Market Overview

The UAE Laboratory Reporting Systems Market is valued at USD ~ million in 2024, showing strong growth driven by the expansion of healthcare and pharmaceutical sectors, particularly in diagnostics and research. The market is propelled by increasing government investments in digital healthcare and laboratory automation. The growing trend towards accurate real-time reporting and data-driven decisions in clinical laboratories has amplified the demand for advanced laboratory information management systems (LIMS) and reporting solutions. Furthermore, regulatory standards, such as those required by the UAE’s Health Authority, encourage the adoption of automated and cloud-based laboratory reporting systems to ensure compliance with national healthcare mandates.

The UAE market for laboratory reporting systems is largely dominated by Dubai and Abu Dhabi due to their status as healthcare and research hubs in the region. Dubai’s robust healthcare infrastructure, combined with its reputation for technological innovation, makes it a primary adopter of laboratory management systems. Abu Dhabi, being home to world-class research institutes and pharmaceutical companies, also plays a significant role in the demand for advanced reporting solutions. These cities’ highly developed healthcare ecosystems, large number of private and government hospitals, and the push for medical tourism create a demand for efficient, state-of-the-art laboratory information systems.

Market Segmentation

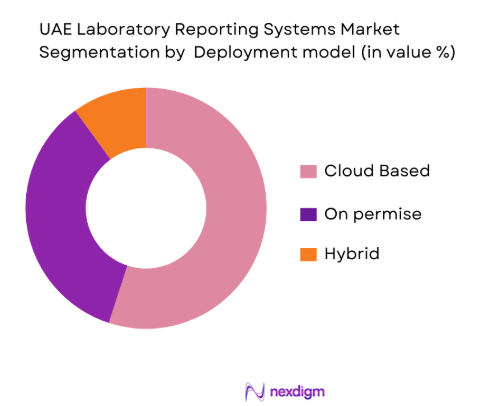

By Deployment Model

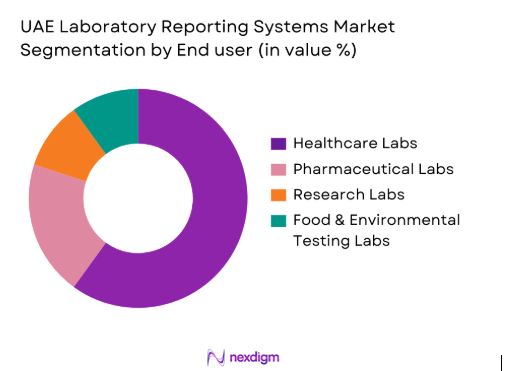

The UAE Laboratory Reporting Systems Market is segmented by deployment model into Cloud-based, On-premise, and Hybrid solutions. The Cloud-based segment holds a dominant market share in 2024. This is due to the increasing shift towards cloud computing across industries, including healthcare. The flexibility, cost-effectiveness, and scalability of cloud-based systems, combined with their ability to support real-time data access and remote reporting, make them an attractive option for labs in the UAE. The growing demand for secure data storage, coupled with cloud’s integration capabilities with other healthcare systems, has significantly contributed to its market dominance. The market is segmented by end-user into Healthcare Labs, Pharmaceutical Labs, Research Labs, and Food & Environmental Testing Labs. Healthcare Labs dominate the UAE

By End-User

laboratory reporting systems market in 2024. The rapid digital transformation in hospitals and medical laboratories is a key driver for the high demand for laboratory reporting systems. Furthermore, the UAE’s commitment to advancing healthcare through government initiatives like “UAE Vision 2021,” which focuses on health and wellness, has spurred the growth of the healthcare lab segment. These labs require efficient reporting systems for diagnostics, treatment decisions, and regulatory compliance, further solidifying their dominance in the market.

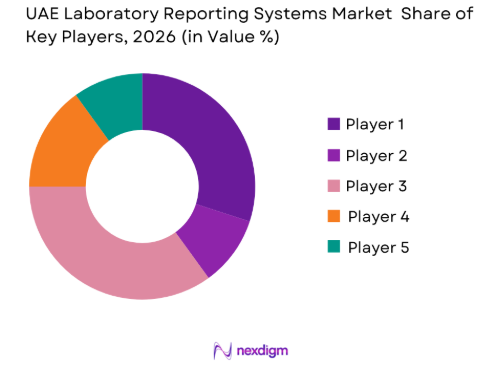

Competitive Landscape

The UAE laboratory reporting systems market is led by a few key players including global giants and local specialists. The competition is characterized by product innovation, strong customer support services, and strategic partnerships with healthcare institutions. Some of the leading players in the market include Thermo Fisher Scientific, Labware, and PerkinElmer. These companies dominate due to their robust product offerings, strong local presence, and their ability to provide customized solutions for different segments like healthcare, pharmaceutical, and environmental labs.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Cloud vs On-Premise | Regional Focus | Key Strengths |

| Thermo Fisher Scientific | 1956 | Waltham, USA | LIMS, LIS, Analytics | ~ | ~ | ~ |

| LabWare | 1999 | Delaware, USA | LIMS, Laboratory Automation | ~ | ~ | ~ |

| PerkinElmer | 1937 | Waltham, USA | LIMS, Laboratory Analytics | ~ | ~ | ~ |

| Agilent Technologies | 1999 | Santa Clara, USA | LIMS, Laboratory Instruments | ~ | ~ | ~ |

| QIAGEN | 1986 | Hilden, Germany | LIMS, Clinical Reporting | ~ | ~ | ~ |

UAE Laboratory Reporting Systems Market Dynamics

Growth Drivers

Digitization of Laboratory Data Flows

The UAE is rapidly adopting digital healthcare solutions, with the country’s healthcare digitization efforts being supported by government initiatives such as the UAE Health Strategy. As of 2024, around 80% of UAE healthcare institutions have already adopted electronic health records (EHR) systems, laying the foundation for a more digitized workflow. The country’s National Health Data Strategy promotes seamless integration of healthcare systems to improve operational efficiencies and provide better patient care. In 2024, government-backed health initiatives are expected to continue supporting the digital transformation of labs, leading to an increase in the adoption of advanced laboratory reporting systems that enhance data flow management. The UAE’s overall healthcare expenditure in 2024 is estimated at USD ~ billion, further accelerating digital health system investments.

Surge in High-Throughput Testing

In response to growing healthcare demands and the shift towards precision medicine, the UAE has invested heavily in enhancing its high-throughput testing capabilities. The UAE’s healthcare infrastructure is expected to expand with state-of-the-art laboratory facilities, many of which incorporate high-throughput screening for genomics and molecular diagnostics. As of 2024, the UAE has more than 10 advanced genomics research centres, including those in Dubai and Abu Dhabi, which provide cutting-edge molecular testing and diagnostics. This surge is spurred by the increasing cases of chronic diseases like diabetes and cancer, with the UAE’s cancer incidence rate growing by 4% annually. This has directly contributed to a stronger demand for laboratory reporting systems capable of managing large datasets and generating real-time, actionable reports.

Market Challenges

Data Privacy, Cybersecurity & Patient Data Governance

The rapid digitalization of healthcare data in the UAE has raised concerns about data privacy and cybersecurity. As of 2024, the UAE is ranked 14th globally in terms of cybersecurity readiness. However, data breaches remain a major issue, with the UAE’s data privacy regulations being reinforced by the newly introduced Data Protection Law in 2024. Healthcare institutions in the UAE are increasingly aware of the need for stringent data protection measures, particularly with the growing use of cloud-based laboratory reporting systems. Cyberattacks on medical institutions worldwide have risen by 70% in the past 2 years, contributing to heightened security concerns. This trend has prompted investments in advanced cybersecurity frameworks, but challenges remain regarding the integration of robust cybersecurity measures in laboratory systems, particularly when they rely on external cloud service providers.

Integration Complexities with Legacy Systems

In many UAE laboratories, especially in government-run institutions, there is still reliance on legacy systems that hinder the smooth adoption of modern laboratory reporting platforms. Around 30% of healthcare facilities in the UAE, including those in Dubai, still use older LIS and LIMS platforms, making integration with modern systems complex. These legacy systems are often incompatible with newer cloud-based technologies, requiring significant time and resources for seamless integration. Moreover, data silos across different healthcare units delay the optimization of laboratory reporting processes. As of 2024, nearly 45% of healthcare IT budgets in the UAE are spent on upgrading and integrating legacy systems with new technologies.

Market Opportunities

Cloud Migration & Mobile Reporting Adoption

The shift to cloud-based platforms has been accelerating in the UAE, with numerous healthcare institutions making the transition to cloud-based laboratory reporting systems. This transition is supported by the UAE government’s push towards adopting digital health infrastructure under the National Health Data Strategy. The UAE’s cloud services market has seen a rise of 25% in investments since 2024, and mobile reporting solutions have become a key trend. Healthcare providers increasingly demand flexible and scalable cloud solutions that allow mobile access to laboratory reports, especially for large hospital chains and outpatient clinics. The total adoption of mobile health applications in the UAE is forecast to exceed 40% by 2025. This is indicative of a broader shift towards mobile, cloud-based healthcare platforms, with laboratory reporting systems being a central part of this trend.

Embedded Analytics & Predictive Reporting

Predictive analytics integrated into laboratory reporting systems are gaining significant traction in the UAE. By leveraging AI and machine learning algorithms, healthcare providers are using data from laboratory systems to predict patient outcomes, optimize lab workflows, and personalize treatment plans. The UAE government has invested heavily in AI-driven technologies, with the AI market in the UAE projected to reach USD ~ million by 2025. These advancements are reflected in the UAE’s healthcare sector, where predictive analytics tools are increasingly embedded in laboratory reporting systems. As of 2024, approximately 20% of laboratory systems in the UAE are expected to include integrated predictive analytics features, helping clinicians make more informed decisions and enhance patient care.

Future Outlook

The UAE laboratory reporting systems market is expected to witness significant growth over the next five years, driven by continuous advancements in digital health infrastructure, the rise of artificial intelligence in diagnostics, and growing government support for healthcare innovation. The increasing adoption of cloud-based solutions, bolstered by data security improvements and cost-effective scalability, will further fuel this growth. Additionally, regulatory pressures in the UAE, requiring hospitals and labs to maintain detailed and accurate records, will continue to create a strong demand for advanced reporting systems.

Major Players

- Thermo Fisher Scientific

- Labware

- PerkinElmer

- Agilent Technologies

- QIAGEN

- Lab Vantage Solutions

- Bio-Rad Laboratories

- Dassault Systems (BIOVIA)

- Veeva Systems

- Medidata Solutions

- Roche Diagnostics Informatics

- Siemens Healthineers

- Hamilton Company

- Sunquest Information Systems

- STARLIMS (Abbott Informatics)

Key Target Audience

- Healthcare Providers Private & Government Hospitals Diagnostic Centers

- Pharmaceutical Companies R&D & Production Labs

- Research Institutes Clinical & Academic Research Organizations

- Food Safety Regulatory Agencies UAE Ministry of Health

- Environmental Testing Laboratories

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies UAE Health Authority, Emirates Food Safety Council)

- Laboratory Equipment Suppliers

Research Methodology

Step 1: Identification of Key Variables

The research begins by defining the key stakeholders in the UAE laboratory reporting systems market, which include hospitals, research labs, government bodies, and pharmaceutical companies. Desk research is used to gather industry-level data, while proprietary databases provide in-depth insights into market trends.

Step 2: Market Analysis and Construction

This phase compiles and analyzes historical data, such as the penetration of reporting systems across different segments like healthcare and research. Market trends and consumer preferences will be considered to generate reliable revenue projections.

Step 3: Hypothesis Validation and Expert Consultation

To validate the hypotheses, interviews with industry experts from top healthcare providers and tech solution providers will be conducted. This consultation process will refine market insights and ensure data accuracy.

Step 4: Research Synthesis and Final Output

Data collected will be synthesized and complemented with real-time consultations with end-users in healthcare and research sectors. This interaction ensures that the market forecasts and segmentation data are accurate and reflect actual market dynamics

- Executive Summary

- Research Methodology (Framework, Definitions and Terminology, Analytical Hierarchy, Primary & Secondary Research, Data Validation, Forecasting Models)

- Landscape of Laboratory Reporting Systems in UAE

- Relationship with LIMS, LIS & ELN platforms

- Key Use Cases Across Healthcare, Pharma, CROs & Environmental Testing

- Technology Genesis & Adoption Curve

- Ecosystem & Value Chain

- Growth Drivers

Digitization of laboratory data flows

Surge in high‑throughput testing

Regulatory requirements for digital reporting & audit trails - Market Challenges

Data privacy, cybersecurity & patient data governance

Integration complexities with legacy systems

Talent & skills gap for advanced reporting systems - Market Opportunities |

Cloud migration & mobile reporting adoption

Embedded analytics & predictive reporting

Expansion in personalized medicine and molecular diagnostics - Emerging Trends

AI‑assisted reporting and anomaly detection

Real‑time KPI dashboards

API‑based integration with EMR and national health data ecosystems

- Historical Market Size, 2019-2025

- By Value, 2019-2025

- Volume, 2019-2025

- Deployment, 2019-2025

- Estimated Market Value of UAE LIMS/Reporting Systems, 2019-2025

- By Deployment Model (In value %)

Cloud SaaS

On‑Premise

Hybrid - By Reporting Platform Type (In value %)

LIMS Integrated

Standalone Reporting

LIS Reporting

ELN Reporting

SDMS Integrated - By End‑User (In value %)

Healthcare Lab

Clinical Diagnostics

Pharma & Biotech R&D

Environmental & Food Testing, CROs - By Feature Tier (In value %)

Basic Reporting

Advanced Analytics & Dashboards

AI‑Driven Anomaly Detection

Regulatory Reporting Modules - By Organization Size (In value %)

Hospital Labs

National Reference Labs

Independent Labs

Research Institutes

- Market Share Analysis (Value & Adoption)

- Cross‑Comparison Parameter (Solution Portfolio Depth, LIMS+ Reporting+ Analytics, Deployment Footprint, Cloud, Hybrid, On‑Premise, Regulatory & Compliance Capabilities, Integration Ecosystem, EMR/LIS/ERP/API support, Implementation Services & Go‑Live Time, Price Tier & Licensing Model, Customer Retention & Expansion Metrics, Support & Service SLAs)

- SWOT – Key Vendors

- Pricing Matrix

- Porter’s Five Forces

- Detailed Company Profiles

Thermo Fisher Scientific

LabWare

STARLIMS

LabVantage Solutions

PerkinElmer Informatics

Agilent Technologies

Dassault Systems

Veeva Systems

Bio‑Rad Laboratories

Medidata Solutions

LabLynx

QIAGEN Informatics

Siemens Healthieer

Roche Diagnostics Informatics

Ligo Lab reporting & LIS solutions

- Adoption Patterns by Sector

- Healthcare & Clinical Diagnostics

- Pharmaceutical / Biotech R&D Labs

- Environmental & Food Safety Labs

- Contract Research Organizations (CROs)

- Forecast by Deployment, 2026-2035

- Forecast by End‑User, 2026-2035

- Reporting Revenues & Price Trends Projection, 2026-2035

- Scenario Analysis, 2026-2035