Market Overview

The UAE healthcare market is valued at USD 22 billion in 2024 with an approximated compound annual growth rate (CAGR) of 3% from 2024-2030, with robust growth driven by government initiatives and an increasing emphasis on health technology advancements. Investment in healthcare infrastructure and services is set to bolster this figure. According to the Dubai Healthcare City Authority, the market is expected to exhibit continued expansion, driven by rising demand for quality healthcare services, particularly in urban areas, alongside the growth of insurance coverage among the population.

Predominantly, cities like Dubai and Abu Dhabi dominate the UAE healthcare landscape due to their status as economic hubs and centers for expatriates. These cities are characterized by modern healthcare facilities, availability of specialized medical services, and a high concentration of healthcare professionals. The government’s commitment to enhancing healthcare infrastructure, promoting medical tourism, and facilitating partnerships with international health organizations further strengthens their dominance in the market.

Advancements in medical technology are transforming the healthcare landscape in the UAE. Investment in healthcare technology is projected to exceed AED 4.8 billion, driven by innovations in telemedicine, diagnostics, and treatment protocols. The UAE government has prioritized the adoption of cutting-edge medical technology as part of its vision 2030 initiative, which includes the establishment of health technology parks.

Market Segmentation

By Service Type

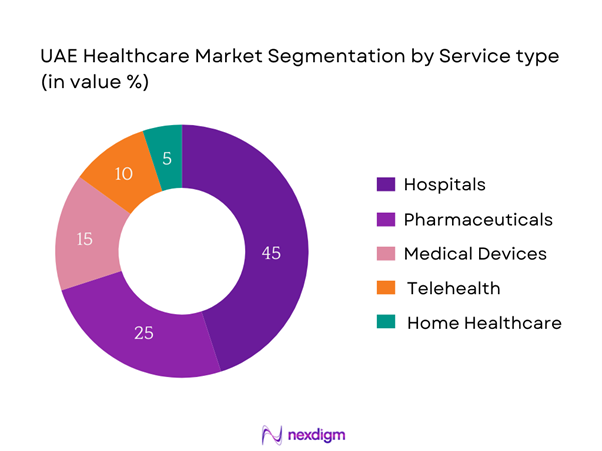

The UAE healthcare market is segmented by service type into hospitals, pharmaceuticals, medical devices, telehealth, and home healthcare. Hospitals hold a dominating position within this segmentation owing to their critical role in providing comprehensive healthcare solutions and advanced medical treatments. As the primary healthcare provider, hospitals offer specialized medical services, emergency care, and surgery, catering to the increasing population and high demand for medical services in the region. The UAE government has invested heavily in upgrading hospital facilities, enhancing service delivery, and increasing accessibility, thereby solidifying the hospitals’ prominence in the sector.

By End User

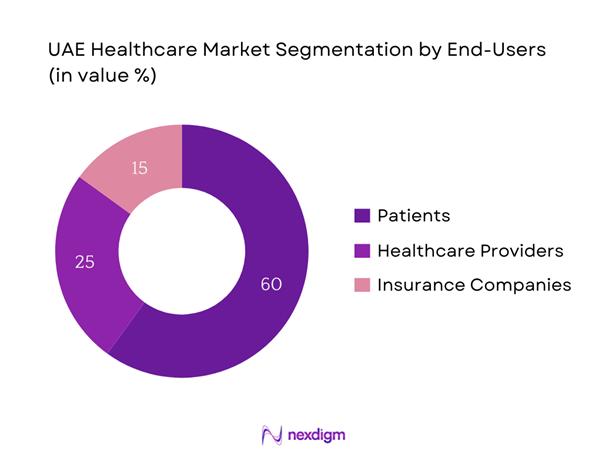

The market is also segmented into end users which include patients, healthcare providers, and insurance companies. Patients are the primary end users in the healthcare market, representing a substantial share due to the growing demand for healthcare services fueled by an increasing population and rising healthcare awareness. They are motivated by the necessity of both emergency and preventative care services. As health insurance coverage expands and public awareness regarding health and wellness increases, patients are increasingly seeking comprehensive medical services, underscoring their dominant position in this segmentation.

Competitive Landscape

The UAE healthcare market is characterized by the presence of major players, including local and international entities. This competitive landscape is dominated by healthcare providers who not only fulfill national healthcare needs but also cater to an increasingly global patient base seeking specialized services. Companies such as NMC Healthcare and Mediclinic International leverage advanced technologies and offer diversified services to strengthen their market position.

| Company | Year Established | Headquarters | Market Segment | Service Offering | Employees | Global Presence | Revenue (Estimated) |

| NMC Healthcare | 1975 | Abu Dhabi, UAE | – | – | – | – | – |

| Mediclinic International | 1983 | London, UK | – | – | – | – | – |

| Abu Dhabi Healthcare Services (SEHA) | 2007 | Abu Dhabi, UAE | – | – | – | – | – |

| Al Zahra Hospital | 1996 | Sharjah, UAE | – | – | – | – | – |

| Emirates Healthcare | 2008 | Dubai, UAE | – | – | – | – | – |

UAE Healthcare Market Analysis

Growth Drivers

Increasing Chronic Diseases

The prevalence of chronic diseases in the UAE is escalating significantly, with an estimated 9.6 million cases reported across various conditions such as diabetes, hypertension, and cardiovascular diseases. According to the World Health Organization (WHO), around 42% of adults in the UAE suffer from obesity, which is primarily associated with these chronic conditions. The Ministry of Health and Prevention (MoHAP) indicates that nearly 1 in 5 adults are diagnosed with diabetes, prompting government initiatives aimed at enhancing healthcare infrastructure and services to manage these diseases. This growing burden of illness necessitates advanced medical interventions and treatments, thus driving healthcare demand.

Growing Elderly Population

The UAE’s elderly population is projected to reach approximately 1.8 million by end of 2025, constituting about 18% of the total population. This demographic shift, highlighted by the Federal Competitiveness and Statistics Authority, is leading to an increased demand for healthcare services tailored for older adults, including long-term care and geriatric services. The government’s initiatives, such as the Aging Strategy 2018-2021, aim to improve healthcare access and facilities for senior citizens, thereby reinforcing the need for a robust healthcare framework. With an aging population prone to chronic diseases, the healthcare sector’s growth is further accelerated.

Market Challenges

Regulatory Compliance

The regulatory framework governing the UAE healthcare sector is complex, with various laws and policies enacted to ensure patient safety and quality of care. The health authority has stringent licensing requirements, which mandates compliance with standards set by the Department of Health in Abu Dhabi and the Dubai Health Authority. Ensuring compliance can be challenging for healthcare providers, especially smaller entities, resulting in delays and increased operational costs due to the necessity of adhering to comprehensive regulatory guidelines. Non-compliance can also attract significant penalties, further complicating market dynamics.

High Operational Costs

Operational costs in the UAE healthcare sector have risen sharply, attributed to escalating expenses related to medical equipment, technology, staffing, and facility management. The healthcare expenditure is projected to reach approximately AED 70 billion, as reported by the Ministry of Health and Prevention. These rising costs are compounded by the need for continuous investment in infrastructure and technology to maintain quality standards mandated by regulatory bodies. High operational costs can limit profitability for healthcare providers, making it a significant challenge to sustain financial viability within the competitive healthcare environment.

Opportunities

Emerging Markets in Telehealth

With over 98% of the UAE’s population being internet users, the demand for telehealth services is experiencing exponential growth. The value of the telehealth market has the potential to reach AED 853 million, providing significant opportunities for healthcare providers to expand their offerings. Presently, telemedicine platforms are being increasingly adopted, allowing healthcare services to reach remote and underserved populations. The government’s support for digital health initiatives, such as the UAE teleneurosurgery program, highlights the sector’s commitment to enhancing healthcare accessibility through innovative technologies. This trend indicates a promising growth trajectory for telehealth services in the UAE.

Rising Demand for Personalized Medicine

The demand for personalized medicine is on the rise in the UAE, with ongoing advancements in genomics and biotechnology. The healthcare sector’s future growth potential is supported by the increasing patient interest in tailored treatment plans based on individual genetic profiles. Current investments in precision medicine initiatives, such as genome sequencing programs supported by leading healthcare institutions, are paving the way for innovative healthcare solutions. According to experts, personalized medicine can significantly enhance treatment efficacy and patient outcomes, positioning it as a key opportunity for growth within the healthcare market.

Future Outlook

The UAE healthcare market is poised for significant growth, bolstered by continuous government support, advancements in healthcare technology, and an increased focus on preventive health measures. Developments in telehealth and digital health solutions are transforming service delivery and ensuring accessibility for a broader segment of the population. Additionally, demographic shifts such as an increase in elderly populations are positioning the healthcare sector for robust demand and innovation in service offerings.

Major Players

- NMC Healthcare

- Mediclinic International

- Abu Dhabi Healthcare Services (SEHA)

- Al Zahra Hospital

- Emirates Healthcare

- Roche

- Siemens Healthineers

- GE Healthcare

- Philips Healthcare

- Johnson & Johnson

- Pfizer

- AstraZeneca

- GSK

- Abbott Laboratories

- Covidien

Key Target Audience

- Healthcare Providers

- Private Hospitals

- Pharmaceutical Companies

- Medical Device Manufacturers

- Insurance Companies

- Government and Regulatory Bodies (Health Authority of Abu Dhabi, Dubai Health Authority)

- Investments and Venture Capitalist Firms

- Health Technology Startups

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping out the ecosystem of the UAE healthcare market, identifying all major stakeholders and their roles. This step employs extensive desk research, using a combination of secondary and proprietary databases to compile comprehensive industry-level information. The objective is to define critical variables that influence market dynamics, including regulatory frameworks, technological advancements, and patient demographics.

Step 2: Market Analysis and Construction

This phase involves gathering and analyzing historical data regarding the UAE healthcare market. This includes evaluating market penetration, service utilization rates, and the financial viability of various healthcare providers. An assessment of service quality metrics will also be performed to ensure the accuracy and reliability of revenue estimates, which will contribute to a comprehensive understanding of market performance.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be formulated and subsequently validated through Computer-Assisted Telephone Interviews (CATIs) with industry experts from key firms within the sector. These consultations yield insights on operational practices, financial data, and future outlooks, which are pivotal for refining and corroborating the gathered market intelligence.

Step 4: Research Synthesis and Final Output

In the final phase, direct engagement with healthcare providers and stakeholders will be conducted to obtain detailed insights regarding service offerings, patient preferences, and market trends. This interaction will serve to affirm and complement the quantitative data gathered through earlier research steps, resulting in a validated and comprehensive analysis of the UAE healthcare market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Chronic Diseases

Growing Elderly Population

Advances in Medical Technology - Market Challenges

Regulatory Compliance

High Operational Costs - Opportunities

Emerging Markets in Telehealth

Rising Demand for Personalized Medicine - Trends

Integration of AI in Healthcare

Shift Towards Preventative Care - Government Regulation

Healthcare Policies

Licensing Requirements - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Service Type, 2019-2024

- By Service Type (In Value %)

Hospitals

– General Hospitals

– Specialty Hospitals (Cardiology, Oncology, Orthopedics)

– Multi-specialty Hospitals

– Government and Private Hospitals

Pharmaceuticals

– Prescription Drugs

– Over-the-Counter (OTC) Medicines

– Generic Drugs

– Biopharmaceuticals

Medical Devices

– Diagnostic Devices (X-ray, MRI, Ultrasound)

– Therapeutic Devices (Dialysis Machines, Infusion Pumps)

– Monitoring Devices (ECG, Blood Pressure Monitors)

– Surgical Instruments

Telehealth

– Teleconsultation Services

– Remote Monitoring Devices

– Mobile Health Apps

– Virtual Health Platforms

Home Healthcare

– Skilled Nursing Services

– Rehabilitation Services

– Chronic Disease Management (e.g., Diabetes, Cardiac Care)

– Palliative and Elderly Care - By End User (In Value %)

Patients

– Outpatients

– Inpatients

– Chronic Illness Patients

– Elderly Population

Healthcare Providers

– Hospitals & Clinics

– Diagnostic Laboratories

– Telemedicine Providers

– Home Healthcare Agencies

Insurance Companies

– Public Insurers (e.g., Daman)

– Private Health Insurers

– Third-Party Administrators (TPAs)

– Corporate Healthcare Plans - By Distribution Channel (In Value %)

Direct Sales

Online Sales

Third-Party Distributors - By Region (In Value %)

Abu Dhabi

Dubai

Sharjah

Ajman

Ras Al Khaimah - By Technology Type (In Value %)

Artificial Intelligence (AI)

– Diagnostic Algorithms

– Predictive Analytics in Patient Care

– AI-powered Radiology and Imaging

Blockchain

– Secure Medical Records

– Insurance and Billing Transparency

– Clinical Trials and Drug Traceability

Internet of Things (IoT)

– Remote Patient Monitoring

– Smart Medical Devices (e.g., IoT-enabled inhalers)

– Hospital Asset Tracking Systems

- Market Share of Major Players on the Basis of Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Revenue, Distribution Channels, Market Position, Customer Feedback, Innovation Index, Technology Adoption, Doctor-to-Patient Ratio, Geographic Coverage, CapEx and Infrastructure Investments, ESG Reporting, and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

NMC Healthcare

Mediclinic International

Abu Dhabi Healthcare Services (SEHA)

Al Zahra Hospital

Emirates Healthcare

Roche

Siemens Healthineers

GE Healthcare

Philips Healthcare

Johnson & Johnson

Pfizer

AstraZeneca

GSK

Abbott Laboratories

Covidien

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Technology Type, 2025-2030