Market Overview

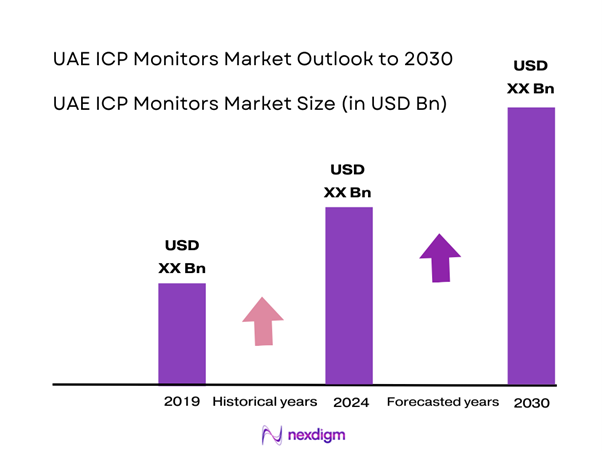

The UAE ICP Monitors Market is valued at USD 9.7 million in 2024 with an approximated compound annual growth rate (CAGR) of 8.8% from 2024-2030, based on a comprehensive historical analysis. This growth is driven by increased environmental monitoring demands, industrial applications, and advancements in technology enhancing measurement accuracy. Rising regulatory compliance in sectors such as agriculture and healthcare further stimulates market expansion, making ICP monitors crucial for real-time analysis.

Key cities like Dubai, Abu Dhabi, and Sharjah dominate the market due to their robust infrastructure, strong industrial growth, and significant investments in research and environmental initiatives. Dubai’s strategic location as a logistics hub, combined with Abu Dhabi’s focus on advanced technology sectors, has fostered an ecosystem well-suited for the adoption of ICP monitoring solutions, further strengthening their market positions.

Technological advancements are facilitating better and more efficient ICP monitoring solutions. Innovations such as remote sensing and IoT integration in environmental monitoring systems are garnering attention in the UAE. The government is investing heavily in smart city initiatives, with a planned investment of AED 14 billion in digital infrastructure by end of 2025. This is anticipated to create a robust framework for deploying advanced ICP monitoring technologies across various sectors, enhancing their reliability and performance. These developments are instrumental in shaping a forward-looking ecosystem that prioritizes environmental sustainability through modern technology.

Market Segmentation

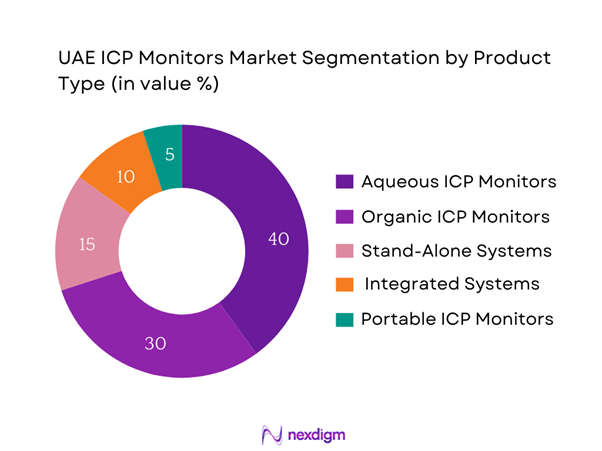

By Product Type

The UAE ICP Monitors Market is segmented by product type into Aqueous ICP Monitors, Organic ICP Monitors, Stand-Alone Systems, Integrated Systems, and Portable ICP Monitors. Recently, Aqueous ICP Monitors have achieved a dominant share in the market due to their wide-ranging applications in environmental monitoring and water quality testing. With increasing regulations on water safety and quality, the demand for these monitors has surged. Key players are focusing on innovation to enhance their performance in detecting trace elements in water, ensuring the continued leadership of this segment.

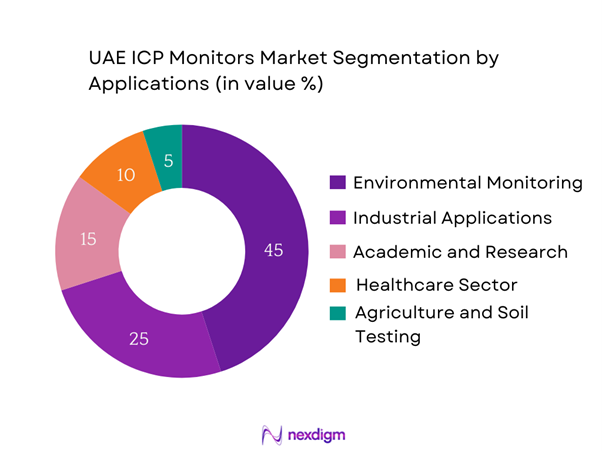

By Application

The market is further segmented by application, including Environmental Monitoring, Industrial Applications, Academic and Research, Healthcare Sector, and Agriculture and Soil Testing. Environmental Monitoring is currently the largest application segment due to increasing government regulations and awareness related to pollution and public health. As industries and regulatory bodies emphasize sustainable practices and monitoring of pollutants, the demand for ICP monitors in this segment continues to rise, benefiting from favorable policies and public funding for environmental protection initiatives.

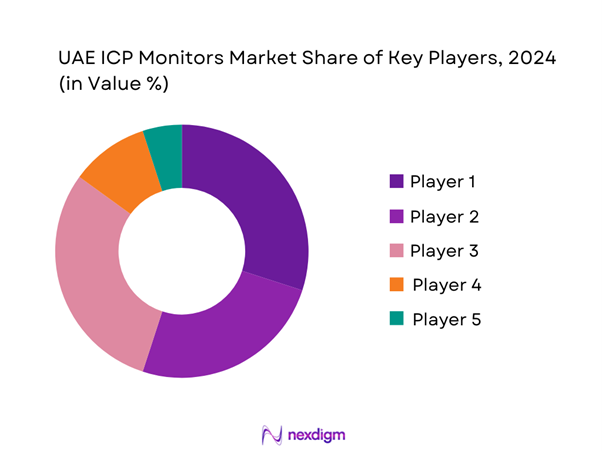

Competitive Landscape

The UAE ICP Monitors Market is dominated by several key players, including Thermo Fisher Scientific, PerkinElmer, Agilent Technologies, Horiba, and Shimadzu Corporation. These leading companies leverage advanced technologies and significant R&D investments to maintain their competitive edge. The concentration of major firms emphasizes the global dominance of the ICP monitor market and underscores its attractiveness to investors.

| Company | Establishment Year | Headquarters | Key Products | Market Focus | Competitive Advantage |

| Thermo Fisher Scientific | 1956 | Waltham, MA, USA | – | – | – |

| PerkinElmer | 1937 | Waltham, MA, USA | – | – | – |

| Agilent Technologies | 1999 | Santa Clara, CA, USA | – | – | – |

| Horiba | 1945 | Kyoto, Japan | – | – | – |

| Shimadzu Corporation | 1875 | Kyoto, Japan | – | – | – |

UAE ICP Monitors Market Analysis

Growth Drivers

Rising Regulatory Standards

The increasing stringency of environmental regulations is significantly driving the demand for ICP monitors in the UAE. As climate change becomes a focal point for policy-making globally, the UAE government has adopted more rigorous environmental laws, with the aim of reducing carbon emissions by 23% by 2030. The UAE’s National Climate Change Plan highlights the importance of sustainability in various sectors, emphasizing continuous environmental monitoring as a key requirement. Regulatory bodies are increasingly mandating the use of advanced monitoring systems, particularly in industries like oil and gas, which is expected to boost market growth.

Increased Environmental Awareness

Public awareness of environmental issues has surged, leading to heightened demand for precise monitoring solutions. Reports indicate that awareness campaigns and education related to environmental protection are becoming more prominent, with national initiatives like the “Year of Tolerance” in 2019 paving the way for increased engagement in sustainability. Furthermore, data from a 2023 environmental survey in the UAE indicated that 75% of residents support stricter regulations on pollution, driving industries to adopt effective monitoring solutions to comply with societal expectations. This growing awareness plays a crucial role in increasing the uptake of ICP monitors.

Market Challenges

High Cost of Advanced Monitors

One of the primary challenges in the UAE ICP Monitors Market is the high cost associated with advanced monitoring systems. High-end ICP monitors can range from AED 75,000 to AED 150,000 depending on specifications and capabilities. Furthermore, ongoing operational costs, such as maintenance and calibration, can make these solutions less accessible for smaller businesses. The World Bank estimates that maintaining environmental quality can absorb 2% to 5% of a nation’s GDP, highlighting the significant financial burden associated with compliance. These costs present a barrier to broader market penetration of ICP technologies in a more diverse array of sectors.

Limited Awareness among End Users

Despite the growing importance of ICP monitors, awareness among potential end users about the benefits and capabilities of these systems remains limited. Many industries in the UAE still rely on traditional methods of environmental monitoring, which can lead to inefficiencies. According to a survey conducted by the UAE Ministry of Environment and Water, nearly 50% of businesses reported using outdated monitoring technologies, indicating a knowledge gap that hampers modernization efforts. This lack of awareness can lead to suboptimal decisions regarding environmental management and compliance, thus slowing market growth.

Opportunities

Growth of Smart Monitoring Technologies

The current landscape presents abundant opportunities for the growth of smart monitoring technologies, reflecting a need for real-time, accurate data in various sectors. The UAE government has set aside AED 3.1 billion for digital transformation initiatives in 2023, creating favorable conditions for the introduction and adoption of smart ICP monitoring technologies. Current trends indicate that companies investing in IoT-enabled solutions report improvements in operational efficiency of up to 30%. The proactive strategy towards smart technology adoption indicates a strong market potential for advanced ICP monitors tailored to meet these evolving needs.

Demand for Real-Time Data

The demand for real-time data is on the rise across multiple industries, particularly in environmental monitoring and compliance. As businesses become more data-driven, the need for solutions that provide instantaneous feedback and analytics is critical. The UAE’s digital economy strategies prioritize the integration of real-time data systems, as indicated by the government’s investment of AED 1 billion into big data initiatives in 2023. This current focus increasingly positions ICP monitors, capable of continuous data reporting, as integral to modern operational frameworks across sectors such as manufacturing, healthcare, and agriculture.

Future Outlook

Over the next five years, the UAE ICP Monitors Market is expected to witness significant growth, driven by continuous advancements in monitoring technologies, increased environmental regulations, and growing demand for real-time data across various applications. The focus on sustainable practices and environmental risk management will further propel market growth, as stakeholders increasingly rely on precision measurement tools for compliance and quality assurance.

Major Players

- Thermo Fisher Scientific

- PerkinElmer

- Agilent Technologies

- Horiba

- Shimadzu Corporation

- Waters Corporation

- Analytik Jena

- Teledyne LeCroy

- Merck Group

- Elementar

- Ametek, Inc.

- QIAGEN

- SPECTRO Analytical Instruments

- Bruker Corporation

- Eurofins Scientific

Key Target Audience

- Government and Regulatory Bodies (Ministry of Climate Change and Environment)

- Environmental Agencies (Federal Environment Agency)

- Manufacturing and Industrial Firms

- Research Institutions (Environmental Research Centers)

- Quality Assurance Departments

- Healthcare Facilities

- Investors and Venture Capitalist Firms

- Environmental NGOs

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that encompasses all major stakeholders within the UAE ICP Monitors Market. This step utilizes extensive desk research, incorporating a combination of secondary and proprietary databases. The primary objective is to identify and define the critical variables that influence market dynamics, such as regulatory pressures, technological advancements, and consumer adoption rates.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the UAE ICP Monitors Market. This includes assessing market penetration and the ratio of ICP monitors to various applications, along with revenue generation patterns. An evaluation of service quality statistics and their correlation with sales figures will be conducted to ensure the reliability and accuracy of our revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed based on initial findings and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from practitioners in the market, enhancing our understanding of competitive strategies and consumer needs.

Step 4: Research Synthesis and Final Output

The final phase entails direct engagement with multiple ICP monitor manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other market dynamics. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the UAE ICP Monitors Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Data Collection Techniques, Sizing Approach, Analytical Framework, Industry Expert Insights, Primary Research Engagement, Limitations and Future Directions)

- Definition and Scope

- Market Genesis and Evolution

- Major Players Timeline

- Market Dynamics Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Regulatory Standards

Increased Environmental Awareness

Technological Advancements in Monitoring - Market Challenges

High Cost of Advanced Monitors

Limited Awareness among End Users - Opportunities

Growth of Smart Monitoring Technologies

Demand for Real-Time Data - Trends

Shift Towards Automation

Innovations in Sensor Technology - Government Regulation

Compliance Framework

Standards and Certifications - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Aqueous ICP Monitors

– Standard Sensitivity Monitors

– High Precision Aqueous Analyzers

Organic ICP Monitors

– Hydrocarbon-Focused Monitors

– Pharmaceutical-Grade Organic Analyzers

Stand-Alone Systems

– Benchtop Systems

– Rack-Mounted Units

Integrated Systems

– ICP-MS + Chromatography Integrated

– ICP-OES Combined Platforms

Portable ICP Monitors

– Battery-Operated Units

– Handheld Monitors for Field Use - By Application (In Value %)

Environmental Monitoring

– Water Quality Monitoring

– Air and Emissions Testing

Industrial Applications

– Metallurgy and Mining

– Petrochemical and Oil Refinery Testing

Academic and Research

– University Labs

– Government R&D Initiatives

Healthcare Sector

– Trace Element Analysis in Clinical Labs

– Toxicology and Pathology Use

Agriculture and Soil Testing

– Nutrient Profiling

– Fertilizer Efficiency Testing - By End-User (In Value %)

Government and Regulatory Bodies

– Environmental Agencies

– Municipal Water Boards

Manufacturing Sector

– Electronics and Semiconductor Firms

– Metal and Alloy Processing Units

Research Institutions

– National Research Facilities

– University-Affiliated Labs

Private Enterprises

– Contract Testing Labs

– Agricultural Input Providers

Healthcare Facilities

– Diagnostic Centers

– Clinical Chemistry Labs - By Distribution Channel (In Value %)

Direct Sales

– Manufacturer-to-End-User Sales

– Enterprise Licensing Agreements

Distributors and Resellers

– Authorized Equipment Dealers

– Laboratory Equipment Distributors

Online Platforms

– OEM Portals

– B2B Marketplaces (e.g., LabX, Alibaba)

Retail Outlets

– Scientific Equipment Stores

– Specialized Medical Retailers - By Region (In Value %)

Abu Dhabi

Dubai

Sharjah

Ajman

Ras Al Khaimah

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of ICP Monitors Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Organizational Structure, Revenues, Revenues by Product Type, Market Footprint, Number of Partnerships and Collaborations, R&D Investment, Production Capacity, Regulatory Approvals, Distribution Channels and Dealer Network, After-sales Support and Clinical Training Capabilities, Unique Value Proposition, others)

- SWOT Analysis of Major Players

- Pricing Analysis for Leading Players

- Company Profiles of Key Competitors

Thermo Fisher Scientific

PerkinElmer

Agilent Technologies

Horiba

Shimadzu Corporation

Waters Corporation

Analytik Jena

Teledyne LeCroy

Merck Group

Elementar

Ametek, Inc.

Eurofins Scientific

QIAGEN

SPECTRO Analytical Instruments

Bruker Corporation

- Demand Patterns

- Budget Allocations and Purchasing Power

- Regulatory Compliance Needs

- Challenges and Pain Points

- Decision-Making Dynamics

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030