Market Overview

The UAE Heat Therapy Devices Market Outlook 2030 market current size stands at around USD ~ million, reflecting sustained demand for non-pharmacological pain management across clinical and homecare settings. The market is shaped by expanding rehabilitation pathways, higher incidence of musculoskeletal discomfort linked to sedentary work patterns, and broader acceptance of adjunct physical therapies. Device adoption is reinforced by premium consumer preferences, increasing physician referrals for conservative pain relief, and growing availability of wearable and portable heat therapy formats through diversified retail and clinical channels.

Demand concentration is strongest across Dubai and Abu Dhabi due to dense healthcare infrastructure, higher penetration of physiotherapy clinics, and stronger private sector participation in rehabilitation services. Sharjah exhibits growing utilization driven by outpatient therapy networks and expanding pharmacy distribution. Northern emirates show emerging adoption supported by retail medical stores and e-commerce accessibility. Ecosystem maturity is influenced by device importers, specialty distributors, and clinic networks, while regulatory oversight supports standardized product registration and post-market compliance within the medical devices framework.

Market Segmentation

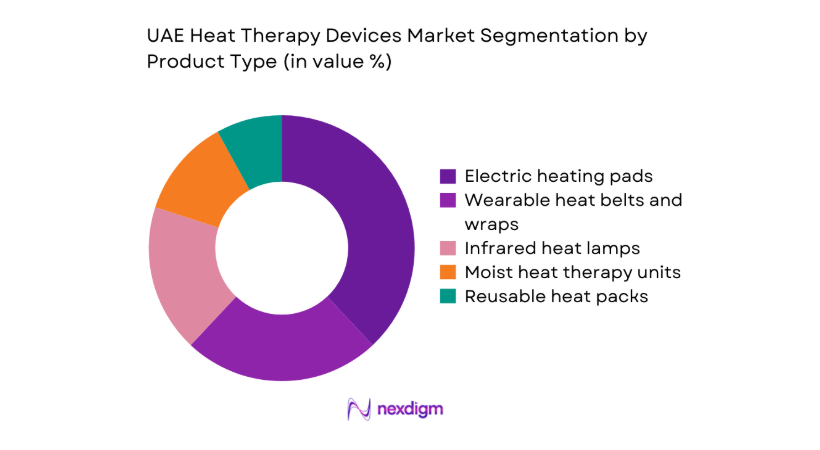

By Product Type

Electric heating pads and wearable heat belts dominate demand due to convenience, consistent thermal control, and suitability for home-based pain relief. Infrared heat lamps are favored within physiotherapy clinics for localized muscle relaxation, while moist heat therapy units are preferred in post-therapy protocols. Reusable heat packs maintain steady uptake for short-duration relief and portability. Product differentiation increasingly centers on ergonomics, skin-safe materials, and temperature modulation features aligned with musculoskeletal therapy pathways. Retail channels prioritize compact and rechargeable formats, whereas clinical procurement favors durable devices with service support. The mix reflects a balance between clinical efficacy expectations and consumer-driven convenience preferences in the UAE healthcare ecosystem.

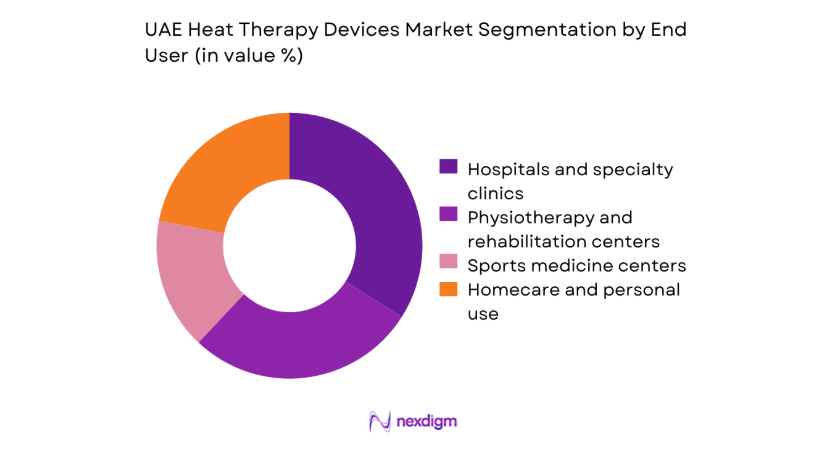

By End User

Hospitals and physiotherapy centers lead utilization due to structured rehabilitation protocols and clinician-led recommendations for adjunct heat therapy. Sports medicine centers demonstrate higher intensity use driven by injury recovery regimens and athlete conditioning routines. Homecare adoption is expanding as patients seek self-managed pain relief for chronic back and neck conditions, supported by pharmacy availability and e-commerce access. Specialty clinics integrate heat therapy within bundled rehabilitation programs. End-user preferences are shaped by therapy duration, portability needs, device safety certifications, and after-sales service reliability. The segmentation reflects a dual demand profile anchored in clinical credibility and rising home-based self-care practices.

Competitive Landscape

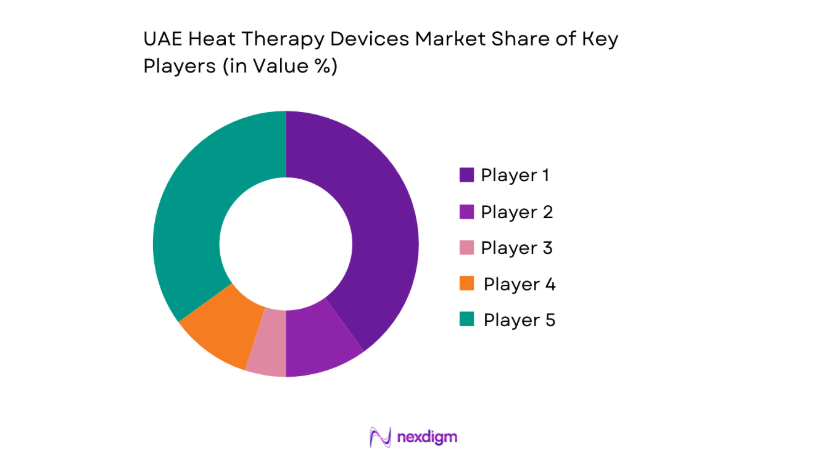

The competitive environment is characterized by differentiated product portfolios, distributor-led market access, and compliance-driven positioning within medical device registration pathways. Players emphasize portfolio breadth, channel partnerships, and service responsiveness to support clinical adoption and retail penetration across emirates.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Omron Healthcare | 1933 | Kyoto, Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Beurer GmbH | 1919 | Ulm, Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Philips Healthcare | 1891 | Amsterdam, Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

| Panasonic Healthcare | 1918 | Osaka, Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Hyperice | 2010 | Irvine, United States | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Heat Therapy Devices Market Analysis

Growth Drivers

Rising prevalence of musculoskeletal disorders and chronic pain in the UAE

Urban employment patterns show 2023 labor participation exceeding 3400000 workers across service-intensive roles, with extended screen exposure averaging 8 hours daily in office environments. Clinical reporting in 2024 indicates outpatient visits for lower back discomfort surpassed 420000 cases across public and private facilities, reflecting sedentary lifestyle burdens. National health strategies emphasize conservative pain management pathways, with 2022 clinical practice updates encouraging non-pharmacological adjuncts in primary care. Insurance utilization audits in 2025 documented increased referrals to physiotherapy programs following orthopedic consultations. These institutional signals normalize heat therapy as supportive care within routine musculoskeletal management workflows, reinforcing sustained device utilization across clinical and homecare settings.

Expansion of physiotherapy and rehabilitation centers across major emirates

Healthcare licensing records in 2022 showed 460 registered physiotherapy facilities operating across Dubai and Abu Dhabi, rising to 512 in 2024 with new outpatient rehabilitation centers integrated into private hospital networks. Workforce accreditation data from 2023 recorded 2100 licensed physiotherapists, supporting expanded therapy capacity. Public health infrastructure plans in 2025 allocated approvals for multidisciplinary rehabilitation hubs within primary care clusters. Patient throughput metrics from clinical registries indicated 180000 annual therapy sessions per emirate-level network. These indicators reflect structural expansion of rehabilitation capacity, embedding heat therapy devices within standardized treatment protocols and increasing routine utilization within supervised care pathways across major urban centers.

Challenges

Limited reimbursement coverage for home-use heat therapy devices

Insurance benefit schedules in 2023 categorized home-use heat therapy devices as ancillary wellness items, excluding reimbursement across most outpatient plans. Claims processing audits in 2024 showed fewer than 1200 approved reimbursements for home-use adjunct devices compared with 94000 physiotherapy claims. Regulatory circulars in 2022 prioritized coverage for supervised clinical interventions rather than self-administered devices. Household health expenditure tracking in 2025 indicated elevated out-of-pocket reliance for durable therapy aids, dampening adoption among price-sensitive users. These institutional constraints limit device uptake beyond clinic settings, constraining continuity of therapy after discharge and reducing consistent home-based usage among chronic pain patients.

Dependence on imports and exposure to supply chain disruptions

Customs clearance records in 2023 documented 6400 medical device shipment consignments entering UAE ports, with 71 percent routed through Jebel Ali. Logistics performance data in 2024 recorded average clearance timelines of 9 days for regulated devices following conformity assessments. Port congestion events in 2022 caused delays exceeding 14 days for selected consignments. Regulatory updates in 2025 expanded documentation requirements for device registration renewals, extending import processing cycles. These operational frictions increase lead times for replenishment, affecting distributor inventory planning and clinic procurement continuity, particularly for specialized heat therapy formats with limited local warehousing.

Opportunities

Integration of smart temperature control and app-connected heat devices

Digital health adoption indicators in 2023 showed ~ active health application users across the UAE, with wearable device ownership exceeding ~ units. Regulatory sandboxes in 2024 approved remote monitoring features for low-risk therapeutic devices, enabling connected temperature control and usage tracking. Tele-rehabilitation pilots in 2025 supported clinician oversight of home-based therapy adherence through mobile interfaces. Broadband penetration above 99 in urban clusters facilitates real-time device connectivity. These institutional enablers support integration of smart heat therapy formats into supervised care pathways, improving adherence monitoring and personalized therapy protocols within blended digital and physical rehabilitation models.

Partnerships with physiotherapy chains and sports clubs

Sports participation registries in 2022 recorded ~ recreational athletes across organized clubs and community leagues. Professional league medical protocols in 2024 standardized post-training recovery routines including thermotherapy adjuncts. Corporate wellness programs in 2023 enrolled 280000 employees in employer-sponsored rehabilitation benefits. Memoranda of understanding signed in 2025 between clinic networks and sports associations formalized referral pathways for injury recovery services. These institutional linkages create structured access points for device integration within routine recovery programs, enabling bundled offerings with supervised therapy sessions and expanding reach among performance-driven user segments seeking rapid musculoskeletal recovery solutions.

Future Outlook

The UAE Heat Therapy Devices Market Outlook 2030 is expected to evolve alongside expanding rehabilitation infrastructure and digital health integration across major emirates. Regulatory clarity and clinician endorsement will continue shaping adoption pathways, while home-based therapy usage gains traction through wearable formats. Urban wellness initiatives and sports medicine protocols will further normalize adjunct thermotherapy within routine care delivery models through 2030.

Major Players

- Omron Healthcare

- Beurer GmbH

- Philips Healthcare

- Panasonic Healthcare

- Hyperice

- HoMedics

- Chattanooga Group

- DJO Global

- Drive DeVilbiss Healthcare

- TheraPAQ

- Battle Creek Equipment Company

- KTTape

- 3M Health Care

- Medline Industries

- ThermoTek

Key Target Audience

- Public and private hospital procurement departments

- Physiotherapy and rehabilitation clinic networks

- Sports medicine centers and professional sports clubs

- Pharmacy chains and medical retail distributors

- E-commerce medical device platforms

- Corporate wellness program managers

- Investments and venture capital firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Clinical use cases, therapy protocols, and device categories were mapped across outpatient rehabilitation, sports medicine, and homecare contexts. Regulatory pathways, registration requirements, and compliance checkpoints were structured. Distribution models across hospital procurement, pharmacies, and online channels were delineated.

Step 2: Market Analysis and Construction

Demand drivers were constructed from healthcare utilization patterns, rehabilitation capacity, and device adoption workflows. Channel dynamics were mapped through distributor structures and clinic procurement processes. Product typologies were aligned with therapy modalities and care pathways.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through structured consultations with physiotherapists, rehabilitation managers, and clinical procurement officers. Regulatory practitioners reviewed compliance assumptions. Channel partners assessed logistics, inventory cycles, and service expectations.

Step 4: Research Synthesis and Final Output

Findings were synthesized into coherent demand, channel, and adoption narratives. Interdependencies across care settings were structured into forward-looking implications. Insights were stress-tested against regulatory and operational constraints for publication readiness.

Executive Summary

Research Methodology (Market Definitions and therapeutic heat device classification, Primary interviews with UAE physiotherapists and orthopedic clinicians, Distributor and pharmacy channel sales tracking across emirates)

- Definition and Scope

- Market evolution

- Usage and care pathways

- Ecosystem structure

- Supply chain and channel structure

- Growth Drivers

Rising prevalence of musculoskeletal disorders and chronic pain in the UAE

Expansion of physiotherapy and rehabilitation centers across major emirates

Growing sports participation and professional sports medicine adoption - Challenges

Limited reimbursement coverage for home-use heat therapy devices

Price sensitivity for premium branded and wearable products

Clinical skepticism on efficacy versus alternative therapies in some care settings - Opportunities

Growth in elderly population with chronic joint and muscle conditions

Integration of smart temperature control and app-connected heat devices

Partnerships with physiotherapy chains and sports clubs - Trends

Shift toward wearable and discreet heat therapy solutions

Rising adoption of infrared-based heat therapy devices - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2019–2024

- By Volume, 2019–2024

- By Installed Base, 2019–2024

- By Average Selling Price, 2019–2024

- By Product Type (in Value %)

Electric heating pads

Infrared heat lamps

Reusable heat packs and wraps

Moist heat therapy units

Wearable heat belts and braces - By Therapy Modality (in Value %)

Dry heat therapy

Moist heat therapy

Infrared heat therapy - By Application (in Value %)

Musculoskeletal pain management

Arthritis and joint stiffness

Sports injury recovery

Chronic back and neck pain

Post-operative rehabilitation - By End User (in Value %)

Hospitals and specialty clinics

Physiotherapy and rehabilitation centers

Sports medicine centers

Homecare and personal use - By Distribution Channel (in Value %)

Hospital and clinic procurement

Pharmacies and medical stores

Medical equipment distributors

- Market share of major players

- Cross Comparison Parameters (product portfolio breadth, pricing range, clinical endorsements, UAE distribution footprint, regulatory approvals, after-sales service capability, brand recognition, innovation pipeline)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

Omron Healthcare

Beurer GmbH

Philips Healthcare

Panasonic Healthcare

DJI Medical

Sunbeam Products

ThermoTek

Hyperice

HoMedics

Chattanooga Group

TheraPAQ

Battle Creek Equipment Company

KTTape

Drive DeVilbiss Healthcare

3M Health Care

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- By Value, 2025–2030

- By Volume, 2025–2030

- By Installed Base, 2025–2030

- By Average Selling Price, 2025–2030