Market Overview

The UAE Laboratory Data Integration Solutions Market is valued at approximately USD ~ million in 2025, with strong growth expected in 2026. This market’s expansion is driven by the increasing demand for interoperability and the digitalization of laboratory systems. Government regulations for enhancing health data exchange across platforms, along with the rise in cloud adoption for laboratory management, have fueled this growth. As healthcare IT infrastructure improves, demand for seamless data integration solutions continues to grow, particularly in the context of electronic medical records (EMR) and laboratory information management systems (LIMS).

UAE’s dominance in the Laboratory Data Integration Solutions market is largely attributed to its robust healthcare infrastructure, particularly in cities like Dubai and Abu Dhabi. These cities serve as hubs for advanced healthcare facilities, driving demand for cutting-edge data integration solutions. The government’s push for digital health transformation and regulatory frameworks such as the UAE’s National Health Data Management Strategy also plays a key role in fostering the growth of this market. Dubai, with its global financial ecosystem and medical tourism, and Abu Dhabi, known for its progressive healthcare initiatives, lead the charge in technological adoption within laboratory data systems.

Market Segmentation

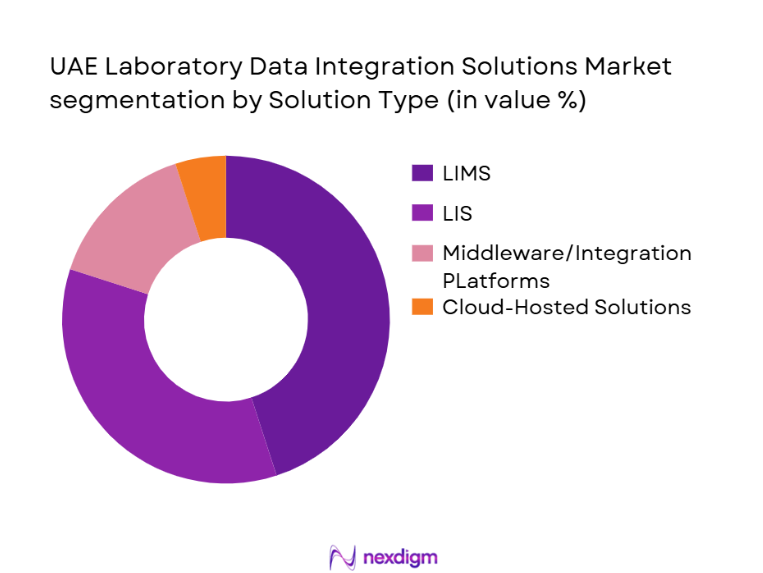

By Solution Type

The UAE Laboratory Data Integration Solutions market is segmented by solution type into LIMS (Laboratory Information Management Systems), LIS (Laboratory Information Systems), Middleware/Integration Platforms, and Cloud-Hosted Solutions.

LIMS remains the dominant solution in the market. This is largely due to the increasing demand for managing large volumes of laboratory data across diverse test samples and enhancing operational efficiency. The use of LIMS ensures greater accuracy, streamlined workflows, and better data traceability in clinical diagnostics, contributing to its market leadership. With regulations mandating the adoption of digital solutions for enhanced data integrity, the integration of LIMS in both public and private laboratories has become essential. Additionally, its ability to offer automation and enhanced reporting capabilities drives its growing market share.

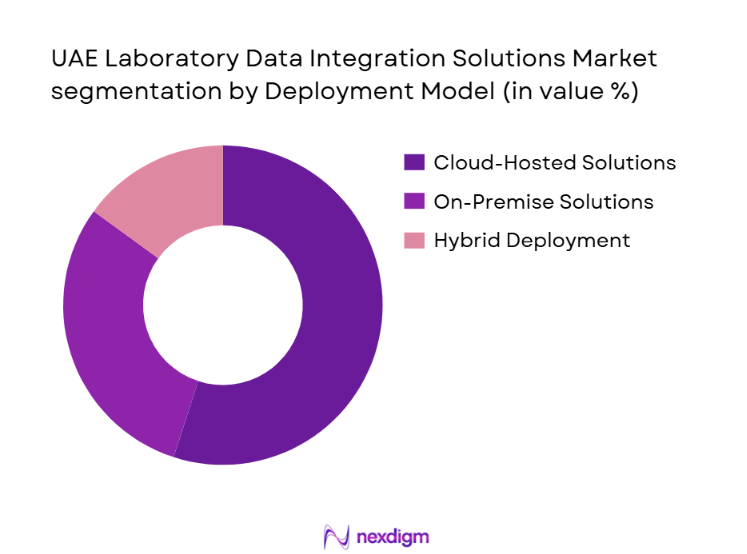

By Deployment Model

The market is segmented into Cloud-Hosted Solutions, On-Premises Solutions, and Hybrid Deployment.

Cloud-Hosted Solutions lead the market due to their scalability, cost-effectiveness, and ease of integration with existing health IT infrastructure. The adoption of cloud-based laboratory management systems has surged as hospitals and diagnostic centers move towards more flexible, multi-tenant solutions. Cloud platforms reduce the need for significant upfront capital investment, making them an attractive option for smaller labs and healthcare providers. Additionally, cloud solutions support real-time data sharing and collaborative research, which are crucial in both clinical diagnostics and R&D sectors, further cementing their dominance in the UAE.

Competitive Landscape

The UAE Laboratory Data Integration Solutions market is dominated by a few major players, with a blend of local and global companies leading the sector. Key players in this space include Thermo Fisher Scientific, LabWare, PerkinElmer, Agilent Technologies, and LabVantage Solutions. These companies are continuously innovating their solutions to stay competitive, offering robust products that address the growing need for data security, interoperability, and real-time reporting.

| Company | Establishment Year | Headquarters | Product Portfolio | R&D Investment | Customer Base | Global Reach |

| Thermo Fisher Scientific | 1956 | Waltham, Massachusetts | ~ | ~ | ~ | ~ |

| LabWare | 1988 | Wilmington, Delaware | ~ | ~ | ~ | ~ |

| PerkinElmer | 1937 | Waltham, Massachusetts | ~ | ~ | ~ | ~ |

| Agilent Technologies | 1999 | Santa Clara, California | ~ | ~ | ~ | ~ |

| LabVantage Solutions | 2000 | New Jersey, USA | ~ | ~ | ~ | ~ |

UAE Laboratory Data Integration Solutions Market Analysis

Growth Drivers

Government Initiatives and Regulatory Support

The UAE government has been actively promoting digital transformation in healthcare, with initiatives like the UAE National Health Data Management Strategy and regulatory frameworks supporting interoperability across healthcare data platforms. This has led to an increased demand for laboratory data integration solutions to ensure seamless data exchange, better patient outcomes, and enhanced operational efficiency.

Rising Demand for Cloud-based Solutions

The adoption of cloud-based laboratory information management systems (LIMS) and other data integration solutions is driving market growth. These solutions offer scalable, cost-effective, and flexible platforms for managing large volumes of laboratory data, making them increasingly popular among both small and large healthcare facilities, and contributing to overall market growth.

Market Challenges

Data Security and Privacy Concerns

As laboratory data involves sensitive patient information, concerns related to data security and privacy are major challenges in the market. Meeting stringent regulatory compliance requirements, such as the UAE’s data protection laws, while ensuring secure data exchange across multiple platforms, remains a key hurdle for many solution providers and healthcare institutions.

Integration with Legacy Systems

Many healthcare providers in the UAE still rely on legacy laboratory systems that are not compatible with modern data integration solutions. Overcoming the technical complexities of integrating these older systems with new technologies is a significant challenge, requiring substantial investment in both time and resources.

Opportunities

Emerging Demand for AI and Machine Learning-driven Solutions

The increasing integration of artificial intelligence (AI) and machine learning (ML) into laboratory data management offers vast opportunities for growth. These technologies enable real-time data analysis, predictive analytics, and automation of routine tasks, allowing laboratories to enhance efficiency and accuracy while reducing human error.

Expanding Research and Biotech Sectors

The UAE is investing heavily in the biotechnology and research sectors, driving demand for advanced laboratory data integration solutions. With an increasing number of research organizations and biotech firms requiring seamless data management solutions for clinical trials, genomic research, and personalized medicine, the market is poised to benefit from this expanding segment.

Future Outlook

Over the next 5 years, the UAE Laboratory Data Integration Solutions market is expected to show steady growth, driven by continuous government support for the digital transformation of healthcare, advancements in LIMS and LIS technologies, and increasing consumer demand for eco-friendly solutions. The move towards interoperable laboratory systems will continue to be a key driver as healthcare institutions align with the UAE’s National Health Data Management Strategy to foster efficient data exchanges between systems. The increasing focus on cloud solutions and AI-driven analytics in labs will further contribute to market expansion.

Major Players

- Thermo Fisher Scientific

- LabWare

- PerkinElmer

- Agilent Technologies

- LabVantage Solutions

- Bio-Rad Laboratories

- Horiba Ltd

- Roche Diagnostics

- Siemens Healthineers

- Beckman Coulter

- Abbott Laboratories

- Danaher Corporation

- Abbott Informatics

- Hitachi High-Technologies

- Merck Group

Key Target Audience

- Healthcare Providers (Hospitals, Clinics)

- Laboratories (Clinical, Diagnostic, Research Labs)

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Health & Prevention, UAE)

- Pharmaceutical & Biotech Companies

- Healthcare IT Service Providers

- System Integrators and Solution Providers

- Cloud Service Providers (Specializing in Healthcare)

Research Methodology

Step 1: Identification of Key Variables

The first phase involves a comprehensive mapping of all stakeholders within the UAE Laboratory Data Integration Solutions market. We gather insights from secondary sources, such as industry reports and databases, and identify key variables, including deployment models, adoption rates, and market growth drivers.

Step 2: Market Analysis and Construction

This phase involves collecting and analyzing historical market data to build a foundation for understanding the dynamics of the laboratory data integration market. It includes studying historical penetration rates, major deployments, and regional growth patterns.

Step 3: Hypothesis Validation and Expert Consultation

We develop hypotheses about the future of the UAE Laboratory Data Integration Solutions market, which are then validated through expert consultations. Interviews with industry professionals and stakeholders provide operational insights and feedback on product adoption trends, helping to refine the market data.

Step 4: Research Synthesis and Final Output

In the final phase, we engage with manufacturers and system integrators to acquire insights into specific product segments, their market positioning, and future growth potential. This direct interaction serves to validate the results obtained through both primary and secondary research methods.

- Executive Summary

- Research Methodology (Market Definitions & Standardization, Abbreviations, Data Integration Taxonomy, Primary/Secondary Research Framework, Global vs UAE Data Harmonization, Interoperability Metrics, Forecast Methodology, Confidence Levels & Limitations)

- Market Definition & Scope

- Market Genesis & Evolution in UAE

- Regulatory & Compliance Environment

- Integration Ecosystem Architecture

- Value Chain Analysis

- Market Growth Drivers

Regulatory Push for Interoperability & eHealth Data Exchanges

Cloud & SaaS Adoption in Healthcare IT

Demand for RealTime Clinical Decision Support

Rise of MultiSite & Networked Lab Operations - Market Challenges

Data Security, Privacy & Sovereignty Constraints

Legacy Systems & Integration Complexity - Opportunities

AI/MLEnabled Integration for Predictive Lab Analytics

MultiEnterprise Data Sharing Platforms for Research - UAE Laboratory Data Integration Solutions Market Trends

Standardized API Adoption

Increased Outsourcing of Integration Services - Ecosystem & Partner Network Dynamics

- Market Value 2019-2025

- Market Volume 2019-2025

- Technology Spend 2019-2025

- Average Contract Value 2019-2025

- Adoption Intensity Score 2019-2025

- By Solution Type (In Value %)

LIMSCentric Integration Platforms

LISCentric Integration Solutions

Middleware & API Frameworks

CloudNative Integration Fabrics

AI/MLEnhanced Data Orchestration Engines - By Deployment Model (In Value %)

CloudHosted (SaaS)

OnPremises

Hybrid Integration

EdgeEnabled Data Streaming - By Integration Use Case (In Value %)

Clinical Diagnostics Data Exchange

Pharma & Biotech R&D Integration

Public Health & Regulatory Reporting

Environmental & Food Testing Data Aggregation

Contract Research & MultiSite Integration - By EndUser (In Value %)

Hospitals & Clinical Networks

Independent Diagnostic Labs

Pharmaceutical & Biotech Firms

Academic & Research Institutions

CROs & Clinical Trial Labs - By Geography (In Value %)

Abu Dhabi

Dubai

Sharjah & Northern Emirates

Rest of UAE - By Integration Complexity Level (In Value %)

Basic HIS/LIS PointtoPoint

Enterprise Service Bus / Orchestrated

EventDriven RealTime Integration

Data Lake & AnalyticsReady Integration

- Market Share Analysis

- CrossComparison Parameters: (Company Overview, Integration Capabilities, Cloud vs OnPrem Delivery, Standards Support (HL7/FHIR), API Library Breadth, Service & Support Footprint, Compliance Certifications, Revenue & Growth Rates, R&D Spend, Partner Ecosystems, Installed Base, Performance Benchmarks, Customer Satisfaction Metrics)

- Detailed Profiles of Major Companies

LabWare

STARLIMS

Thermo Fisher Scientific

LabVantage Solutions

PerkinElmer Informatics

Agilent Technologies

Autoscribe Informatics

Dassault Systèmes

Veeva Systems

K2view

Denodo Technologies

Innovaccer

InterSystems Corporation

CompuGroup Medical SE

Oracle Health Sciences

- Demand Drivers by Segment

- Budget Allocation & Procurement Cycles

- Interoperability Priorities

- Pain Points & Requirements Mapping

- Clinical & Research DecisionMaking Criteria

- Forecast by Value & Deployment 2026-2030

- Forecast by Integrated Endpoints & Use Cases 2026-2030

- Forecast by Segment Growth Metrics 2026-2030