Market Overview

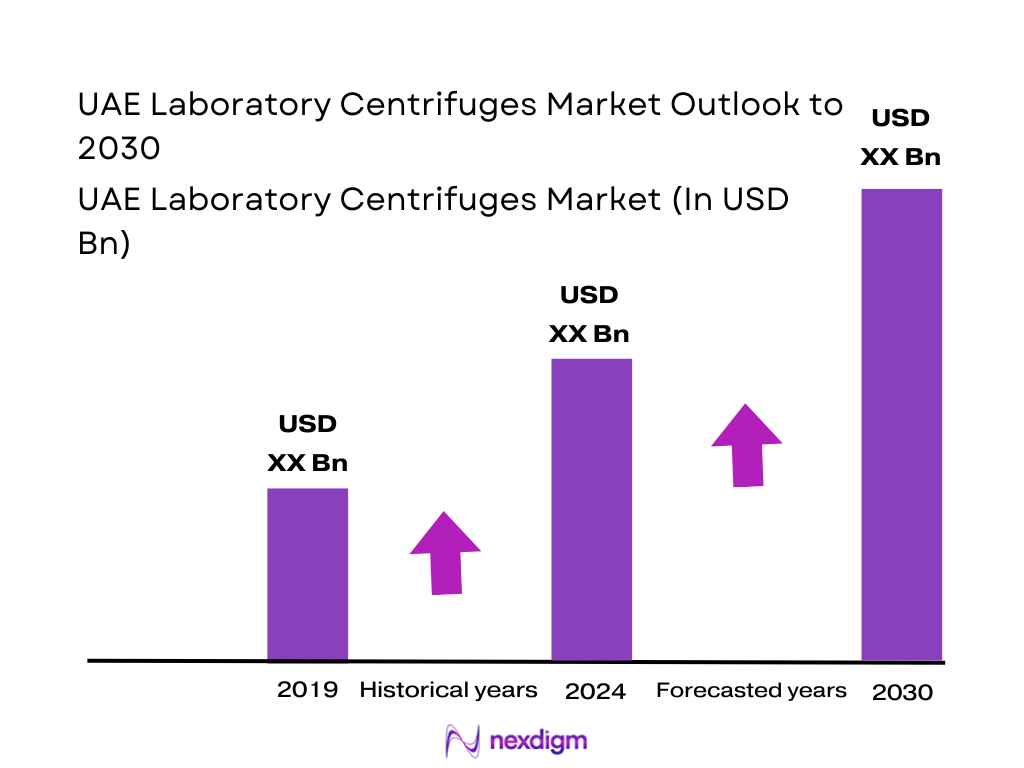

The UAE laboratory centrifuges market is embedded within a diagnostics and lab ecosystem where clinical laboratory services generate about USD ~ billion and diagnostic labs revenues are close to USD ~ billion in the latest reported cycle, reflecting strong test volumes across hospital and independent labs. Globally, laboratory centrifuges generate roughly USD ~ billion in revenue in the prior reporting cycle and around USD ~ billion in the current cycle, showing steady demand across clinical and research settings. In the UAE, rising chronic disease burden, higher insurance coverage and premium positioning of labs collectively pull through centrifuge demand as part of broader lab equipment budgets.

Within the UAE, Dubai and Abu Dhabi dominate laboratory centrifuge deployment because they host the bulk of tertiary hospitals, large public medical cities, free-zone life science hubs and reference laboratories. Dubai alone accounts for healthcare expenditure above AED 22 billion in the latest reporting period, while UAE and Saudi Arabia together represent over four-fifths of GCC healthcare spend, underlining the scale of infrastructure in these hubs. Pathology laboratories revenues of about USD ~ million in the UAE further cluster around major metropolitan centers, reinforcing their role as anchor markets for advanced centrifuge systems.

Market Segmentation

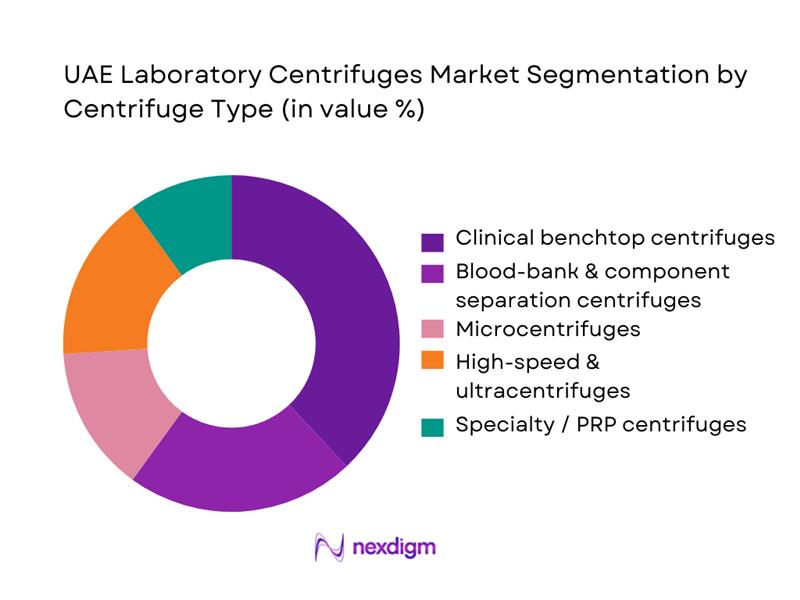

By Centrifuge Type

The UAE laboratory centrifuges market is segmented into clinical benchtop, blood-bank, microcentrifuges, high-speed/ultracentrifuges and specialty/PRP units. Clinical benchtop centrifuges hold the dominant share because every core hospital lab and standalone diagnostic center requires multiple routine serum and plasma processors tied to hematology, chemistry and coagulation analyzers. Their relatively lower capital cost, compact footprint and compatibility with standard VACUTAINER® tubes make them the default choice when new labs are commissioned or existing facilities expand capacity. Rising test volumes in clinical laboratories and pathology labs, evidenced by near-billion-dollar diagnostics revenue pools in the UAE, keep utilization high and replacement cycles shorter for this installed base, reinforcing their leading position.

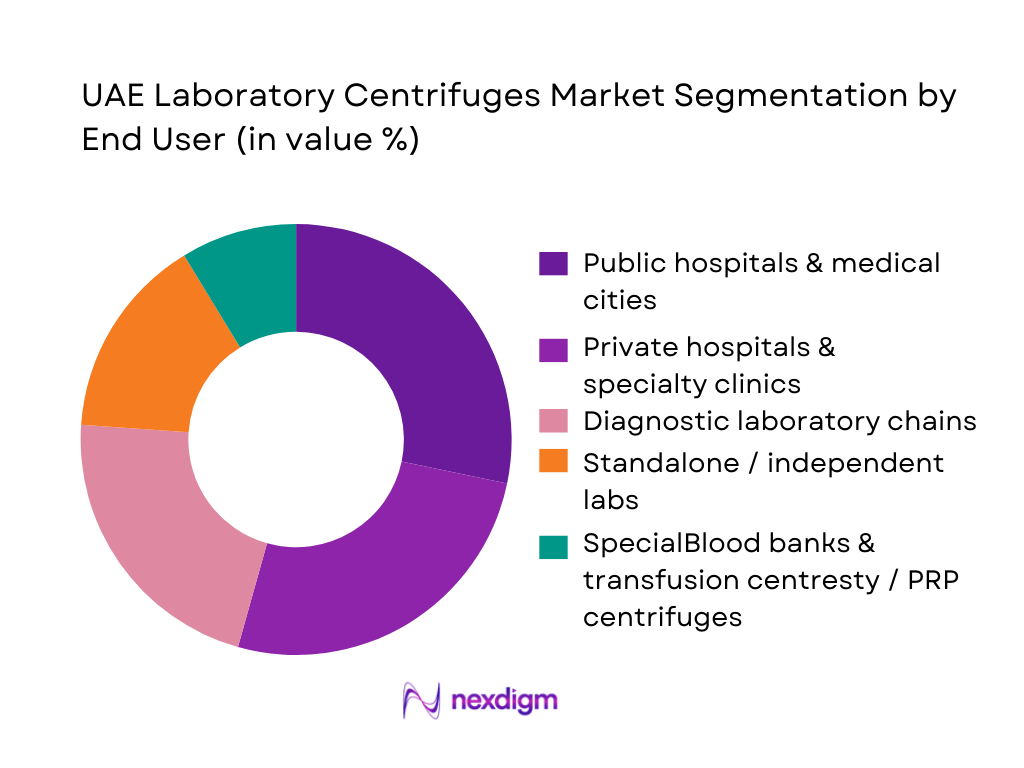

By End User

The UAE laboratory centrifuges market covers public hospitals and medical cities, private hospital groups, diagnostic lab chains, independent labs, blood banks and IVF/aesthetic clinics. Public and private hospitals together form the dominant cluster because they command the highest inpatient and outpatient volumes, run 24×7 core labs and operate specialist departments such as oncology, cardiology and transplant units that rely heavily on timely blood, serum and plasma processing. Government and private providers together account for the majority of current health expenditure in the UAE, with Dubai alone spending over AED ~ billion on healthcare in the latest cycle. These facilities typically deploy multiple centrifuges per lab—ranging from basic clinical models to high-capacity blood-bank units—concentrating equipment value in the hospital segment.

Competitive Landscape

The UAE laboratory centrifuges market is shaped by a combination of global OEMs and strong regional distributors. Thermo Fisher Scientific, Eppendorf, Beckman Coulter Life Sciences and other international brands supply a broad portfolio of clinical and research centrifuges, often represented locally via partners such as Apex Instrument, EasyLab and Gulf Scientific Corporation, which bundle installation, validation and after-sales service. Competition is fairly consolidated in premium segments like high-speed and ultracentrifuges, while mid-range clinical benchtop units face price pressure from Asian manufacturers and regionally configured offerings.

| Company | Establishment Year | Headquarters | Core Centrifuge Focus in UAE | Primary End-User Focus | Local Channel / Presence | Service & Validation Footprint | Notable Differentiator in UAE Market |

| Thermo Fisher Scientific | 2006 (current form) | Waltham, USA | ~ | ~ | ~ | ~ | ~ |

| Eppendorf SE | 1945 | Hamburg, Germany | ~ | ~ | ~ | ~ | ~ |

| Beckman Coulter Life Sciences | 1935 | Indianapolis, USA | ~ | ~ | ~ | ~ | ~ |

| Gulf Scientific Corporation (GSC) | 1990 | Dubai, UAE | ~ | ~ | ~ | ~ | ~ |

| Al Hayat Pharmaceuticals | 1982 | Sharjah, UAE | ~ | ~ | ~ | ~ | ~ |

UAE Laboratory Centrifuges Market Dynamics and Thematic Analysis

Growth Drivers

Expansion of Hospital & Lab Infrastructure

The UAE’s hospital and laboratory network is a core demand engine for laboratory centrifuges. The UAE’s population is estimated at about 11.0 million residents, with density around 132 people per km², reflecting highly urbanized care clusters that depend on centralized diagnostic labs. MoHAP’s latest statistical report shows that Abu Dhabi alone operates 69 hospitals with 7,699 beds, while Dubai has 51 hospitals with 6,642 beds, together accounting for 120 hospitals and 14,341 beds that require routine sample processing, blood separation and biochemistry workflows where centrifuges are critical. With UAE nominal GDP around USD ~ billion and GDP per capita near USD 49,550, healthcare providers have the budgetary headroom to expand and upgrade diagnostic equipment, moving from basic bench-top units to automated, high-throughput centrifuge platforms to support growing inpatient and outpatient testing loads.

Rising Test Volumes

Rising diagnostic volumes across hospitals, day-surgery centers and private clinics directly lift utilization of clinical centrifuges in chemistry, hematology and microbiology labs. WHO-linked datasets indicate the UAE has about 29.92 medical doctors per 10,000 population, significantly denser than many global peers and signalling high consultation and investigation rates per capita that translate into substantial specimen flows needing centrifugation. MoHAP records 96,631 registered live births and 11,762 deaths in a single year, each associated with antenatal, neonatal, chronic-disease and end-of-life testing episodes, from coagulation and cross-matching to metabolic and infection panels. Combined with a total population now above 11 million and strong health coverage, this structural throughput underpins demand for reliable, multi-bucket and swing-out rotor centrifuges that can support long operating hours, rapid turn-around times and integration with automated pre-analytics in central laboratories.

Market Challenges and Constraints

Capex Constraints

Although the UAE is a high-income economy, capital budgeting remains a constraint for centrifuge procurement, especially in smaller private labs and secondary hospitals. World Bank data indicate UAE total health expenditure per capita at USD 2,314.75, while domestic general government health expenditure per capita stands at USD 1,371.04, implying that a substantial share of spending is borne by private insurance and households. At the same time, the UAE’s imports reached about USD ~ billion in one year and USD ~ billion in the next, reflecting a trade-intensive economy exposed to global currency, logistics and interest-rate dynamics that influence imported medical-equipment budgets. As hospitals allocate capital across MRI, CT, cath labs, surgical robots and IT infrastructure, centrifuge replacements must compete for limited annual capex pools, delaying upgrades from older analog units to networked, energy-efficient models despite clear workflow benefits.

Price Competition from Low-Cost Imports

The UAE’s role as a major trading hub intensifies price competition from low-cost centrifuge imports, especially from Asian manufacturing bases, putting pressure on premium brands. World Bank trade statistics show UAE total imports of goods at about USD ~ in the latest reported year, with consumer goods imports alone worth USD ~ million and capital-goods imports USD ~million, underlining the scale of inbound products competing for shelf space and procurement attention. UN Comtrade data further indicate that UAE imports of instruments and appliances used in medical, surgical, dental or veterinary sciences under HS 9018 reached USD ~ in one recent year, demonstrating a large, diversified inflow of medical devices that naturally includes centrifuges and accessories. In this environment, distributors aggressively discount entry-level units, compressing margins and making it harder for high-spec systems with superior service coverage and validation support to justify higher upfront prices to procurement teams.

Market Opportunities

Premiumization

The UAE’s income profile and health-system ambitions create strong headroom for premiumization in the laboratory centrifuges market, shifting demand toward networked, low-noise, high-capacity and ergonomically designed systems. Nominal GDP is estimated around USD ~ billion, with GDP per capita close to USD 49,550, placing the UAE among the world’s higher-income economies and supporting willingness to invest in best-in-class medical technology. World Bank data show total health spending per capita at USD 2,314.75 and government health spending per capita at USD 1,371.04, indicating a robust mix of public and private funding that can underwrite premium equipment procurement, preventive health programs and digital labs. The country also attracted ~ billion dirhams (about USD ~ billion) in foreign direct investment in one year, with a target to raise annual FDI inflows to ~ billion dirhams, reinforcing a pro-investment, innovation-oriented environment where flagship hospitals, private chains and academic centers differentiate themselves through advanced, automated centrifuge platforms integrated into laboratory information systems and broader “smart hospital” architectures.

High-End Research Centrifuges

High-end research centrifuges—ultracentrifuges, high-speed refrigerated models and cell-therapy-ready systems—benefit from the UAE’s growing complex-care and life-science ecosystem. GLOBOCAN-based estimates of 5,526 new cancer cases and 2,283 cancer deaths in the UAE underpin demand for translational oncology research, biobanking and clinical trials, all of which require advanced centrifugation for cell pellets, viral vectors and exosomes. MoHAP’s organ-transplant milestones—1,000 transplants since 2017, a donor rate of 9.1 per million and 338 transplants in a single year—demonstrate the emergence of sophisticated transplant immunology and cell-therapy programs, further lifting the need for precisely controlled centrifuges that can handle cell suspensions and apheresis products without compromising viability. Combined with dense medical-doctor availability (29.92 per 10,000 people) and ambitious innovation strategies, UAE research hospitals and specialized labs are well-positioned to invest in global-tier centrifuge technologies, including IoT-enabled fleet management and GMP-compliant systems for advanced therapy medicinal products.

Future Outlook

Over the next six years, the UAE laboratory centrifuges market is expected to expand steadily, tracking the broader growth of diagnostic laboratories, pathology labs and healthcare spending. Clinical laboratory services alone are projected to rise from roughly USD ~ billion to more than USD ~ billion over the coming decade, while pathology laboratory revenues in the country are also forecast to grow robustly. As hospitals proliferate, specialised centres (oncology, transplant, IVF) scale up, and advanced molecular testing diffuses, centrifuges will remain foundational infrastructure in both clinical and research workflows. Key themes in the outlook include a gradual mix shift from basic clinical models towards higher-capacity refrigerated units, blood-component centrifuges and automation-ready systems in core labs. Increasing accreditation pressure from JCI, CAP and ISO standards will encourage equipment upgrades, particularly where traceability, data logging and temperature control are required.

Major Players

- Thermo Fisher Scientific

- Eppendorf SE

- Beckman Coulter Life Sciences

- Sartorius AG

- Hettich Instruments

- REMI Group (laboratory & blood-bank centrifuges)

- Centurion Scientific

- Sigma Laborzentrifugen

- Benchmark Scientific

- Drucker Diagnostics

- Gulf Scientific Corporation

- Al Hayat Pharmaceuticals

- EasyLab (laboratory equipment supplier)

- Apex Instrument

Key Target Audience

- Global laboratory equipment OEMs and product managers

- Regional medical and scientific equipment distributors and importers

- Hospital groups and integrated healthcare networks

- Independent diagnostic laboratory chains and reference labs

- Blood banks and transfusion medicine centres

- Pharmaceutical, biotechnology and vaccine manufacturers

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map covering all stakeholder groups within the UAE laboratory centrifuges market, including hospitals, diagnostic labs, blood banks, IVF centres, research institutes, OEMs and distributors. Extensive desk research using regional healthcare reports, lab market studies and equipment vendor documentation is undertaken to define critical variables such as installed base, procurement cycles, centrifuge types, end-user categories and regional deployment patterns across emirates.

Step 2: Market Analysis and Construction

In this step, historical and current data related to global and Middle East & Africa laboratory centrifuges is compiled, alongside UAE-specific diagnostics and healthcare expenditure benchmarks. This includes analyzing diagnostic lab revenues, clinical laboratory service values, lab equipment spending ratios and healthcare expenditure metrics. Bottom-up models estimate centrifuge revenues from the number of labs, typical units per facility and replacement timelines, while top-down cross-checks rely on regional market sizes and UAE’s share of GCC healthcare spending.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses on segment mix, growth rates and price bands are validated through structured interviews with lab managers, hospital biomedical engineering teams, procurement heads and channel partners representing leading centrifuge brands. Computer-assisted interviews and targeted virtual consultations capture real-world data on equipment utilisation, product preferences, budget constraints and service expectations, which are then used to refine the bottom-up models and adjust assumptions around installed base and future demand.

Step 4: Research Synthesis and Final Output

The final stage reconciles quantitative models with qualitative insights to produce an integrated view of the UAE laboratory centrifuges market by type, end user and region. Scenario analysis is applied to reflect different trajectories in healthcare spending, lab consolidation and technology adoption. The resulting output includes a fully validated market size and forecast, competitor profiling, segmentation tables and strategic recommendations tailored for OEMs, distributors, healthcare providers and investors seeking to understand or enter the UAE centrifuge space.

- Executive Summary

- Research Methodology (Market Definition – Laboratory Centrifuges, Product & Application Inclusion/Exclusion, Data Triangulation Approach, Installed-Base Modeling, Procurement & Tender Analytics, Primary Interviews – Pathologists & Lab Managers, Secondary Sources – MOHAP/SEHA/DHA & Trade Data, Assumptions & Limitations)

- Definition and Scope of Laboratory Centrifuges

- Role of Centrifuges Across UAE Clinical and Research Ecosystem

- Market Structure – OEMs, Regional Distributors, Local Dealers and Service Providers

- Supply Chain and Value Chain Mapping

- Centrifuge Usage Across Pre-Analytical and Analytical Workflows

- Growth Drivers

Expansion of Hospital & Lab Infrastructure

Rising Test Volumes

Oncology & Transplant Programs

Molecular & Genetic Testing

Blood-Component Demand - Market Challenges and Constraints

Capex Constraints

Price Competition from Low-Cost Imports

Service & Downtime Risks

Space & Utility Limitations

Compliance Requirements - Market Opportunities

Premiumization

High-End Research Centrifuges

Automation-Ready Systems

Connectivity & Data Logging

Leasing/Managed Service Models - Emerging and Structural Trends

Shift to High-Throughput Core Labs

Centralization vs Decentralization

Day-Surgery & IVF Growth

Biologics & Cell-Therapy Programs

PRP & Aesthetic Usage - Regulatory, Accreditation and Compliance Landscape

- Pricing, Margin and Total Cost of Ownership Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- Average Selling Price and Mix by Centrifuge Category, 2019-2024

- Installed Base Split, 2019-2024

- Installed Base by Lab Tier, 2019-2024

- By Centrifuge Type (in Value %)

Clinical Benchtop Centrifuges

Blood-Bank and Component Separation Centrifuges

Microcentrifuges and Mini-Centrifuges

High-Speed and Ultracentrifuges

Specialty and PRP/Orthopedic Centrifuges - By Speed Class (in Value %)

Low-Speed Centrifuges

Medium- and High-Speed Centrifuges

Ultracentrifuges - By Application (in Value %)

Clinical Diagnostics and Core Hospital Labs

Blood Banking and Transfusion Medicine

Molecular Biology, PCR and Genomics Workflows

Cell Culture, Bioprocess and Biologics Development

Environmental, Food and Industrial Testing Laboratories - By End User (in Value %)

Ministry and Government Hospitals & Medical Cities

Private Multispecialty Hospital Chains and Specialty Centres

Standalone and Chain Diagnostics Laboratories

Blood Banks and Transfusion Centers

IVF, Fertility and Specialty Day Surgery Clinics - By Rotor Configuration & Tube Format (in Value %)

Fixed-Angle Rotor Centrifuges

Swing-Out and Multi-Bucket Rotor Centrifuges

Vertical and Zonal Rotor Centrifuges

Specialized Rotors – Microtubes, Cryovials, Microplates, Blood Bags - By Capacity & Footprint (in Value %)

Microvolume

Low-Capacity Benchtop

Medium-Capacity Benchtop

Large-Capacity Floor-Standing

High-Throughput Blood-Bank Systems - By Refrigeration & Control Features (in Value %)

Ambient Centrifuges

Refrigerated Centrifuges

Cryogenic-Ready, Analog Controls

Digital & Touchscreen Controls

Programmable Profiles - By Region (in Value %)

Dubai

Abu Dhabi

Sharjah & Northern Emirates

Al Ain & Western Region

Free-Zone & Science Parks - By Procurement & Commercial Model (in Value %)

Direct OEM Sales

Regional Distributors

Group Purchasing Organizations

Government Tenders

E-Procurement & Online Platforms

- Market Share of Major Players by Value and Volume

Brand Positioning by Centrifuge Type and Speed Class - Cross Comparison Parameters (Company Overview & Centrifuge Portfolio Breadth, Installed Centrifuge Base in UAE Labs, Speed/RCF & Capacity Range Offered, Rotor & Accessory Compatibility, Local Service & Validation Footprint and SLA, Regulatory & Quality Certifications Coverage, Connectivity & Automation Features, Commercial Model – Upfront Capex vs Leasing & Service Bundling)

- SWOT Analysis of Key Players

- Channel and Distribution Landscape

- Tender, Framework Agreement and Key Account Landscape

- Detailed Profiles of Major Companies

Thermo Fisher Scientific

Eppendorf SE

Beckman Coulter Life Sciences

Sartorius AG

REMI Group

Hettich Instruments

Centurion Scientific

Sigma Laborzentrifugen

Drucker Diagnostics

Benchmark Scientific

Gulf Scientific Corporation

Al Hayat Pharmaceuticals

InstaMed

Apex Instrument

- End-User Profiling and Workload Characterization

- Budget Allocation and Procurement Decision Cycles

- Pain Point and Unmet Need Analysis

- Decision-Making Units and Buying Centers

- Preference Mapping

- By Value, 2025-2030

- By Volume, 2025-2030

- Average Selling Price and Mix by Centrifuge Category, 2025-2030

- Installed Base Split, 2025-2030

- Installed Base by Lab Tier, 2025-2030