Market Overview

The UAE Laboratory Data Security and Privacy market is valued at USD ~ billion. The demand logic is driven by the rising cybersecurity threats to sensitive laboratory data, growing adoption of digital technologies in healthcare and research sectors, and the increasing regulatory pressure for data protection. As laboratory environments become increasingly digitized, the importance of safeguarding critical patient data, research findings, and intellectual property from cyber threats has escalated. The regulatory framework is increasingly aligning with global standards like GDPR, making compliance a crucial factor for laboratory organizations. This results in a steady demand for advanced security and privacy solutions to safeguard sensitive data and ensure compliance with regulations.

The dominant cities driving the UAE Laboratory Data Security and Privacy Market are Dubai and Abu Dhabi. These cities represent the epicenters of technological adoption and innovation in the UAE, with Dubai being a global leader in healthcare and technology infrastructure, and Abu Dhabi housing several major research institutions and governmental agencies. The concentration of healthcare facilities, government-backed research projects, and a growing number of multinational pharmaceutical and biotech companies in these cities creates significant demand for robust data security and privacy solutions. Furthermore, the UAE government’s strong emphasis on cybersecurity regulations and the enforcement of data privacy laws contributes to the high demand for these services in these regions.

Market Segmentation

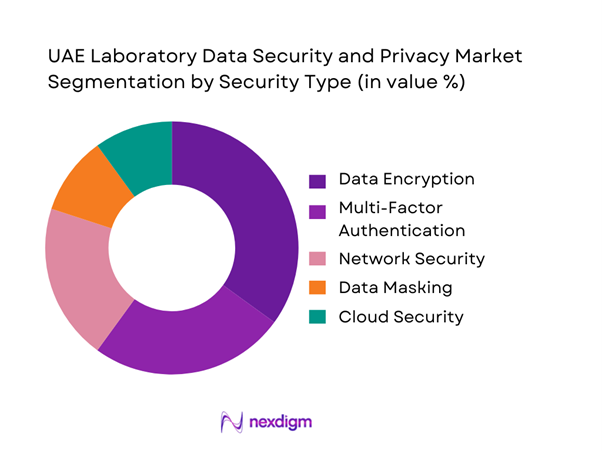

By Security Type

Data Encryption leads the market as it is the most essential security measure for protecting sensitive laboratory data, especially in healthcare and pharmaceutical sectors. The growing incidence of data breaches and the increasing regulatory requirements for data protection have made data encryption a fundamental tool in safeguarding sensitive information. This solution is indispensable for ensuring that laboratory data remains confidential and complies with global standards like GDPR and HIPAA. Cloud-based solutions are also increasingly integrating data encryption features, further driving its adoption across sectors.

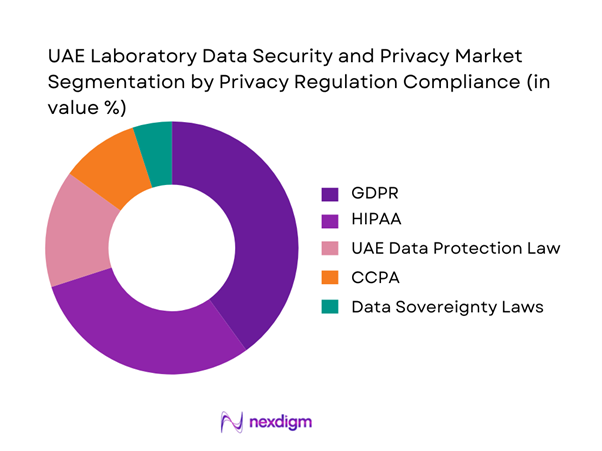

By Privacy Regulation Compliance

GDPR compliance is a dominant factor in the UAE Laboratory Data Security and Privacy Market. Due to the UAE’s increasing international engagement and the global reach of GDPR, organizations operating in the UAE, particularly in healthcare and research, must adhere to GDPR’s stringent data privacy requirements. The growing awareness of data privacy laws, both local (UAE Data Protection Law) and international, has also driven the adoption of compliance-focused data security solutions in laboratories. The need for GDPR compliance ensures that organizations implement the highest standards of data protection and privacy, making it a key segment in the market.

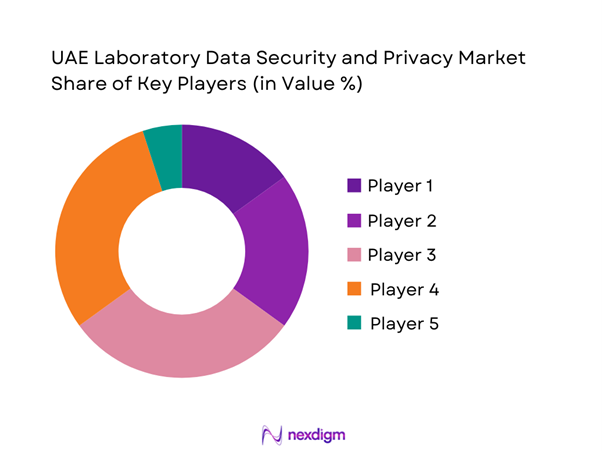

Competitive Landscape

The UAE Laboratory Data Security and Privacy Market is dominated by a few major players, including McAfee and global brands like Palo Alto Networks, Cisco Systems, and Fortinet. This consolidation highlights the significant influence of these key companies. These firms provide a comprehensive suite of cybersecurity solutions, including encryption technologies, multi-factor authentication, and compliance-driven data protection systems tailored to the laboratory environment. Their strong presence, coupled with the growing demand for data protection in laboratories, reinforces their leading positions in the market.

| Company | Establishment Year | Headquarters | Key Parameter 1 | Key Parameter 2 | Key Parameter 3 | Key Parameter 4 | Key Parameter 5 | Key Parameter 6 |

| McAfee | 1987 | Dubai | ~ | ~ | ~ | ~ | ~ | ~ |

| Palo Alto Networks | 2005 | Abu Dhabi | ~ | ~ | ~ | ~ | ~ | ~ |

| Cisco Systems | 1984 | Dubai | ~ | ~ | ~ | ~ | ~ | ~ |

| Fortinet | 2000 | Dubai | ~ | ~ | ~ | ~ | ~ | ~ |

| Check Point Software Technologies | 1993 | Abu Dhabi | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Laboratory Data Security and Privacy Market Analysis

Growth Drivers

Increased Data Breaches in Healthcare Sector

The rise in cyberattacks targeting healthcare organizations has significantly contributed to the growth of the data security market in the UAE. Data breaches in the healthcare sector have become a common threat, as sensitive patient data, medical records, and research information are lucrative targets for cybercriminals. These breaches not only threaten the privacy and integrity of data but also lead to reputational damage and legal consequences for organizations. As a result, healthcare providers and research institutions are increasingly adopting advanced data protection measures, driving the demand for security solutions specifically tailored to the sector’s needs.

Rising Adoption of Cloud Technologies

The adoption of cloud computing technologies has dramatically transformed industries, including healthcare and research. The shift to cloud-based systems offers flexibility, scalability, and cost savings. However, it also introduces significant security risks as data is stored off-site, often across multiple jurisdictions, making it vulnerable to breaches. The increasing migration of laboratory and healthcare data to the cloud necessitates stronger security measures to protect sensitive information. As more organizations move their data to the cloud, the demand for advanced cloud security solutions grows, making it a critical driver of the data security market in the UAE.

Market Challenges

Cost and Complexity of Data Protection Solutions

One of the primary challenges facing the laboratory data security market in the UAE is the high cost and complexity of implementing comprehensive data protection solutions. Advanced security technologies, such as data encryption, multi-factor authentication, and secure cloud infrastructure, can be expensive for small to medium-sized organizations to deploy. Additionally, managing and maintaining these systems requires specialized expertise and ongoing resources. As the complexity of cyber threats increases, businesses must continually invest in updated solutions, which can strain budgets and require significant operational adjustments. This challenge can deter some organizations from fully adopting the necessary security measures.

Lack of Skilled Personnel in Data Security

The shortage of skilled cybersecurity professionals is a significant hurdle for organizations seeking to enhance their data protection strategies. As the volume and sophistication of cyberattacks rise, the demand for qualified personnel to design, implement, and manage security systems has outpaced supply. In the UAE, many organizations struggle to find cybersecurity experts with expertise in laboratory and healthcare data security. This skill gap results in inadequate implementation of security measures and leaves organizations vulnerable to breaches. To overcome this challenge, businesses are investing in training programs, but the demand for skilled professionals continues to outstrip availability.

Opportunities

Increasing Demand for Cloud-Based Security Solutions

As the healthcare and research sectors increasingly migrate to cloud-based platforms, the demand for robust cloud security solutions is growing exponentially. Cloud computing provides significant advantages, such as cost-efficiency, accessibility, and scalability, but it also exposes sensitive data to various cyber threats. This presents a lucrative opportunity for security providers to develop innovative cloud security technologies, such as encryption, intrusion detection systems, and automated compliance monitoring. As organizations seek to protect their cloud-based data, there is ample opportunity for the market to expand with tailored, scalable security solutions to meet the evolving needs of the UAE’s data-driven industries.

Enhanced Government Focus on Data Privacy

The UAE government has placed a significant emphasis on enhancing data privacy regulations, which has created a wealth of opportunities for companies providing data security solutions. With laws such as the UAE Data Protection Law and alignment with international standards like GDPR, businesses are increasingly required to implement stringent data protection measures to comply with government mandates. This regulatory focus fosters the growth of the data security market, as organizations look for solutions to ensure compliance and avoid penalties. Moreover, the government’s proactive stance in promoting cybersecurity initiatives encourages further investments in data security, opening doors for innovation and market expansion.

Future Outlook

The UAE Laboratory Data Security and Privacy Market is poised for sustained growth, fueled by technological advancements, government regulations, and the increasing need for data protection across the healthcare, pharmaceutical, and research sectors. As laboratories continue to digitize and adopt cloud technologies, the demand for robust cybersecurity solutions will rise, creating opportunities for both local and global players in the market. The integration of AI and machine learning in data security solutions will also drive future innovations, ensuring that laboratories remain well-protected against evolving threats.

Major Players

- McAfee

- Palo Alto Networks

- Cisco Systems

- Fortinet

- Check Point Software Technologies

- Trend Micro

- Symantec

- CrowdStrike

- Splunk

- Fortune 500 Group

- FireEye

- IBM Security

- Kaspersky

- Barracuda Networks

- SonicWall

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Healthcare Providers

- Pharmaceutical Companies

- Research Institutions and Labs

- Data Privacy Auditing Firms

- Cloud Security Solution Providers

- Cybersecurity Consultants

Research Methodology

Step 1: Identification of Key Variables

In this phase, the critical factors influencing the UAE Laboratory Data Security and Privacy Market are identified, including the regulatory landscape, technological advancements, and sector-specific challenges.

Step 2: Market Analysis and Construction

Data is collected and analyzed from various sources, including industry reports and expert interviews, to assess market size, demand drivers, and competitive dynamics in the laboratory data security sector.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested through consultations with industry experts, including cybersecurity professionals, laboratory directors, and policymakers. This ensures the accuracy and relevance of the data.

Step 4: Research Synthesis and Final Output

The final analysis integrates insights from primary research, expert consultations, and secondary data to provide a comprehensive overview of the UAE Laboratory Data Security and Privacy Market, including key trends, drivers, and challenges.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- Topic-Specific Usage / Value-Chain / Care-Continuum Mapping

- Business Cycle and Demand Seasonality

- UAE Industry / Service / Delivery Architecture

- Growth Drivers

Increasing Cybersecurity Threats in Healthcare

Rising Adoption of Cloud Technologies

Stringent Government Regulations on Data Protection

Increasing Data Privacy Concerns in Research Labs

Technological Advancements in Cybersecurity Solutions - Challenges

High Implementation Costs of Security Solutions

Lack of Skilled Cybersecurity Professionals

Regulatory Compliance Complexity

Concerns Over the Privacy of Health and Research Data

Barriers in Cross-Border Data Sharing - Opportunities

Growing Demand for Cloud-Based Security Solutions

AI and Machine Learning Integration in Data Security

Government Support for Cybersecurity Initiatives

Expanding Healthcare and Pharmaceutical Sectors

Emerging Trends in Data Masking and Anonymization - Trends

AI Integration in Data Security Solutions

Growing Awareness of Data Privacy Among Enterprises - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Average Price, 2019–2024

- By Security Type (in Value %)

Data Encryption

Multi-Factor Authentication

Network Security

Data Masking

Cloud Security - By Privacy Regulation Compliance (in Value %)

GDPR

HIPAA

UAE Data Protection Law

CCPA

Data Sovereignty Laws - By Data Type (in Value %)

Patient Data

Research Data

Employee Data

Operational Data - By End-Use Industry (in Value %)

Healthcare

Research & Academia

Government and Defense

Pharmaceutical

Laboratories - By Region (in Value %)

Dubai

Abu Dhabi

Sharjah

Northern Emirates

- Competition ecosystem overview

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value Offering, and others)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

McAfee

Palo Alto Networks

Cisco Systems

Fortinet

Check Point Software Technologies

Trend Micro

Symantec

CrowdStrike

Splunk

Fortune 500 Group

FireEye

IBM Security

Kaspersky

Barracuda Networks

SonicWall

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Value, 2025–2030

- By Volume, 2025-2030

- By Average Price, 2025-2030