Market Overview

The UAE Holter Monitors Equipment market current size stands at around USD ~ million, reflecting a mature diagnostic equipment category embedded within ambulatory cardiology workflows across tertiary and secondary care settings. Demand is anchored by routine rhythm assessment, post-procedural monitoring, and medication response evaluation within structured care pathways. Procurement is driven by institutional purchasing cycles, equipment replacement needs, and clinical protocol updates, supported by distributor networks, device servicing ecosystems, and standardized compliance requirements across public and private providers.

Demand concentration is strongest in Abu Dhabi and Dubai, where advanced hospital infrastructure, specialty cardiology centers, and dense diagnostic networks support higher utilization intensity. These hubs benefit from established clinical governance frameworks, centralized procurement mechanisms, and streamlined regulatory oversight that enable faster technology adoption. Secondary demand clusters exist in Sharjah and Northern Emirates, supported by expanding outpatient cardiology services, private clinic networks, and referral pathways linked to tertiary centers, reinforcing ecosystem maturity and channel depth.

Market Segmentation

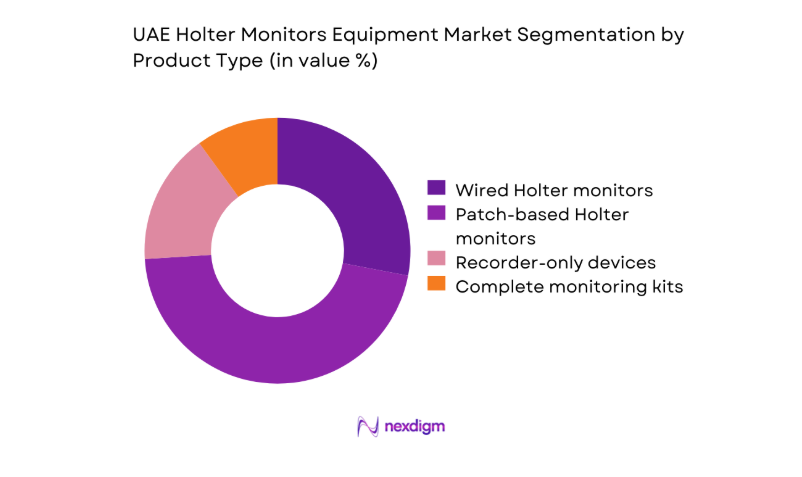

By Product Type

Patch-based Holter monitors dominate adoption due to patient comfort, higher adherence during extended wear, and simplified workflows for clinicians managing ambulatory monitoring volumes. Hospitals and diagnostic centers increasingly favor lightweight, cable-free devices to reduce setup time and improve data quality across routine rhythm assessment and post-intervention follow-up. Wired recorders retain relevance for inpatient monitoring protocols and complex lead requirements, particularly in tertiary facilities with established ECG interpretation teams. Complete monitoring kits are preferred by multi-site providers seeking standardized deployments, streamlined maintenance, and compatibility with centralized data platforms across distributed care networks.

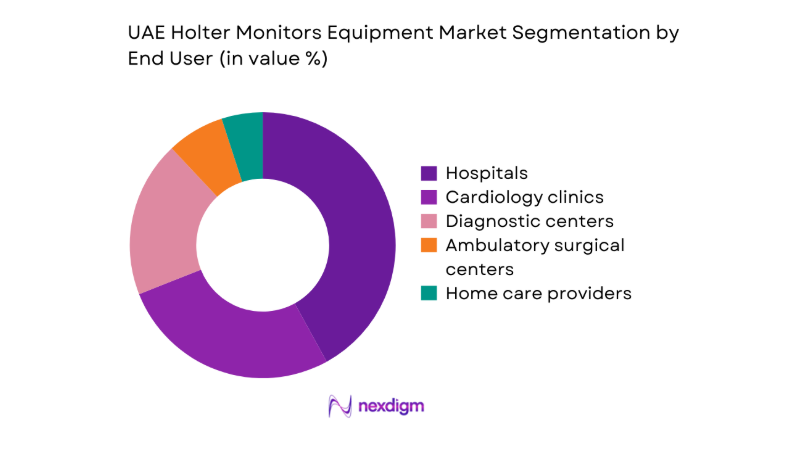

By End User

Hospitals account for the largest share due to high patient throughput, protocol-driven cardiac diagnostics, and integration with inpatient and outpatient cardiology services. Cardiology clinics follow, driven by ambulatory testing demand, medication titration workflows, and referral-based diagnostics. Diagnostic centers benefit from outsourced monitoring services and standardized reporting models supporting multiple physician networks. Ambulatory surgical centers and home care providers show emerging uptake as post-procedure monitoring and remote care pathways expand. End-user preference is shaped by procurement scale, service support availability, data integration needs, and compliance requirements within regulated clinical environments.

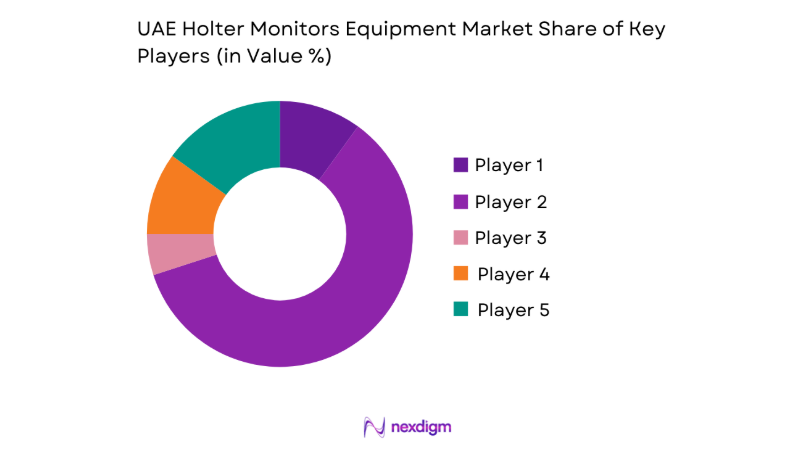

Competitive Landscape

The competitive environment is characterized by multinational device manufacturers and specialized diagnostic technology providers operating through distributor-led models. Competition centers on product reliability, software analytics integration, service responsiveness, and regulatory readiness aligned with hospital procurement standards. Channel strength and after-sales support significantly influence vendor selection within tender-driven public systems and large private hospital groups.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Philips | 1891 | Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

| GE HealthCare | 1892 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Nihon Kohden | 1951 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Schiller AG | 1974 | Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| Mindray | 1991 | China | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Holter Monitors Equipment Market Analysis

Growth Drivers

Rising cardiovascular disease burden in the UAE

Cardiovascular conditions account for substantial inpatient and outpatient encounters across public and private facilities, increasing diagnostic monitoring intensity. Hospital admissions for cardiac complaints exceeded 120000 in 2023, with emergency presentations rising by 18000 compared to 2022. Outpatient cardiology visits across major emirates surpassed 450000 in 2024, reflecting chronic disease management needs. National screening programs expanded coverage to 65 primary care centers in 2024, increasing referrals for ambulatory rhythm assessment. Procedure volumes for catheter-based interventions reached 7400 in 2023, driving post-procedural monitoring demand. The Ministry of Health recorded 38 specialized cardiac units in operation by 2024, supporting routine deployment of ambulatory diagnostics.

Expansion of private cardiology clinics and diagnostic centers

Private sector capacity expanded steadily, with 54 new specialty clinics licensed between 2022 and 2024 across major urban centers. Diagnostic imaging and cardiology service licenses increased by 19 facilities in 2023, strengthening referral-driven monitoring volumes. Outpatient procedure rooms rose by 112 units in 2024 within private networks, enabling higher throughput for rhythm assessment. Insurance-covered cardiology encounters increased by 260000 visits in 2024 versus 2022, supporting sustained equipment utilization. Regulatory approvals for new outpatient centers averaged 22 per year during 2023 and 2024, reinforcing distributed care models. Workforce licensing added 480 cardiology technicians by 2024, improving operational readiness for ambulatory monitoring services.

Challenges

Price sensitivity in public sector tenders

Public procurement frameworks emphasize lowest compliant bids, constraining technology upgrades despite clinical preference for advanced features. Centralized tenders issued 14 framework agreements in 2023 for diagnostic equipment categories, intensifying competition on non-price criteria. Tender evaluation cycles averaged 9 months in 2024, delaying deployment and reducing vendor planning certainty. Contract durations of 24 months limit mid-cycle product refresh adoption. Compliance documentation requirements increased by 27 checkpoints in 2023, raising administrative burdens for suppliers. Payment settlement timelines extended to 120 days across multiple health authorities in 2024, affecting distributor cash flow and inventory planning. These constraints temper rapid diffusion of higher-specification devices within publicly funded facilities.

Dependence on imports and supply chain lead times

Holter equipment supply relies on imported components, exposing providers to logistics variability. Average shipment lead times rose from 28 days in 2022 to 46 days in 2024 due to port congestion and compliance checks. Customs clearance processing involved 11 regulatory verifications in 2023, extending delivery cycles. Distributor safety stock coverage averaged 62 days in 2024, constraining rapid replenishment during demand spikes. Air freight utilization increased to 38 shipments in 2024 to mitigate delays, elevating operational complexity. Local warehousing capacity expanded by 3 facilities in 2023, yet last-mile delivery within northern emirates still averaged 6 days, impacting service-level commitments for urgent replacements.

Opportunities

Expansion of outpatient and day-care cardiology services

Ambulatory care expansion supports decentralized monitoring models aligned with same-day diagnostics and rapid discharge protocols. Day-care cardiology beds increased by 420 units between 2022 and 2024, enabling higher patient turnover for rhythm evaluation. Same-day discharge rates after minor cardiac procedures reached 41 in 2024, increasing reliance on post-discharge monitoring. Outpatient appointment slots expanded by 210000 annually by 2024 across major networks, creating sustained monitoring volumes. Referral turnaround times reduced from 12 days in 2022 to 7 days in 2024, improving utilization cadence. Health authority approvals for extended clinic hours rose to 96 sites in 2023, supporting higher daily throughput for ambulatory diagnostics.

Adoption of patch-based and extended-wear devices

Clinical preference is shifting toward longer wear durations that capture intermittent arrhythmias missed by short recordings. Protocols in tertiary hospitals extended monitoring periods from 24 to 72 hours across 18 cardiac units in 2023. Patient adherence improved with lightweight form factors, reducing repeat tests by 2400 cases in 2024 across participating networks. Data completeness rates improved from 86 in 2022 to 93 in 2024 following patch-based deployments. Training programs certified 320 technicians in 2023 for new device workflows. Interoperability pilots across 9 hospitals in 2024 enabled faster report turnaround, improving clinical decision timelines and reinforcing institutional confidence in extended-wear monitoring pathways.

Future Outlook

The market is expected to evolve toward more ambulatory-centric care models, with broader integration of remote review workflows and analytics-enabled diagnostics through 2030. Policy support for outpatient services and digital health interoperability will accelerate adoption. Vendor differentiation will increasingly depend on service depth, data integration, and compliance readiness aligned with tender frameworks. Replacement cycles and protocol updates will shape procurement patterns.

Major Players

- Philips

- GE HealthCare

- Nihon Kohden

- Schiller AG

- Mindray

- Fukuda Denshi

- Norav Medical

- BTL Industries

- Spacelabs Healthcare

- BIOTRONIK

- Hillrom

- Edan Instruments

- Medicomp

- iRhythm Technologies

- Bittium

Key Target Audience

- Public hospital procurement departments

- Private hospital groups and clinic chains

- Diagnostic center operators

- Cardiology specialty networks

- Medical device distributors and service partners

- Health insurers and payer organizations

- Investments and venture capital firms

- Ministry of Health and Prevention and local health authorities

Research Methodology

Step 1: Identification of Key Variables

Core variables included device categories, lead configurations, end-user settings, procurement pathways, regulatory checkpoints, and service coverage requirements across public and private care environments.

Clinical workflow integration, replacement cycles, and compliance dependencies were mapped to define scope boundaries.

Step 2: Market Analysis and Construction

Demand-side drivers were aligned with outpatient and inpatient cardiology workflows, referral patterns, and utilization pathways.

Supply-side mapping assessed distributor networks, service infrastructure, import logistics, and regulatory readiness across emirates.

Step 3: Hypothesis Validation and Expert Consultation

Structured consultations with clinicians, biomedical engineers, and procurement specialists validated workflow assumptions and adoption barriers. Institutional policy documents and operational metrics were triangulated to refine assumptions on deployment cadence and service expectations.

Step 4: Research Synthesis and Final Output

Insights were synthesized into coherent demand, supply, and ecosystem narratives aligned with clinical pathways and procurement realities.

Findings were stress-tested against regulatory processes, service models, and implementation constraints to ensure practical relevance.

- Executive Summary

- Research Methodology (Market Definitions and Device Scope, Primary interviews with UAE cardiologists and distributors, Hospital procurement and tender analysis, Regulatory and import data review, Installed base and utilization mapping)

- Definition and Scope

- Market evolution

- Clinical use pathways

- Ecosystem structure

- Supply chain and channel structure

- Growth Drivers

Rising cardiovascular disease burden in the UAE

Expansion of private cardiology clinics and diagnostic centers

Government investment in hospital infrastructure - Challenges

Price sensitivity in public sector tenders

Dependence on imports and supply chain lead times

Limited trained technicians for data analysis - Opportunities

Expansion of outpatient and day-care cardiology services

Adoption of patch-based and extended-wear devices

Localization of service and after-sales support - Trends

Shift toward lightweight and patient-friendly devices

Longer recording durations and higher memory capacity - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2019–2024

- By Shipment Volume, 2019–2024

- By Installed Base, 2019–2024

- By Average Selling Price, 2019–2024

- By Product Type (in Value %)

Wired Holter monitors

Patch-based Holter monitors

Recorder-only devices

Complete monitoring kits - By Lead Configuration (in Value %)

2–3 lead

5–7 lead

12-lead - By End User (in Value %)

Hospitals

Cardiology clinics

Diagnostic centers

Ambulatory surgical centers - By Distribution Channel (in Value %)

Direct sales

Distributors

Government and hospital tenders - By Application (in Value %)

Arrhythmia diagnosis

Ischemia monitoring

Post-procedure follow-up

- Market share of major players

- Cross Comparison Parameters (Product portfolio breadth, Recording duration options, Lead configurations, Software analytics capabilities, Local service footprint, Price positioning, Regulatory approvals in UAE, Distribution coverage)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Philips

GE HealthCare

Nihon Kohden

Schiller AG

Spacelabs Healthcare

BTL Industries

Hillrom (Baxter)

iRhythm Technologies

Medicomp

Mindray

Edan Instruments

Fukuda Denshi

Norav Medical

Bittium

BIOTRONIK

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- By Value, 2025–2030

- By Shipment Volume, 2025–2030

- By Installed Base, 2025–2030

- By Average Selling Price, 2025–2030