Market Overview

The UAE In-Flight Entertainment and Connectivity market is a rapidly growing sector, primarily driven by the increasing demand for advanced in-flight services and connectivity solutions. Market size is driven by both technological advancements and passenger expectations for seamless entertainment and connectivity during flights. The growth of the airline industry, particularly in the Middle East, has further boosted demand for in-flight entertainment and connectivity systems, with a market size based on a recent historical assessment reaching USD ~ billion. The sector’s expansion is also fueled by rising disposable incomes, tourism, and regional airline fleets.

The dominance of the UAE in the in-flight entertainment and connectivity market can be attributed to its strategic location as a global travel hub, along with significant investments in infrastructure. Major cities like Dubai and Abu Dhabi are key drivers due to their advanced airports and thriving aviation sector, with local airlines investing heavily in state-of-the-art technologies. The UAE’s vision to position itself as a global leader in tourism and aviation further strengthens its position in this market, attracting more international passengers and airlines to utilize advanced in-flight services.

Market Segmentation

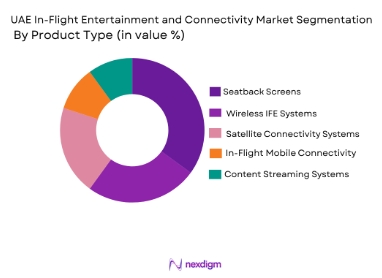

By Product Type:

The UAE In-Flight Entertainment and Connectivity market is segmented by product type into seatback screens, wireless IFE systems, satellite connectivity systems, in-flight mobile connectivity systems, and content streaming systems. Recently, seatback screens have dominated the market share due to the widespread demand for personalized in-flight entertainment solutions. The preference for fixed, high-definition screens in business and first-class cabins, along with their ability to offer extensive content options, has made them the dominant product type. Seatback screens also have the advantage of offering a tangible, premium experience for passengers, especially on long-haul flights, which significantly contributes to their large market share in the region. The continuous advancement in display technology and increased passenger demand for superior visual experiences are also major factors that drive the dominance of seatback screens in this market.

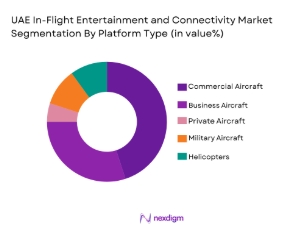

By Platform Type:

The UAE In-Flight Entertainment and Connectivity market is segmented by platform type into commercial aircraft, business aircraft, private aircraft, military aircraft, and helicopters. Recently, commercial aircraft have dominated the market share due to their widespread adoption by airlines operating in the region. The need for in-flight connectivity and entertainment solutions on long-haul flights has created substantial demand for advanced systems. Commercial aircraft, due to their larger fleet sizes and higher passenger volumes, are particularly suited for the integration of such systems, driving market growth. The continuous expansion of global and regional airline networks, along with the focus on enhancing the passenger experience, further contributes to the dominance of commercial aircraft in this segment. These factors, combined with technological advancements in wireless connectivity and entertainment systems, continue to position commercial aircraft as the leading platform type in the market.

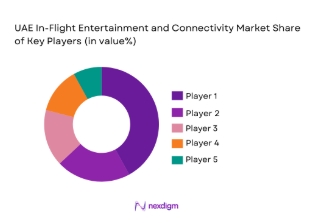

Competitive Landscape

The competitive landscape in the UAE In-Flight Entertainment and Connectivity market is shaped by consolidation and the increasing influence of major players who are leading technological innovations and global partnerships. As the market expands, key players such as Gogo Inc., Thales Group, and Panasonic Avionics Corporation are solidifying their positions through strategic alliances, technological advancements, and increasing investments in high-demand markets like the Middle East. These players, along with emerging competitors, continue to focus on providing seamless connectivity solutions and enhancing passenger experiences across regional and international flights.

|

Company Name |

Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Customer Engagement Platforms |

| Gogo Inc. | 1991 | USA | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

| Panasonic Avionics Corporation | 1979 | Japan | ~ | ~ | ~ | ~ | ~ |

| Viasat Inc. | 1986 | USA | ~ | ~ | ~ | ~ | ~ |

| Inmarsat | 1979 | UK | ~ | ~ | ~ | ~ | ~ |

UAE In-Flight Entertainment and Connectivity Market Analysis

Growth Drivers

Increasing Demand for Seamless Connectivity:

The increasing demand for seamless in-flight connectivity is a significant growth driver for the UAE market. As passenger expectations continue to rise, they seek continuous connectivity during their flights, including high-speed internet, entertainment, and the ability to stream content directly to their devices. This growing demand has led to substantial investments in satellite-based and Wi-Fi technologies, improving the passenger experience and encouraging airlines to enhance their inflight services. Furthermore, the expansion of low-cost carriers in the UAE has created more opportunities for affordable yet efficient connectivity solutions, as passengers now expect an internet-connected environment on almost all flights. As the demand for seamless connectivity increases, airlines are exploring the possibility of integrating advanced systems that allow passengers to remain connected across different flight stages, creating a compelling business case for service providers. This shift toward connectivity is expected to drive the market’s growth in the coming years, as consumers increasingly value connectivity during travel as an essential feature, rather than a luxury.

Government Support and Infrastructure Investment:

Another important growth driver is the strong government support and investment in aviation infrastructure in the UAE. The country has heavily invested in enhancing its airports, establishing itself as a major global hub. These developments, such as the expansion of Dubai International Airport and Al Maktoum International Airport, help accommodate the growing number of travelers and the demand for in-flight entertainment and connectivity systems. The UAE government’s strategic initiatives also include facilitating regulatory changes that support the expansion of in-flight communication infrastructure, such as new satellite licensing and 5G connectivity rollouts. These initiatives are expected to drive the market as airlines operating in the region upgrade their fleets to meet the increasing expectations of their passengers. Additionally, government investments are creating opportunities for further development and deployment of new technologies, such as autonomous connectivity systems and innovative IFE solutions, further fostering market growth.

Market Challenges

High Installation and Maintenance Costs:

One major challenge facing the UAE In-Flight Entertainment and Connectivity market is the high cost of installing and maintaining advanced in-flight connectivity systems. Airlines must make significant investments to integrate cutting-edge technologies such as satellite systems, Wi-Fi networks, and entertainment solutions across their fleets, which can be expensive. The costs associated with retrofitting older aircraft with these systems are particularly burdensome, especially for smaller carriers that may face budget constraints. The high operational costs of maintaining and upgrading these systems also pose a challenge, as they require consistent investments in hardware, software updates, and troubleshooting services. These costs can lead to price increases for passengers, which could impact the affordability of in-flight services, especially for budget-conscious travelers. Airlines operating in the UAE must find a balance between providing high-quality services and managing these rising costs, which is increasingly difficult in a competitive market where passengers demand both affordability and premium experiences.

Regulatory Hurdles:

Another challenge for the UAE market is navigating complex regulatory frameworks governing satellite communications and in-flight connectivity. The region’s aviation regulations must be carefully aligned with international standards, and acquiring the necessary licenses for satellite communications can be a lengthy and costly process. Additionally, the evolving nature of international telecommunications laws, especially in light of the increasing use of 5G and other advanced technologies, presents uncertainties for service providers in the UAE. Regulatory changes in global and regional aviation policies can delay the implementation of new systems, hindering market growth and technological adoption. In particular, managing cross-border regulations around the installation of satellite connectivity systems can be difficult, as there may be differences in licensing agreements, signal transmission protocols, and data privacy rules between the UAE and other countries. The regulatory hurdles in this market may slow down the rollout of new technologies, which could limit the scope for growth in the short term.

Opportunities

Expansion of Business and Private Aviation:

A key opportunity in the UAE In-Flight Entertainment and Connectivity market is the growing demand for business and private aviation services. As the UAE becomes an increasingly prominent global business hub, the demand for private jets and business aircraft is rising. These aircraft often require top-tier in-flight entertainment and connectivity systems to meet the high expectations of corporate clients. Business travelers demand seamless connectivity, fast internet, and in-flight entertainment options to stay productive during their journeys. As the private aviation sector expands in the UAE, so does the need for advanced inflight connectivity solutions, offering a significant market opportunity for service providers. Additionally, private jets are often equipped with exclusive, high-end entertainment systems, which provide lucrative prospects for companies offering high-performance systems in this niche market. The UAE’s position as a business travel hub further supports this opportunity, providing the market with a steady flow of demand for premium in-flight services.

Technological Advancements in 5G and Satellite Connectivity:

Another significant opportunity arises from the ongoing technological advancements in 5G and satellite connectivity systems. The implementation of 5G technology is expected to revolutionize in-flight connectivity by offering ultra-fast data speeds, low latency, and improved network reliability. As 5G infrastructure becomes more widespread, airlines in the UAE will be able to offer enhanced services such as high-definition video streaming, faster Wi-Fi, and more interactive entertainment options. Additionally, satellite systems continue to improve, providing airlines with more reliable global coverage, even in remote and underserved regions. The convergence of these technologies presents a unique opportunity to elevate passenger experiences, as well as increase operational efficiencies for airlines. This technological evolution is expected to spur the adoption of advanced in-flight connectivity solutions, positioning companies that focus on innovation in the best position to capture future market share in the UAE.

Future Outlook

The future outlook for the UAE In-Flight Entertainment and Connectivity market is promising, with continued growth driven by technological advancements, increasing passenger expectations, and strategic government investments. The rise of 5G and satellite technologies is expected to significantly improve connectivity and in-flight entertainment options, creating new opportunities for service providers. Demand from both commercial and private aviation sectors will continue to rise, with airlines investing in upgraded infrastructure to meet evolving consumer demands. Additionally, regulatory support for these technologies is expected to accelerate their adoption. With Dubai’s role as a major global travel hub, the UAE is well-positioned to remain at the forefront of this market.

Major Players

- Gogo Inc.

- Thales Group

- Panasonic Avionics Corporation

- Viasat Inc.

- Inmarsat

- Global Eagle Entertainment Inc.

- Rockwell Collins

- SITA OnAir

- Zodiac Aerospace

- DigEcor Inc.

- TriaGnoSys GmbH

- Kymeta Corporation

- SwiftBroadband

- Honeywell International

- Astronics Corporation

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airlines and air transport operators

- Aircraft manufacturers

- Aerospace and defense contractors

- Aviation technology providers

- Telecom and satellite companies

- In-flight entertainment and connectivity system integrators

Research Methodology

Step 1: Identification of Key Variables

Key variables that impact market dynamics, including technological advancements and regulatory frameworks, are identified.

Step 2: Market Analysis and Construction

A thorough market analysis is conducted, assessing historical trends and current market conditions.

Step 3: Hypothesis Validation and Expert Consultation

Insights from industry experts and stakeholders are used to validate market hypotheses and assumptions.

Step 4: Research Synthesis and Final Output

The research findings are synthesized, and a final report is prepared, presenting a comprehensive market outlook.

- Executive Summary

- Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Demand for Passenger Connectivity

Technological Advancements in Satellite Communication

Rising Adoption of Personalized In-Flight Entertainment

Expansion of Low-Cost Carriers

Government Initiatives to Enhance Aviation Infrastructure - Market Challenges

High Installation and Maintenance Costs

Regulatory and Certification Hurdles

Cybersecurity and Data Privacy Concerns

Limited Coverage in Remote Areas

Compatibility Issues Across Different Aircraft - Market Opportunities

Growth in Business and Private Aviation

Integration of 5G Connectivity for Faster Speeds

Partnerships with Content Providers for Enhanced Offerings - Trends

Emerging Demand for Seamless Connectivity Solutions

Increased Use of Artificial Intelligence in Content Delivery

Growth in Personalized Passenger Experience

Integration of Augmented and Virtual Reality in IFE

Rise of In-Flight E-Commerce Solutions - Government Regulations & Defense Policy

Cybersecurity Regulations for In-Flight Connectivity

Aviation Standards for IFE Systems

Government Support for Connectivity Infrastructure - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Seatback Screens

Wireless IFE Systems

Satellite Connectivity Systems

In-Flight Mobile Connectivity Systems

Content Streaming Systems - By Platform Type (In Value%)

Commercial Aircraft

Business Aircraft

Private Aircraft

Military Aircraft

Helicopters - By Fitment Type (In Value%)

Linefit

Retrofit

Modular Solutions

Portable Solutions

Integrated Solutions - By EndUser Segment (In Value%)

Airlines

Aircraft Manufacturers

Technology Providers

System Integrators

Travel Agencies - By Procurement Channel (In Value%)

Direct Procurement

OEM Procurement

Government Tenders

Third-party Distributors

Online Bidding Platforms - By Material / Technology (in Value%)

Satellite Connectivity Technology

Wi-Fi Technology

In-Flight Entertainment Technology

Fiber Optic Technology

Cloud-based Content Delivery Systems

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

SWOT Analysis of Key Competitors

Pricing & Procurement Analysis - Key Players

Gogo Inc.

Honeywell International Inc.

Panasonic Avionics Corporation

Thales Group

Global Eagle Entertainment Inc.

Viasat Inc.

Inmarsat

SITA OnAir

Astronics Corporation

Zodiac Aerospace

Lufthansa Systems GmbH & Co. KG

DigEcor Inc.

TriaGnoSys GmbH

Kymeta Corporation

SwiftBroadband

- Airlines’ Focus on Enhancing Customer Experience

- Aircraft Manufacturers’ Integration of New Technologies

- Technology Providers’ Investment in Innovative Solutions

- Travel Agencies’ Role in Distribution and Content Delivery

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035