Market Overview

The ketone testing devices market—which includes blood ketone meters, glucose‑ketone combination systems, and related detection equipment—is experiencing steady global expansion driven by rising diabetes prevalence, growing health awareness, and increasing adoption of home and point‑of‑care diagnostics. Globally, the blood ketone meter market has been expanding with forecasts showing solid growth rates in the high single digits (around ~CAGR depending on the source and forecast period), with total market valuations projected to rise significantly over the next decade as more individuals monitor metabolic health both clinically and at home. Technological advancements such as portable devices, digital connectivity, and integration with healthcare apps are further broadening adoption and driving innovation within the segment.

In the UAE and Middle East & Africa region, the market for blood ketone and related at‑home testing devices is smaller relative to major global markets but is poised for relatively stronger regional growth. The MEA blood ketone meter market is expected to grow at a moderate CAGR in coming years, with the UAE anticipated to register one of the highest growth rates within the region due to rising chronic disease awareness, increasing healthcare spending, and expanded access to home health monitoring solutions. Local health‑care initiatives and a growing focus on proactive self‑monitoring among patients with diabetes and metabolic conditions are contributing to rising demand for ketone testing devices in the UAE.

Market Segmentation

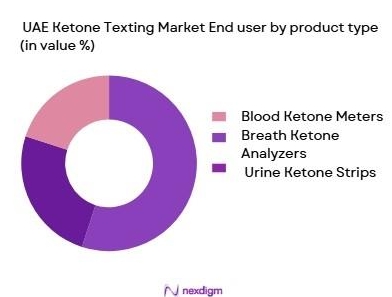

By Product Type

The UAE Ketone Testing Devices Market is segmented by product type into blood ketone meters, breath ketone analyzers, and urine ketone strips. Recently, blood ketone meters have dominated the market, primarily due to their accuracy and precision, which are crucial for individuals managing diabetes and adhering to ketogenic diets. Blood meters offer real-time, precise readings, making them the preferred choice in healthcare settings for both home users and medical practitioners. As the demand for more reliable and effective testing methods continues to rise, blood ketone meters will maintain their dominance, supported by technological advancements in device accuracy and usability.

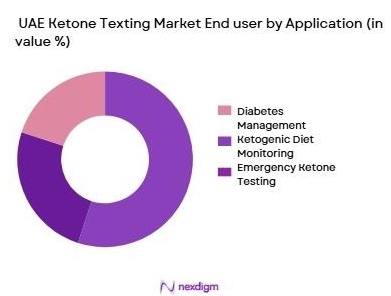

By Application

The market is segmented by application into diabetes management, ketogenic diet monitoring, and emergency ketone testing. Diabetes management leads the market due to the increasing number of individuals diagnosed with diabetes in the UAE. The region’s rising diabetes prevalence, coupled with government efforts to improve diabetes management through regular testing, drives the demand for ketone testing devices for glycemic control. These devices are crucial for ensuring that individuals with diabetes are monitoring their ketone levels effectively to prevent complications such as diabetic ketoacidosis Diabetes Management

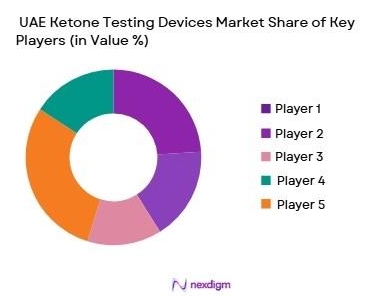

Competitive Landscape

The UAE Ketone Testing Devices Market is dominated by a few major global and regional players, including established companies in the healthcare and diagnostics space. Key players like Abbott Laboratories, Roche Diagnostics, and Dexcom, alongside regional companies like Keto-Mojo, dominate the market through their innovative product offerings and strong distribution networks. The consolidation of these major players reflects their significant influence on market trends, product development, and technological advancements.

|

Company Name |

Establishment Year |

Headquarters |

Product Portfolio |

Key Markets |

Technology Used |

Distribution Channels |

|

Abbott Laboratories |

1888 |

USA |

~ |

~ |

~ |

~ |

|

Roche Diagnostics |

1896 |

Switzerland |

~ |

~ |

~ |

~ |

|

Dexcom |

1999 |

USA |

~ |

~ |

~ |

~ |

|

Keto-Mojo |

2017 |

USA |

~ |

~ |

~ |

~ |

|

ACON Laboratories |

1990 |

USA |

~ |

~ |

~ |

~ |

UAE Ketone Testing Devices Market Analysis

Growth Drivers

Urbanization

Urbanization is a significant driver of the UAE Ketone Testing Devices Market. The UAE’s urban population has reached over 90% in 2023, with major cities like Dubai and Abu Dhabi leading in both economic activities and health-conscious consumer behavior. As urban populations grow, so does the demand for efficient health monitoring devices like ketone testing devices. This trend is supported by increased healthcare awareness and the desire for personalized health management, particularly among individuals with diabetes and those on ketogenic diets. These factors push for broader adoption of home-use testing devices. Source: World Bank.

Industrialization

Industrialization in the UAE has contributed to the rise of chronic health issues, such as diabetes and obesity, further boosting demand for ketone testing devices. The UAE government has invested heavily in diversifying its economy, leading to a rise in sedentary lifestyles, which are linked to increased rates of metabolic disorders. The industrial sectors in urban centers generate significant demand for health monitoring devices, including ketone meters, as part of corporate wellness programs. With industrial development directly tied to health-related risks, the market for monitoring tools is expected to continue expanding.

Opportunities

Technological Advancements:

Technological advancements in ketone testing devices present significant opportunities for growth in the UAE market. Innovations such as non-invasive blood ketone meters, Bluetooth-enabled devices, and IoT integration have revolutionized how individuals monitor their health. The introduction of more user-friendly, portable devices that offer real-time data integration with mobile applications allows consumers to manage their health more effectively. These technologies not only improve the accuracy of testing but also enhance the overall user experience, fostering further market growth. Source: Ministry of Health and Prevention

International Collaborations:

International collaborations between UAE healthcare organizations and global companies are driving the growth of the ketone testing device market. Partnerships with leading manufacturers of medical devices, such as Abbott and Roche, are enabling the introduction of advanced technologies in the UAE market. These collaborations bring innovation, quality control, and the latest advancements in medical technology, ensuring the UAE has access to the best products. This increasing globalization of healthcare technology will continue to support the market’s expansion. Source: United Nations Economic and Social Commission for Western Asia.

Restraints

High Initial Costs:

The high initial costs of ketone testing devices are a significant restraint in the UAE market. The prices of ketone meters and related accessories, especially the advanced blood ketone meters, can be prohibitive for some consumers. While the health benefits are apparent, the initial investment in purchasing these devices, along with the recurring costs for testing strips and other supplies, remain a barrier for widespread adoption, particularly in lower-income segments of the population. This financial hurdle slows the growth of the market, despite the increasing health awareness. Source: Ministry of Finance Link.

Technical Challenges:

Technical challenges associated with ketone testing devices present another constraint in the UAE market. Some devices may suffer from calibration issues, resulting in inaccurate readings, which can be a concern for individuals managing health conditions like diabetes. Additionally, many of these devices require regular maintenance, which may not always be accessible, particularly in remote areas. These technical issues reduce consumer trust and can discourage adoption, particularly in a market that relies on precision for health management. Source: UAE Ministry of Health and Prevention

Future Outlook

Over the next ~years, the UAE Ketone Testing Devices Market is expected to show steady growth, driven by continuous healthcare advancements, increasing awareness about diabetes and ketogenic diets, and the rising adoption of home health monitoring devices. The government’s focus on enhancing healthcare access and promoting preventive healthcare will also play a key role in expanding the market. Additionally, technological innovations, such as IoT integration and the shift towards more user-friendly devices, are expected to drive future demand.

Major Players

- Roche Diagnostics

- Dexcom

- Keto-Mojo

- ACON Laboratories

- Ascensia Diabetes Care

- LifeScan

- Nipro Corporation

- iHealth Labs

- Medtronic

- Trividia Health

- Abbott Diabetes Care

- Bayer Healthcare

- Diabetes Technology Solutions

- Abbott Diabetes Care

Key Target Audience

- Healthcare Providers

- Hospitals and Clinics

- End-Users (Consumers)

- Diabetes Associations

- Investment and Venture Capitalist Firms

- Regulatory Bodies

- Insurance Companies

- Pharmaceutical Companies

Research Methodology

Step 1: Identification of Key Variables

In this phase, we identify and define the critical variables that influence the UAE Ketone Testing Devices Market. This involves comprehensive desk research using secondary data sources such as medical publications, government reports, and industry research.

Step2: Market Analysis and Construction

Here, we analyze historical data to understand market penetration, product type preferences, and the role of various stakeholders. This helps establish a robust market model that reflects trends and opportunities accurately.

Step3: Hypothesis Validation and Expert Consultation

We validate hypotheses and data through interviews and consultations with industry experts, healthcare professionals, and manufacturers to ensure data accuracy and operational insights.

Step4: Research Synthesis and Final Output

We engage directly with manufacturers and distributors to gain insights into sales performance, market share, and future market outlook. The data is then synthesized to ensure a comprehensive market outlook, which is validated through the bottom-up approach.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis in the UAE

- Timeline of Key Milestones

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Healthcare Awareness and Chronic Disease Management

Technological Innovations in Monitoring Devices

Economic Impact of Lifestyle Diseases in the UAE - Market Challenges

Healthcare Affordability Issues

Regulatory and Compliance Hurdles

Opportunities - Trends

Growth in IoT-Enabled Devices for Home Monitoring

Integration with Mobile Health Apps

Government Regulation

Device Approval and Certification Processes

Import and Distribution Regulations

SWOT Analysis

Stakeholder Ecosystem

Porter’s Five Forces Analysis

Competition Ecosystem

Market End-User Analysis - Utilization

Purchasing Power and Budget Allocations

Regulatory and Compliance Requirements

Needs, Desires, and Pain Point Analysis

Decision-Making Process

- By Value, 2019-2026

- year Volume, 2019-2026

- By Average Price, 2019-2026

- By Product Type,(In Value %)

Blood Ketone Meters

Breath Ketone Analyzers

Urine Ketone Strips - By Application, (In Value %)

Diabetes Management

Ketogenic Diet Monitoring

Emergency Ketone Monitoring - By End-User, (In Value %)

Consumers

Hospitals and Clinics

Diagnostic Laboratories - By Distribution Channel, (In Value %)

E-commerce

Pharmacies and Retail Stores

Direct Healthcare Providers - By Region, (In Value %)

Dubai and Northern Emirates

Abu Dhabi

Sharjah and Other Emirates

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure

Revenues) - Pricing Analysis of Major Companies

- Detail profile of major players

Abbott Laboratories

Roche Diagnostics

Dexcom

Ascensia Diabetes Care

Medtronic

Keto-Mojo

ACON Laboratories

KetoneTest

Abbott Laboratories

Nipro Corporation

Enzo Biochem

health Labs

Trividia Health

Fitbit

LifeScan

- Patient / Consumer Segment

- Hospitals and Clinics

- Diagnostic Centers and Laboratories

- Home Healthcare Providers

By Value, 2026-2030

By Volume, 2026-2030

By Average Price,2026-2030