Market Overview

The UAE Laboratory Incubators Market is nested within a rapidly expanding life-science ecosystem. Globally, the automated incubator segment alone is valued at about USD ~ billion, while the wider laboratory incubator market is assessed at roughly USD 1.6 billion based on recent historical analysis, driven by automation and cell-culture intensive research. Within the UAE, laboratory equipment and disposables – the category that includes incubators – generates about USD ~ million in revenue at baseline and is projected to approach USD ~ million over the mid-term, underpinned by national investments in genomics, precision medicine, and smart hospitals.

Demand for incubators in the UAE is highly concentrated in Dubai and Abu Dhabi, followed by Sharjah. Dubai hosts more than 50 hospitals and around 3,800–4,000 hospital beds, alongside over 400 life-science companies and 4,000 professionals clustered in Dubai Healthcare City and Dubai Science Park. Abu Dhabi’s SEHA network alone operates 14 hospitals and 70+ primary and ambulatory care clinics, acting as the state’s largest institutional buyer of advanced laboratory systems. These city-level hubs concentrate tertiary care, IVF, oncology, and reference labs, making them focal points for high-specification CO₂ and microbiological incubator demand.

Market Segmentation

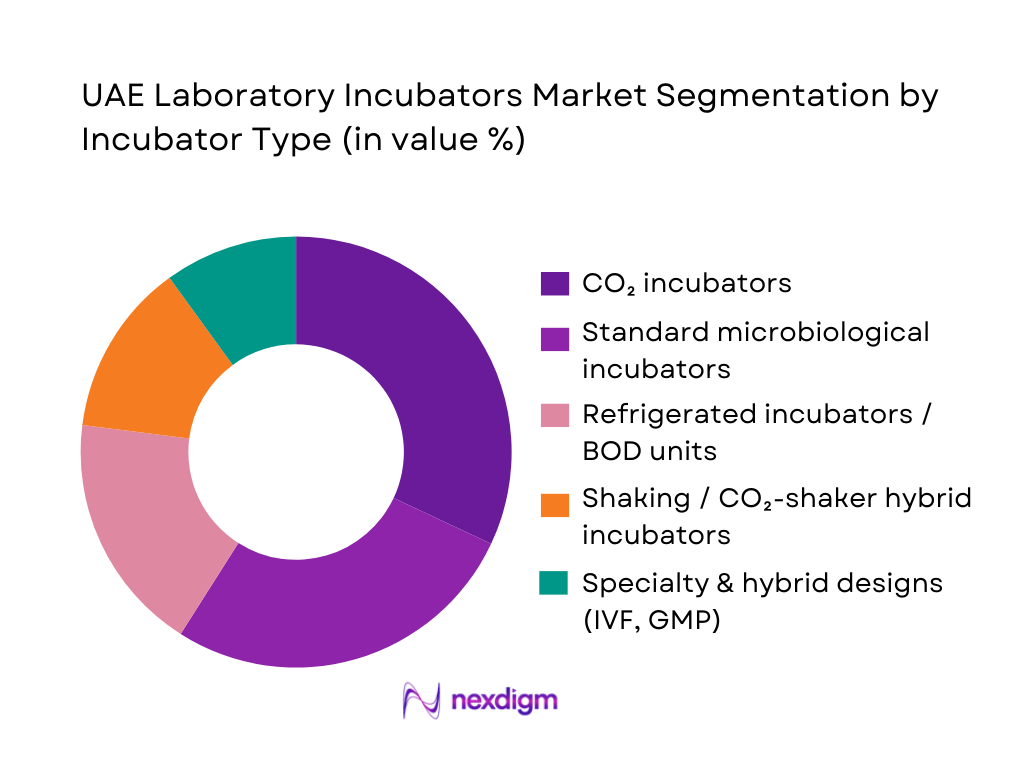

By Incubator Type

The UAE Laboratory Incubators Market is segmented by incubator type into CO₂ incubators, standard microbiological incubators, refrigerated incubators and BOD units, shaking and CO₂-shaker hybrid incubators, and specialty or hybrid designs tailored for IVF and GMP bioprocessing. CO₂ incubators currently hold a dominant share because they are essential for cell-culture-based IVF, oncology, and regenerative medicine programs that the UAE is actively scaling via national fertility, cancer-care and stem-cell strategies. These units are standard fixtures in fertility chains, tertiary hospitals, and private reference labs where demand is tied to rising cycles of IVF procedures, oncology diagnostics and translational research, driving repeat tenders for premium, validated CO₂ platforms.

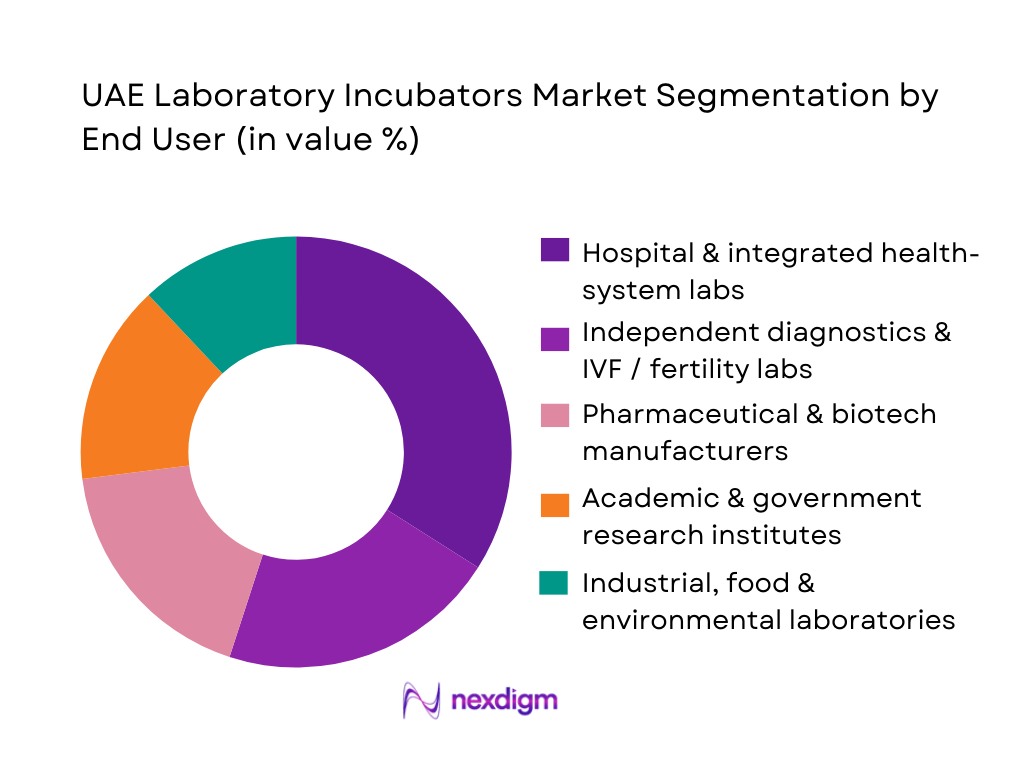

By End User

The UAE Laboratory Incubators Market is segmented by end user into hospital and integrated health-system laboratories, independent diagnostics and IVF / fertility labs, pharmaceutical and biotech manufacturers, academic and government research institutes, and industrial, food and environmental laboratories. Hospital and integrated health-system labs dominate because large networks such as SEHA, Dubai Health Authority, and Emirates Health Services operate extensive inpatient and outpatient footprints that centralize microbiology, serology, and cell-based testing under single procurement frameworks. These institutions run high sample volumes from emergency, oncology, neonatal and transplant units, which requires redundant incubator capacity, stringent uptime SLAs, and regular lifecycle refresh of critical CO₂ and microbiological units. Their capital budgets, accreditation requirements, and multi-hospital tenders give them outsized influence over vendor selection, specifications, and technology standards across the country.

Competitive Landscape

The UAE Laboratory Incubators Market is shaped by a small number of global OEMs with strong regional distributors rather than purely local manufacturers. Global brands dominate tenders for tertiary care, pharmaceutical and IVF applications due to their regulatory dossiers, validation packages and track record with CAP, JCI and ISO-accredited labs. Thermo Fisher Scientific, Binder, Memmert, Eppendorf and Esco Lifesciences are particularly prominent, leveraging dedicated channel partners in Dubai and Abu Dhabi, local service centers, and compatibility with UAE’s growing base of automated analyzers, cleanrooms and tissue-culture workflows.

| Company | Establishment Year | Global HQ (Country) | Core Incubator Focus in UAE | Primary UAE End-User Focus | Channel Strategy in UAE | Local Service & Validation Footprint | Technology / Differentiation Focus |

| Thermo Fisher Scientific | 2006 (current form) | United States | ~ | ~ | ~ | ~ | ~ |

| BINDER GmbH | 1983 | Germany | ~ | ~ | ~ | ~ | ~ |

| Memmert GmbH | 1933 | Germany | ~ | ~ | ~ | ~ | ~ |

| Eppendorf SE | 1945 | Germany | ~ | ~ | ~ | ~ | ~ |

| Esco Lifesciences Group | 1978 | Singapore | ~ | ~ | ~ | ~ | ~ |

UAE Laboratory Incubators Market Analysis

Growth Drivers

Expansion of Tertiary Hospitals, Oncology, Transplant and ICU Beds

UAE’s aggressive healthcare build-out directly lifts demand for high-reliability laboratory incubators in tertiary hospitals, oncology and transplant programs. The latest federal health statistics show 172 operating hospitals in the country with 19,102 beds, of which 7,699 beds are in Abu Dhabi and 6,642 beds in Dubai, indicating strong concentration of tertiary capacity that relies on advanced microbiology, pathology and cell-culture labs. At the same time, total population has reached 10,876,981, raising the need for more ICU and oncology beds that require continuous blood, tissue and microbiological testing under controlled incubation conditions. High health spending per capita of about USD 2,315 underlines the financial capacity to equip these facilities with premium incubators rather than low-spec units.

Surge in IVF Cycles, Fertility Tourism and Advanced Reproductive Medicine

Laboratory incubators used for embryo culture and gamete handling benefit from UAE’s fast-growing IVF and fertility-tourism ecosystem. A recent clinical review on fertility preservation in the country notes that around 25 assisted-reproduction centres now provide advanced IVF and fertility services, collectively performing more than 15,000–16,000 IVF cycles each year, with patients drawn from across the GCC, South Asia and Africa for high-end reproductive care. Dubai alone attracted 691,000 international health tourists for medical and wellness procedures, including fertility treatments, underscoring the scale of cross-border reproductive care that relies on CO₂ incubators, benchtop incubators and embryo-scope systems. With UAE health spending per capita at 2,314.75 US dollars and life expectancy at 83 years, demographic and income profiles support sustained demand for advanced IVF and fertility labs that are highly incubator-intensive.

Market Challenges

Capex Constraints and Tender-Based Price Compression

Despite high per-capita health spending, capital budgets for laboratory equipment face scrutiny as UAE rationalises public expenditure and promotes value-based procurement. World Bank data show UAE’s GDP at about USD ~ billion, yet current health expenditure remains near 5.3% of GDP, forcing hospitals to prioritise big-ticket projects such as new beds and operating theatres over frequent upgrades of support equipment like incubators. Health-spend per capita of 2,314.75 US dollars in 2022 already sits well above the world average, so payors push hard on price in open tenders for laboratory devices to contain further budget escalation. As a result, public institutions often bundle incubators with other lab equipment in large framework tenders, favouring vendors willing to offer extended warranties, service inclusions or discounted multi-site pricing, compressing margins for mid-tier suppliers.

Regulatory Approvals, Calibration and Validation Compliance

UAE’s lab-heavy sectors operate under overlapping regulatory regimes from the Ministry of Health and Prevention, Dubai Health Authority, Department of Health – Abu Dhabi and municipal food-safety and environmental authorities. Abu Dhabi’s AI-driven Open Data Dashboards are fed from a unified health-statistics database, reflecting the extent of regulated data and performance reporting expected from hospitals and labs using critical devices such as incubators. WHO’s country profile lists indicators for density of doctors, nurses, pharmacists and safely-managed drinking water and sanitation, signalling that authorities track multiple health-system and environmental metrics that are influenced by laboratory results. To remain compliant, incubators must undergo scheduled calibration, temperature mapping, CO₂ validation and documentation to standards referenced in these regulatory frameworks, increasing lifecycle compliance costs for both providers and vendors.

Opportunities

Migration from Basic to Advanced CO₂ and Multigas Incubators in IVF and Cell Therapy

Rising complexity of IVF, stem-cell work and emerging cell-therapy initiatives in the UAE is driving a gradual shift from simple dry incubators to advanced CO₂ and multigas systems. The fertility-preservation review indicating 25 IVF centres and more than 15,000–16,000 cycles annually suggests a large installed base of culture equipment that must maintain pH, temperature and low-oxygen environments for embryos and gametes. On the demand side, Dubai’s 691,000 international health tourists and expenditures running into hundreds of millions of dirhams show that reproductive medicine is part of a broader high-value medical-tourism portfolio, where clinics compete on success rates and lab sophistication. With health spending per capita at more than 2,300 US dollars, IVF and emerging cell-therapy centres can justify premium multigas incubators with features such as rapid recovery, HEPA-filtered airflow and continuous data-logging, creating an upgrade opportunity for vendors that can demonstrate clinical performance benefits over basic models.

Service Contracts, Remote Monitoring and Predictive Maintenance Programs

The expansion of UAE’s healthcare and laboratory footprint—172 hospitals and over 19,000 beds nationwide, plus a growing number of municipal and environmental labs—creates a sizeable installed base of incubators that must be kept within calibration at all times. the same time, health-spend per capita and total GDP (USD ~ billion) offer budget headroom for operating-expenditure models, where hospitals outsource uptime risk through long-term service contracts and remote-monitoring platforms instead of frequent capital purchases. Abu Dhabi’s AI-enabled health-statistics dashboards and the national move toward unified digital licensing for more than 200,000 healthcare professionals underline a policy shift toward data-driven operations and connected systems. Incubator vendors that integrate IoT-based temperature/CO₂ telemetry, remote alarms and predictive-maintenance analytics into their offerings can lock in multi-year service revenue, reduce unplanned downtime for hospitals and laboratories, and align with UAE’s broader digital-health and “Zero Government Bureaucracy” vision.

Future Outlook

Over the next forecast period from 2024 to 2030, the UAE Laboratory Incubators Market is expected to expand steadily, broadly tracking the approximately 4% compound annual growth rate projected for the national laboratory equipment and disposables market. Growth will be driven by sustained capital expenditure in hospital infrastructure, the scale-up of IVF and fertility services, expansion of oncology and transplant programs, and the country’s ambition to become a regional hub for biotech, genomics and regenerative medicine.

Major Players

- Thermo Fisher Scientific

- Eppendorf SE

- BINDER GmbH

- Memmert GmbH

- Esco Lifesciences Group

- PHCbi

- Nuaire

- Sheldon Manufacturing

- Labconco Corporation

- MMM Medcenter / MMM Group

- Tritec GmbH

- VWR / Avantor

- Heraeus / Kendro legacy lines

- BioMérieux

- Local and regional distributors offering rebadged mid-tier incubators

Key Target Audience

- Hospital and health-system procurement heads

- Independent diagnostics and IVF / fertility lab owners and operations leaders

- Pharmaceutical and biotechnology manufacturing companies

- Contract development and manufacturing organizations (CDMOs) and contract testing laboratories

- Industrial, food, water and environmental testing laboratories

- Healthcare infrastructure developers and lab design–build firms

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map of all major stakeholders active in the UAE Laboratory Incubators Market, including OEMs, distributors, hospitals, IVF chains, pharma/biotech plants and industrial labs. Extensive desk research is performed using specialist databases, regulator publications and leading market-research reports on laboratory equipment and incubators. The objective is to define core variables such as installed base by incubator type, replacement cycles, capex intensity per bed, and R&D spend per lab.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data on global and regional incubator revenues, UAE laboratory equipment spending, and life-science infrastructure build-out. We estimate market penetration across hospital, IVF, pharma and industrial labs, and derive indicative revenues by multiplying installed base estimates with average selling prices segmented by specification (CO₂, refrigerated, shaking, specialty). Validation is achieved through cross-checks against global automated incubator benchmarks, UAE lab equipment revenues, and typical incubator-to-analyzer ratios observed in accredited laboratories.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding segment growth, brand positioning, and procurement behavior are validated through structured interviews and computer-assisted calls with biomedical engineers, lab managers, IVF embryologists, pharma plant heads and regional distributors. These experts provide guidance on actual replacement intervals, preferred OEMs, bundle purchasing patterns (incubator + biosafety cabinet + monitoring), and the impact of accreditation and regulatory audits on equipment choices. Insights from these consultations are used to refine bottom-up estimates and reconcile them with top-down regional and global benchmarks.

Step 4: Research Synthesis and Final Output

The final phase integrates quantitative estimates with qualitative drivers, challenges and trends into a coherent narrative for the UAE Laboratory Incubators Market. Direct feedback from large hospital networks, IVF chains and biotech tenants in key clusters such as Dubai Science Park and Dubai Healthcare City is used to stress-test assumptions around future demand, technology adoption (e.g., connected “smart” incubators) and price–value preferences. This synthesis yields segment-wise market sizing, future-growth scenarios and strategic recommendations aimed at equipment manufacturers, distributors, and institutional buyers.

- Executive Summary

- Research Methodology (Market Definitions, Segment Boundaries and Use-Cases, Assumptions, Normalization Factors and Currency Conventions, Bottom-Up Sizing from Installed Base and New Build Pipelines, Top-Down Validation using Import Data, Capex Budgets and OEM Disclosures, Primary Research Approach, Secondary Research Benchmarks from Global Market Studies)

- Definition, Functional Scope and Technology Archetypes

- Evolution of the Lab Infrastructure Landscape in UAE

- Role of Incubators Across Clinical, Research and Industrial Workflows

- Value Chain and Ecosystem Mapping – OEMs, Regional Distributors, System Integrators, Service Providers

- Typical Incubator Configuration by Lab Type – Hospital, IVF, Pharma QC, University, Contract Labs

- Growth Drivers

Expansion of Tertiary Hospitals, Oncology, Transplant and ICU Beds

Surge in IVF Cycles, Fertility Tourism and Advanced Reproductive Medicine

Growth of Pharma, Biotech and Vaccine Fill-Finish Capacity

Food Safety, Environmental Monitoring and Water Testing Requirements

Public–Private Partnerships and Laboratory Outsourcing Models - Market Challenges

Capex Constraints and Tender-Based Price Compression

Regulatory Approvals, Calibration and Validation Compliance

High Ambient Temperatures and Power Quality Impact on Equipment Life

Limited Skilled Bio-Medical Engineering Capacity in Peripheral Facilities

Competing Low-Cost Imports and Refurbished Equipment Penetration - Opportunities

Migration from Basic to Advanced CO₂ and Multigas Incubators in IVF and Cell Therapy

Service Contracts, Remote Monitoring and Predictive Maintenance Programs

Local Assembly, Light Manufacturing and Customization for UAE Conditions

Integration with LIMS, EMR and Quality Management Systems

Green and Energy-Efficient Incubator Designs and Certifications - Trends

Smart, Connected and Alarm-Integrated Incubation Infrastructure

Contamination-Control Features and Cleanroom-Compatible Designs

Compact, Stackable and Modular Footprints for High-Rent Lab Space

Multi-Mode Incubators Supporting Cell Culture, Stability and BOD Testing - Regulatory and Compliance Landscape

Device Registration and Import Approvals for Lab Incubators

Calibration, IQ/OQ/PQ, Temperature Mapping and Quality Standards

Safety, Electromagnetic and Energy-Efficiency Standards Compliance - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Installed Base, 2019-2024

- By Incubator Type and Capacity, 2019-2024

- By Incubator Type (in Value %)

CO₂ Incubators

Microbiological Incubators

Refrigerated Incubators

Shaking Incubators

BOD / Stability / Growth Chambers

Custom and Specialty Incubators - By Application

Hospital and Reference Laboratory Microbiology

IVF, Fertility and Stem Cell Centers

Pharmaceutical, Biotech and Cell Culture Facilities

University, Government and Private Research Institutes

Food & Beverage, Environmental, Water and Veterinary Labs - By Technology and Control Features (in Value %)

Air-Jacketed vs Water-Jacketed CO₂ Incubators

Direct Heat vs Peltier Cooling Incubators

IR vs Thermal Conductivity CO₂ Sensing

Decontamination Technologies

Connected Smart Incubators with Remote Monitoring - By Capacity and Form Factor (in Value %)

Benchtop Incubators

Mid-Capacity Standalone Units

High-Capacity, Double-Stack and Triple-Stack Systems

Walk-In Room Incubation Solutions - By Buyer Type and Ownership Model (in Value %)

Federal and Emirate-Level Government Hospitals and Reference Labs

Private Hospital Chains and Specialist Clinics

IVF Networks and Standalone Fertility Clinics

Pharma Manufacturing, QC Labs and Biotech Firms

Universities, Education Providers and Government Research Centers - By Emirate and Healthcare/Science Cluster (in Value %)

Abu Dhabi and Al Ain

Dubai – Dubai Health, Free Zones and Private Hospital Clusters

Sharjah and Northern Emirates – Public Hospitals, Universities and Industrial Labs

Free Zones and Science Parks

- Market Share of Major Players by Value and Volume

Market Share by Incubator Type

Market Share by Application Cluster

Market Share by Channel - Cross Comparison Parameters (Installed Base and Reference Sites in UAE Tertiary Hospitals and IVF Centers, Breadth of Incubator Portfolio (CO₂, Multigas, Shaking, BOD, Stability, Growth Chambers, Average Service Response Time and Field-Engineer Coverage by Emirate, Compliance and Certifications – Medical vs General Lab, IQ/OQ/PQ Capability in UAE, Chamber Uniformity, Recovery Time and Contamination-Control Features)

- SWOT Analysis of Major Players

- Pricing and Discount Structure Analysis

- Detailed Profiles of Major Companies

Thermo Fisher Scientific

Eppendorf

Binder GmbH

Memmert GmbH

PHCbi

Esco Lifesciences

Haier Biomedical

Nuaire

Jeio Tech

MMM Group

Labtech

Gulf Scientific Corporation

Emphor DLAS

Pearl Laboratory Supplies LLC

Scitek UAE

- Hospital Microbiology and Clinical Labs

- IVF and Reproductive Medicine Labs

- Pharma/Biotech Manufacturing and QC Labs

- Research and Academic Labs

- Food, Beverage, Environmental and Water Testing Labs

- Budget Allocation, Capex Approval Flows and Opex Preferences by Segment

- By Value, 2025-2030

- By Volume, 2025-2030

- By Installed Base, 2025-2030

- By Incubator Type and Capacity, 2025-2030