportunity is to translate this ecosystem into employer wearables programs with measurable KPIs (activity, sleep, adherence) without relying on survey-led engagement claims.

Future Outlook

Over the next several years, the UAE health monitoring wearables market is expected to expand steadily as consumer wellness shifts from step counting to multi-parameter health insights and continuous monitoring. Growth will be supported by premium device cycles, broader adoption of smart rings and sleep-centric wearables, and deeper linkage with provider programs for chronic disease monitoring. Dubai and Abu Dhabi’s digital health infrastructure—through platforms such as NABIDH and Malaffi—creates enabling rails for connected care and data exchange, improving feasibility for RPM-led scaling. A parallel push toward more formal registration and trading of regulated devices will also strengthen authorized channels.

Major Players

- Apple

- Samsung

- Huawei

- Google Fitbit

- Garmin

- Xiaomi

- Amazfit

- Withings

- Oura

- WHOOP

- Polar

- Suunto

- Omron Healthcare

- Abbott

Key Target Audience

- Wearables OEMs and regional distributors

- Consumer electronics retailers and omnichannel operators

- E-commerce marketplaces and D2C enablers

- Hospital groups and provider networks

- Health insurers and TPAs

- Telecom operators

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

The work begins by building a UAE ecosystem map covering OEMs, distributors, retailers, telecom operators, pharmacies, providers, and payers. Secondary research is used to define variables such as device mix, channel mix, ASP ladders, subscription attach rates, replacement cycles, and regulatory constraints that influence market performance.

Step 2: Market Analysis and Construction

Historical market patterns are compiled to understand demand build-up, premiumization, and channel migration from offline to online. Market sizing is constructed using a triangulated approach, including vendor landscape mapping, channel revenue logic, and validation of device category expansion, with smartwatch-led demand and rising condition-specific wearables.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are validated through structured expert consultations with UAE stakeholders, including retail category leaders, distributor sales heads, provider digital health owners, and insurer wellness managers. Interviews test assumptions on sell-through velocity, price bands, feature priorities, and adoption barriers.

Step 4: Research Synthesis and Final Output

The final stage synthesizes insights across consumer demand, enterprise and RPM feasibility, compliance factors, and channel economics. Findings are cross-checked against regulatory pathways and digital health infrastructure context to ensure conclusions are actionable and locally grounded.

- Executive Summary

- Research Methodology (market definitions, device inclusion/exclusion, “medical-grade vs wellness-grade” framework, triangulation approach, assumptions and abbreviations, sizing framework, primary research approach, secondary research approach, validation and limitations)

- Definition and Scope

- Market Genesis and Evolution

- Wearables Value Chain and Stakeholder Roles

- Demand Ecosystem Linkages (Wellness, Clinical Monitoring, Remote Care)

- Operating Landscape (Retail, Healthcare Providers, Insurers, Telecom, Platforms)

- Growth Drivers

Chronic disease management demand

Remote patient monitoring expansion

Premium consumer technology adoption

Fitness and wellness culture

Corporate wellness budgets - Challenges

Clinical validation and accuracy expectations

Data residency and privacy requirements

Reimbursement ambiguity

Grey market imports

Integration complexity - Opportunities

Medical-grade wearables in cardiology and endocrinology

Employer wellness expansion

Insurer incentive programs

Localized user experience and support

Subscription-based analytics - Trends

AI-driven insights and predictive analytics

Smart ring adoption

Hybrid wellness and clinical positioning

Pharmacy channel expansion

Telecom bundling

Regulatory & Policy Landscape - Technology and Innovation Landscape

- Pricing and Monetization Models

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- By Value, 2019–2024

- By Units, 2019–2024

- By Average Selling Price, 2019–2024

- By Channel Contribution, 2019–2024

- By Premiumization Index, 2019–2024

- By Fleet Type (in Value %)

Smartwatch

Fitness Band

Smart Ring

CGM or Patch Sensor

ECG Patch or Holter Wearable

- By Application (in Value %)

Cardiac Monitoring

Metabolic Monitoring

Blood Pressure and Vascular

Sleep and Recovery

Respiratory and SpO2

- By Technology Architecture (in Value %)

iOS Ecosystem

Android Ecosystem

Huawei Health Ecosystem

Proprietary Platforms

API-Enabled Interoperable Systems

- By Connectivity Type (in Value %)

Bluetooth

Wi-Fi

Cellular or eSIM

Hybrid Connectivity

- By End-Use Industry (in Value %)

Consumers

Corporate Wellness Programs

Hospitals and Clinics

Insurance Providers

Government Health Programs

- By Region (in Value %)

Dubai

Abu Dhabi

Sharjah and Northern Emirates

- Market Share Analysis

- Cross Comparison Parameters (regulatory compliance readiness, health information exchange integration potential, data residency and privacy posture, clinical validation and accuracy claims, ecosystem lock-in and app experience, channel strength, pricing ladder and subscription strategy, service and warranty footprint)

- Competitive Benchmarking

- Pricing Analysis

- Company Profiles

Apple

Samsung

Huawei

Google Fitbit

Garmin

Xiaomi

Amazfit (Zepp Health)

Withings

Oura

WHOOP

Polar

Suunto

Omron Healthcare

Abbott

Dexcom

- Consumer Personas

- Provider and Hospital Demand

- Payer and Insurer Perspective

- Corporate Wellness Buyers

- Decision Journey and Conversion Funnel

- By Value, 2025–2030

- By Units, 2025–2030

- By Average Selling Price, 2025–2030

- By Channel Contribution, 2025–2030

- By Premiumization Index, 2025–2030