Market Overview

The UAE Implantable Cardiac Monitors market current size stands at around USD ~ million, reflecting established clinical adoption within tertiary care cardiology programs and specialized electrophysiology services. Demand is shaped by structured referral pathways for syncope, atrial arrhythmia detection, and post-stroke monitoring, supported by integrated diagnostics across hospital networks. Device utilization is driven by physician-led protocol standardization and expanding use of remote monitoring workflows embedded in hospital information systems and clinical governance frameworks.

Market activity concentrates in major metropolitan healthcare hubs where advanced cardiac care infrastructure, reimbursement administration capacity, and specialized physician availability are highest. These locations benefit from mature private hospital networks, public sector centers of excellence, and centralized procurement mechanisms. Ecosystem maturity is reinforced by established distributor networks, clinical training pipelines, and coordinated regulatory review processes, enabling consistent deployment of implantable monitoring solutions across high-acuity cardiology pathways.

Market Segmentation

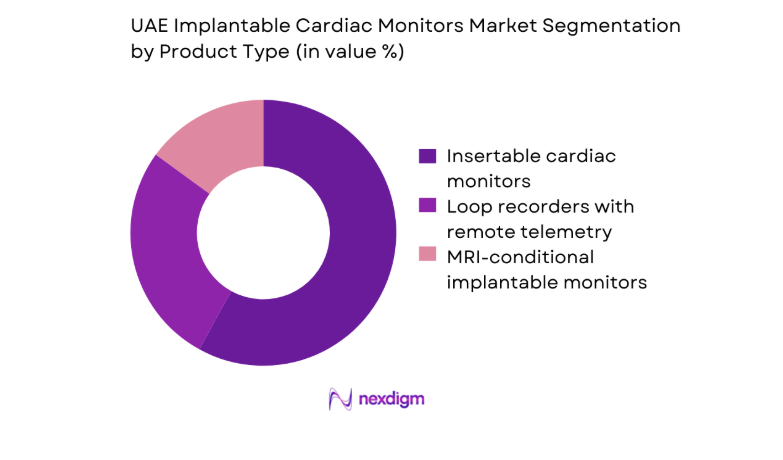

By Product Type

Insertable cardiac monitors dominate utilization due to clinical preference for long-duration rhythm surveillance in unexplained syncope and cryptogenic stroke pathways. Devices with remote telemetry capabilities are increasingly favored, as hospital groups standardize longitudinal monitoring workflows and integrate alerts into enterprise clinical systems. MRI-conditional models support broader adoption in tertiary centers managing complex comorbidities, reducing diagnostic disruption during imaging pathways. Procurement committees emphasize form factor miniaturization, battery longevity, and compatibility with existing monitoring platforms.

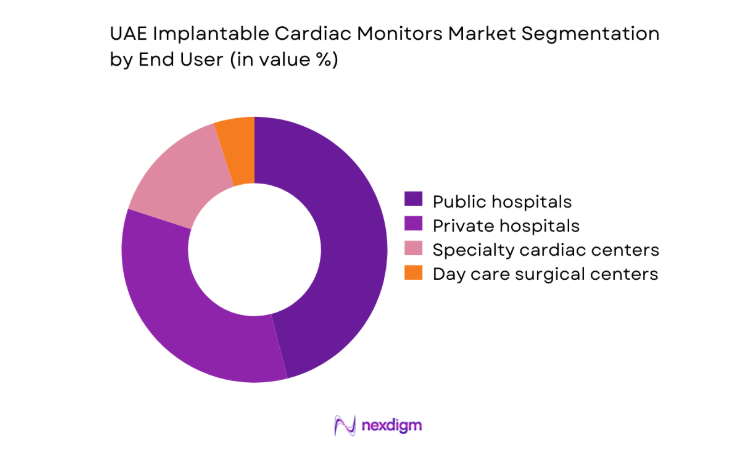

By End User

Public hospitals account for substantial procedural volumes due to centralized referral networks for syncope evaluation and post-stroke rhythm assessment. Private hospitals and specialty cardiac centers show faster protocol adoption for long-term monitoring in ambulatory populations, supported by bundled diagnostic pathways and integrated remote follow-up. Day care surgical centers are emerging users for implantation procedures, driven by outpatient workflow optimization and reduced length-of-stay models.

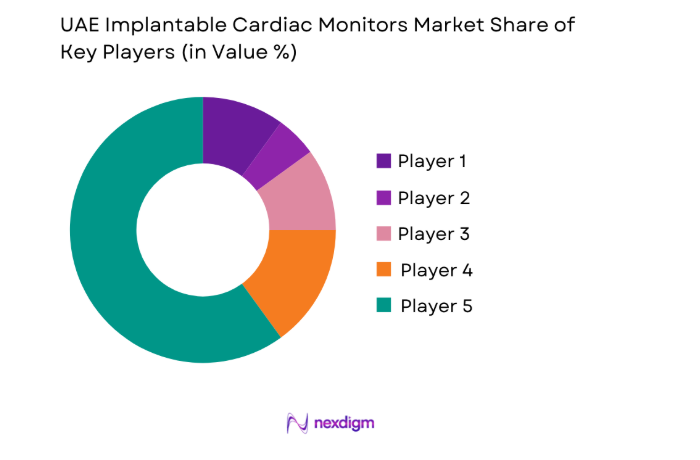

Competitive Landscape

The competitive landscape reflects structured procurement processes, clinically driven vendor qualification, and reliance on distributor-led market access. Product differentiation centers on device longevity, monitoring reliability, and service integration, while institutional buyers prioritize regulatory readiness, clinical support capacity, and channel strength for long-term device programs.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Medtronic | 1949 | Ireland | ~ | ~ | ~ | ~ | ~ | ~ |

| Abbott | 1888 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Biotronik | 1963 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Boston Scientific | 1979 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| MicroPort CRM | 1998 | China | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Implantable Cardiac Monitors Market Analysis

Growth Drivers

Rising prevalence of atrial fibrillation and stroke risk in aging UAE population

Clinical demand is shaped by higher arrhythmia detection needs as hospital admissions for stroke reached 21400 in 2023 across tertiary facilities, with atrial fibrillation identified in 28 of ischemic cases during inpatient monitoring. National registries reported 4600 new atrial fibrillation diagnoses recorded through cardiology clinics in 2024, compared with 3900 in 2023. Referral volumes for unexplained syncope exceeded 17000 episodes in emergency departments during 2024. Expanded neurology–cardiology collaboration protocols implemented in 2023 increased post-stroke rhythm monitoring referrals by 1400 cases, strengthening sustained clinical utilization pathways nationally across integrated care networks.

Expansion of electrophysiology labs and cardiac centers of excellence

Infrastructure expansion has accelerated capacity for implantable diagnostics, with 11 electrophysiology laboratories operational across public and private tertiary hospitals in 2024 compared with 7 in 2022. Dedicated cardiac centers increased to 14 sites in 2024, supported by 62 credentialed electrophysiologists registered nationally in 2023 and 68 in 2024. Annual electrophysiology procedural throughput exceeded 9200 interventions in 2024, up from 7600 in 2023. New catheterization suites commissioned in 2023 added 18 procedure rooms, enabling higher throughput for diagnostic implants and follow-up workflows across metropolitan referral hospitals.

Challenges

High device and procedure costs limiting uptake in price-sensitive segments

Budget constraints within public procurement frameworks restrict broader adoption for low-risk indications, as annual cardiac diagnostics allocations were capped at ~ across multiple hospital groups in 2023 and 2024. Outpatient reimbursement ceilings limited procedure authorization volumes, with 2400 requests deferred in 2024 due to funding thresholds. Private insurers approved 61 percent of implantable monitoring pre-authorizations in 2023, rising to 66 in 2024 after pathway revisions, yet denials persisted for ambulatory indications. Hospital finance committees prioritized acute interventions over extended diagnostics, constraining equitable access across lower-income patient cohorts.

Tender-driven procurement leading to pricing pressure and long sales cycles

Centralized tender cycles averaged 14 months between specification release and contract award during 2023 and 2024, delaying program scale-up for new diagnostic pathways. Procurement documentation required 27 technical compliance items and 9 post-market surveillance commitments in 2024, extending evaluation timelines. Framework agreements limited mid-cycle vendor onboarding, reducing flexibility for clinical pilots. Contract renewals clustered in Q3 2024 across four major hospital networks, compressing supplier engagement windows. Administrative workload rose by 21 procurement staff additions in 2023 to manage compliance audits, increasing operational friction for clinical teams.

Opportunities

Integration of ICM data with national health information exchanges

Health information exchange integration expanded connectivity for longitudinal patient records, with 4 national interoperability interfaces operational in 2024 compared with 2 in 2023. Hospitals enabled 23 clinical data elements for rhythm monitoring uploads in 2024, facilitating continuity across neurology and cardiology services. Secure data exchange nodes increased to 19 facilities in 2024, supporting coordinated follow-up. Standardized terminologies adopted in 2023 enabled automated alert routing to care teams, reducing manual review cycles by 6 hours per case. These institutional enablers create scalable pathways for device-agnostic monitoring programs.

Partnerships with telehealth and remote monitoring platform providers

Remote care utilization expanded as 128000 virtual cardiology consultations were delivered in 2024, up from 94000 in 2023 across national hospital networks. Remote monitoring command centers increased to 7 hubs in 2024, enabling centralized triage for rhythm alerts. Clinical response protocols standardized in 2023 reduced average callback times to 24 hours for abnormal events. Workforce training programs certified 420 nurses in remote cardiac monitoring workflows during 2024. These operational indicators support scalable partnerships with digital health platforms, improving continuity of care and post-implant follow-up efficiency nationwide.

Future Outlook

The market outlook reflects continued integration of long-term rhythm monitoring into standardized care pathways across public and private cardiology services. Digital health alignment and interoperability initiatives are expected to improve continuity of care and follow-up adherence. Expansion of outpatient implantation and remote monitoring models will shape care delivery. Policy emphasis on preventive cardiology and post-stroke surveillance is likely to sustain institutional adoption momentum through the outlook period.

Major Players

- Medtronic

- Abbott

- Biotronik

- Boston Scientific

- MicroPort CRM

- Lepu Medical

- Shenzhen Mindray Bio-Medical Electronics

- Koninklijke Philips

- GE HealthCare

- AliveCor

- Preventice Solutions

- iRhythm Technologies

- Hillrom

- Medico S.p.A.

- Shree Pacetronix

Key Target Audience

- Public hospital procurement departments

- Private hospital networks and cardiac center administrators

- Cardiology and electrophysiology clinical leadership

- Health insurance providers and payer organizations

- Digital health and remote monitoring platform operators

- Investments and venture capital firms

- Government and regulatory bodies with agency names

- Medical device distributors and channel partners

Research Methodology

Step 1: Identification of Key Variables

Clinical indications, care pathways, procurement mechanisms, regulatory clearance steps, and post-implant monitoring workflows were defined through structured scoping. Institutional protocols and service delivery models across public and private cardiology networks were mapped. Device adoption criteria and operational constraints were consolidated. Key performance indicators for utilization, workflow integration, and service readiness were established.

Step 2: Market Analysis and Construction

Care delivery pathways were decomposed into referral, implantation, monitoring, and follow-up stages to structure analysis. Institutional indicators from hospital operations, reimbursement administration, and regulatory processes informed scenario construction. Demand drivers were aligned to epidemiological and service capacity indicators. Channel structures and service models were mapped to reflect real-world deployment conditions.

Step 3: Hypothesis Validation and Expert Consultation

Clinical pathway assumptions were validated through structured consultations with cardiology program managers and hospital operations leads. Regulatory workflow interpretations were cross-checked with institutional compliance teams. Digital health integration hypotheses were reviewed against interoperability frameworks. Operational feasibility of outpatient and remote monitoring models was stress-tested with service delivery stakeholders.

Step 4: Research Synthesis and Final Output

Findings were synthesized into coherent market narratives aligned to institutional realities and care delivery structures. Analytical outputs were cross-validated for internal consistency across demand drivers, challenges, and opportunities. Assumptions were reconciled against operational indicators and policy frameworks.

- Executive Summary

- Research Methodology (Market Definitions and clinical scope of implantable cardiac monitors, UAE hospital procurement data triangulation and distributor channel mapping, Cardiologist and electrophysiologist primary interviews across public and private hospitals)

- Definition and Scope

- Market evolution

- Usage and care pathways in arrrythmia and syncope management

- Ecosystem structure across hospitals, distributors, and remote monitoring platforms

- Supply chain and channel structure

- Growth Drivers

Rising prevalence of atrial fibrillation and stroke risk in aging UAE population

Expansion of electrophysiology labs and cardiac centers of excellence

Adoption of remote patient monitoring by major hospital networks - Challenges

High device and procedure costs limiting uptake in price-sensitive segments

Tender-driven procurement leading to pricing pressure and long sales cycles

Dependence on imports and distributor-controlled market access - Opportunities

Integration of ICM data with national health information exchanges

Partnerships with telehealth and remote monitoring platform providers

Expansion into ambulatory and day surgery cardiac diagnostics - Trends

Miniaturization of devices with longer battery life

AI-enabled arrhythmia detection and analytics

Shift toward remote-first cardiac monitoring workflows - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2019–2024

- By Volume, 2019–2024

- By Installed Base, 2019–2024

- By Average Selling Price, 2019–2024

- By Product Type (in Value %)

Insertable cardiac monitors

Loop recorders with remote telemetry

MRI-conditional implantable monitors - By Indication (in Value %)

Atrial fibrillation detection

Unexplained syncope

Cryptogenic stroke monitoring

Bradyarrhythmia and tachyarrhythmia diagnosis - By End User (in Value %)

Public hospitals

Private hospitals

Specialty cardiac centers

Day care surgical centers - By Distribution Channel (in Value %)

Direct sales to hospitals

Local distributors and agents

- Market share of major players

- Cross Comparison Parameters (product portfolio depth, remote monitoring platform capability, local distributor strength, clinical evidence and trials footprint, pricing competitiveness in tenders, service and technical support coverage, regulatory and registration track record, training and physician engagement programs)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Medtronic

Abbott

Biotronik

Boston Scientific

MicroPort CRM

Lepu Medical

Shenzhen Mindray Bio-Medical Electronics

Koninklijke Philips

GE HealthCare

AliveCor

Preventice Solutions

iRhythm Technologies

Hillrom (Baxter)

Medico S.p.A.

Shree Pacetronix

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- By Value, 2025–2030

- By Volume, 2025–2030

- By Installed Base, 2025–2030

- By Average Selling Price, 2025–2030