Market Overview

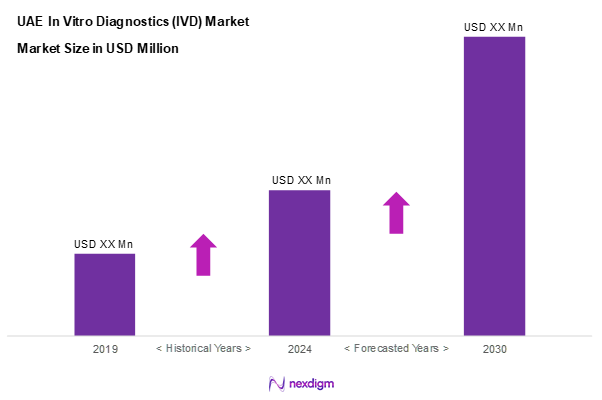

As of 2024, the KSA soft gelatin capsules market is valued at USD ~ million, with a growing CAGR of 5.2% from 2024 to 2030, with consistent growth driven by rising prevalence of chronic diseases and an increasing geriatric population. The demand for advanced diagnostic solutions, such as molecular diagnostics and point-of-care testing, plays a significant role in expanding the market. Furthermore, the integration of innovative technologies, including artificial intelligence and automation in diagnostics, continues to stimulate market growth, providing healthcare professionals with precise and timely diagnostic tools.

Dominant cities in the UAE’s IVD market include Dubai, Abu Dhabi, and Sharjah, largely due to their advanced healthcare infrastructure and strategic investments in healthcare technologies. Dubai’s status as a regional healthcare hub attracts numerous multinational diagnostic companies, while Abu Dhabi’s government initiatives and funding bolster research and development in the health sector. Sharjah’s efforts in developing healthcare facilities and laboratories further contribute to its market dominance, providing essential services to a growing population.

Market Segmentation

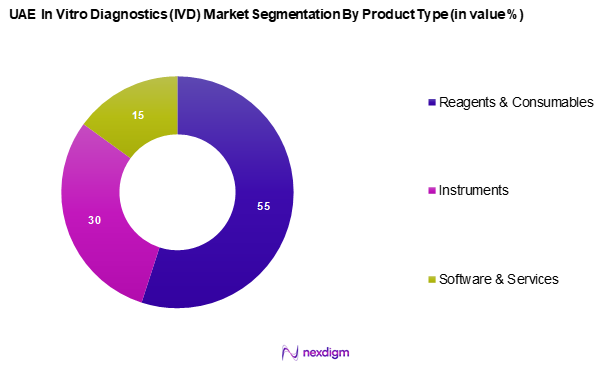

By Product Type

The UAE in vitro diagnostics market is segmented into reagents & consumables, instruments, and software & services. Among these, reagents & consumables hold a dominant market share, as they are pivotal for the functioning of diagnostic tests and are consistently in demand. The increasing need for accurate testing, especially in critical areas like infectious diseases and oncology, drives the consumption of reagents, which are crucial for routine diagnostics. As healthcare providers increasingly adopt these diagnostic solutions, the reliance on high-quality reagents and consumables continues to grow.

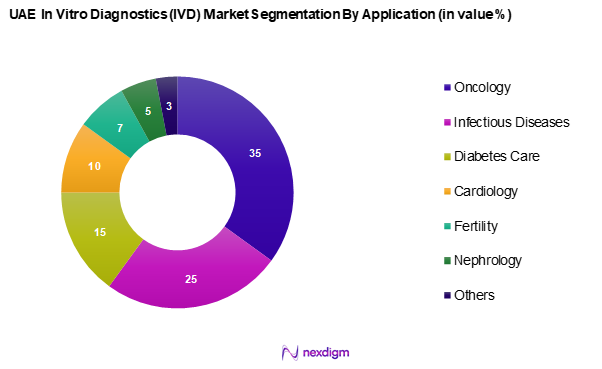

By Application

The UAE in vitro diagnostics market is segmented into oncology, infectious diseases, diabetes care, cardiology, fertility, nephrology, and others. The oncology segment leads the market share due to the rising incidence of cancer and the emphasis on early detection and management of the disease. Advances in biomarkers and genetic testing significantly enhance precision medicine in oncology, resulting in a higher demand for diagnostic tests in this area. The growing awareness about the importance of early diagnosis and the effective management of cancer drives investment and innovation in the oncology diagnostics segment.

Competitive Landscape

The UAE in vitro diagnostics market is characterized by the presence of several key players, including major international companies known for their innovative products and extensive distribution channels. The competitive landscape highlights a few dominant firms, emphasizing their influence in shaping the market dynamics.

| Company Name | Establishment Year | Headquarters | Revenue

(USD Mn) |

Market Share

(%) |

Key Strengths | Product Focus |

| Abbott Laboratories | 1888 | Abbott Park, USA | – | – | – | – |

| Roche Diagnostics | 1896 | Basel, Switzerland | – | – | – | – |

| Siemens Healthineers | 1847 | Erlangen, Germany | – | – | – | – |

| Thermo Fisher Scientific | 1956 | Waltham, USA | – | – | – | – |

| Bio-Rad Laboratories | 1952 | California, USA | – | – | – | – |

UAE In Vitro Diagnostics (IVD) Market Analysis

Growth Drivers

Rising Prevalence of Diseases

The rising prevalence of diseases in the UAE is a critical driver for the In Vitro diagnostics market. Reports indicate that the number of diabetes cases in the UAE has risen to approximately 1.3 million in 2023, with projections indicating that this figure will continue to escalate. Furthermore, cancers are expected to become one of the leading health issues, with annual cases forecasted to reach around 20,000 by 2025. Such an increase in chronic conditions necessitates advanced diagnostic capabilities, showcasing the growing demand for IVD solutions. The need for timely and effective diagnosis is paramount in managing these health challenges, hence propelling the market forward.

Increasing Geriatric Population

The increasing geriatric population in the UAE is significantly impacting the In Vitro Diagnostics market. By 2025, it is anticipated that the elderly population (aged 60 and above) will comprise 15% of the total population, equating to approximately 1.5 million individuals. Older adults are typically more susceptible to chronic diseases, including diabetes and cardiovascular conditions, which require frequent diagnostic testing. Consequently, healthcare systems are adapting to this demographic shift, investing in enhanced IVD technologies to accommodate the increased healthcare demand from an aging population. This trend is set to generate sustained growth in the IVD market as older patients seek regular health assessments.

Market Challenges

Regulatory Complexity

Regulatory complexities present a significant challenge to the UAE In Vitro Diagnostics market. The UAE has implemented stringent regulatory requirements for medical devices, including IVDs, which can delay product approvals and market entry. In 2023, the Ministry of Health and Prevention issued over 800 new regulatory guidelines aimed at ensuring patient safety and product efficacy. These detailed processes can sometimes take up to 12 months for approval. This prolonged evaluation period can hinder the timely introduction of innovative diagnostic solutions, presenting obstacles for manufacturers looking to establish their presence in the market.

Reimbursement Issues

Reimbursement issues pose another challenge to the growth of the In Vitro Diagnostics market in the UAE. Despite increased investments in health infrastructure, a significant proportion of IVD procedures are not fully reimbursed by health insurance providers. In 2022, only about 55% of diagnostic tests received adequate reimbursement coverage, leading to increased out-of-pocket expenses for patients. This can deter patients from undergoing necessary tests, effectively limiting market potential. As stakeholders push for greater inclusion of diagnostic services in rebate structures, this challenge must be addressed to enhance market accessibility and improve overall public health outcomes.

Opportunities

Expansion of Diagnostic Laboratories

The current expansion of diagnostic laboratories in the UAE presents a substantial opportunity for the In vitro diagnostics market. In 2023, the number of licensed laboratories reached approximately 300, demonstrating a move toward enhancing diagnostic capabilities. This expansion is bolstered by government initiatives aimed at strengthening healthcare infrastructure. Laboratories are increasingly investing in advanced IVD technologies, such as molecular diagnostics, to improve accuracy and turnaround times for test results. As the demand for timely and reliable diagnostics continues to increase, the expansion of laboratory facilities is expected to significantly contribute to the growth of the IVD market, driving advances in healthcare availability.

Personalized Medicine

The growing emphasis on personalized medicine in the UAE offers exciting prospects for the In vitro diagnostics market. Current advancements in genomics and biotechnology have led to the development of tailored diagnostic solutions that enhance treatment efficacy. In 2022, the UAE government allocated approximately USD 50 million for research into precision medicine initiatives. This funding supports innovative diagnostic tools that provide customized treatment options for patients based on their genetic profiles. As awareness of personalized healthcare grows, the demand for IVD solutions that facilitate targeted therapies is anticipated to surge, creating a fertile environment for market expansion.

Future Outlook

Over the next five years, the UAE in vitro diagnostics market is expected to show significant growth driven by advancements in technology, rising demand for personalized medicine, and government support for healthcare initiatives. The integration of artificial intelligence in diagnostics and the growing focus on preventive healthcare are likely to further propel market expansion. With an increasing emphasis on early detection and treatment of diseases, the market is set to evolve substantially, catering to the evolving healthcare needs of the population.

Major Players

- Abbott Laboratories

- Roche Diagnostics

- Siemens Healthineers

- Thermo Fisher Scientific

- BD (Becton, Dickinson)

- bioMérieux

- Ortho Clinical Diagnostics

- Agilent Technologies

- Hologic Inc.

- Sysmex Middle East FZ-LLC

- Danaher Corporation UAE

Qiagen N.V. - Genomic Health

- Bio-Rad Laboratories UAE

- Medtronic plc

Key Target Audience

- Healthcare Providers

- Pharmaceutical Companies

- Diagnostic Laboratories

- Research Institutions

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., UAE Ministry of Health and Prevention)

- Biotechnology Companies

- Healthcare Technology Firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map identifying major stakeholders within the UAE in vitro diagnostics market. This includes extensive desk research using secondary and proprietary databases to gather industry-level information. The objective is to identify and define the critical variables influencing market dynamics, such as technological advancements, regulatory frameworks, and demographic changes.

Step 2: Market Analysis and Construction

In this phase, historical data pertinent to the UAE in vitro diagnostics market will be compiled and analysed. This includes evaluating market penetration rates, the balance between service providers and clients, and revenue generation. A thorough evaluation of service quality metrics will ensure the reliability and accuracy of revenue estimates, supporting a comprehensive understanding of market performance.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be formulated and validated through consultations with industry experts via Computer-Assisted Telephone Interviews (CATIs). These experts will represent a diverse range of companies within the IVD sector, providing valuable operational and financial perspectives that will help refine and corroborate the gathered market data.

Step 4: Research Synthesis and Final Output

The final phase encompasses direct engagement with multiple IVD manufacturers to obtain detailed insights into various product segments, sales performance, and consumer preferences. This interaction aims to verify and complement the data gathered from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the UAE In Vitro Diagnostics Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Rising Prevalence of Diseases

Increasing Geriatric Population - Market Challenges

Regulatory Complexity

Reimbursement Issues - Opportunities

Expansion of Diagnostic Laboratories

Personalized Medicine - Trends

Point-of-Care Testing Growth

Integration of AI in Diagnostics - Government Regulation

Health Technology Assessment Guidelines

Quality Control Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type, (In Value %)

Reagents & Consumable

Instruments

Software & Services - By Application, (In Value %)

Oncology

Infectious Diseases

Diabetes Care

Cardiology

Fertility

Nephrology

Others - By End-User, (In Value %)

Hospitals

Diagnostic Laboratories

Research Institutions - By Technology, (In Value %)

Immunoassay

Molecular Diagnostics

Clinical Chemistry

Hematology

Microbiology

Others - By Region, (In Value %)

Abu Dhabi

Dubai

Sharjah

Ajman

Ras Al Khaimah

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Product Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Distribution Channels, Product Portfolio, Global Reach)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Abbott Laboratories

Roche Diagnostics

Siemens Healthineers

Thermo Fisher Scientific

BD (Becton, Dickinson and Company)

bioMérieux

Ortho Clinical Diagnostics

Agilent Technologies

Hologic Inc.

Sysmex Middle East FZ-LLC

Danaher Corporation UAE

Qiagen N.V.

Genomic Health

Bio-Rad Laboratories UAE

Medtronic plc

Others

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030