Market Overview

As of 2024, the KSA soft gelatin capsules market is valued at USD 70.4 billion, with a growing CAGR of 5.2% from 2024 to 2030, driven by substantial government investment and a booming population contributing to urbanization. The ongoing economic diversification efforts push the demand for robust infrastructure, showcasing a commitment to modernization and future-proofing cities. By 2024, the market is projected to reach USD 25 billion as developments continue in sectors like residential and commercial construction, alongside public works projects, which are vital for the nation’s growth strategy.

Dominant cities such as Dubai and Abu Dhabi drive the UAE infrastructure landscape due to their economic significance and visionary development plans. Dubai’s blend of commercial viability and tourist attractions fuels ongoing investments in infrastructure. Meanwhile, Abu Dhabi’s focus on sustainable urban growth ensures that both cities remain at the forefront of the construction sector, dictating trends and driving demand across the UAE.

Market Segmentation

By Project Type

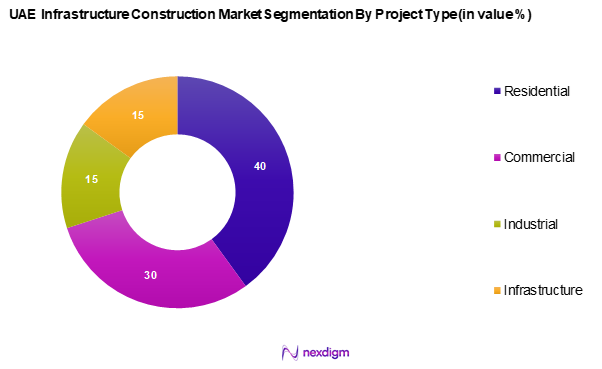

The UAE infrastructure construction market is segmented into residential, commercial, industrial, and infrastructure projects (e.g., roads, bridges). The residential segment currently holds a dominant market share, accounting for approximately 40% in 2024. This dominance stems from the rapid population growth and the government’s commitment to housing initiatives, particularly offering affordable housing solutions to meet the needs of a diverse population, thus driving continuous investments in new residential developments.

By Construction Method

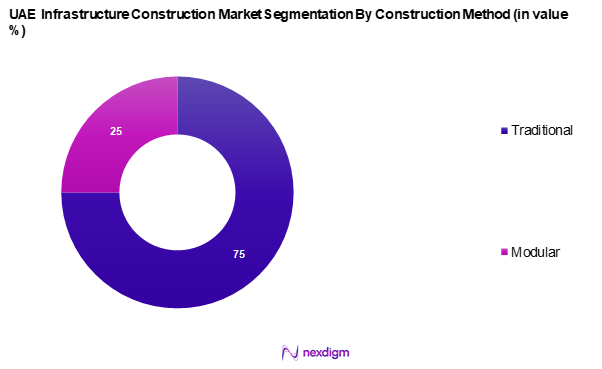

The UAE infrastructure construction market is segmented into traditional and modular methods. The traditional construction method commands a market share of 75% in 2024, primarily due to its longstanding practices and familiarity among local contractors and stakeholders. Despite the rise of modular construction because of its efficiency, traditional methods continue to prevail as clients prefer established practices backed by a robust workforce accustomed to conventional techniques, ensuring reliability in project execution.

Competitive Landscape

The UAE infrastructure construction market is characterized by a competitive landscape dominated by leading players including Arabtec Holding, Al Habtoor Group, and others. The consolidation among these companies highlights their significant influence on market stability and development patterns, with established firms leveraging their expertise and resources to capture substantial project opportunities and adhere to evolving government regulations.

| Company | Establishment Year | Headquarters | Market Share | Core Services | Recent Developments | Key Projects |

| Arabtec Holding | 1975 | Dubai | – | – | – | – |

| Al Habtoor Group | 1970 | Dubai | – | – | – | – |

| Drake & Scull Int. | 1966 | Dubai | – | – | – | – |

| Nasa Multiplex | 1996 | Dubai | – | – | – | – |

| Six Construct | 1909 | Dubai | – | – | – | – |

UAE Infrastructure Construction Market Analysis

Key Growth Drivers

Economic Diversification

The UAE’s strategic shift away from oil dependency has significantly influenced the infrastructure construction market. As part of broader efforts to diversify the economy, the government has prioritized sectors such as tourism, logistics, and technology, all of which demand strong infrastructure foundations. This shift has translated into consistent public and private investment in construction, reflecting the country’s long-term vision for sustainable economic growth. The emphasis on physical capital development is expected to continue, cementing infrastructure’s role as a core pillar of national progress.

Urbanization Trends

Urbanization remains a powerful catalyst for infrastructure expansion in the UAE. Major cities like Dubai and Abu Dhabi continue to attract large inflows of residents and businesses, driving the need for enhanced residential, commercial, and public infrastructure. Urban migration patterns suggest a sustained push toward modern city living, which brings growing demand for smart mobility systems, sustainable buildings, and improved public services. This demographic and spatial shift offers significant opportunities for developers and infrastructure stakeholders.

Market Challenges

Regulatory Hurdles

Despite the favorable growth landscape, regulatory processes remain a critical barrier in the UAE infrastructure market. Complex approval systems and rigorous compliance requirements often delay project execution. While reforms are underway to streamline administrative procedures, industry stakeholders still face significant bottlenecks that impact efficiency and project timelines. These challenges particularly affect new entrants and smaller developers, potentially limiting the market’s competitiveness and agility.

Skilled Labor Shortage

The rapid pace of infrastructure development has outstripped the availability of skilled labor. While the country continues to rely heavily on expatriate workers, there remains a shortfall in specialized skills required for advanced construction techniques and large-scale infrastructure projects. This gap has resulted in increased pressure on existing resources and affects both the quality and timeliness of project delivery. Addressing this issue is critical to sustaining long-term industry growth and maintaining high construction standards.

Opportunities

Innovations in Construction Technologies

Technological advancements are redefining the construction landscape in the UAE. The adoption of digital tools and modern building methods—such as BIM, prefabrication, and 3D printing—is improving productivity and sustainability. These innovations are supported by national initiatives aimed at fostering a tech-enabled construction ecosystem. As firms increasingly embrace digital transformation, they are better positioned to deliver efficient, cost-effective, and environmentally friendly infrastructure projects.

Public-Private Partnerships

Public-Private Partnerships (PPPs) are gaining traction as a strategic model to deliver infrastructure solutions in the UAE. These collaborations help mobilize private capital and expertise to execute large-scale projects in critical sectors like transportation and utilities. By distributing risk and encouraging innovation, PPPs serve as a vital mechanism to accelerate infrastructure development while ensuring fiscal prudence. The growing policy emphasis on such partnerships reflects a broader commitment to inclusive and efficient infrastructure expansion.

Future Outlook

Over the next five years, the UAE infrastructure construction market is expected to experience significant growth, driven by government-led initiatives focused on smart city developments and sustainability measures. The shift towards innovative construction technologies and materials is set to transform existing processes, while increasing investments in public infrastructure projects underscores the market’s robust potential. As demographic and economic factors steer demand, the sector is anticipated to thrive amidst investments and strategic partnerships.

Major Players

- Arabtec Holding

- Al Habtoor Group

- Drake & Scull International

- Nasa Multiplex

- Six Construct

- Cebarco-WCT

- Meraas Holdings

- Iskan

- ENOC

- Deyaar Development

- Al-Futtaim

- Gilbane

- Khansaheb Civil Engineering

- Khansaheb Properties

- Obaid Al Busaidy

Key Target Audience

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., UAE Ministry of Infrastructure Development)

- Contractors and Construction Firms

- Engineering Services Companies

- Real Estate Developers

- Material Suppliers

- Construction Equipment Manufacturers

- Infrastructure Banks and Funding

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the UAE infrastructure construction market. Comprehensive desk research is conducted utilizing a combination of secondary and proprietary databases to gather industry-level information. The primary objective of this step is to identify and define critical variables, including market dynamics, challenges, and drivers, that affect the infrastructure sector’s growth trajectory.

Step 2: Market Analysis and Construction

This phase focuses on compiling and analyzing historical data pertinent to the UAE infrastructure construction market. It examines market penetration, the relationship between various stakeholders, and revenue generation within the sector. An evaluation of service quality and project timelines is conducted to ensure the accuracy and reliability of revenue estimates, providing a solid foundation for future projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formulated and subsequently validated through consultations with industry experts representing a diverse array of companies in the construction sector. These discussions provide valuable operational and financial insights directly from practitioners. The expert opinions gathered play a critical role in refining and corroborating the market data collected in previous phases.

Step 4: Research Synthesis and Final Output

In the final phase, engagement with multiple construction stakeholders is undertaken to obtain detailed insights into project segments, performance metrics, and emerging trends. This interaction serves to verify and complement the statistics derived from earlier research approaches, facilitating a comprehensive, accurate, and validated analysis of the UAE Infrastructure Construction Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Methodology, Consolidated Research Framework, In-Depth Industry Interviews, Primary Research Strategy, Limitations and Future Considerations)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Economic Diversification

Urbanization Trends - Market Challenges

Regulatory Hurdles

Skilled Labor Shortage - Opportunities

Innovations in Construction Technologies

Public-Private Partnerships - Trends

Rise of Smart Infrastructure

Sustainable Building Practices - Government Regulation

Building Codes and Standards

Environmental Laws - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces Analysis

- By Market Value, 2019-2024

- By Market Volume, 2019-2024

- By Average Project Cost, 2019-2024

- By Project Type (In Value %)

Residential

– High-Rise Apartment Complexes

– Gated Communities

– Affordable Housing Projects

– Luxury Villas and Estates

Commercial

– Shopping Malls and Retail Centers

– Business Parks and Office Towers

– Hospitality Infrastructure (Hotels, Resorts)

– Mixed-Use Developments

Industrial

– Manufacturing Plants

– Warehouses and Distribution Centers

– Free Zones and Industrial Parks

– Logistics and Supply Chain Facilities

Infrastructure

– Expressways and Highways

– Inter-city and Intra-city Road Networks

– Bridges and Flyovers

– Public Transportation Systems

– Utilities Infrastructure - By Construction Method (In Value %)

Traditional

– Cast-in-Place Concrete

– Masonry Construction

– On-site Steel Fabrication

Modular

– Precast Concrete Panels

– Steel Frame Modules

– Container-based Units

– Prefabricated Housing Blocks - By Material Type (In Value %)

Concrete

– Ready-Mix Concrete

– Precast Concrete Products

– Reinforced Concrete

Steel

– Structural Steel

– Steel Rebars

– Prefabricated Steel Frames

Wood

– Engineered Wood Panels

– Laminated Timber

– Traditional Wood Framing - By Stakeholder Type (In Value %)

Government

– Federal Government

– Municipal Authorities

– Public Utilities

– Government Real Estate Developers

Private Sector

– Private Real Estate Developers (e.g., Emaar, DAMAC)

– Foreign Infrastructure Investors and Developers

– Engineering, Procurement, and Construction (EPC) Contractors

– Project Finance Sponsors and Banks - By Region (In Value %)

Abu Dhabi

Dubai

Sharjah

Ajman

Ras Al Khaimah

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Project Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Organizational Structure, Revenue Breakdown, Distribution Channels, Project Execution Capabilities)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Comprehensive Profiles of Major Companies

Arabtec Holding

Drake & Scull International

Al Habtoor Group

Cebarco-WCT

Nasa Multiplex

Six Construct

Meraas Holdings

Iskan

ENOC

Deyaar Development

Al-Futtaim

Gilbane

Khansaheb Civil Engineering

Khansaheb Properties

Obaid Al Busaidy

- Project Demand and Sustainability

- Investment Trends and Budget Allocations

- Regulatory and Compliance Considerations

- Needs Assessment and Market Pain Points

- Decision-Making Dynamics

- By Market Value, 2025-2030

- By Market Volume, 2025-2030

- By Average Future Project Cost, 2025-2030