Market Overview

The UAE Laboratory Information Systems (LIS) market is a rapidly evolving sector within the healthcare industry, valued at USD ~ million. This market’s growth is primarily driven by the increasing adoption of digital health technologies, the growing need for efficient laboratory management systems, and the government’s initiatives to improve healthcare infrastructure. The UAE’s emphasis on healthcare modernization, coupled with an increasing demand for automation in laboratories, enhances the market’s expansion. In 2024, the market size is expected to grow substantially due to continuous technological advancements, rising demand for integrated solutions, and regulatory support for health IT integration in labs.

Dubai and Abu Dhabi are the dominant cities in the UAE’s LIS market. Dubai is a global hub for healthcare services and has numerous high-tech hospitals and diagnostic centers that adopt state-of-the-art LIS solutions. The Emirate’s forward-looking health policies, which align with the UAE Vision 2030, make it a hotspot for health IT investments. Abu Dhabi, with its significant healthcare infrastructure development and government backing for digitization, also leads in LIS adoption. Both cities benefit from significant public and private investments in healthcare innovation, positioning them as key players in the market.

Market Segmentation

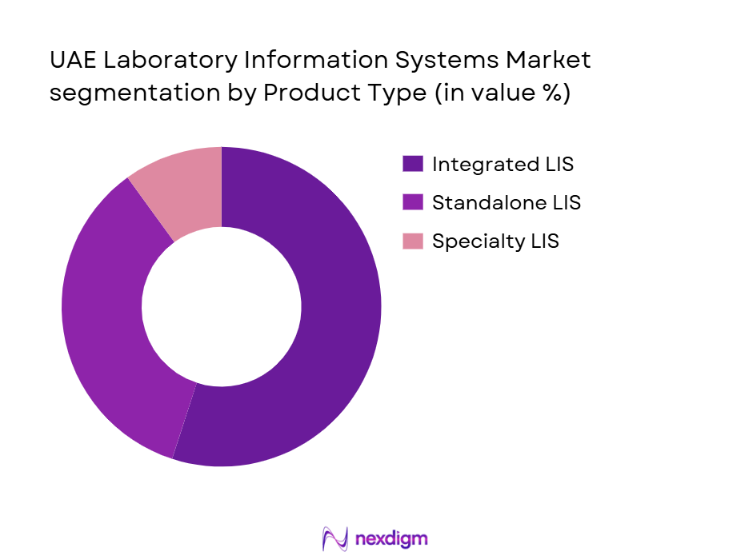

By Product Type

The UAE Laboratory Information Systems market is segmented by product type into integrated LIS, standalone LIS, and specialty LIS (e.g., molecular, pathology, and blood bank systems). The integrated LIS segment holds a dominant share in the UAE market. The increasing need for interoperability with hospital information systems (HIS) and electronic health records (EHR) is propelling the demand for integrated solutions. These systems ensure seamless data flow between labs and healthcare facilities, improving diagnostic accuracy and efficiency. Major hospitals in Dubai and Abu Dhabi are opting for integrated solutions to align with national health policies promoting healthcare digitization.

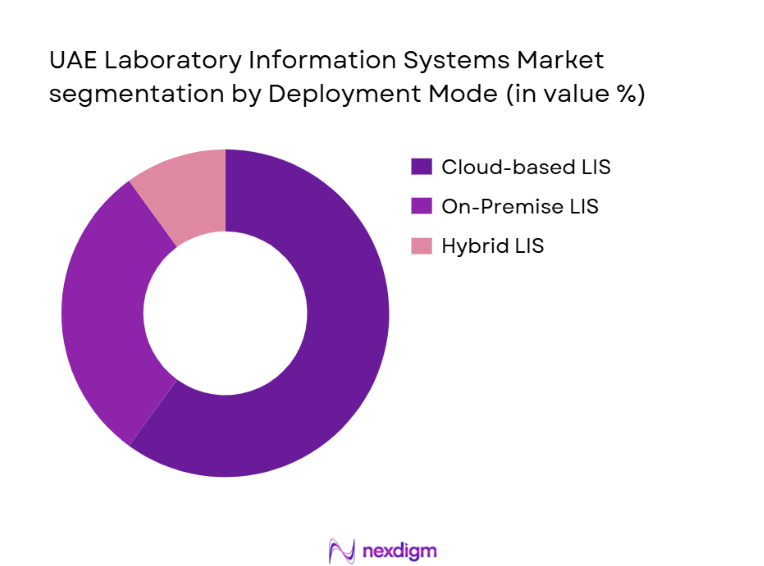

By Deployment Mode

The UAE LIS market is also segmented by deployment mode into cloud-based, on-premise, and hybrid systems. Cloud-based deployment is the most dominant mode due to its flexibility, scalability, and cost-effectiveness. Hospitals and diagnostic centers in the UAE prefer cloud solutions as they offer easier access to real-time data, enhanced data security, and reduced IT overheads. Additionally, the UAE government has been promoting cloud adoption through its national eHealth initiatives, further boosting the cloud-based segment. On-premise systems, though still widely used in older setups, are gradually being replaced by cloud-based systems due to the increasing need for mobile access and remote working capabilities.

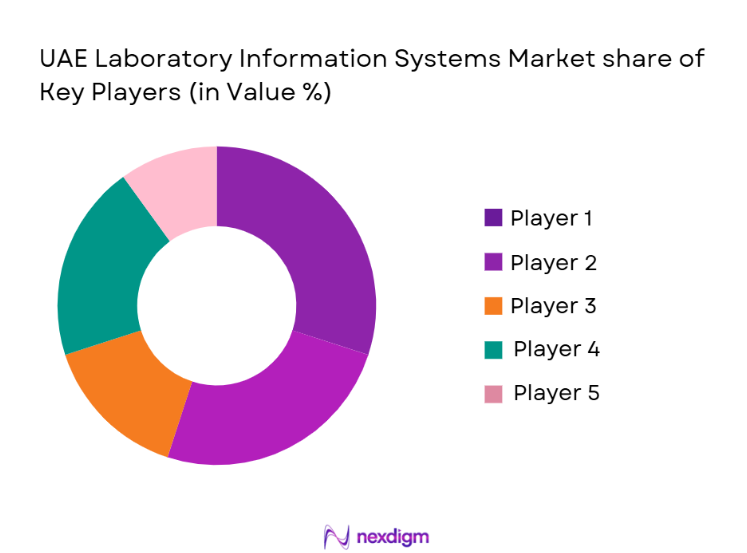

Competitive Landscape

The UAE LIS market is dominated by key players offering a wide range of solutions tailored to the unique needs of the region’s healthcare sector. The competition is characterized by both global players and regional vendors, offering cutting-edge solutions with an emphasis on integration, scalability, and cloud-based services. The market is also marked by significant collaboration between LIS vendors and healthcare providers to ensure seamless interoperability with existing healthcare IT infrastructure. The leading players in the UAE market include Cerner Corporation, CompuGroup Medical, and LabVantage Solutions, among others.

| Company Name | Establishment Year | Headquarters | Market Focus | Technology Offered | Specialization | Regional Presence |

| Cerner Corporation | 1979 | USA | ~ | ~ | ~ | ~ |

| CompuGroup Medical | 1987 | Germany | ~ | ~ | ~ | ~ |

| LabVantage Solutions | 1999 | USA | ~ | ~ | ~ | ~ |

| LabWare | 1999 | USA | ~ | ~ | ~ | ~ |

| NovoPath | 2005 | USA | ~ | ~ | ~ | ~ |

UAE Laboratory Information Systems (LIS) Market Analysis

Growth Drivers

Government Initiatives and Healthcare Digitization

The UAE government’s ongoing focus on healthcare modernization and digitization is a significant growth driver for the LIS market. Initiatives such as the UAE Vision 2030 and national eHealth strategies encourage the adoption of automated systems like LIS to improve efficiency and accuracy in laboratories, leading to increased demand for such systems across the healthcare ecosystem. This push for technological advancement creates opportunities for vendors to deploy integrated solutions across the public and private healthcare sectors.

Rising Demand for Laboratory Automation and Efficiency

Laboratories in the UAE are increasingly turning to Laboratory Information Systems to automate workflows, reduce human error, and improve diagnostic accuracy. As the healthcare industry embraces data-driven decision-making, LIS solutions provide real-time data access, automation of sample tracking, and better reporting tools, making them indispensable for modern laboratories. This demand for enhanced operational efficiency, alongside growing healthcare volumes, further fuels market growth.

Market Challenges

High Initial Investment and Implementation Costs

The high cost associated with implementing and maintaining LIS solutions, especially for small to medium-sized laboratories, poses a significant challenge. Although LIS solutions provide long-term benefits, the upfront investment in software, hardware, and training can be prohibitive, particularly for smaller healthcare providers. This financial barrier may delay or deter adoption in certain regions, affecting overall market growth.

Integration Complexities with Existing Systems

Integration of LIS with existing hospital information systems (HIS) and electronic health records (EHR) remains a key challenge. Ensuring seamless interoperability between these systems requires significant customization and specialized expertise. The complexity of integrating these systems across different healthcare facilities with varying IT infrastructures can result in delayed deployment, additional costs, and operational disruptions, hindering widespread adoption.

Opportunities

Cloud-Based LIS Solutions

Cloud-based LIS solutions are rapidly gaining traction due to their scalability, lower maintenance costs, and flexibility. The shift towards cloud computing in healthcare enables laboratories to access LIS data remotely, providing a competitive edge in terms of cost-effectiveness and operational efficiency. This trend presents a growing opportunity for vendors to develop and market cloud-based platforms tailored to the unique needs of UAE healthcare providers.

AI and Machine Learning Integration

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into LIS systems presents substantial opportunities to enhance laboratory operations. These technologies can help predict trends, analyze large volumes of diagnostic data, and support decision-making processes. With the UAE’s focus on smart healthcare and innovation, there is a significant opportunity for LIS vendors to incorporate AI and ML capabilities, improving diagnostic accuracy, speed, and patient outcomes.

Future Outlook

Over the next 5 years, the UAE Laboratory Information Systems market is poised to experience significant growth, driven by continuous government support for healthcare digitization, advancements in laboratory technologies, and the rising demand for integrated solutions. The focus will shift towards enhancing the interoperability of LIS with other healthcare systems such as electronic health records (EHR), and incorporating AI-based analytics for better decision-making. Additionally, the trend of cloud adoption in healthcare will continue to flourish, facilitating cost-effective and scalable LIS solutions. With increasing investments from both government and private sectors, the future of the UAE LIS market looks promising.

Major Players

- Cerner Corporation

- CompuGroup Medical

- LabVantage Solutions

- LabWare

- NovoPath

- Thermo Fisher Scientific

- Roche Diagnostics

- McKesson Corporation

- Epic Systems

- GE Healthcare

- Siemens Healthineers

- Qventus

- AhnLab

- LigoLab

- Sunquest Information Systems

Key Target Audience

- Healthcare Providers

- Government and Regulatory Bodies

- Health Authority

- Abu Dhabi Health Authority

- Healthcare IT Decision-Makers

- Investments and Venture Capitalist Firms

- Private Sector Healthcare Investors

- Healthcare System Integrators

- Laboratory Equipment Manufacturers

- Technology Providers

Research Methodology

Step 1: Identification of Key Variables

In this phase, we identify the critical variables that drive the UAE Laboratory Information Systems market. This includes the integration needs of healthcare facilities, the technological infrastructure of labs, and the regulatory framework that influences market dynamics. Secondary research from credible healthcare and IT sources, such as market reports and governmental publications, serves as the basis for identifying these variables.

Step 2: Market Analysis and Construction

This step involves compiling historical data from various reliable sources on the deployment and use of LIS in the UAE. We analyze the data by assessing adoption rates, service quality, and revenue growth. The focus is on identifying trends such as cloud adoption, integration with EHR systems, and the increasing need for analytics in laboratory operations.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through expert interviews with key players in the healthcare and IT sectors. These consultations will provide insights into the actual operational dynamics of LIS within UAE healthcare facilities. We will interview CTOs, healthcare IT professionals, and senior executives from both public and private sectors.

Step 4: Research Synthesis and Final Output

The final research phase involves synthesizing all gathered data into a coherent, actionable report. Primary data from expert interviews will be cross-referenced with secondary data. We will engage with leading vendors to acquire insights into product development, market positioning, and customer satisfaction to refine and validate our findings.

- Executive Summary

- Research Methodology (Market Definitions & Scope, Abbreviations, Data Sources & Triangulation, Primary vs Secondary Research Approach, Market Sizing & Forecast Method, Assumptions & Limitations, Validation Protocol)

- Definition and Scope of LIS

- Market Genesis & Digital Health Evolution

- Healthcare Ecosystem Enablers

- Regulatory Landscape

- Value Chain & Stakeholder Map

- Growth Drivers

Expansion of diagnostic laboratory infrastructure

National digital health and interoperability initiatives

Rising demand for laboratory workflow automation - Market Challenges

High system integration and customization complexity

Data security and patient privacy compliance pressures

Limited availability of skilled LIS professionals - Market Opportunities

Adoption of cloud-native and SaaS LIS platforms

Integration with national health information exchanges

Advanced analytics and AI-driven laboratory management - Trends

Shift toward cloud-hosted laboratory platforms

Growing emphasis on interoperability standards

Increasing automation across laboratory workflows - Government Regulations

National healthcare data protection regulations

Laboratory accreditation and compliance requirements

Health IT interoperability and reporting mandates

- Market Revenue by Value 2019-2025

- Market Volume Metrics 2019-2025

- Technology Adoption Rates 2019-2025

- Price Metrics & Average Contract Value 2019-2025

- Drivers & Restraints Impacting Growth 2019-2025

- By System Type (In Value%)

Standalone laboratory information systems

Integrated laboratory information systems with hospital information systems

Cloud-based laboratory information systems

On-premise laboratory information systems

Modular and specialty laboratory information systems - By Platform Type (In Value%)

Web-based LIS platforms

Enterprise-wide LIS platforms

Interoperable LIS platforms

Mobile-enabled LIS platforms

Multi-site laboratory network platforms - By Fitment Type (In Value%)

New laboratory implementations

System upgrades and replacements

Multi-location laboratory deployments

Reference laboratory system integrations

Specialty diagnostic laboratory fitments - By EndUser Segment (In Value%)

Government hospitals and public laboratories

Private hospitals and healthcare networks

Independent diagnostic and pathology laboratories

Academic and research laboratories

Specialty clinics and testing centers - By Procurement Channel (In Value%)

Direct vendor procurement

Government tenders and centralized procurement

System integrator-led procurement

Channel partners and regional distributors

Subscription-based and managed service procurement

- Market Share Analysis

- CrossComparison Parameters (Deployment model, Interoperability capability, Regulatory compliance, Customization flexibility, Total cost of ownership)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Cerner Corporation

Oracle Health

Epic Systems Corporation

Sunquest Information Systems

CompuGroup Medical

Siemens Healthineers

Agfa HealthCare

InterSystems Corporation

Dedalus Group

Clinisys Group

Orchard Software

Medical Information Technology

SoftLab

NOVA Biomedical

Alphasoft

- Public laboratories prioritize compliance and standardization

- Private diagnostic chains focus on scalability and efficiency

- Reference laboratories require high-volume data processing

- Research laboratories demand flexible and configurable systems

- Forecast Market Value 2026-2030

- Forecast Installed Units 2026-2030

- Price Forecast by System Tier 2026-2030

- Future Demand by Platform 2026-2030