Market Overview

The UAE InsurTech market is valued at USD 8.5 billion in 2024, based on a published report by Nexdigm. It is driven by rising consumer demand for digital insurance products, growing adoption of fintech and digitalization in financial services, and expanding regulatory support for innovation in insurance. Traditional insurers are investing in AI, automation, and embedded insurance models, while startups leverage big data and tech infrastructure to reduce inefficiencies and reach underserved customers.

Dubai and Abu Dhabi dominate the UAE InsurTech market. Dubai’s prominence comes from its status as a regional fintech hub with highly developed infrastructure, favorable regulatory sandbox environments, strong expatriate population, and high business coverage demand. Abu Dhabi contributes through its strong healthcare infrastructure, regulatory mandates in health insurance, and government‑led innovation programs. These two emirates offer the largest pools of insured individuals, corporate clients, and technological & regulatory support, making them focal points for product launches and scale‑ups.

Market Segmentation

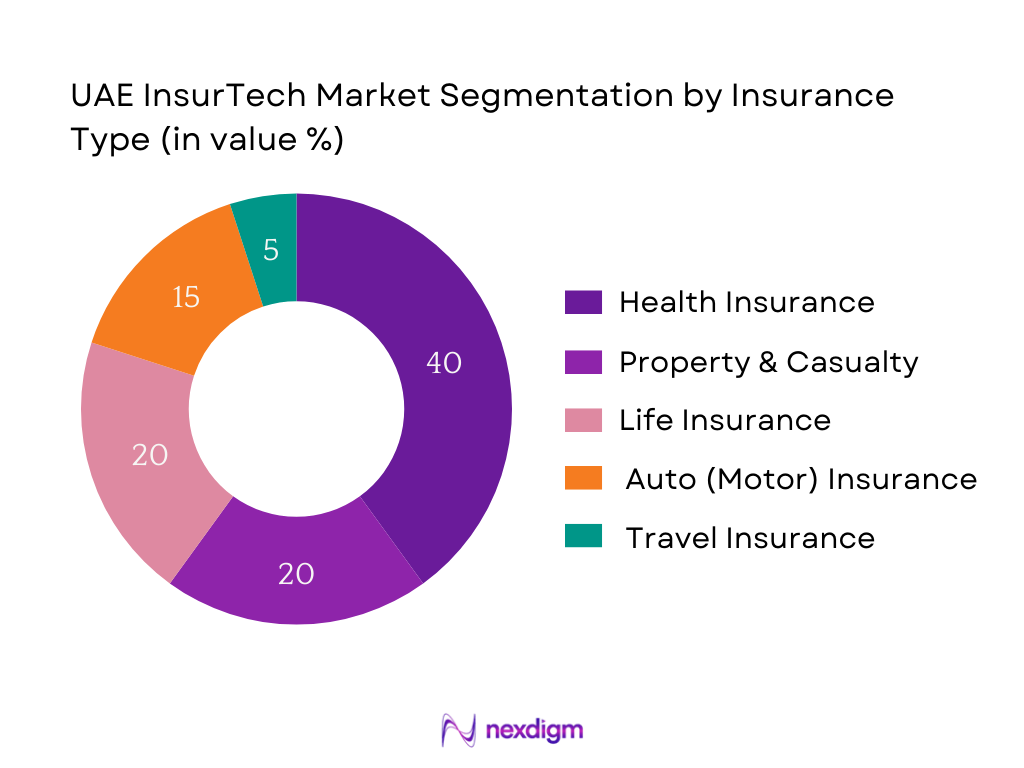

By Insurance Type

Health Insurance dominates among these in 2024. It leads because of mandated health insurance requirements for employees and dependents, large expatriate population needing medical coverage, and increasing medical cost inflation forcing people to rely on insurance. Additionally, digital health insurance platforms are more mature, with higher uptake of group health plans, individual health plans, and growing offerings in wellness integrated insurance. These factors give health insurance a higher share of InsurTech‑enabled premiums.

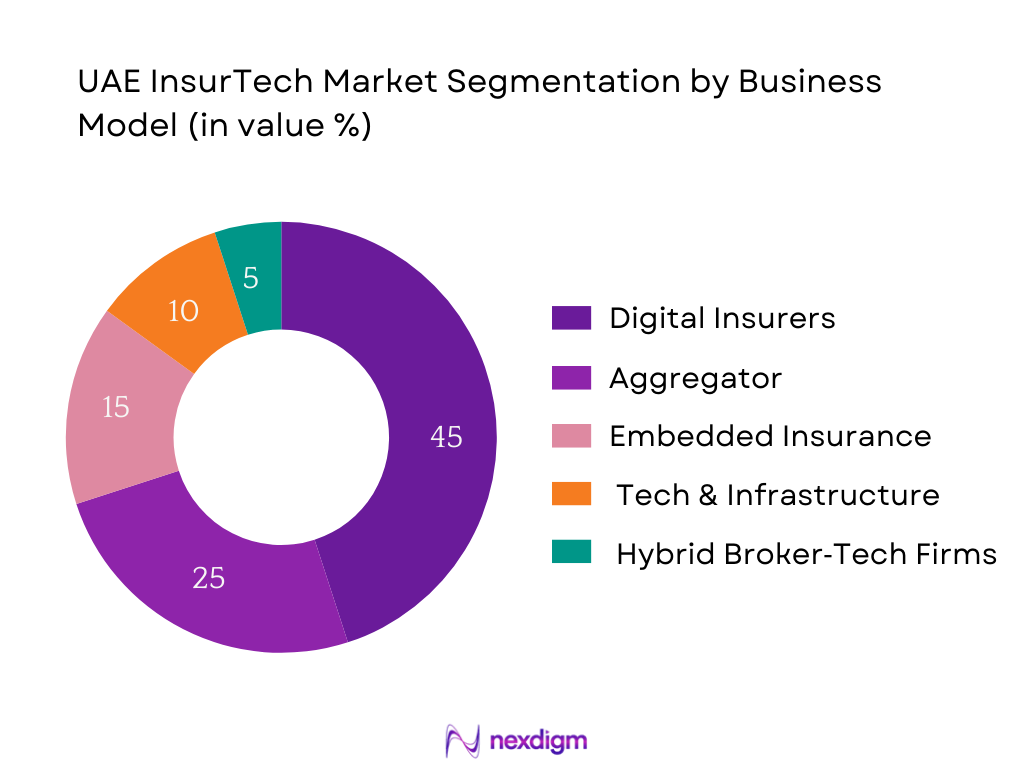

By Business Model / Service Offering

Digital Insurers / Digital MGAs hold the largest share in 2024. They dominate because they directly issue policies, control pricing, underwriting, and customer engagement digitally. Their cost structure allows scaling faster than traditional brokers, and consumers increasingly prefer the convenience of online platforms. Health and life products via digital insurers are more standardized and trusted, and regulatory facilitation (licensing, sandboxes) has helped digital MGAs expand. Aggregators are growing fast but are secondary in share, since they often distribute rather than underwrite.

Competitive Landscape

The UAE InsurTech market is competitive yet with a few major players leading in scale, brand trust, regulatory compliance, and distribution reach. Incumbent insurers are increasingly investing or partnering with InsurTechs, and newer tech‑native firms are leveraging agility to introduce innovative models. Consolidation, partnerships, and regulatory clarity are key themes. Here is a table of five major players, with their establishment, headquarters, and six market‑specific parameters:

| Player | Established Year | Headquarters | Key Insurance Lines Covered | Digital/Tech Innovation (AI, Embedded, Telematics etc.) | Distribution & Channels (aggregator, direct, API etc.) | Regulatory / Licence Status (Insurer / MGA / Broker / Platform) | Key Partnerships & Ecosystem Alliances |

| Bayzat | ~2013 | Dubai, UAE | – | – | – | – | – |

| Yallacompare | ~2006 | Dubai, UAE | – | – | – | – | – |

| Souqalmal.com | ~2012 | Dubai, UAE | – | – | – | – | – |

| Wellx | recent (~early‑2020s) | UAE | – | – | – | – | – |

| Daman (National Health Insurance Co.) | 2006 | Abu Dhabi, UAE | – | – | – | – | – |

UAE InsurTech Market Analysis

Key Growth Drivers

Health Insurance Mandates and Digital Push

The UAE Cabinet has decreed that all private‑sector employers must provide health insurance for their foreign employees starting in 2025, expanding mandatory coverage from just Abu Dhabi and Dubai to the other five emirates. This affects approximately one‑third of the UAE’s population living in those remaining emirates. Concurrently, digital connectivity in the UAE reached 99.0 percent internet penetration among its ~9.55 million people in early 2024, with 20.96 million active mobile connections (i.e. about 219 percent of population counting multiple lines per person). These mandates combined with near‑universal digital access enable digital health insurance models to scale rapidly, facilitating seamless enrollment, renewals, claims, and telemedicine‑based services.

Government‑Backed Innovation and Sandbox Initiatives

Regulatory sandboxes and “RegLab” type initiatives in the UAE offer controlled environments for testing insurance‑adjacent fintech and InsurTech innovations. The UAE has a dedicated insurance regulatory sandbox under its RegLab programme, plus a co‑sandbox programme between the Central Bank of the UAE, ADGM, and DIFC. Also, in June 2024 the Central Bank introduced the Sandbox Conditions Regulation, enabling early‑stage fintechs to test products without needing full licenses in some cases. These structures reduce regulatory uncertainty and cost for InsurTech entrants, helping speed product testing and adoption in areas like embedded insurance or digital underwriting.

Key Market Challenges

Complex Regulatory Licensing (Insurer vs Broker vs MGA)

InsurTech firms in the UAE need to navigate multiple regulatory jurisdictions: the Central Bank of UAE (onshore), plus free zones such as ADGM and DIFC each with their own insurance or fintech regulation. Firms must often decide between being licensed as insurers, brokers, MGAs or platform providers. The Sandbox Conditions Regulation of mid‑2024 allows fintech companies to test without full licenses in some cases, but excludes certain activities such as insurance or deposit‑taking. This complexity increases legal and compliance costs, slows time‑to‑market, and may deter smaller InsurTech entrants.

Low Awareness Among SMEs and Gig Economy

While the expatriate population forms about 88 percent of the UAE’s total population (≈ total pop ~9.55 million in 2024) many SMEs and gig economy workers are informal or less engaged with formal employee benefits including insurance. Though employer mandates will expand coverage, there is limited data showing strong current uptake in voluntary or platform‑embedded insurance for gig workers. Without tailored products, awareness programs, or low‑cost digital solutions, this segment may lag behind despite large addressable population.

Opportunities

Parametric and Usage‑Based Models (Motor, Climate, Travel)

The Middle East & Africa Usage‑Based Insurance (UBI) market is valued at USD 2.12 billion in 2024. UAE is expected to be a leading country in UBI adoption in this region due to mature automotive sector and favorable regulatory framework. Also, the UAE Usage‑Based Insurance market alone is projected at USD 368.16 million in 2025. These figures indicate there is growing demand among vehicle owners and commercial fleets for PAYD (Pay‑As‑You‑Drive), PHYD (Pay‑How‑You‑Drive) models. Climate risk parametric covers (e.g. flood, extreme weather) may similarly benefit from connected device/internet penetration.

Cross‑Selling via HealthTech and Telemedicine

In UAE, the health insurance market is heavily propelled by the expatriate population exceeding 11.06 million persons who depend on private health insurance. Meanwhile, the number of internet users in UAE is ~9.46 million in 2024, and mobile connectivity stands at ~20.96 million connections. Telemedicine and digital health platforms are increasing in usage, and wellness tracking / remote monitoring devices are being adopted. These digital channels create opportunities to cross‑sell insurance products (riders, wellness incentives, preventive checkups) via health apps, providers, corporate wellness programmes. The combination of high connectivity + large health insurance customer base makes cross‑selling via digital health an attractive opportunity.

Future Outlook

Over the forecast period 2024‑2030, the UAE InsurTech market is expected to grow significantly. Growth will be propelled by increasing regulation (including mandatory insurance and digital compliance), technological advancements (AI, IoT, embedded insurance), rising adoption among expatriates, SMEs, and digital‐first consumers, as well as collaboration between traditional insurers and InsurTech startups. Market expansion will also come from new product lines such as cyber insurance, parametric and usage‑based insurance, wellness‑linked health insurance, and digital travel/embedded insurance offerings.

Major Players

- Bayzat

- Yallacompare

- com

- Wellx

- Klaim

- Democrance

- Sehteq

- Neuron

- Addenda

- Policybazaar UAE

- Aqeed

- Daman (National Health Insurance Company)

- Abu Dhabi National Insurance Company (ADNIC)

- Sukoon Insurance (formerly Oman Insurance)

- Click2SecureMe

Key Target Audience

- Investments & Venture Capitalist Firms

- Government and Regulatory Bodies (e.g. Central Bank of UAE, Insurance Authority / Regulatory Authority)

- Large Traditional Insurance Companies seeking digital transformation

- Health Service Providers and Hospital/Clinic Chains

- Corporate Employers and Human Resources Departments

- Financial Institutions / Banks interested in embedded finance

- Technology Infrastructure Providers / Platform Vendors

- Private Equity & Family Offices interested in InsurTech startups

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping all stakeholders in the UAE InsurTech ecosystem: insurers, MGA, brokers, aggregator platforms, embedded partners, regulators. Data is collected from secondary sources (government publications, regulatory filings, industry reports) and proprietary databases to define variables such as GWP via digital channels, technology adoption, regulatory status, customer segments.

Step 2: Market Analysis and Construction

In this phase, historical financials (premium volumes, gross written premium, digital vs non‑digital splits) for 2023 and 2024 are collected. Segmentation by insurance type, business model, distribution channel and geography is constructed. Service quality, tech integration, and product innovation metrics are used to refine estimates.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses (e.g. that health insurance leads share, or that embedded insurance will grow fastest) are validated via interviews with industry experts, including executives of major insurers, regulators, InsurTech founders, and tech vendors. Challenges and opportunities are cross‑checked with practitioner input to ensure operational realism.

Step 4: Forecasting & Research Synthesis

The quantitative forecasting (2024‑2030) uses a bottom‑up model built from known drivers (population, regulatory mandates, digital penetration, insurer investments). This is complemented by top‑down checks (macroeconomic growth, past growth rates). Final output is synthesized to include segmentation, competitive analysis, forecasts, and recommendations.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach [GWP, Digital Premiums], Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Ecosystem Structure

- Timeline of Major Digital Insurance Milestones

- UAE Digital Insurance Regulatory Evolution

- InsurTech Business Model Cycle in UAE

- Value Chain Analysis – Insurer, MGA, Tech Partner, Platform

- Technology Enablement Stack (API, Cloud, AI, Blockchain, IoT)

- Licensing and Compliance Framework (CBUAE, IA, Shariah Takaful Compliance)

- Key Growth Drivers

Health Insurance Mandates and Digital Push

Government-Backed Innovation and Sandbox Initiatives

Embedded Insurance via Mobility & E-Commerce Platforms

Rise of Wellness Tech and Personalization

Digitization of Claims, Onboarding, and KYC - Key Market Challenges

Complex Regulatory Licensing (Insurer vs Broker vs MGA)

Low Awareness Among SMEs and Gig Economy

Actuarial Data Scarcity for New Lines

Fraud and Cybersecurity Risks in Digital Channels

Thin Margins and High CAC in Early Stages - Opportunities

Parametric and Usage-Based Models (Motor, Climate, Travel)

Cross-Selling via HealthTech and Telemedicine

Demand for Cyber SME Insurance and Takaful Lines

Expansion to Under-Served Emirate Markets - Trends

Shift Towards Wellness-Based Insurance Rewards

PaaS and Insurance-as-a-Service (IaaS) Emergence

AI/ML Underwriting and Claims Automation

Blockchain Use Cases in Smart Contracts - Regulatory Environment

Central Bank & IA Licensing Protocols

Shariah Compliance in Digital Takaful

IFRS 17 and Digital Disclosures

CBUAE Sandbox and RegTech Developments - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces Analysis

- By Gross Written Premium – Digital Channels (Value), 2019-2024

- By Embedded Insurance Share (Value), 2019-2024

- By Life vs Non-Life InsurTech Contributions (Value), 2019-2024

- By Direct and Platform-Based Premiums (Value), 2019-2024

- By Insurance Type (In Value %)

Health Insurance

Motor Insurance

Life Insurance

Cyber Risk Insurance

Takaful & Specialty Lines - By Business Model (In Value %)

Aggregator / Comparison Platforms

Digital Insurers (B2C/B2B2C)

Embedded Insurance Providers

Digital MGAs and InsurTech Brokers

Tech Infrastructure Providers (PaaS, Claims AI, Risk Analytics) - By Customer Segment (In Value %)

Individual / Retail Customers

SMEs (Micro & Small Businesses)

Large Corporates

Public Sector / Government Organizations

Freelancers and Gig Economy - By Distribution Channel (In Value %)

Direct-to-Customer (Web, App)

Aggregator-Enabled Policies

API-Based Embedded Platforms

Traditional Brokers with Digital Support

Bancassurance & Telecom Partnerships - By Emirate (In Value %)

Dubai

Abu Dhabi

Sharjah

Northern Emirates

Free Zones

- Market Share Analysis (By Insurer Type and Digital Premiums)

- Cross Comparison Parameters (Company Overview, Regulatory License Status, Product Breadth, AI/Tech Stack, CAC, Retention Rates, Digital App UX Rating, Partner Alliances, Financials [Revenue, Burn], Geographic & Emirate Penetration)

- SWOT Analysis – Top Players

- Pricing Analysis – Sample SKUs Across Life, Motor, Health

- Detailed Profiles of 15 Key Players

Bayzat

Yallacompare

Souqalmal.com

Wellx

Klaim

Democrance

Sehteq

Neuron

Addenda

Policybazaar UAE

Aqeed

Sukoon Insurance (Oman Insurance)

Daman Health

ADNIC

Click2SecureMe

- Key Decision-Making Personas (Individual vs SME vs Corp)

- Purchase Drivers – Cost, Convenience, Coverage

- Digital Literacy and Device Penetration Metrics

- App Retention, Feedback, and Usage Metrics

- Employer-Driven vs Voluntary Digital Health Insurance

- By Gross Digital Premiums, 2025-2030

- By Embedded & API Channel Share, 2025-2030

- By Business Model Adoption (Aggregator, MGA, Embedded), 2025-2030

- By Coverage Line (Health, Cyber, Takaful), 2025-2030